Free Emergency Fund Challenge Tracker: 2024 Peace of Mind

Are you wondering how can I save a $1000 emergency fund fast? Or even how can I save $10,000 for emergencies? Then this emergency fund challenge and tracker are for you!

Why do you need an emergency fund?

An emergency fund is crucial because it protects you from life’s hardships.

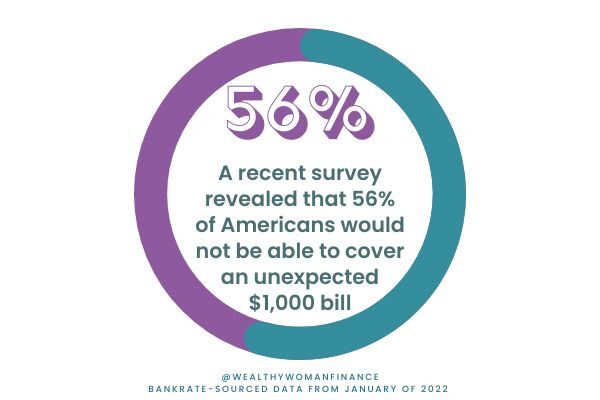

Many of the 56% of people surveyed above will fall into debt over a car, home, or medical bill that they didn’t expect. Suddenly, they are paying twice as much for something that could have been covered with savings. Don’t let that be you!

Think of an emergency fund as your superhero shield. It’s not for offense, but it makes an excellent defense. And once you have your shield in place for protection, you can go out and kick butt with your money. (Plus, you will stress a whole lot less!)

Your emergency fund can cover:

- Job loss

- Unexpected home repairs

- Car issues

- Out-of-the-blue family travel (You need to get home to see your dad pronto)

- A medical emergency

- A dental emergency

Want to save this challenge? Enter your email below and I’ll send a link straight to you.

What is a good emergency fund amount?

Ok, so what’s the rule for having money in case of emergencies?

How much you need for emergencies depends a lot on where you live, your life choices, and what helps you sleep at night.

Here are a few factors:

- I need more for my family of 5 than others may need for a family of 3.

- If your kids are young, some emergencies are more likely to happen.

- If you have other money invested (not in an ultra-risky endeavor and that could be pulled out within a few weeks), you may feel comfortable with a smaller emergency fund.

- If your cost of living is high, you need more money.

Is there an emergency fund ratio?

3-6 months of your expenses is a great rule for most.

First, add up your basic living examples for one month.

Then, multiply your expenses by 3 or 6 to see how much your emergency savings should be. Use the questions and emergency fund calculator below to help you determine the number that is right for you.

Emergency Fund Examples

You should be able to get to these savings easily in the case of minor or major bumps in the road. For this reason, you will want to keep your fund in a high-yield savings account instead of investing it or putting it into real estate where it’s difficult to get the money out.

You know that something is an emergency when it checks these boxes:

- It is necessary.

- It is urgent.

- Is it unexpected. (If something is expected, save for it using a sinking fund)

Emergency Fund Challenge Calculator

Use the calculator below to help you determine how much your family needs for your emergency fund.

Emergency Fund Challenge Definition

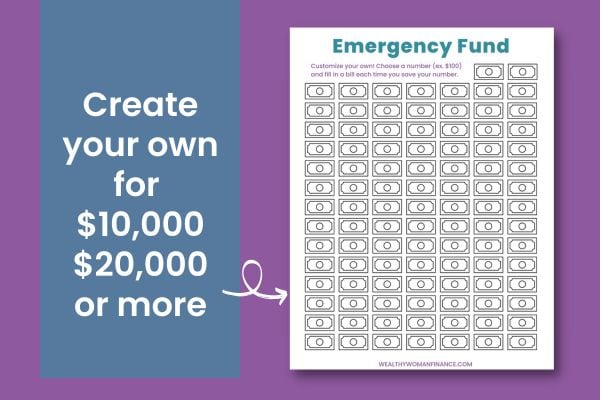

Now that you know your amount, how do you get there? With an emergency fund challenge! Break up your large number into the number of months it will take to have a fully funded emergency fund.

Then, push yourself to save consistently. Keep reading for great ways to save too!

Why This Works!

Here’s why this emergency fund challenge is amazing:

It breaks Your number into smaller steps

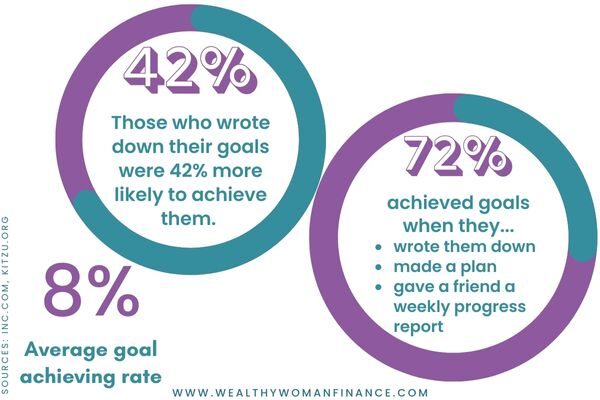

Looking at the full number may give you bad butterflies in your stomach. But once you break it down into small doable steps, you have a plan that is realistic and achievable.

It’s measurable

We can only improve what we measure. So, use the emergency fund challenge tracker below and make your progress visual. It is highly motivating!

It’s flexible

You will be able to alter the full amount as well as the time frame. This makes it reasonable for any budget.

It Helps You Become Resourceful

A challenge pushes you just enough to get creative with your spending and earning. Often, what we need is that little nudge to reach outside of our comfort zone and make great change happen.

Emergency Fund Challenge Trackers

1000 emergency fund challenge printable

5000 emergency fund challenge printable

Related: Save 5000 dollars in 3 months

Customizable tracker in the resource library

Grab this in the resource library! Sign up below to gain access:

Emergency Fund Savings Tips

Now, you know what you need and you have an emergency fund challenge tracker to measure progress. But how will you save enough to reach your goals? Here are great ideas!

1. Grab The Low Hanging “Fruit” First

We all have these. They are the things we know we should not be spending money on. It might be that junk food at the gas station, the six tv streaming services, or the liquor tab. Often, these are vices (that are not good for us anyway) or things we purchase and then forget about.

Dig around your budget and find “the low-hanging fruit first.” This will give you a big win early, making it easier to build momentum for later.

2. Evaluate Your Needs And Wants to live well

Use these needs and wants examples to help you determine exactly what should be in your budget and what can be left out. Start with a zero-based approach and you will get a much clearer view.

3. Pay Yourself First

Instead of spending and saving what is left, swap that. Transfer the amount you determined in your emergency fund calculator to your savings FIRST, and then use the rest for spending.

Related Post: Reverse Budgeting: How It Works

4. Make More Money

Cutting back is important for saving money. But often, we forget the amazing power of earning more money. Ask for a raise at work, negotiate a bonus, start a side hustle, or pick up overtime.

Many of these are actions that give you massive results in less time.

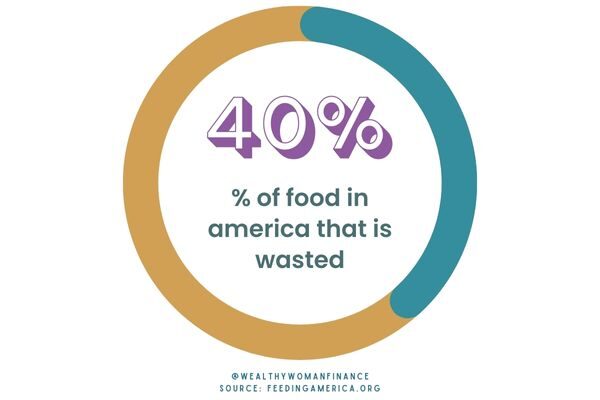

5. Save on Food

Save on food without sacrificing the quality of food that you put in your body. Try these tips for saving on food:

- Shop at a cheaper grocery store

- Buy generic instead of name brand when the quality is the same

- Order online so that you are not tempted to impulse buy in the store

And don’t forget these three steps to make sure you are wasting less food.

- Look through your freezer, fridge, and pantry to see what needs to be used up.

- Meal plan around what you already have.

- Make a list of the rest of the items needed.

Related: Pantry Challenge Ideas

6. Save on Home and Car

These are often your BIGGEST expenses. That means that if you can cut back on them, you save hours of trying to save on the smaller things. In many cases, one change here could fully fund your emergency savings.

- Downsize your car or home

- Pay off your car

- Move close to work (or work from home)

- Buy a used car instead of new

7. Use a Budget & Track it

I love Mint.com. It is a digital software that keeps track for you. Or you can use paper and a pencil as well. Either way, track that budget so that you know when you are spending.

Try one of these popular budgets and free printables:

If you struggle with staying within budget, then make things easier on yourself with a cash-only budget system. You can even hide, freeze, or leave your credit card at home when you go out.

8. Stay Motivated

Keeping your head in the game is half the bottle. Here are easy ways to stay focused!

- Treat yourself in self-indulgent but inexpensive ways.

- Put your emergency fund challenge printable on the fridge so you see it often.

- Write why you are saving or write your financial goals. Then, review each morning. (Grab more millionaire morning routine ideas)

- Repeat success affirmations to build your wealth mindset.

- Make an inspirational money vision board. What will you gain from having a financial cushion?

- Read money books about mindset that inspire you.

9. Find Better Options

Just because you are saving money doesn’t mean you have to cut everything. In many cases, all it takes are creative tweaks.

- When you are hosting, why not have everyone bring a side?

- Find cheap things to do instead of spending hundreds of dollars every time.

- Give thoughtful thank you gifts without spending a fortune.

It doesn’t have to be all or nothing. It is more about becoming intentional with your choices.

10. Do Mini challenges within the Emergency Fund challenge

Finally, if you need a boost during your emergency fund challenge, try one of these shorter (but very effective) ways to save money:

- Try a no spend challenge or spending freeze

- Do the how to stop eating out challenge

- Complete a 100 envelope challenge or 200 envelope challenge to turn this into a cash system

- Buy no new clothes for a set period of time

- Challenge yourself to make amazing homemade gifts until your emergency fund is funded.

Is a $5,000 emergency fund enough?

This question gets asked a lot. And as we discussed above, it depends on your situation. If you are single or without kids and live in a low-cost-of-living area, then this may be enough.

One financial research paper has found that $2,467 is the actual number needed for the average low-income household. This is far less than what is recommended, but will also cover most minor immediate cash emergencies.

If you have dependents, live in a mid-high income household, or would not have peace of mind with this number, then you will want to beef your emergency fund up with the tips above.

Is $10,000 or $20,000 too much for an emergency fund?

These numbers can both make sense.

If your monthly expenses are $3,500 a month, then a $10,500 emergency fund will cover you for three months.

If your monthly expenses are $5,000 a month, then $20,000 will cover 4 months of your expenses. And you might even be more comfortable with a bigger fund.

*Use the emergency fund calculator above to help you get to your “peace of mind” number!

To Consider With The Emergency Fund Savings Challenge

Alright, you are set up to win in this challenge! Try the emergency fund challenge and let us know what you think in the comments below!

“Save what you can toward the emergency and life happens fund. But don’t worry yourself sick at the slow growth. The point is it’s growing even if it’s just one dollar at at time.” – Michelle Singletary

More Wealthy Woman challenges you’ll love…

- Penny Money Saving Challenge Chart

- Vacation Savings Challenge Printable

- 52 Week Money Challenge Printables

- 30 Day Money Challenge Printable (Includes specific daily actions!)