31 Interesting Investing Facts You Need to Know In 2024

These saving and investing facts are surprising! Most importantly, they can help you make better decisions, build confidence, and steer you in the right direction (based on statistics!)

Plus, don’t miss the key takeaways at the end to help you use these investing facts to strengthen your future game plan.

What are the most important things to know about investing?

Here are the five facts I think are most important for you.

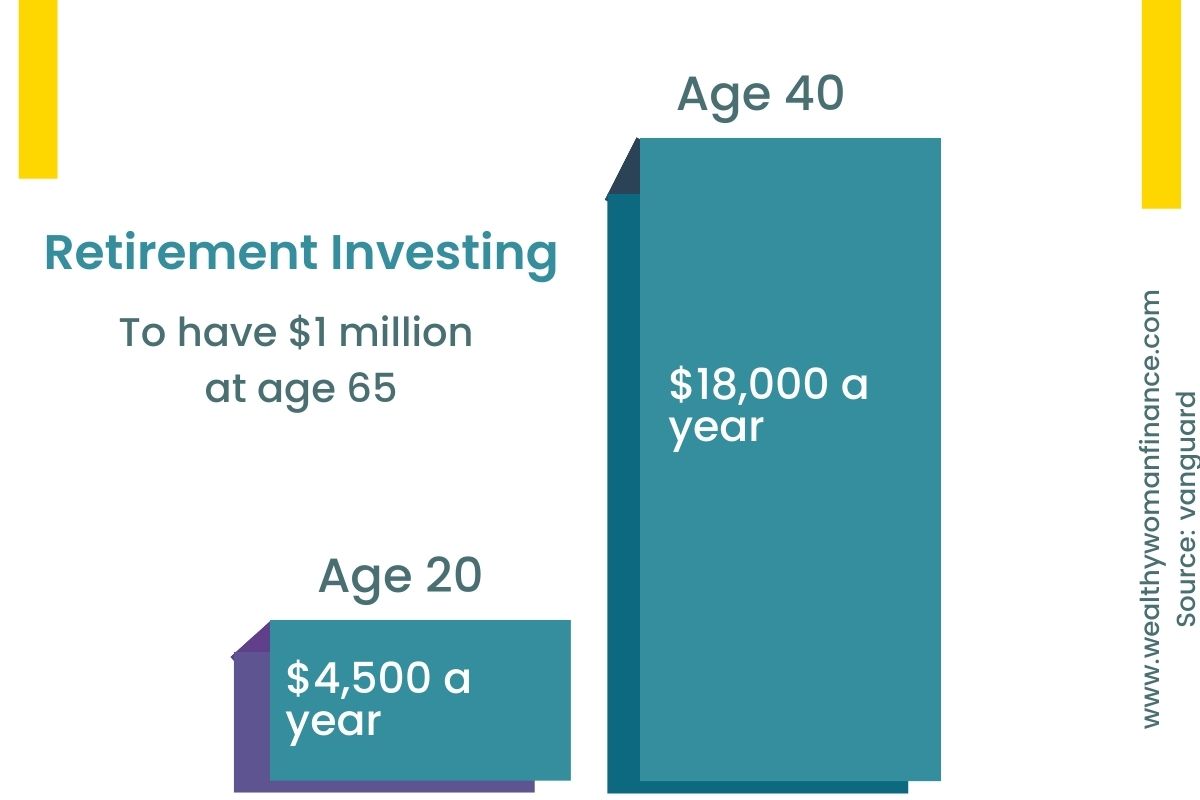

1. If you do not start saving until 40, you will need to save four times as much as at 20. (Vanguard)

2. “If you bought the original S&P 500 stocks, and held them until today—simple buy and hold, reinvesting dividends—you outpaced the S&P 500 index itself.” (Jeremy Siegel, The Future for Investors)

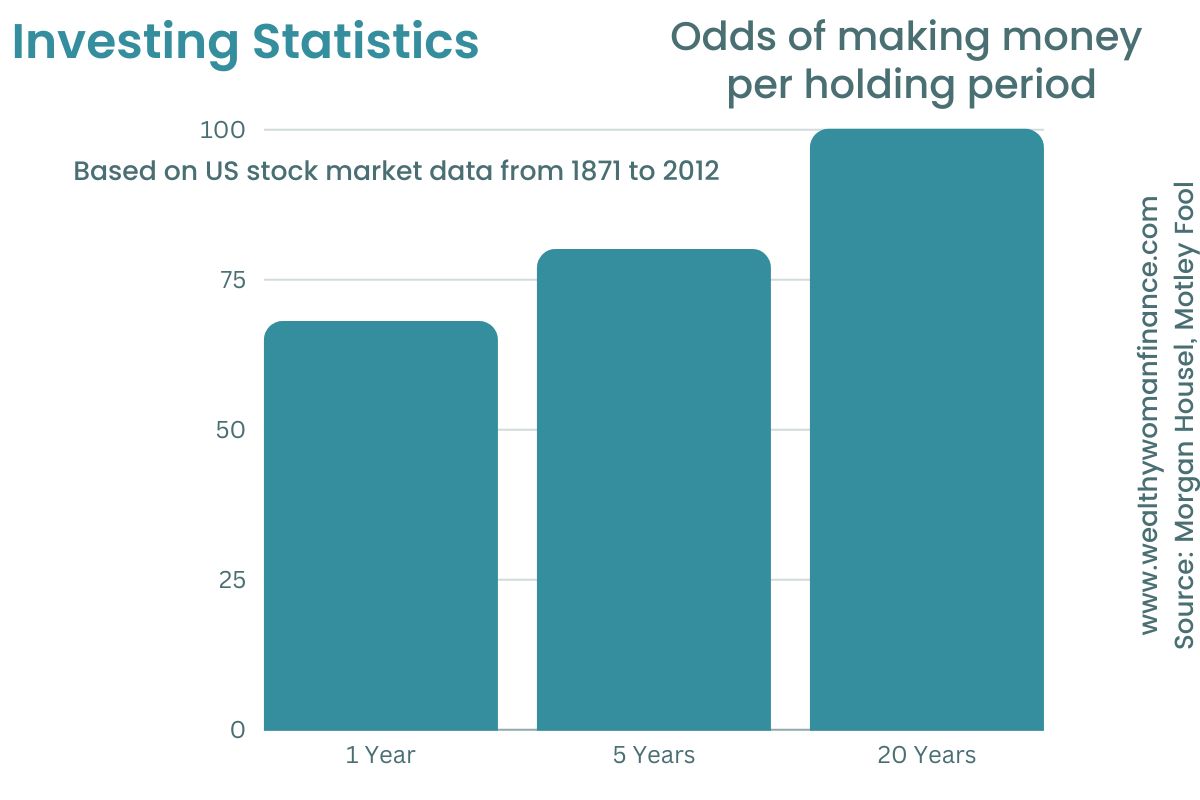

3. Many active traders garner the lowest returns. Between 1992 and 2006, a study in Taiwan found that 80% of active traders lost money. In Brazil, a study revealed that 97% lost money, and only 1% of them were profitable. (Ramseysolutions, SSRN)

4. If you invested $100,000 over 20 years and you pay 1% in fees, you’ll end up with nearly $30,000 less than if you paid .25 in fees. (sec.gov)

5. When asked about retirement, 66% of Americans were worried they would run out of money in their retirement years. (Yahoo Finance)

Takeaway: Start investing early with a buy and hold strategy. Studies show that investing in index funds has proven a historically better return (and you will save in fees too).

Surprising and Most Interesting Investing Stats

6. Not one actively managed mutual or bond fund consistently beat the market over the last five years (nytimes.com)

7. Based on US stock market data from 1871 to 2012 (analyzed by Morgan Housel of MotleyFool), if you hold stocks for one year, you have a 68% chance of making money. Make it 5 years and your chances go up to 80%. And over a 20 year period? 100%.

8. According to SPIVA research, 89.38% of funds underperformed the S&P 500 in the last 15 years. (SPIVA)

9. More than one-third of Americans didn’t own investments or investment accounts in 2022. (emoneyadisors.com)

10. The U.S has approximately 1.16 billion dollars being managed by robo advisors, the most of any other country. (statista.com)

11. While the U.S. stock market has generally trended upwards over time (6.9% per year after inflation and including dividends) from 1872 to 2022, the market from year to year can be volatile. In this time frame, the market has grown in 69% of the years, and declined in 31% of years on record. (with 5 cases of declines by 30 to 40% in a year). (TheMeasureofPlan)

Related: How to Invest $500 For Beginners

Women Saving and Investing Facts

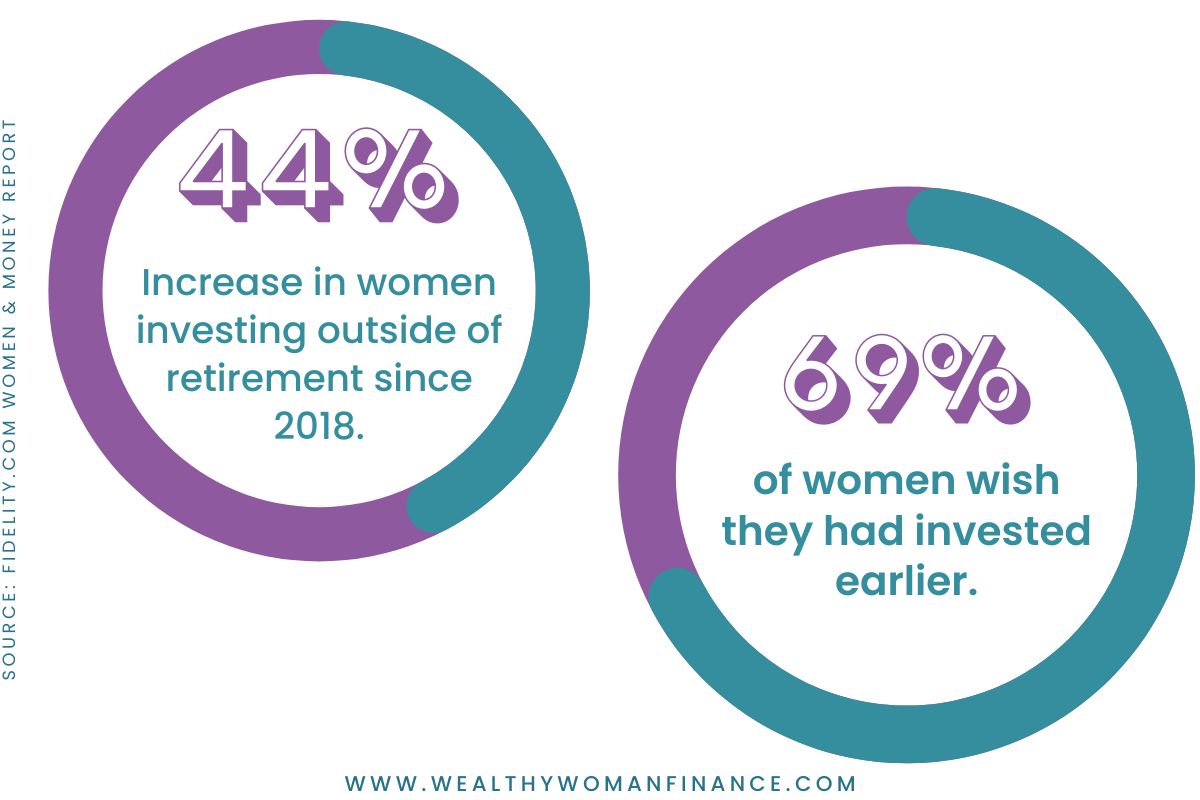

12. In 2021, a 44% increase of women invested outside of their retirement since 2018. (Fidelity.com)

13. Only 9% of women believe they are better investors than men, despite research showing that they earn consistently better returns. (Motley Fool)

14. In 2021, women made about $0.82 for every dollar the average man earned. (Motley Fool)

15. The average woman keeps 68% of her portfolio in cash and cash equivalents, compared to 59% of the average man’s portfolio. (The Motley Fool)

16. Women work more part-time jobs than men (source). Often, these afford women flexibility with family, but do not have retirement plans. It also leaves them contributing less to social security.

17. Women earning $50,000-$74.000 are more likely to participate in their employer’s retirement plan than men. (Vanguard)

18. In a women and investing study, 69% of women wish they had started investing their savings earlier. (Fidelity)

Stats About Where Investors Are Putting Their Money

19. The most common assets people invest in are stocks, bonds, mutual funds and ETF’s. (investor.gov)

20. Men represent 70% of cryptocurrency owners. (bankrate.com)

21. Approximately 67% of Americans own real estate. (statista.com)

Facts About Saving & Investing

22. The average age investors started saving is 29 years old. (gallup.com)

23. Employees ages 35-64 are 24% more likely to contribute to their employers retirement plan compared to ages 25 or younger. (Vanguard)

24. Nearly 19% of Americans 65 years and older still have a mortgage (Forbes).

*Use these free debt tracker charts to climb out of debt faster >>

Fun Facts About Investing in Stocks & The Stock Market

25. Historically, September is the worst month for the stock market.

26. In 2023, Apple is worth more than the entire GDP of Canada or India (source).

27. There’s a 70% chance the stock market will go up in any particular year. (sovereignboss.co.uk)

28. The idea of the stock market was started in the Netherlands in 1602. It’s not a modern idea!

29. A large percentage of stocks deliver negative returns over the stocks lifetime. Fewer than 4% of stocks account for all the profits. (The Agony and the Ecstasy: The Risks and Rewards of a Concentrated Stock Position, J.P. Morgan)

30. The technology sector remains the highest percentage of the Global Top 100 companies. (pwc.com)

31. Stock prices are more volatile than dividends. Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?, Robert Shiller)

Related: Warren Buffett’s Investing Checklist Template

7 Key Takeaways From These Investing Facts

1. Invest early and often.

2. Consider index funds over actively managed ones. Statistics show that you’ll do better AND save on fees. (Plus, you will have more diversification than stocks without the decision fatigue).

3. Over a short period, stocks can be quite volatile.

4. Historically speaking, if you buy and hold for a period of 20 years, you’ll be in great shape.

5. It’s extremely hard to predict or time the market. Consider the 1962 Shareholder letter from Warren Buffett:

“I think you can be quite sure that over the next ten years there are going to be a few years when the general market is plus 20% or 25%, a few when it is minus on the same order, and a majority when it is in between.

I haven’t any notion as to the sequence in which these will occur, nor do I think it is of any great importance for the long-term investor.” (The Columbus Dispatch)

6. Women are actually great at investing, even though they don’t feel confident about it.

7. Women have to play catch up with investing due to lower pay and part-time job status. It’s time to get investing to get more of your money working for you!