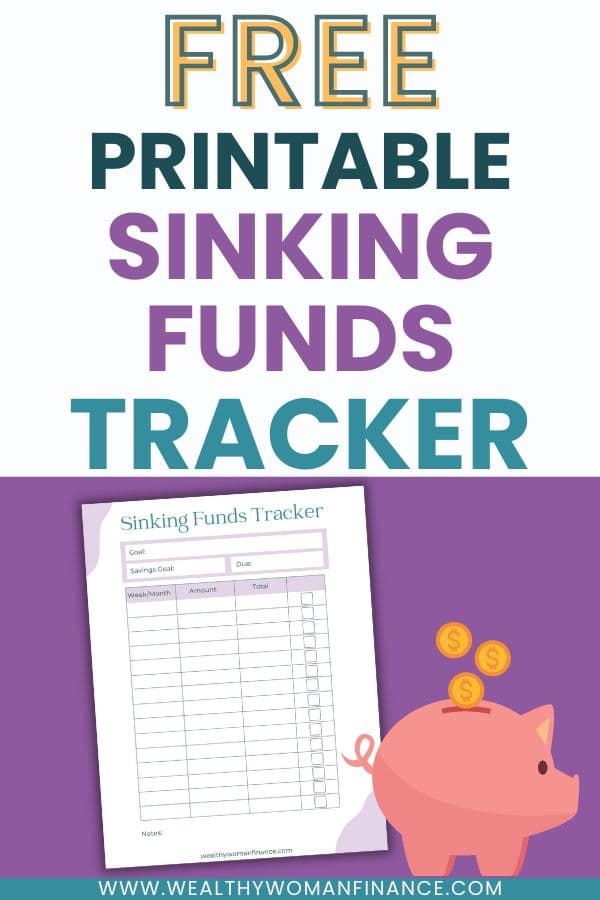

Free Printable Sinking Funds Tracker

Sinking funds are a great way to save money for things you know you will need to spend on in the future. And like everything, the best way to stay consistent in your saving is to keep track.

That’s why, today we have a free sinking funds tracker printable and calculator to help you. You’ll be piling up that cash in no time!

What Are Sinking Finds?

First, what even are sinking funds? They are savings funds you put money into monthly.

By doing this you can save smaller amounts for longer periods of time (instead of trying to come up with the cash all at once.) It gives you flexibility and peace of mind when the time comes to pay.

What are examples of sinking funds?

Typical sinking funds can be used for irregular big expenses or smaller expenses you see often. In the past, I’ve had them for both:

Irregular big expenses: a vacation fund, a car fund, a home improvement fund

Little/medium expenses that ebb and flow: Kids activity fund, charity fund, future learning/education costs fund

But you can use them for whatever you’d like!

Note: A sinking fund is NOT an emergency fund! Sinking funds are for expenses you expect but aren’t part of your monthly budget categories. Emergency funds are for unexpected things that smack you in the face.

Find a full list of sinking fund categories and examples >>

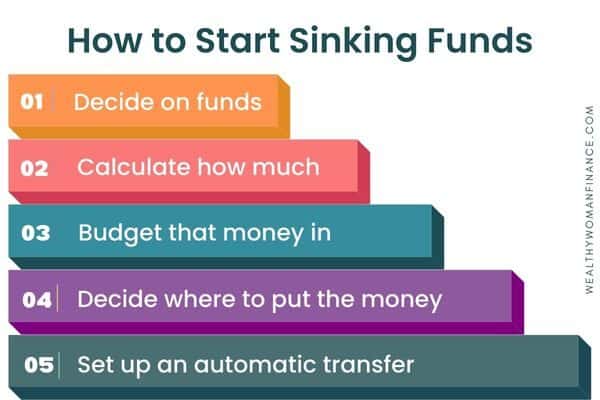

How to Set Up Your Sinking Funds

The image below shows you the exact steps for getting your sinking funds going. Then, keep reading for the calculator and tracker.

Sinking Funds Calculator

Calculate how much you need for each fund with the sinking fund calculator below:

How To Track Sinking Funds

Free Sinking Funds Tracker Pdf

Next, you might be thinking, how do I keep track of my sinking funds? Make your savings visual with the sinking funds tracker pdf below!

Related: Reverse Budgeting: How to Pay Yourself First

How Do You Create A Digital Sinking Fund Tracker?

I’ve also kept track of my sinking funds in Excel and Google Sheets for years, and it works especially well if you are doing multiple sinking funds at once. Plus, when you use this software, you can set up formulas to add your totals together effortlessly.

More on How to Track Sinking Funds

If you bank with an online bank, you should be able to label separate savings accounts within your larger account. Give these accounts a name like “car fund” so that you know exactly where your money is within your account.

How do I make a sinking fund schedule?

Make saving for your sinking funds a regular habit with these tips:

- Try our 30-day money saving challenge, read up on living below your means, or set up a solid budget plan so that you can easily save what is needed for the sinking funds.

- Set up an automatic transfer so that your savings are moved on a schedule that you don’t have to think about.

- Make sure that you have an emergency fund fully funded first. That way you won’t ever be tempted to dip into your sinking funds. These should be separate.

Want to save this tracker? Enter your email below and I’ll send the link straight to your inbox.

Do sinking funds count as saving?

This one is a bit tricky, but I think it is. You are giving yourself the gift of money in the bank for an upcoming expense.

This means that you won’t have to go into debt, eat up emergency funds, or stress about where the money will come from. In my opinion, these are all the big benefits of saving, so sinking funds are saving for your bright future!

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

More Great Articles on Wealthy Woman Coming Soon!

- What Are Your Personal Needs And Wants?

- How to Create a Family Travel Budget

- Is It Ok to Spend Money on Myself? Find out!