How Living Below Your Means Is the Ticket to Financial Freedom

A friend’s husband was laid off recently. Yet, because they live below their means, they were able to wait for an even better opportunity. Instead of snapping up the first job that came along, he ended up in a better position than he had been in before.

And this is the power of living below your means.

This post contains affiliate links. See our disclaimer for more.

Living Below Your Means Definition

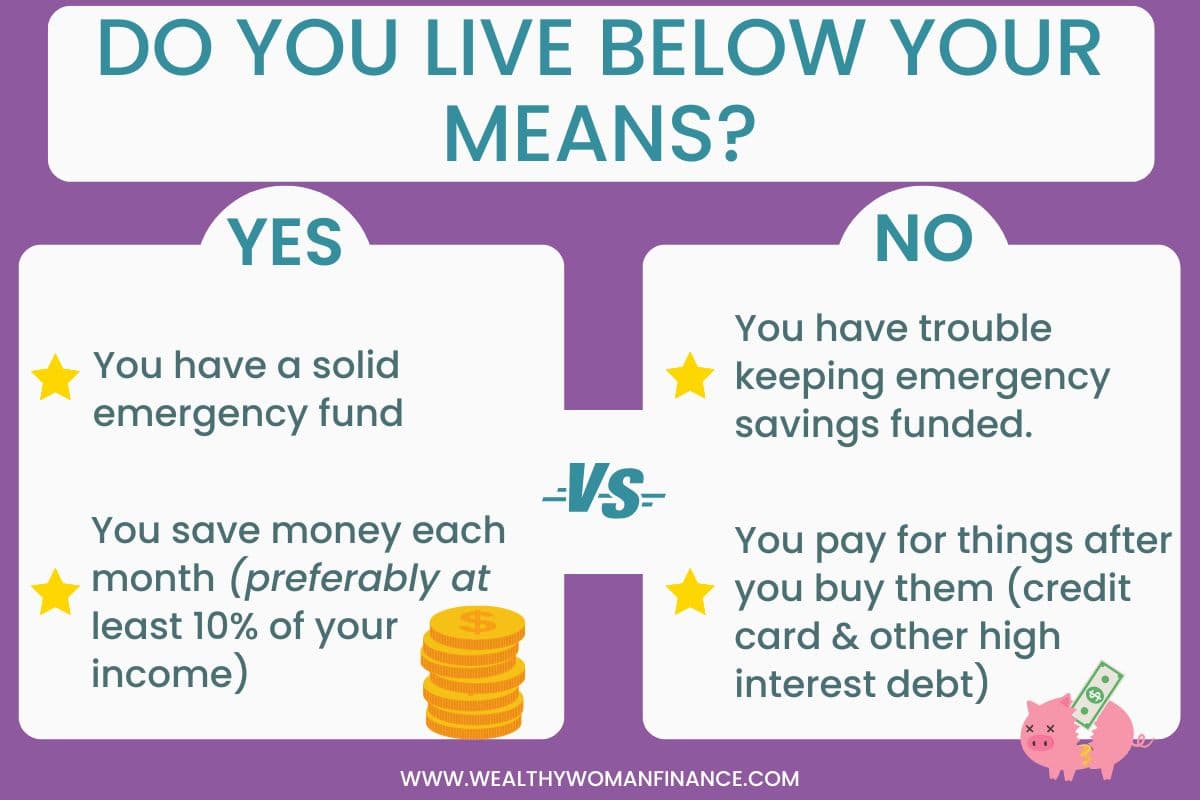

First, what does it mean to live below your means?

You make more than you spend.

This could be a lot or a little, but you are consistently saving money because you have a gap between the two.

Here’s a great chart to help you see the difference:

Amazing Benefits of Living Below Your Means

Money in the bank affords you all sorts of advantages. Let’s check it out!

Job flexibility

In a different way than my friend’s family above, living below our means has allowed me to start an online business. Without the funds to support it for several years, the business would not be thriving now.

You can also take time off of work. Or go back to school if you live within your means.

cover minor emergencies easily

Everyday hardships happen to all of us. But an intentional lifestyle allows you to fix the dishwasher without wondering where the money will come from.

Security & Freedom From Financial Stress

Not having enough money to cover your bills causes significant strain and misery. In a world of problems, isn’t it nice not to have money be one of them?

You can make snappy decisions for fun

Let’s say your high school daughter has the opportunity to go on a trip with her school. Going with her is an easy decision. And it’s a great way to take advantage of life’s unexpected opportunities.

It allows for financial freedom

Retire early. Take a sabbatical. Raise your kids. Spend more of your time surfing.

Living below your means allows you to break out of the cage that other people live in. And instead, live life on your terms.

Related: Hidden benefits of saving money

How to Live Below Your Means: 15 Great Tips

Now, are you wondering how to live below your means? This section has you covered!

1. Make Financial Goals

First, a clear vision of your money dreams makes it much easier. Set a few financial goals that motivate you, and don’t forget to highlight why and how you want to travel, have security for your family, and enjoy your retirement.

Financial goals might include:

- an emergency fund goal

- a debt payoff plan

- an investment plan (make your money work for you!)

- large purchase goals like a home (or home renovation), kids college, weddings, etc.

2. Change the Way You Think About It

Like with budgeting, living below your means can have a negative connotation and feel restrictive for some. If that’s you, change the way you view it.

Title your new financial plan one of these instead:

3. Find out where you stand

Now, before you can dig in, you need to know how much you spend. Look at the last 3 months of spending to get an idea.

Are you currently living below or above what you bring in? And by how much?

4. Start & Use a budget

Next, decide how much you would like to save going forward. Check out one of the budgeting methods below for guidance and a template. Or start with what you can, and make a commitment to build slowly as you go.

5. Track Your Progress

Utilize Mint.com or another budgeting app. Or keep track on paper. But do NOT underestimate the motivational power of seeing your progress!

Plus, tracking your income and savings will allow you to make adjustments quickly. Tweak your budget using the tips below and investigate additional clever ways to save.

6. Pay down debt

Next, if you have high-interest debt, that’s the first thing to go! Debt is like throwing money out the car window as you drive.

Use one of the free debt tracker printables here to pay down your car, home, student loan, and credit card debt. >>

7. Get rid of Sneaky spending

Here are quick tips to avoid those most insidious expenses.

Impulse Shopping: Remove your credit card from the saved option on your computer.

Unsubscribe from subscriptions: Audit your memberships and subscriptions and get rid of what you don’t use.

Remove a tv streaming service: Pick up a book instead!

Scale back on your vices: In many cases, cutting back will make you healthier AND wealthier. Double win! My hubby and I did a dry January and saved $200 that month. Plus, it helped us cut the habit long-term.

8. Optimize your big 3 Expenses

Home: Decide whether your home size is based on your needs or what society tells you that you “need.” Downsize if it’s appropriate, and you will be living below your means effortlessly.

Car: Drive a used car. Pay cash upfront for your cars if you can, and keep them for as long as you can.

Food: Shop at a discount store. And order online so you aren’t tempted to spend on impulse purchases.

9. Make It Automatic

Pay yourself first by setting up automatic transfers to your savings and investment accounts. And create sinking funds to help take care of expenses you know about.

10. Pay with cash

If you struggle with impulse spending, make it hard to use your credit cards. Set up an envelope budgeting system or use your debit card. And leave your credit card at home when you go out.

11. Make More to Have More

Widen your savings gap by making more money. This can be done by getting raises or promotions, saving your bonuses, or starting a side hustle.

See great ways to make 500 fast here >>

12. Practice Delayed Spending

Before you splurge on a big purchase, make sure that you have thought it over. Wait 48-72 hours before sealing the deal. You can also practice delayed gratification by waiting for the next sale. Most stores run sales over big holidays.

13. ASK

Asking can be hard for women especially. But what’s the worst that someone can say?

No. That’s it. (And even if they say no, you’ve planted the seed for the future!)

Practice asking as much as possible. Ask for a raise, negotiate a salary, and ask for a lower price on big purchases. Learn to be a great haggler and you’ll save in more ways than you can fathom.

See the book Ask For It: How Women Can Use the Power of Negotiation to Get What They Really Want if you need help!

14. Utilize Small Treats

Tightening your spending too much can be a recipe for disaster once your motivation wears off. Instead, cut costs but also add small ways to keep your spirits up.

These are great treats for on a budget. >>

Try a Money Saving Challenge to Get a Jumpstart

These money challenges are excellent to get you motivated to save more! They all come with free printables to make it easy.

- Vacation Savings Challenge Plan

- 100 Envelope Savings Challenge Chart

- 52 Week Saving Challenge Printable

Living Below Your Means Calculator

Next, play with your numbers to see how much you are saving now, and what you can do in the future.

How to Live Below Your Means Example

Using the calculator above, let’s say Sally makes $5,000 a month and she wants to start living well below her means. She’d like to save $1,000 a month.

If she keeps her monthly expenses to $4,000 a month, then she will be saving 20%.

Q&A

And finally, here are a few common questions and answers about how to live below your means!

Is living below your means worth it?

Heck yes! It requires you to plan and sometimes sacrifice up front. But the freedom of living life on your own terms is well worth the cost. And it’s a life choice that you will never regret.

How much below your means should you live?

The answer to this depends on the person, cost of living in your area, goals, and life situation. And it’s why the living below your means calculator has different options.

If you want to retire early, you might be more aggressive.

If you’d just like to have options and live comfortably, start with 10% and increase it to 20-30% or more over time.

How do you live far below your means?

Want to take it to the next level? Here are ideas to start saving drastically:

- If you have two incomes in your family, live off one of them and save the other.

- Live in a home &/or cost of living area that gives you plenty of wiggle room.

- Make wealth building your favorite hobby. The more you learn and do, the easier it becomes to spot savings and income opportunities.

More Great Wealthy Woman Articles:

- How to Get Ahead Financially Now

- Stealth Wealth: How the Wealthy Go Unseen

- Rich Vs. Wealthy: Do You Know the Difference?