Is It Ok To Spend Money on Yourself?

Have you ever thought, “I feel guilty spending money on myself?”

Perhaps for you, it’s a relaxing massage or a fun video game. And maybe you don’t want to feel the guilt. But it rears its ugly head anyways.

This happens to all of us at times. And it can be perplexing. Why do we feel this way? Is it good for us? And how do we make it go away when we are truly spending money according to our values?

Why do I feel guilty after spending money?

First, let’s dig into the psychology, then keep reading for ways to quit feeling so guilty!

These are all valid reasons you may feel guilt after spending.

You Have a Scarcity Mindset

You feel guilty because you are afraid you won’t have enough money tomorrow if you spend it today.

Instead of thinking, “I will earn more.” and “more money is coming my way,” you are thinking along the lines of “I won’t have enough.” These types of thoughts impact every decision you make.

According to the American Psychological Association (APA), 65% of adults say that money is a significant source of stress in their lives.

You Had Childhood Trauma Around Money

This is an incredibly common one. Perhaps…

- your family grew up poor and you never had enough.

- Or you had enough but your parents always worried about money.

Even in families with great financial literacy, there can be baggage around how money is handled. In real life, this looks like your aunt saying “don’t tell your uncle Mike I bought this.”

Your Partner Affects How You See Money

In some cases, you feel guilty about the money you spend because of what your partner will say. When your spending habits do not align, or you place different values on saving and spending, this becomes an issue.

Learn to talk to your spouse about money without fighting >>

Stay-at-home moms struggle with this a lot! If not enough value is placed on the work of a stay-at-home mom in the household, she will feel guilty for spending money.

You Have Self Worth Issues

And this leads to how you view yourself. You must believe that you are worth spending money on. If you have low self-esteem or self-worth issues, you will often feel bad about purchases.

You Need More Confidence In Your Decisions

Maybe you feel that you don’t know what you are doing with your finances. That’s ok!

All you have to do is learn to help you feel confident in the road ahead. This confidence will translate into a better feel for what you want to spend your money on.

You Have Money Dysmorphia

Here’s the definition of money dysmorphia:

- You feel insecure or unstable despite having plenty of money. You perceive flaws and defects in your finances (even when there are none).

Symptoms include:

- Feeling that you are never saving or investing enough.

- You only allow yourself to spend on essential needs.

- You feel guilty spending money on yourself in most situations.

Money dysmorphia is a lot like body dysmorphia. You are seeing your finances through a fear-based lens in which there are always major flaws. Often, this thinking will make you overly cheap as well.

You Made An Impulse Purchase

It happens. To all of us. And in this case, your guilt knows it and is trying to get you to face the truth. We’ll address how to handle these types of purchases too!

Related: How To Stop Buying Stuff To Save

You Have a Lot of Debt

Perhaps that debt was for your bright beautiful future or perhaps it was a few bad decisions. Whatever the reason, it doesn’t mean you can never spend money on yourself. You just need a plan!

Grab these free debt tracker printables and then keep reading!

How do I stop feeling guilty about spending money on myself?

So, now that you know why you feel guilty spending money on yourself, try these tips to banish the guilt for good.

Set aside “fun money” ahead of time.

Go into your budget and separate fun money from the rest of your expenses. Setting money aside ahead of time is intentional, strategic, and can work for any budget. Plus, it helps you from becoming tight-fisted when it is time to spend.

Bonus Tip: I also do this with the money I want to donate (for the same reason)!

Understand the Power of Self-Care and Self-Investment

Think about what you are spending money on.

- Is it a whim to make you feel better? Are you filling a hole or giving into a fear?

- Or is it an investment in yourself? In your health, happiness, or future?

If it is the latter, then know that you are worth every penny. And you have the power to decide how you view your investment.

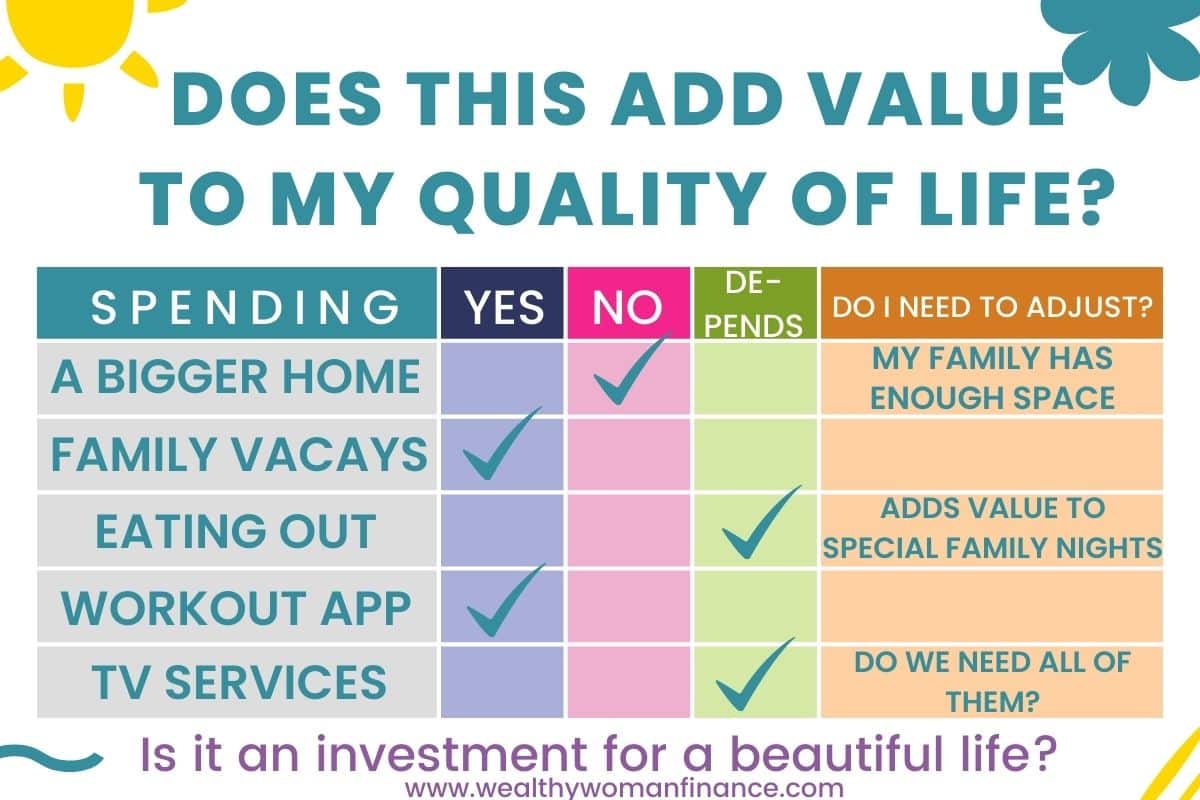

Use The Quality of Life Metric

Many financial gurus will tell you to not spend money at all. Save. Save. Save.

And I agree…to a point. But I also believe that there is hidden value in spending money strategically. And not enough people talk about this.

Financially, the more money I invest in my business, myself, and my family the better my life becomes. This has held true for years.

That is why I use my own “quality of life” metric with spending. As long as I stick to the guidelines of what will add true value to my life, I rarely feel guilty about the purchase.

Try using this metric. It’s a game-changer.

“Peace, happiness, and love are a daily practice. Give time and energy to that which you want more of in your life. Invest in yourself for a higher quality of life. You’re worth it.”

― Akiroq Brost

Wait 24 Hours For Medium-Large Purchases

Stores are incredibly good at getting people to part with their money. It is unbelievable how much hidden psychology goes on behind the scenes. And when you are burnt out, buying something fun can become a way to de-stress.

So if you get sucked into an impulse buy, take a breather. Then, instead of wringing your hands in guilt, return the item if you don’t want it anymore.

Next time, enforce the 24-hour rule. If it is something you just found, and you “have to have it!” then wait a full day before buying it. You may find that one day later you don’t feel the same way about it. Or that you are willing to wait for this special item to go on sale.

And if you still love it, then there’s no need for the guilt.

Leave Wiggle Room in Your Budget

Aside from your fun money, it helps to leave a little room in your budget in case a normal expense costs more than planned. This small margin can keep you from stressing out about money in general and feeling guilt over other purchases.

An emergency fund is important too! Try this emergency fund challenge to get yours where it should be.

Have a Conversation With Your Partner Or Family

Don’t let guilt and baggage from another person affect how you feel about money.

- If you want your partner to place a higher value on what you do for your family, then you have to talk about it.

- If you want more spending room in the budget, discuss it.

Value yourself enough to express what you want openly with this person.

Here are a few tips for the conversation:

- Talk when you are both well-rested and relaxed.

- Refrain from making accusations. You do NOT want your partner on the defensive.

- Talk at a restaurant or other public place if you tend to fight over money.

- Highlight the benefits for your partner (discuss how investing in yourself or your family will raise the quality of life they live too)

- Do research beforehand. Do you know how much stay-at-home moms would make outside of the home for all of the work they do? $184,000 (Business Insider). You can also tally up the hours you spend on certain tasks. Or get ballpark estimates for the things you want and have a plan for how to make it work.

Enter your conversation calm and prepared, and then you will be surprised by what you accomplish.

*Related:

- Come up with an inspiring money vision board together to get on the same page!

Spend on Experiences

How many times have you felt guilty over making beautiful memories with those you love?

Rarely, right? That’s because they often boost your quality of life!

Obviously, be smart about what you spend on, but also know that we all feel less guilty spending on experiences rather than with stuff.

Work on Your Money Mindset

- Use these wealth affirmations for more success and feelings of financial abundance. Over time, you will notice that your feelings around money will change.

- Try these amazing books to build your money mindset and banish the guilt.

- Journal about the hang-ups you have around money. Explore why you might feel that way and the mental shifts you can make. (Try these financial questions)

- Learn the difference between and rich and poor mindset.

Learn. Learn. And Learn Some More.

Aside from working on your mindset, learn everything you can about handling your finances. Hint: this site is a great start!

The more you learn, the more confidence you will have. And this will lead to lower feelings of spending guilt over time.

It Takes Repetition (To Spend Money On yourself)

And finally, know that it takes time and practice. The more you analyze why you feel guilty about spending money, the easier it will be to let go of the guilt when you want to.

How much of my money should I spend on myself?

This is a great question and there is no “one size fits all approach.”

I once read from Brian Tracy that you should invest 3% of your income in yourself. It’s the only way you grow.

With that said, not everything you spend money on is an “investment.” Some things are just for fun. But if they make you feel good, then those might be worthwhile purchases too. This answer will be different for everyone!

Is it ok to spend money on clothes?

Yes! Just like it is ok to spend money on eating out. And entertainment. Stop looking at spending as bad, and start looking at spending as an opportunity to determine what is good for yourself.

To Consider With Spending Money on Yourself

Yes, you should budget, save, and invest money. But spending money is also a tool for a better life. Plus, spending money can allow you to do amazing things in this world for others. And that’s the kind of thing that brings true happiness!

So, what about you? Do you feel guilty when you spend money? Leave a comment below and let me know!