Reverse Budgeting: Pay Yourself First For Better 2024 Results

What is reverse budgeting?

Reverse budgeting is a monthly budget system that helps you emphasize long terms savings over inessentials.

In the reverse budgeting method, you are doing the exact opposite of most traditional budgets. You look at savings and investing FIRST, and then focus on your expenses.

The future takes priority over the present in reverse budgeting.

Pay yourself first budget pros and cons

Now, as with any method, this type of budget may not work for everyone. Here are great pros and cons to consider.

Reverse Budgeting Pros:

- Reverse budgeting is easy to automate. Which means that you will follow through. Every. Single. Time

- If you need to change your money habits, this is the best budget to do that.

- It’s low maintenance. Once it’s set up, it’s very hands-off.

- It is the most focused plan for your future financial goals.

- It naturally reduces impulsive purchases

Reverse Budgeting Cons:

- If you have a lot of debt, this approach may be difficult to stick with.

- It’s important to make sure you don’t squeeze yourself too hard. This could lead to overspending, which gets you in trouble on this budget.

How to Create A Reverse Budget

1. Know Your Income

Find your average after-tax monthly income for the last three months.

2. Assess your absolute needs

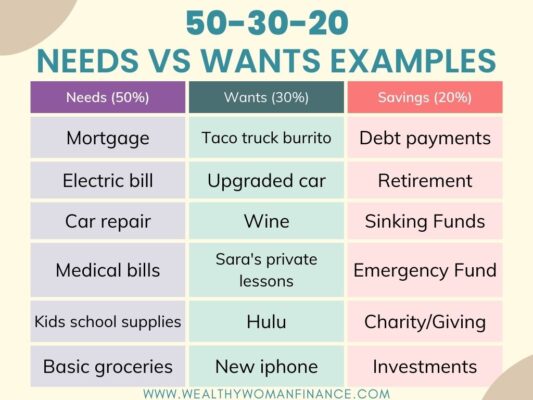

Use this needs vs wants examples and worksheet to understand your absolute needs. You don’t want to take out so much for your goals that you can’t cover your basics.

*Be conservative, you can always change this number later.

3. Decide on Savings & Investing

Next, run the numbers on your money goals. What are you hoping to accomplish?

- Emergency fund

- Retirement

- College for the kids

- Vacation

- Saving for a car, home, or wedding

If you aren’t sure, use the popular 50 30 20 rule as a starting guide. With this framework, 50% is for your needs, 30% for wants, and 20% for savings.

For example, let’s say you have $5,000 of after-tax monthly income. With the 50 30 20 method, $1,000 (20%) needs to be taken out for savings.

4. Set Savings & Investing Up Automatically

Next, this step is crucial. Take an hour or an afternoon and set up automatic transfers. This way your saving and investing come BEFORE you spend the rest.

5. Use What’s Left to Spend on needs and wants

You’ve covered your basics and your bright beautiful future. Now, allocate the rest for things that you want.

6. Adjust As Needed

As you get the hang of this budget, scale back if needed or adjust however makes sense for your situation and goals.

Reverse Budgeting Calculator

Use this calculator to determine how much to pay yourself first.

Pay Yourself First Examples

In my own life, we use reverse budgeting for a variety of things. Here are the savings and investing we take out of our paychecks automatically before we spend any of our monthly money:

- 401K

- Family HSA

- Sinking Fund Money: Vacation Planning, Giving, Car fund etc. (The total for our funds automatically transfers to a savings account)

- IRA

- 529s for the kids

What else could you pull out first?

Here are more Examples of Reverse Budgeting:

- Want to start investing in real estate or your own home? Set up an automatic transfer to a savings fund to start building your down payment.

- Regularly pull money into a savings account to fill up your emergency fund.

- Save for your next car instead of buying it on debt.

- Open a brokerage investing account and regularly transfer money to it.

- Save for a business conference that will help your career.

- Set your transfers up to your debt collectors to get out of debt faster.

Reverse Budgeting Method Template

Grab a free template to help you through your reverse budgeting process.

Do not save what is left after spending, but spend what is left after saving.

– Warren Buffett

Use this Method With or Without Other Budgets

The great thing about reverse budgeting is that it can go hand in hand with other budgets. Paying yourself first is a principal you apply to anything! Here are a few other examples of budgeting methods:

Zero Based Budgeting

The zero based budgeting method can be high maintenance, but if you are looking for a large shift or a true audit, this is excellent. In this method, you start from scratch every month. No expense is “grandfathered in.”

Percentage Based Budgeting

These free templates can guide you with your savings. I mentioned the popular 50 30 20 above but here are other percentages you can use as well:

- The 60 20 20 budget rule: a slightly different breakdown than the 50 30 20

- The 70 20 10 budget rule: this one has a specific spot for debt

- The 60 30 10 budget rule: excellent for if you want a high savings rate

- The 30 30 30 10 budget rule: gives you a spot for housing.

Envelope Budgeting

And finally, envelope budgeting is exactly like what it sounds. Instead of handling your money digitally, you are separating it out into envelopes as your categories every month.

This budget is great for if you struggle with how easy it is to spend in the digital world (and it is darn easy!)

Related: 100 Day Envelope Challenge To Save Money >>

Can you still do Reverse budgeting with debt?

Yes! Replace the savings category with a debt category and then do your reverse budgeting that way. It will help you eliminate debt faster!

Related: Grab these free debt tracker printables >>

What’s Next?

Grab motivation as you kickstart your savings using the reverse budgeting method.

Next, these fun money challenges will give you accountability. Plus, the free templates help you see your amazing progress!

- The Penny Savings Challenge: Anyone can save a penny!

- The 52 Week Money Saving Challenge

- 200 Days of Saving Envelope Challenge