7 Different Types of Income Streams of Millionaires (+ How to Build Each)

According to records from the IRS, the average millionaire has 7 streams of income.

You might be wondering what the heck these are. And how a person goes about building them!

Below, I’ll break down each type of income stream, along with examples and links to learn more. So you can get started building your wealth now!

Active Vs Passive Income Streams

But first, let’s talk about active vs passive income. Millionaires employ a combination of both to grow their wealth. You should too.

Active Income:

You trade work for money. This is not a bad thing. But the income you produce is limited to the hours you can work.

Passive income:

These ventures make money whether you are actively working or not. Often there’s plenty of work upfront or intermittently. But it’s not like active income in that you trade hours for dollars.

Below, I’ve marked which income streams are active and passive for you to see.

7 Types of Income Stream Examples

It’s ok if not every income stream is right for you. Learn from each, and pursue the one or two that make sense for your life right now.

1. Main Earned Income

*Active

This is income earned through your main job. Wages, salaries, and self-employment income fall under this category.

Boost your job income through:

- overtime

- bonuses

- commission

- additional education or certifications

- promotions

- changing careers or jobs

See also:

2. Interest Income

*Passive

This income is the interest you earn from savings accounts, Certificates of Deposits (CDs), and bonds.

To boost this income:

- Set up an automatic transaction to put more money in regularly

- Look for high-yield savings accounts and CDs (often found with online banks)

Note: These are also great, low-risk places to have your emergency fund.

3. Dividend Income

*Passive

When you invest in stocks or mutual funds, some companies distribute a portion of their profits to shareholders. They’ll pay out to you throughout the year. And you’ll then have the choice to take this money out or re-invest it back into the asset.

To boost this income:

- Make room in your budget to invest.

- Set up an automatic transaction to your investing account.

- Actively look for investments that give out dividends when you invest.

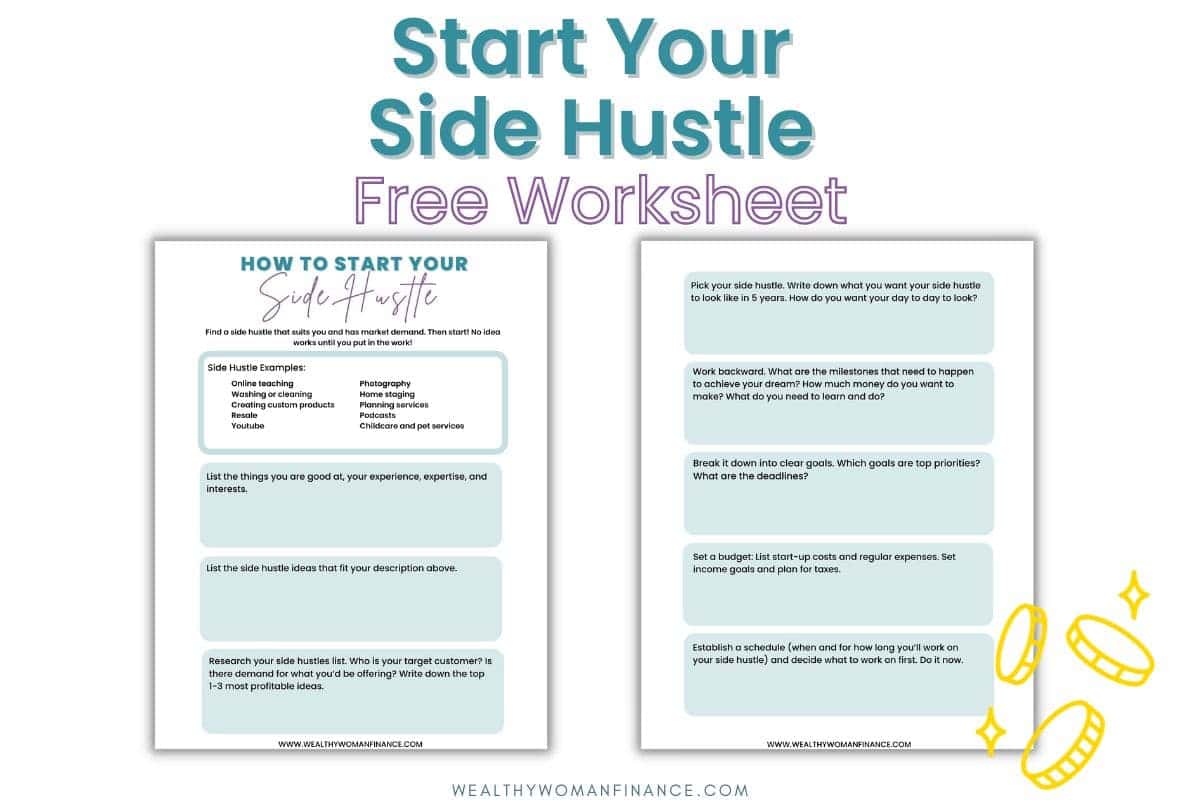

4. Side Hustle or Profit Income

*Active & Passive

For this, you own a side business or have a part-time job that generates income. This is often active, but can have passive income elements to it.

For example, if you pet-sit through a site like Rover, much of your income is passive because you don’t need to take care of the pets every minute of the day.

Profit income can also include things like:

- Fixing and reselling items for profit

- Offering childcare services

- Starting a side business, like car washing or event planning

See also:

- Great side hustle for couples ideas (many of which you can do yourself too!)

- Top home businesses for moms

- Passive Income Ideas for When You’re on a Budget

5. Capital Gains Income

*Passive Income

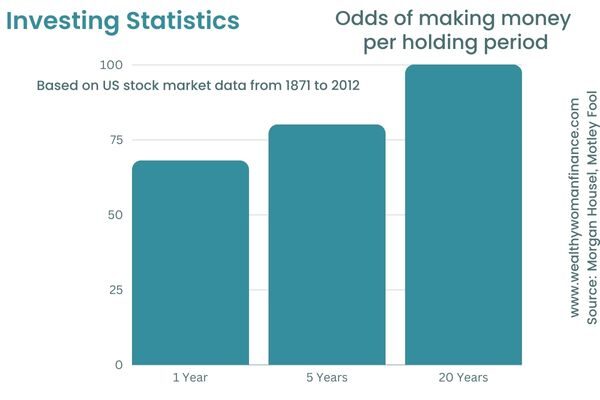

Capital gains are earned when you sell your investments, (like stocks, mutual funds, and ETF) and they’ve earned a profit.

Note: Capital gains are subject to taxes. Some can be taxed highly depending on your tax bracket and how long you held the investments for.

To boost capital gains income:

- Set aside room in your budget to invest and do it.

- Be patient as your investments grow.

6. Rental Income

*Active & Passive

To have rental property, you must first purchase real estate (home, duplex, apartments, office space, etc) and then have someone lease it.

Note: Many people talk about how rental real estate is passive, but there is still the purchase, set up, maintenance, and paperwork involved.

See: How to Invest in Real Estate

To start or boost rental income:

- Do research, talk to those with experience, and learn about real estate investing to see if this is an option for you.

- Save money for a downpayment.

- Decide if you will manage the rental yourself or use a management company.

- Run the numbers and purchase a property.

- Find tenants and maintain the property.

You can rent more than a living space! Rent out cars through Turo, storage space, and just about anything you can think of.

7. Royalty Income

*Passive Income

Royalty income is made from allowing someone else to use your property, intellectual property, or product.

Celebrities, big companies, and even Youtube stars make money doing this by developing a recognizable brand.

To start or boost royalty income, you’ll need to establish:

- books

- patents

- songs

- or trademarks

Then, make them successful enough that others want to use them.

How to Start Building Your Income Stream

To build a successful income stream you have to start. And then decide that you aren’t going to stop!

- Decide which income stream works best for you.

- Make a plan. What are the first 3 steps? What’s the 1st thing? Do #1 today!

- Strive to make a little progress every day. Even one phone call or 20 minutes of research keeps you moving in the right direction.

Before you know it, you’ll have income coming in that you hadn’t even dreamed of!

Free Side Hustle Pdf to Get You Started

Note: Tax laws and regulations vary. Consult with a financial advisor or accountant to understand the specific rules of your income streams.

What’s Next?

Receive inspiring wealthy woman ideas through the newsletter! You’ll feel empowered with practical tips that build your wealth now.