10 Best Budgeting Practices & Tips For Success in 2024

We know we should budget and keep track of money. But knowing something and doing it (when Johnny has lessons and you are trying to meet a work deadline) are two very different things.

That’s why today we have budgeting best practices. These are simple budgeting tips to make staying on track easier than ever before. You will love how they fast-track your progress!

Budgeting Practices Meaning

First, what are budgeting practices?

Good budgeting practices are simple things you can do to make sure that you set a realistic budget and follow through. The money truth is, no matter what your financial dreams, a budget is often how that dream comes true.

Best Budgeting Practices: Step By Step

1. Decide Your Why & Set Goals

Before you can get to budgeting, make good financial goals that motivate you. Why is sticking to a budget important to you? Does it offer freedom? Pleasure?

Get crystal clear on what you are gaining from being intentional with your money.

2. Name It Differently

I’ve heard the word “budget” used with condemnation and annoyance. If you associate it with something distasteful too, it is time to shift your mindset.

Give your budget a new name. Call it “operation freedom” if you’d like instead.

Next, use a wealth affirmation to help you see that a budget is not a cage. Instead, it is a set of boundaries that allows you to live free from the TRUE things that cage you:

- debt

- not being able to cover your bills

- living life on someone else’s terms

“A budget doesn’t limit your freedom; it gives you freedom.”– Rachel Cruze

3. Choose one: the Best Budgeting Methods

Now, you have made a goal and a mindset shift on your freedom journey. But which budgeting method is best? That depends on your needs! Here are three of the most popular budgeting methods:

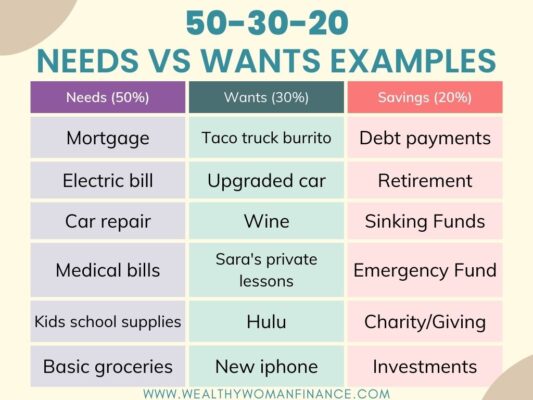

The 50 30 20 (50% Needs, 30% Wants, 20% Savings)

Advantages: This method is the most popular budgeting rule. It allows for more spending on your wants, which works nicely if you have fewer needs.

Disadvantages: If you have more “needs” you might struggle to fit that into only 50% of your budget.

See a 50 30 20 budget template & calculator >>

The 60 30 10 (60% Savings, 30% Needs, 10% Wants)

Advantages: This method is by far the most aggressive. It has you saving 60%. If you split up your savings into debt repayment and giving, you’d be able to do a lot with your money.

Disadvantages: Saving that much money is a big commitment. If you are a beginner, or you need to start with something steady and consistent, go with a different rule instead.

See a 60 30 10 budget template & calculator >>

The 70 20 10 (70% Needs & Wants, 20% Savings, 10% Donation/Debt)

Advantages: This rule puts needs and wants together, which makes it very flexible. It also has a specific allocation for donations or debts, which is unique from other methods.

Disadvantages: Using 30% for savings or debt can be a lot if you are already struggling to make ends meet. Consider the 50-30-20 method if you’re looking to ease your way into saving more.

See a 70 20 10 budget template & calculator >>

4. Determine Needs & Wants

Next, you will notice that all of the methods above divide spending into “needs” and “wants.” But how do you notice the difference between the two?

Here’s a quick summary:

Needs

Imagine that you started your budget with 0 and your entire goal was to make sure your family could survive. You’d quickly find that what you need are things like food, shelter, basic clothes, and utilities.

Wants

Everything else. When you think about it, our true needs can be covered with very little money. It is our society that makes so many of our wants look like needs.

When Needs Become Wants

Now, it’s not so simple. For example, basic food is a need, but organic food is a want. A car may be a need, but a nice car is a want. As is a nice house.

Even if some of your expenses are intertwined in both a need and a want, the process of defining them will help you see what you are spending on that may not be a priority.

Related: How To Stop Eating Out & Save

5. Make it Realistic

Next, best budgeting practices give you a little wiggle room. If you feel like you are walking a tightrope, it will be too easy to fall off.

Leave room for small treats that keep the momentum up. Building in small changes over time will create habits that last and compound into truly spectacular results.

6. Use Tools & Apps That Make Budgeting Easier

I love Mint.com. It’s a free website that automatically combines accounts and shows you how much spending you have left for the month. You could also try:

- YNAB

- EveryDollar

- Goodbudget (Good for the envelope budgeting system)

7. Build Budgeting Into Your regular Routine

The biggest mistake people make is that they set a budget and then forget it. So, make your ongoing budget a scheduled part of your routine. If you are using an app, have notifications pop up. Or put your paper budget tracker on your fridge.

See more in this millionaire morning routine article >>

8. Rig Your Environment To Stay on Budget

No matter how much you want something, if your surroundings always tempt you, you will eventually give in. So, answer this question:

Is your lifestyle conducive to the budget you set? If not, how can you change it?

Here are a few ideas:

- Leave your credit cards at home when you know you are going somewhere that’s tempting to spend money.

- Spend time around others who are good with money. Stay on budget with a friend.

- Take a different route to and from work if you always stop to buy something.

Find more creative ways to save and fun things to do when on a budget >>

9. Tweak & Revisit Your Best Budgeting Practices

Your needs change over time, and that includes your budgeting practices. Especially if you have others who live with you! So, revisit and modify your budget over time.

10. Measure Your Results

And finally, use a tracker. This can be an online app (#6) or the act of putting your money directly into an account. Either way, you need to visually see the money you save and the progress you make.

*Find great free debt tracker printables >>

To Consider With Personal Budgeting Practices

What are your best budgeting practices? Leave a comment and let us know what helps you stay on track!

More Wealthy Woman Articles You Will Love…

- Vacation Savings Challenge Printable

- Interesting Investing Facts – to help make great decisions!

- How to Teach Budgeting To Kids