17 Smart Financial Goals Examples to Grow Your Wealth

What are some smart financial goals?

Have you made goals but had trouble achieving them? You’re not alone. In fact, 92% of New Year’s goals are never achieved.

This crazy high failure rate shows us that how you set a goal is incredibly important. That’s why, today we’re looking at smart financial goals examples that give you a leg up towards victory.

The sky is the limit when it comes to your dreams! But you’ll only get there if you take the time to set an excellent goal and course of action.

How to Make a Smart Goal

The acronym for SMART goals has stood the test of time because it’s effective. A SMART goal is simply a well-written goal with the following aspects clearly defined.

S: Specific

Is your goal crystal clear?

As you set your goal, be as specific as you can. Include what, when, where, and for how long to do your action. You may also ask yourself if anyone else will be involved to help you achieve this goal.

For example, I go over my budget every Saturday morning at 10:00 in the living room.

Decide these details early so it leaves no room to wiggle out of the goal later.

M: Measurable

How will you determine if you meet your goal?

Instead of, “I’ll save lots of money for a wedding,” decide exactly how much you need to save. Then, break it down into measurable savings goals each month or week.

“What gets measured gets managed.”

Peter Drucker

A: Achievable/Attainable

How will you reach your destination?

Your goal should be big enough to stretch you, but not so big that it’s unrealistic. A nearly impossible goal will cause you to give up early, unless you have a good stepping stone path.

This step also focuses on discovering what you need to achieve your goal.

- Will you need to adjust your mindset?

- What skills or knowledge will be critical to learn?

- What actions will be essential to reach your goal?

- Do you have other goals that could get in the way?

Research, and find out what will be required to succeed.

R: Relevant

Why does this goal matter?

The goal needs to be relevant to the bigger scope of your life. Does the goal fit with your overall mission and work? And how can you attach a “why” to your goal to make it more internally motivating?

T: Time-Bound

When will you accomplish your goal?

Set a target date to motivate you to work on your goal TODAY.

And be wary of goals that are too far out. When we give ourselves 12 months to complete something, we often lose focus and forget. Instead, break long-term goals into monthly or quarterly markers to increase urgency.

Short, Intermediate, & Long-Term Goals

Next, let’s divide smart financial goals examples into short-term (6-12 months), intermediate (12-24 months), and long-term goals (2+ years).

Short-term goals: 6-12 months

First, these are things that you need the money for within the next year. They can be big or small, fun or boring. Here are a few:

3 Short-Term Smart Financial Goals Examples

Next, turn your short-term goal idea into a SMART goal.

SMART Goal #1: Build an Emergency Fund

I will save 6 months of expenses ($15,000) by August 31st (10 months from now) to eliminate my financial worries. To accomplish this, I will set aside $1500 a month towards my financial security by…

- Having a garage sale in April

- Shopping around for car and house insurance today

- Picking up a part-time job this month

Specific: To build a 6-month emergency fund – use this tracker to mark progress!

Measurable: The goal covers exactly how much you’ll need in total ($15,000) and how much each month ($1500).

Attainable: You know how you’ll reach the goal and that it’s within reach. You’ll have a garage sale in April, shop around for insurance today, and pick up a part-time job this month.

Relevant: This goal eases your mind and helps you achieve financial security.

Time-Bound: The goal is set for 10 months from now, and it’s broken down into monthly milestones.

SMART Goal #2 Example: Eliminate Credit Card Debt

I will pay off my $4,000 credit card balance by August 31st (7 months from today) to avoid interest fees and use that money for a vacation instead. I will keep track on my credit card debt tracker and put $572 a month towards the debt by…

- Selling old clothes

- Adding 3 overtime hours a week

- Eating out only once a week

Specific: Pay off $4,000 credit card balance.

Measurable: You’ll put $572 a month towards your debt, measured by the tracker.

Attainable: This goal is realistic for anyone with credit card debt. And you’ll achieve your goal by adding overtime hours, selling clothes, and eating out less.

Relevant: You’ll be avoiding interest fees and using the money for something you want.

Time-Bound: You have 7 months.

SMART Goal #3: Protecting Your Family

I will save $500 to make a will by August 31st (3 months from now) to protect my kids no matter what happens in life. I’ll research the next step by June 31st. And save the cash by…

- using my credit card cashback rewards

- Putting 10 items to sell on Etsy to put towards this goal.

Specific: Create a will.

Measurable: You’ll have the will done 3 months from now. You’ll know your first step in the process by June 31st. (You may also want to set deadlines for completing each step).

Attainable: This is attainable for anyone. You’ll achieve your goal by cashing in rewards and selling items online.

Relevant: To protect your family.

Time-Bound: You’ve set a date for having the money ready and for when you’ll know the next step. This goal has multiple parts (saving the money and making the will). So, it helps to break down both.

Intermediate goals: 12-24 months

Here are things you may want to do in the next 1-2 years:

3 Intermediate Examples of Personal Finance Goals

SMART Goal #1: Learning To Build Wealth

I will read 4 personal finance books (&/or listen to 44 hours of podcasts/audiobooks) in the next 12 months to fast-track my saving and money-making efforts. I will read/listen to one book every 3 months while commuting to/from work and waiting on kids activities.

Specific: Read or listen to personal finance.

Measurable: Read or listen to 44 hours worth. (Or 1 book every 3 months)

Attainable: Anyone can do this, and you’ll do it while commuting, waiting, and exercising.

Relevant: You’re learning to skyrocket your overall progress.

Time-Bound: You have 12 months to do it.

SMART Goal #2: Create Passive Income

I will purchase 1 rental property in the next 15 months to provide a source of income that passively builds wealth. I will evaluate at least 6 properties a week to accomplish this goal.

Specific: This goal is a little different from the others. Instead of saving money, you’re taking action by purchasing a rental property.

Measurable: You’ll evaluate 6 properties a week to find the right property for you.

Attainable: This goal is achievable if you already have a downpayment saved and need to motivate yourself to action. You’ll achieve the goal by running the numbers on many properties.

Relevant: Your goal gives you a source of income outside of your job.

Time-Bound: You have 15 months to do it.

Related: Strong Work Ethic Examples

SMART Goal #3: Increase Your Savings To Invest

I will increase my savings by $200 a month to invest in my future (through stocks, skill building, etc.). This move will multiply my wealth and lead to financial freedom. I will save an extra $2,400 this year by packing my lunch 3 days a week and selling items on Facebook.

Specific: You’ll be increasing your savings by $2,400 this year.

Measurable: You’re putting away $200 a month.

Attainable: This goal is achievable by packing your lunch and selling items online.

Relevant: You are putting this money towards your future success.

Time-Bound: You’ll save it in 12 months.

*Need help uncovering more money? See these genius ways to save >

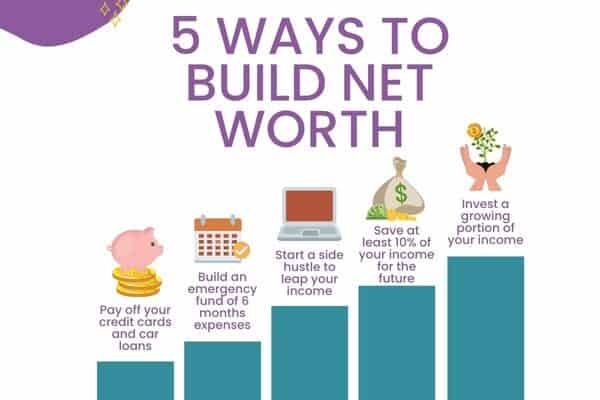

Long-term Goals: 2+ years

With long-term goals, you’re planting the seeds for your future. How do you want your life to look 10-20 years from now?

These are often larger goals that can be broken down into short and intermediate goals.

*Find more great ideas for things to save up for >>

3 Long-Term Goals Examples

These goals may be far out, but we’re keeping the actions within your line of sight.

SMART Goal #1: Save To Retire When You Want To

I will be able to retire at age 60 with X in savings. I will save $X a month by:

- setting up an automatic transfer from my paycheck to a retirement account

- saving an extra $200 in the budget every month

- and picking up extra hours at work on Mondays

(For your specific numbers, you’ll need to account for your age, cost of living, and the lifestyle you want in retirement.)

Specific: You’re saving X amount to retire.

Measurable: You’ll save $X a month.

Attainable: This goal is attainable for anyone by setting up an automatic transfer, saving, and increasing income.

Relevant: By sticking to this goal, you’ll give yourself the freedom to retire when you want to (at age 60).

Time-Bound: The time depends on how old you are. If you set this goal at age 40, you’ll have 20 years to accomplish it.

SMART Goal #2: Save for college

I will save $21,600 in the next 18 years to help my child through college. I will add $100 a month to a bank account/529 by renting out my home, car, or other property once a month.

Specific: You’re saving $21,600 for college.

Measurable: You put monthly payments of $100 into an account.

Attainable: This is achievable if you want to go back to school or have kids (nieces, grandkids, etc.) you want to help through college. In order to reach this goal, you’ll need a bank account/529 set up first (This could be a separate goal). And you’ll have the cash by renting out something you own.

Relevant: You’re accomplishing this goal to help your child pay for the steep price of college.

Time-Bound: You have 18 years. (Split into each month)

Financial Goals Examples #3: Pay off your mortgage

I will pay off my remaining mortgage by paying an extra $25,200 in the next 7 years. I will add $300 a month to the monthly payments and mark progress on my home loan tracker. I will gain the freedom and security of owning my home by…

- saving money by making coffee at home daily

- getting rid of 1 tv streaming subscription this week

- starting a side hustle by Sept 1st

Specific: Paying off your mortgage with $25,200

Measurable: Monthly payments of $300 with progress marked on the tracker.

Attainable: This goal is attainable if you’re a homeowner and will be accomplished through making coffee at home, eliminating a streaming option, and starting a side hustle.

Relevant: You’ll be gaining the security of having no debt and achieving financial freedom.

Time-Bound: You’ll achieve your goal in 7 years.

3 Smart Financial Goals Examples For Students

These examples of financial goals are perfect for high school students and college kids. They’ll help you achieve success much faster than vague intentions.

SMART Goal #1: Establish a credit score (Intermediate)

I will open and use a credit card responsibly by paying for gas and groceries for the next 2 years, never exceeding $500 a month, and paying it off at the end of every month. I will monitor the card and purchases once a month. Doing this will establish credit and allow me to get better rates on car and home loans.

Smart Financial Goals #2: Buy a car (Short/Intermediate)

I will save $5,000 to buy a car in 1 year that can get me to work, school, and home. To save $5,000, I will save $417 every month by saving my part-time job income and limiting eating-out purchases to $200 a month.

*This 52 week saving challenge template can help you save too!

SMART Goal #3: Graduate with low debt (Intermediate/Long Term)

I will graduate from college 4 years from now with $10,000 or less in debt so that I can start my post-graduate life with the freedom to buy a house. To do this, I will take out no more than $277 in loan money every month. I will pay through…

- my job and savings

- buying used books

- help from my parents

- only spending $50 a week on extras

*Use this student loan tracker when you start paying back!

5 Financial Smart Goals Examples For Business

All of these business financial goals can be short, intermediate, or long-term depending on your time horizon and overall dreams. They are excellent examples for a business owner or for employees.

And as before, the numbers are just a sample. Work your own numbers to fit your life.

SMART Goal #1: Have a revenue goal

The business will make $10,000 in monthly revenue by August 31st (12 months from now). To reach this goal, revenue will raise by $500 a month by increasing product selection to 15, doubling marketing efforts, and narrowing down the target audience. This goal allows for the business to increase pay and give employee bonuses.

SMART Goal #2: Pay off business debt

The business will pay off $6,000 in debt in the next 12 months by paying $500 a month. This will save on interest fees and free up cash to spend on growth building. And it will be achieved by

- dropping business subscriptions no longer needed

- spending $400 less on supplies

- and adding 1 client account

SMART Goal #3: Develop a business plan

The company will have a business plan in place by March 31st (3 months from now). The plan will include revenue-building, team building, and cost-cutting strategies. It will ensure that the company is focused for 2nd quarter. Lead executives will meet on January 31st to discuss and begin writing the plan.

SMART Financial Goals Examples #4: Make investments

The business will re-invest $500 a month of profits for the 2024 year. These investments will take place through lunch & learns and new equipment, adding to the growth of the company. We’ll find this money by reducing $X spending on overhead and re-allocating money.

Related: How to Invest 500 Dollars

SMART Goal #5: Increase productivity

The business will implement a procedure for handling emails on August 31st through a meeting and checklist. This will keep email distraction and overload down, increasing productivity on projects that bring in revenue.

*For more ideas with your business, see these great business vision board examples >>

How to Start Using Your Money Goals

Now, we’ve gone through many examples of smart financial goals. But how do you make your own unique goals? Here’s a step-by-step process!

1. Brainstorm

Jot down the things you know you’ll need/want in your future. Start with big ideas and let your thoughts flow. (These financial questions to ask yourself can help you with soul-searching too).

2. Decide on your top 1-3 goals

Next, pick the goals that will make the biggest impact on your life or business. Run the numbers on what you’ll need to make your dreams come true.

3. Make your SMART goal

Use the step-by-step process outlined at the start of this article.

4. Check in with your goals often

Place your goals where you see them and write them every day. In a study done by the Dominican University of California, participants who wrote their goals daily were 42% more likely to achieve them. Sending a weekly progress report to a friend also indicated higher goal achievement.

Before You Go….

- Need cash now? Check out these ways to make 500 dollars cash fast!

- Dream big with a money vision board! (This can help you work backward to get specific goals too.)