23 Hard Money Truths You Need To Know in 2024

Many of us avoid conversations around money, deeming it taboo or uncomfortable. And yet, it is something that affects every single day of our lives. Why can’t we discuss the universal money truths we’ve learned over time? This is how we grow!

In this article, you’ll find the most important money truths. Some are fundamental principles, while others are from my own life experiences.

Top 10 Money Truths Everyone Should Know

First, the top 10 money truths are hard-hitting and mega-important!

1. With Money, Ignorance is NOT Bliss.

In fact, it’s downright dangerous. Without a clear understanding of money truths, you

- fall prey to scams and bad investments (remember Bernie Madoff?)

- accumulate debt that you can’t pay back

- trash your credit score (affecting your ability to buy a home or get a job)

In contrast, if you spend a little bit of time educating yourself, you will have more money in the bank and a much brighter future.

2. Money Won’t Make You Happy. Or Will It?

Ask many lottery winners and washed-out celebrities, and they’ll say it does not. In fact, after a certain income point, studies show that the happiness factor of making money drops off significantly. But here’s what bothers me about this often-used study: the studies only measure income.

What about measuring wealth instead of income? Does wealth not bring flexibility? Options? Peace of mind?

Does it not allow you to take that once-in-a-lifetime trip to Italy with your partner?

I’ve watched dozens of people stress about money. I’ve observed…

- a family member not be able to quit a job they hate.

- another worry about how they’ll pay for a simple house repair.

- a friend have to go back to work weeks after having a baby.

And this leads me to my own controversial money truth. Income may not make you happy. But money in the bank gives you stability and opportunity. And these sure do.

3. Time is your most valuable asset.

The average person spends 2 hours and 30 minutes on social media and another 2 and half hours watching tv (source, source)

Self-made millionaires and billionaires are not among those people. They also aren’t trading all of their hours for work. Working three jobs that barely make enough to survive isn’t a good use of your time either.

These people are leveraging their time. They’re learning new skills. Setting up passive income streams. Cooking healthy food at home. Spending time with their families. And making the most of the time they’re given.

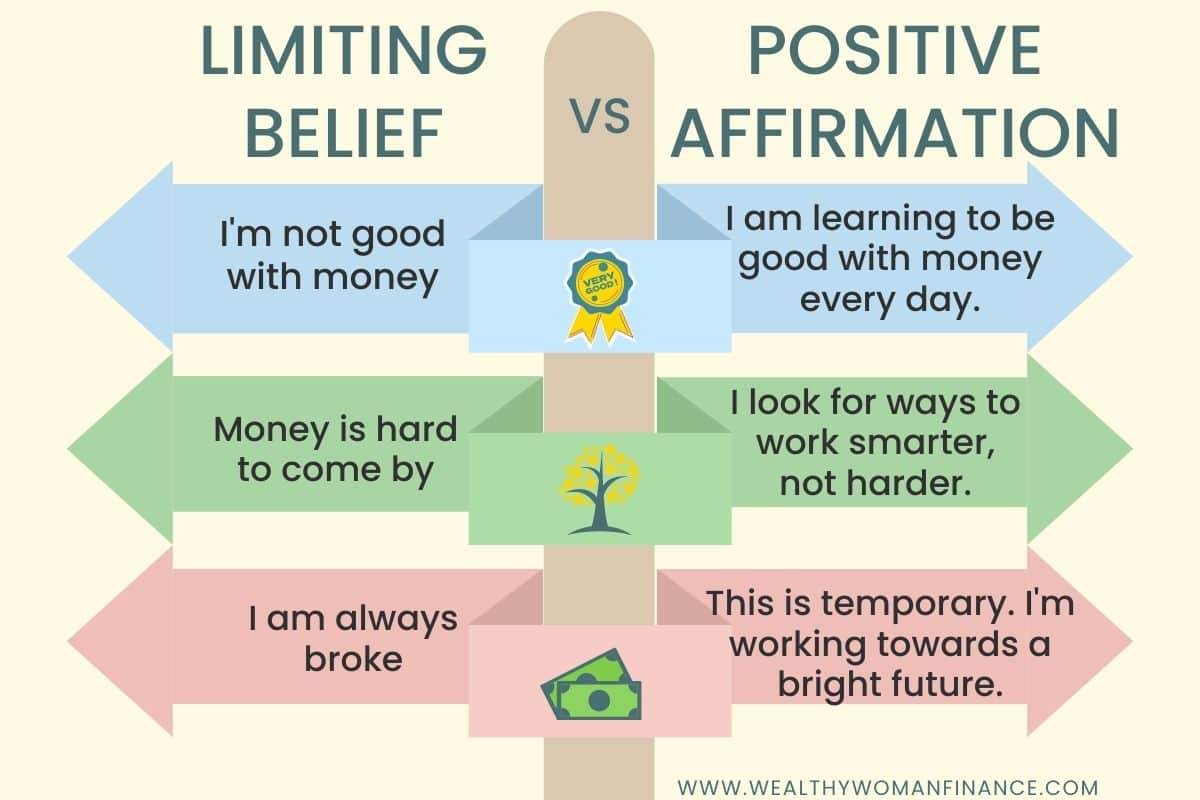

4. Your mindset is of utmost importance

People who are successful in accumulating wealth have a positive attitude toward money. They believe that they can create wealth. They also tend to be optimistic and have a growth mindset.

On the other hand, those with a negative mindset toward money struggle. They believe that wealth is only for a select few. And so they never truly bother building it.

Related: How to overcome limiting money beliefs

5. Hard Money Truth: All 3 Wealth Principles matter

So much financial advice centers around the advice “save, save, save.” But without earning and investing, that leaves you at a massive disadvantage.

In fact, I’d dare say that earning is the most beneficial of the three.

- There are no limits on how much you can earn

- You are adding value to society

- There’s not much time left over to spend when you’re focused on earning

- You are living an abundance mindset instead of a scarcity one

- You don’t have to wait on compound interest

6. People make investing seem WAAAYYY harder than it is.

You don’t need fancy spreadsheets, know how to short stocks, or know how the heck Bitcoin works. (Seriously, I’ve had 20 people explain it to me, and I still don’t get it).

It’s great if you do, but you don’t have to.

Put your money into a broad index fund and you’ll do better than all those boasting day traders (which investing studies show don’t perform well). You may not be able to brag about your prowess, but you’ll still be building wealth.

Related: Warren Buffett’s Investing Checklist for Beginners

7. Some level of risk is required

This can be especially hard for women. Risk means possible failure. But over time, I’ve also realized that you have to get in the game to see the rewards.

For example, these all require risk:

- Starting (and growing) a business

- Going back to school to improve your job skills

- Asking for a raise or promotion

- Investing in anything (real estate, new tech, a house cleaner, stocks)

Sure, you can keep all of your money in a savings account and work for the same amount all your life. But you’ll be losing money because of inflation.

It’s about managing and being smart about your risk. Not avoiding it.

8. Financial Success Requires Consistent Action

A friend recently had a life insurance agent look at her finances and say “you must live on a tight budget” because of how much she had saved.

She laughed. No one at her home is making massive sacrifices.

But what she HAS DONE is taken intentional action. She tracks spending, learns about finance, sets financial goals, and has a (loose) budget. With time, these consistent actions have led to wider gaps between income and spending. Compound interest does the rest.

9. Giving Makes You Happier

A 2008 study by Harvard Business School made an interesting discovery. Despite participants’ predictions that spending money on themselves would make them happier, it was found that giving money to someone else lifted participants’ happiness more.

Hoarding your money is a hollow victory when you can be leading a much happier life.

10. Debt Is A Slippery Slope

While it may be tempting to take out loans or use credit cards to make ends meet, it can lead to a cycle of debt that is difficult to break.

Be mindful of spending habits. Debt can certainly be used strategically, but shouldn’t be what you rely on to get by.

Remember that debt is someone else’s way of making money.

More Epic Money Truths People Don’t Know

11. Recessions & Change Are Not Something To Fear

Are you worried about the price of eggs? Or what AI will do to your job?

Perhaps it’s time for a mindset shift. Uncertain periods are full of growth.

You can fill your mind with media doom or you can use change and economic downtimes to improve. Become more resourceful. Use recessions to problem-solve and find solutions. Use new technology to innovate and pivot.

12. Small habits make a huge difference over time.

It’s the compound factor with your habits!

For example, recently I noticed that I gained a bit of weight. This led me to notice we were eating out much more than we used to. How did I not realize this sooner?

Because it wasn’t a sudden occurrence. It started with 1 day a week, then eventually became 2, and so on over a period of several years. It was so slow and insidious, that it was easy to not notice.

On the flip side, good habits work this way too. Checking your family finances monthly can be boring and tedious. But it will also be the reason you are in good financial shape in 5 years.

13. Compound Interest Will Surprise You

Let’s say you invest $1000 and it earns 6% interest per year. After one year, you will have earned $60 in interest, bringing your total balance to $1,060.

If you leave that money alone and continue to earn 6% interest each year, after 10 years, your initial investment will have grown to $1,790.85. Without you doing anything.

Related: Begin investing with $500

14. Quality beats quantity.

Rich vs poor is often similar to the approach of quality vs quantity. Wealthy individuals know that quality is worth the cost of their time. They don’t want to have to buy another or repair something that broke in a week. They buy 1 and move on.

And yet, a person with a poor mindset will think “the cheaper the better” regardless of the quality. Then, they’ll buy 15 because it was a good deal.

Related: Cheap Vs Frugal: Which are you?

15. Minimalism can make you wealthy in multiple ways.

The more clutter my home accumulates, the more out of control and distracted I feel. The same goes for time. The more activities we get involved in, the less focused I am on my core priorities.

When you strip away the complexity of your stuff and busyness, you are left with what matters most. And the trail to wealth (in all areas of your life) becomes a lot simpler.

Related: More Declutter Motivation

16. Money Truths: Pay Yourself First

It’s simple. Don’t give yourself time to spend money you want to save.

Use reverse budgeting and have your savings deducted straight from your paycheck.

17. Diversify. But Keep It Simple Too.

You should never put all of your money in one stock. Or one venture. If it loses money, you lose too much. Instead, invest in a mix, but keep it within what you can keep track of too.

18. Building Wealth Means You Can Make A Bigger Impact.

I read something once that changed my mindset about women building wealth.

Often ambitious women are looked down upon. But why? As a society, women are giving people. They help and take care of others.

We should WANT women to be wealthy. We should WANT the impact women can make. They will mentor others. Advocate against injustices. And fight for children.

“Ambitious” women can change our world.

You can give $5 or you can give $5,000. Who is making the bigger impact?

19. Want to Get Paid More? Be More Helpful.

Add value. Find a solution to someone’s problem. The more useful you can be, the more money you make. It’s a simple, but powerful formula.

20. You Are Your Best Investment. Of All Time.

Ah, but how do you become more helpful? You work on yourself.

People can drone on about which is better: stocks, bonds, or real estate. But none of those come close to the earning potential you have when you upgrade your own skills and life.

Compound interest is a beautiful thing, but while you wait years for that money to grow you can do a lot more with your money.

21. Wealth is ultimately about delayed gratification

Delayed gratification can be difficult, especially in a world where you can get an Amazon package by the end of the day. However, it is an important mindset to adopt if you want to build wealth.

By delaying gratification, you avoid unnecessary debt and expenses, and instead invest your money in assets that will appreciate.

22. Life Is About More Than Money

Money is a number on a computer screen. Or it’s paper in your hand. Either way, it’s just a tool. One that helps you live out your lifestyle dreams.

But remember that if you spend all of your time crunching numbers, you are missing out on the nonmonetary moments of life too.

No one will ever pay you to hang out with your kids, have a date with your partner, or go for a run. But these matter just as much.

23. Look Towards The Future

Finally, those that build wealth are excellent at seeing their future vision as reality. They aren’t stuck in the actions of their past. Or their present. It’s all about getting to where they want to be.

Think like them and work towards your future self.

Related: How to Make a Money Vision Board & How to Make a Business Vision Board

To Consider With Hard Truths About Money

Successful wealth builders develop a set of habits, have a positive attitude toward money, and are willing to look toward the long-term gains of the future.

These are all money truths that you can adopt for yourself. Start now!