5 Wealthy Woman Mindful Spending Hacks No One Talks About

Wealthy woman hacks are all about working smarter, not harder.

Today’s mindful spending tips save money, but they often also save time. Because you’re a busy woman and you have other things to do.

1. Embrace Minimalism

The easiest way to embrace mindful spending is to become a minimalist. As a lifestyle.

What does this mean? Minimalists…

- ask themselves if what they’re buying is useful.

- regularly declutter the items that they no longer need.

- don’t often get caught up in impulsive sales. Shopping is not a form of entertainment for them.

One of the greatest benefits of being a minimalist is there’s less to clean, maintain, and clutter up your mental space. It’s a freeing practice for your entire life!

As an up-and-coming minimalist, focus on:

2. Give Yourself a Time Rule

Before spending money online or on large purchases, employ a rule that you’ll wait 24-48 hours.

This ensures that when you buy something, it’s because you truly want it. Not because you’re getting sucked in by marketing.

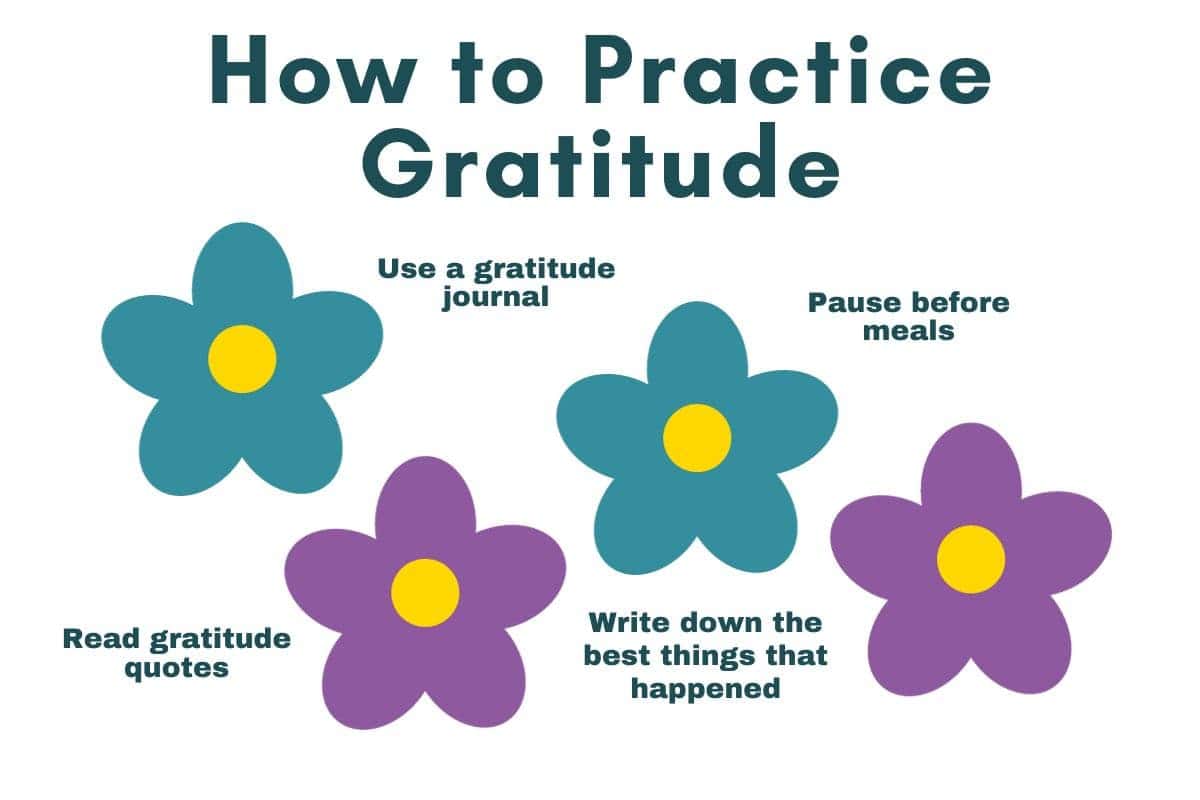

3. Practice Gratitude

When you feel blessed and abundant, you’re far less likely to spend money to fill emotional holes inside of you. Your insecurities and scarcity mindset fall by the wayside. And you’ll be happier too.

Write down 3 things you’re grateful for as you drink your morning coffee.

Related: Money Mindset Prosperity Exercises

4. Keep a Money Journal for Mindful Spending

Putting pen to paper helps you remember things – but it also makes you more aware of your spending habits.

How many bad habits do we repeat because we don’t see them?

Use your money journal as a place to track your income and expenses. This budgeting tool can be amazing for your day-to-day spending. It’s the same reason experts recommend counting calories for weight loss.

Tracking creates awareness. And awareness leads to progress.

5. Set financial goals and put them on the fridge

Finally, it’s much easier to spend mindfully when you know why it’s important to save.

- Are you hoping for a beach vacation without debt?

- Or a retirement on the lake?

- Or helping your children through school?

These things matter enormously, but they can get shoved to the back of your mind.

Create a money vision board and write out specific financial goals. Then, stick it to the fridge or post it on your office bulletin board.

What’s Next?

Get ongoing wealthy woman ideas through the free newsletter. You’ll also gain instant access to the resource library full of goodies!