How To Invest $500: Start Building Wealth Now For Beginners

Are you a beginner investor? Or perhaps you are a seasoned one, but you’re looking for a good money move with smaller funds.

Investing can be daunting, but it doesn’t have to be.

Today’s article shows you how to invest $500 in a variety of ways. It will give you a clear idea of how you can make your money work for you.

Can I start investing with $500?

Yes! You can begin investing with any amount. Don’t let large numbers and complicated spreadsheets scare you away from building wealth.

First, When Investing, consider:

Your Financial Goals

What are you hoping to achieve with this money? Do you have specific money goal examples that you are working towards?

Your Time Frame

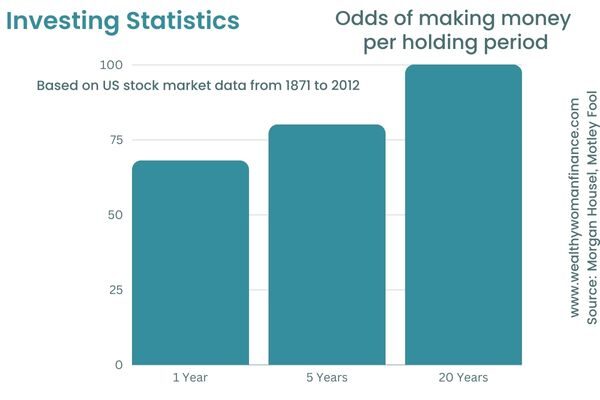

Will you need this money in 2 years? 5 years? 20 years? The amount of time you have makes a big difference in what you want to invest in. If you need the money within a few years, you will want to choose a safer investment option.

Your Risk Tolerance

Are you comfortable with risky investments or do you prefer to be conservative? Most people benefit from a mix that serves their goals and risk tolerance.

Related: Important Financial Questions to Ask Yourself

Your Financial Foundation

Before you jump into investing, make sure you have built the foundation of your financial house first.

- Debt. if you have high-interest debt, your $500 may be better served paying this off first.

- An emergency fund. Do you have at least 3-6 months of cash reserved for emergencies?

- Positive cash flow. Are you living below your means? It’s important to have a gap every month between your income and spending.

Do you have a 401k?

First, you should be contributing enough to get your 401K employer match if one is offered. This is free money!

You can also open a Roth IRA or Traditional IRA to contribute more money to retirement.

*Retirement accounts are the first stop for how to invest $500 because of the tax advantages they provide. Once your financial foundation is built and you are saving for retirement, consider these other wealth-building options for your $500.

Best Ways To Invest $500

Here are the different kinds of things that you can invest in.

Certificates of Deposit (CDs)

These are considered the safest investment because they are similar to a savings account. They are also insured by the FDIC for up to $250,000. The rate of return is slightly better than a savings account because the investor is keeping the money there for a time period. And you can take your money out early, but there is a penalty.

You are extremely unlikely to lose money in a CD, but you won’t make a ton either. This money is easy to get ahold of if you need cash quickly.

Bonds

Bonds mature at a certain date just like CDs above, but the length of time before maturity is usually longer.

A bond is a type of fixed-income security that involves you lending money to a government entity or corporation. In return, the bond issuer makes regular interest payments to you. When the bond reaches maturity, the loaner returns your principal investment.

Bonds are not as talked about as stocks because they aren’t as volatile and the returns are lower. But they are a safer way to earn income as well.

Stocks

Hands down the most popular investing option, these are easy to buy and sell. A stock is a security that represents the ownership of a small fraction of the issuing corporation.

Stocks offer higher possible returns but are also risky if you do not diversify your portfolio. You want to research the company before investing.

Related: Checklist Template for Investing

Mutual Funds

A mutual fund is a combined group of stocks and bonds. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates.

Mutual funds help you diversify your stocks. But you will want to look for funds with lower fees.

ETFs

ETFs are similar to mutual funds in that they represent a grouping of individual securities (ex. stocks and bonds). These offer the same diversification advantage as mutual funds and often have lower fees.

A Key Difference Between Mutual Funds & ETFs

ETFs can be bought or sold during the day at different prices (like a stock). Mutual fund trades are executed once a day, at one singular price.

Invest in a Business

One of the best decisions I ever made was to invest an initial $500 into starting a business. I continue to invest regularly in the business because its returns have been spectacular compared to some of the more traditional forms of investing.

If you are serious about starting or improving a business, this is an investment secret that not enough people share!

Real Estate

Most think that you need large amounts of cash to invest in real estate. But you can also invest in a REIT within your brokerage account or into real estate crowdfunding sites.

As a shareholder, you typically earn dividends and possible appreciation.

Invest In Yourself

“The best investment you can make is in yourself.”

–Warren Buffett

Investing in yourself and your business can yield stunning returns on your wealth, productivity, and happiness.

- Go back to school

- Get that certification

- Attend the conference

- Take a course

- Invest in your health

- Buy the books to learn

- Invest in better networking

*Not sure how to come up with $500 to begin with? Try:

Ok, now that you have seen your options, here is a step-by-step guide for following through.

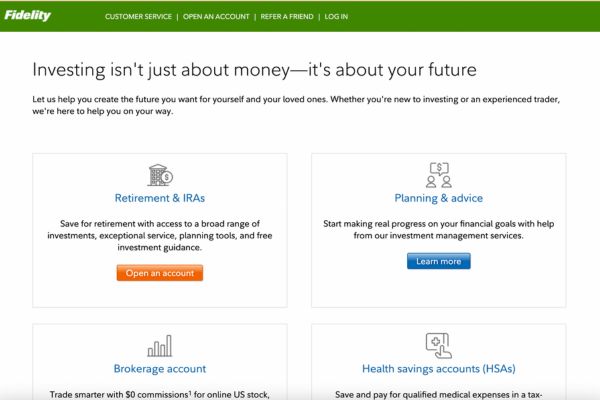

Open An Account

You can find CDs at banks. To invest in stocks, mutual funds, REITS, or ETFs, open a brokerage account. Here are a few popular ones:

- Charles Schwab

- Fidelity

- Vanguard

- Robinhood – A great site for starting with lower amounts of money

Get Started: Invest 500 Dollars Today

The biggest mistake that people make is that they stay on the sidelines. So, follow these steps to keep yourself moving forward.

Of course, never take on more risk than you can handle. But also know that you have to be in the game in order to see the rewards.

“I never lose. I either win or I learn.” – Nelson Mandela

Try A Robo Advisor (How to Invest $500)

If you are having trouble taking the plunge, try a robo advisor. This is an online account that uses a computer algorithm to choose your investments.

It finds the right mix by using your answers to questions about goals, risk tolerance, etc. Here are a few examples:

- Wealth Front

- Vanguard Digital Advisor

- Schwab Intelligent Portfolios

You can find a robo-advisor option in almost all brokerage companies.

Our kids’ 529 plans use this as well. The investing algorithm changes the investments to be more conservative as the kids get older and we are closer to needing the money.

Monitor Your Investments

And finally,

- Keep an eye on your fees and expenses. If you invest in low-cost index funds this will be easy.

- Check in once a month or quarter to see if your investments still fit with your goals and timeline.

- Rebalance occasionally as your money grows. Most brokerages will give you a big picture of your portfolio in their “tools” section. This helps you see if you need to make adjustments.

Related: Money Saving Game Printables For Adults

Questions About How To Invest $500

What would you consider to be risky investments?

Stocks can be volatile, so you want to diversify your portfolio in other ways too. Real estate can have the same disadvantage in terms of diversification.

It’s not a good idea to have all of your eggs in one option. Mix your riskier investments (with higher possible returns) with safer investment options.

What would you consider to be safe investments?

CDs and bonds are safer investments, but will not make a lot of money. I would also argue that investing in yourself or your business is relatively safe, but this depends on the investment decision.

How far will your $500 investment go?

This depends on where you put the money and how long you leave it there to grow. In most investments, the longer you give it to grow, the more potential money it will make.

What if you want to flip $500?

Flipping is slightly different than investing, but you can still make your $500 grow this way. My husband is handy. And when he had more time, he used to buy, fix, and then flip (sell) lawnmowers. He made good cash by doing something that he loved.

What should you NOT invest $500 in?

The lottery. Suprime mortgages. The thing your neighbor keeps telling you is “quick money and a sure deal.” Quick money is a sham. And often an excellent way to lose your money!

What’s Next?

Next, join the Wealthy Woman newsletter and get inspirational and practical wealth building ideas straight to your inbox. Plus, you’ll gain instant access to the free resource library.

More Articles You’ll Love on Wealthy Woman…

- Get Ahead Financially in Your 20s, 30s, 40s

- Treat Yourself on Any Budget

- Dave Ramsey’s 7 Baby Steps Pros & Cons