Free Commitment Card: How to Make Sure You Achieve Goals

Have you ever said you were going to do something and then…

fallen off the wagon?

We all have! But it’s not that you lacked willpower or motivation. It’s that you didn’t have a system in place to keep you on track. That’s what this free commitment card is. It gives you clear direction and accountability in reaching your goals.

It helps you carry out the vision.

After all, money isn’t all about numbers. It’s really about behavior.

And a commitment card is how you direct that behavior.

Why You Should do a commitment card

When you make a written commitment you are more likely to follow through. In the book Influence, social psychologist, Dr. Robert Cialdini explains that once we’ve committed to a course of action, we naturally pressure ourselves to conform to that commitment (source).

Add a dash of accountability and you’re well on your way to keeping that commitment to yourself.

What you Can Use the Card for

The best part about this commitment card is that you can use it for any goal or habit. But since we’re here to help you build your financial future, that’s the target of this article.

Here are a few ideas:

- Save up for a vacation

- Build an emergency fund

- Pay down high-interest debt

- Make a will

- Take a class or learn a new skill

- Learn more about money and finance

- Create passive income

- Buy a rental property

- Save more for retirement or retire early

- Save for a wedding

- Save for a downpayment

- Go back to school (or finish a degree)

- Save for your kids’ college

- Pay off your mortgage

What’s in the Commitment Pledge Template

Now, here is what is on the commitment card template and why. Then, keep reading for specific examples to guide you and to print the download.

Financial Goal or Habit:

*State your main goal(s) or habit(s)

why You Are Determined To Achieve This:

Write down what your motivation is to reach this goal. Dig deep and be specific about how it will improve your quality of life.

Will it allow you to change your job? Travel with your partner? Or finally feel free?

How You Will Measure Your Goal & Milestones:

Write what you will use to measure your progress. If it is a large goal, you may want to break it down into smaller milestone touchpoints along the way as well.

Here are different ways to measure financial progress:

- Credit Score Number

- Amount of Money in the Bank or Investments

- Amount of Debt You Owe

- Amount of Income You Make

- Using a tracker or log to record good habits

The Very Next Step: Other Action Steps:

Next, your mind loves to give excuses when you are vague. So, don’t let that happen.

Write down the first step towards meeting your goal. Make it an action verb so that you know exactly what to do. For example: “Call _____.” “Write _____.”

There’s also space here to brainstorm what the following steps may look like.

The Consequence of Not Following Through:

To keep a commitment to yourself, it helps to add an incentive or consequence. Since most humans are loss-averse, the commitment card includes a consequence.

Here are examples:

- You donate to an organization that you hate

- You dress up for a month

- You wear a sports team rival’s gear/clothing for a week

- You do all the chores in the house for a week

- You give cash to someone to use as they’d like

- You post your failure publicly on social media

The consequence you pick can be hardcore or light. Base it on the goal, your personality, and your situation.

Speaking from experience, the threat of donating to a person or organization you dislike is very effective. Especially if you feel this person goes against your moral code.

With Whom & When You Check In

This accountability piece ensures you work towards your goals consistently, even when the going gets tough. Pick a friend, your partner, or a family member. Then, decide which day of the week you will send your measure of progress.

Your signature

Adding your signature provides the formal commitment piece.

Your accountability partner’s signature

Having your partner sign means that you are serious about what’s happening.

“Unless commitment is made, there are only promises and hopes… but no plans.”

– Peter F. Drucker

Free Commitment Card Contract Pdf

Start today! And keep reading for specific examples you can use.

Want more like this? Find budget templates, worksheets, and more in our free resource library. Grab access below!

Commitment Card Examples #1

Financial Goal or Habit:

To pay off $4,000 in debt by December 10th.

why You Are Determined To Achieve This:

I’m sick of paying extra fees and being stressed out about money. I want to build financial wellness, buy that home, and enjoy fun vacations in the future.

How You Will Measure Your Goal & Milestones:

I’ll pay $500 dollars a month to achieve this by the date. My debt balance will be my measurement.

Related: Free Debt Trackers

The Very Next Step: Other Action Steps:

The very next step is to sign up for 2 hours of overtime this month. After that, I can:

- Make a list of possible side hustles to start

- Cook at home 6 days a week (make a monthly meal plan ASAP)

- Declutter and have a garage sale this fall

- Start a cash envelope system to put my spending on hold

- Check the budget once a week on Saturday mornings

The Consequence of Not Following Through:

If I fail to meet any of my $500 a month payoffs, I have to spend the rest of football season cheering on the Denver Broncos (and wearing the gear), instead of my home team.

With Whom & When You Check In

Every Saturday, I’ll check in with Amy, giving her an update of how much I have saved for the month. At the end of each month, I’ll show her a screenshot of the debt owed.

“There’s a difference between interest and commitment. When you’re interested in doing something, you do it only when circumstances permit. When you’re committed to something, you accept no excuses, only results.”

– Art Turock

Card Goal Example: #2

Financial Goal or Habit:

I will do one thing every day towards building my home business.

why You Are Determined To Achieve This:

I want to be able to quit my job in 3 years and depend solely on my business income.

How You Will Measure Your Goal & Milestones:

I will get up an hour earlier (6:00 am) 5x a week and use this time for the most important business task. After, I will record exactly what I did.

The Very Next Step: Other Action Steps:

My very next step is to prioritize my list of business tasks and decide what I will do on each day. After that, I can:

- Set up an LLC

- Outline my product design

- Research how to set up my online store

- Run the numbers on the costs of materials

- Make 5 “starter” products to begin

The Consequence of Not Following Through:

If I fail to spend my 5 morning hours a week on my business, I will cut out Netflix and Hulu for a year.

With Whom And When You Check In

Every Sunday, I will check in with Laura. I will show her my log of what I did during the week, as well as the progress made on the business.

Example #3:

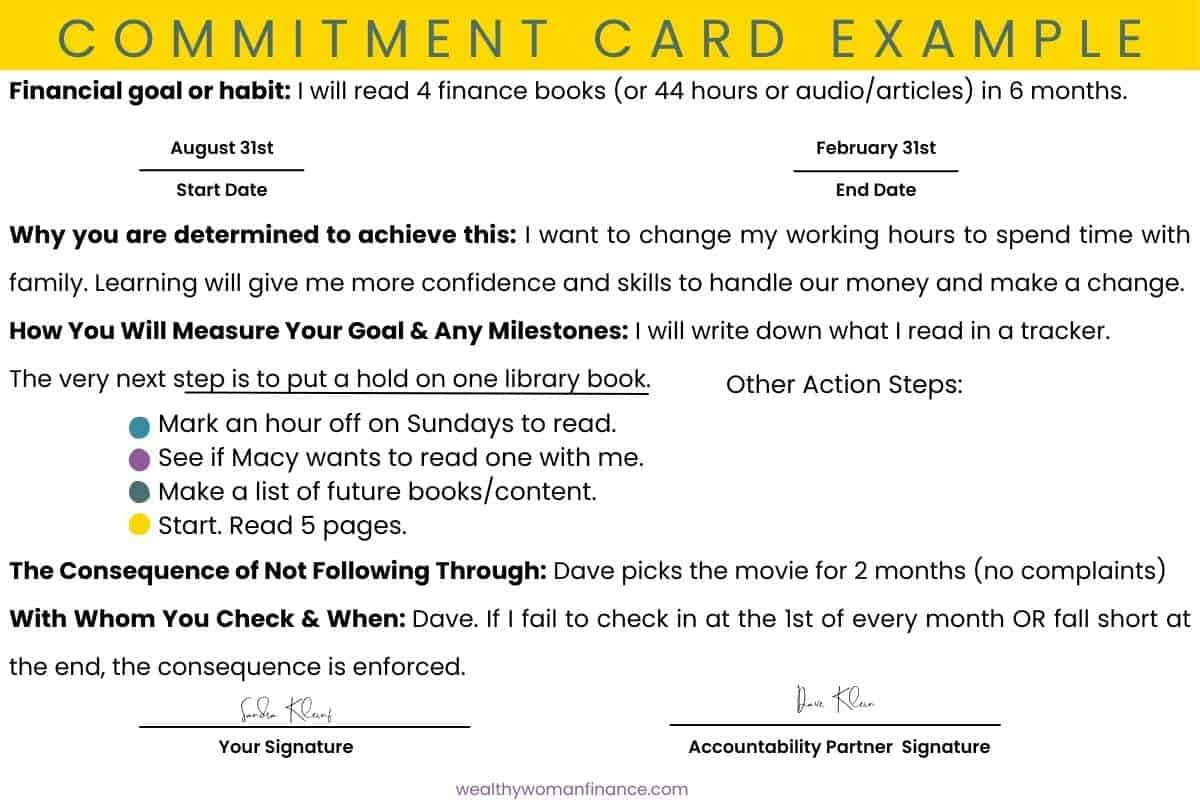

Here is an example of what a completed card may look like:

Commitment is the foundation of great accomplishments.

– Heidi Reeder

To Consider With the Commitment Pledge Card

I hope you use this commitment card contract to finally keep your commitments to yourself.

No flowery words and empty promises.

Just good, old-fashioned action. You do what you say you’re going to do. It’s as simple as that.

Leave a comment and let us know how you’re using your commitment card!