Why Can’t I Save Money?: 25 Ways to Save Now

Do you ever wonder why you can’t save more money?

If it feels like your wheels are spinning or keeping cash in your pocket is harder than it used to be, read on. You’ll learn the top reasons saving is difficult and what you can do about it!

Five Main Reasons: Why It’s Difficult to Save

First, why is it so hard to save money in America? And have you noticed that saving seems harder for some than others? Any of these are likely the culprit!

1. You Live in a High Cost of Living Area

Big cities and coastal areas are notorious for being hard places to save. You may have to work long hours just to survive.

2. You Have a Lot of Debt

If you have large debts hanging over your head, all of your resources are spent paying them. Saving isn’t even part of the equation.

3. You Don’t Make Enough Money

The hard money truth is, you can DIY everything under the sun. But if you don’t start with enough money, saving is so much harder.

4. You Fly By the Seat of Your Pants

You have no clear money goals. No saving priorities. And with no clear path, there isn’t enough reason to save.

5. You Don’t Have Any Idea Where Your Money Is Going

You never track your spending or have a budget. Those things feel restricting. But, if you never know where your money is going, you won’t be aware of when you need to cut back.

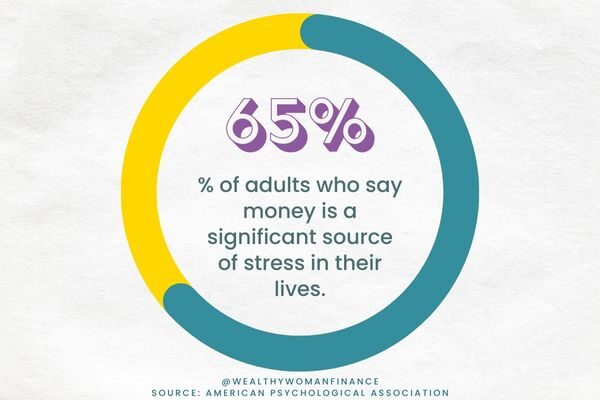

Consequences of Not Saving Money

Not saving money is stressful. You want to have security for your family, enjoy the present, and look forward to a sunny future.

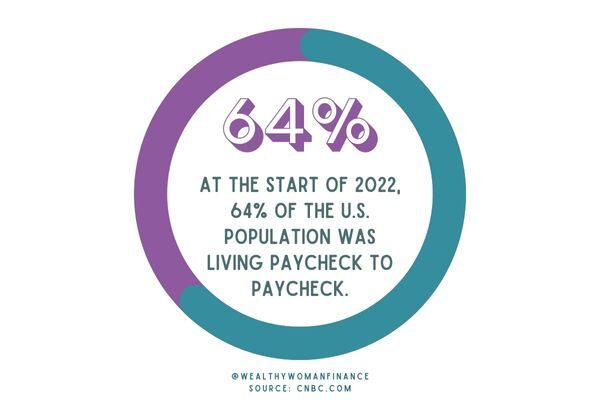

But 36% of Americans don’t believe they’ll ever retire (source). And 56% of Americans can’t cover a $1000 emergency expense (source). These are scary numbers. And it’s time to change them!

How Can I Force Myself To Save Money?

That’s the big question, isn’t it? Sometimes we need a nudge to do what should be done. Below is a list of 25 ways to address the challenges of saving. Start by picking the one or two that will impact you most.

1. Pay Yourself First

The very best way to save money is to force it upon yourself – with automatic transfers. Before your paycheck even hits your checking account, make sure it’s getting whisked away to your most important money goals.

This is reverse budgeting at its finest! And it can be done with any online bank account.

2. Do an Expense Audit

Next, look at your expenses for the last three months. Does anything funky pop up? Does anything surprise you?

Go through every single expense and determine what is a need and what is a want. You will walk away with a much clearer view of your spending.

3. Figure out If You Are Living Below Your Means

Subtract your monthly expenses from your monthly income. Do you get a positive or a negative number?

Try this calculator:

If your number is positive, you are living below your means (and saving money!) If not, you’ll know how much work you have to do to get there.

3. Get Yourself on a Budget

Some people feel confined in a budget. If that’s you, use the image below to reframe the wording (and your thoughts). You are using a set of boundaries that help you achieve financial freedom. Without a little discipline, there’s no reward!

Next, check out the popular 50 30 20 budget template to help you get a feel for what to save and spend. Or try the zero based budgeting template if you’d like to go deeper and evaluate your spending closely.

4. Get Out From Under Your Debt

Pay off your debts as quickly as you can and soon you’ll have more money to save then you know what to do with! These free debt trackers can help show your progress and keep you motivated.

Related: Cover the basics with Dave Ramsey’s 7 Baby Steps

5. Set Specific Money Goals

Make saving the priority it should be. In order to do this, you need to sit in a quiet room for 10 minutes and let your mind dream. What do you want for your future? Is it a house big enough for your family? To be financially independent? To retire young?

Whatever it is, write it down and make it specific. The clearer you can be about what you want, the easier it will be to resist spending temptations.

For ideas, see also:

6. Build An Emergency Fund

An emergency fund is a set amount of money, ideally 3-6 months’ worth of expenses, that keeps you from having to fall into debt to pay for something. It’s your superhero shield!

Use this emergency fund challenge template to build yours today >>

7. Earn More

When you don’t earn enough money, saving is an uphill battle – for life. Instead, add more value to make more. Or be a better advocate for the value you already add.

Here are ways to earn more:

- Learn and upgrade the skills in your job

- Ask for a raise or negotiate your salary

- Start a side hustle with your partner or individually

- Begin investing

8. Relocate

This one isn’t easy. But in today’s more flexible work environment, you have more options than ever to live where you choose. And if you can, live in a place that doesn’t make survival hard. It’s one key decision that makes the next 20 years a wealth-building era instead of a constant struggle.

If you can’t relocate from a high-cost-of-living area, consider getting a roommate!

10. Stop Being An Impulse Shopper

When shopping:

- Use the 24-hour rule for small things and the 48-hour rule before buying big items.

- Unsubscribe from emails and notifications that get you to buy impulsively.

- Delete your credit card information from the auto-save on your computer.

- Stick to your grocery list or buy groceries online.

Related: How to Stop Buying Stuff You Don’t Need

11. Cut Out A Vice

Junk food, alcohol, lottery tickets, cigarettes – these things add up. If you are wondering why you can’t save money, it’s time to look at the indulgences that are robbing you of your wealth (and in many cases your health too).

My husband and I did a dry January this year and saved $200!

Related: Try a Low Spend Year Challenge

12. Put Your Money In Cash

The great thing about cash is that it’s tangible. It’s much harder to spend your bills than it is to use your card! So, to save more, break out your “problem” budget areas into cash envelope categories. Then, take cash with you when you go to these places, and only spend what’s in the envelope.

When it’s gone, it’s gone!

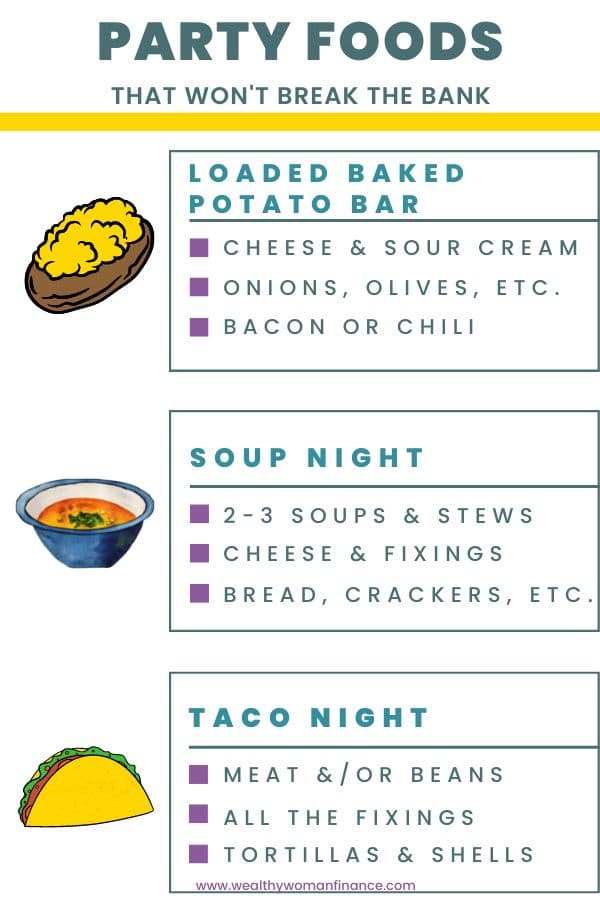

13. Rethink Your Entertainment

Having fun with others doesn’t have to cost a fortune. You can learn to make fancy cocktails at home, have friends bring sides, and take advantage of matinee rates, happy hours, and discount days.

It’s all about getting creative with how you save!

Check out these amazing things to do when broke or on a budget >>

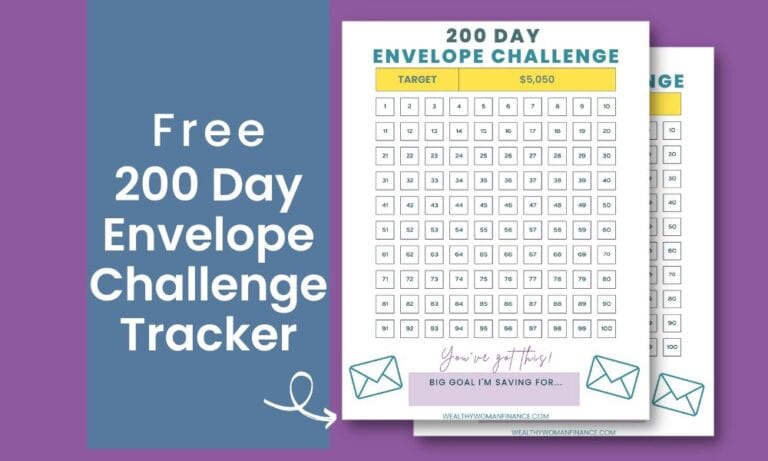

4. Do a Challenge

Money saving challenges are the best! They allow you to jumpstart an amazing savings habit and your motivation at the same time. Try one of these:

- 52 Week Savings Challenge

- Stop Eating Out Challenge

- Penny A Day Savings Challenge (great for someone struggling to save money)

15. Rig Your Environment For Success

Here’s the truth, no matter how much you want something, if your surroundings always tempt you, you will eventually give in. So, answer this question:

Is my environment helping me? Or making reaching my goals more difficult?

Here are a few ideas:

- Leave your credit cards at home if you’re trying not to be tempted.

- Spend time around others who are good with money. They’ll rub off on you.

- Take a different route to and from work if you always stop to buy something.

Comb through your life and find out why you can’t save money. Then, take action!

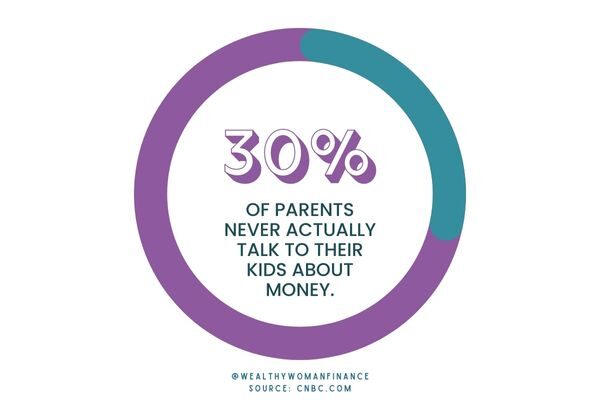

16. Get Your Family On Board

Sometimes it isn’t you. Or at least not entirely you.

If you have a partner or a family, saving money is a group effort. Teach your kids how to manage money. Discuss why saving for your future is important. And educate your kids with the best money books out there.

Soon, you’ll find that your financial situation is improving dramatically – but you’re also setting your kids up for success later too!

Related: Great Ways Kids Can Make Money

17. Learn About Money

Part of why you can’t save money is that it’s tempting to stick your head in the sand when the going gets tough. Fight this temptation with knowledge!

Read financial books and articles (like this one), listen to podcasts on the way to work, and self-educate whenever you can. The more you learn, the more you will be empowered to take control of your financial situation.

Try fun finance trivia >>

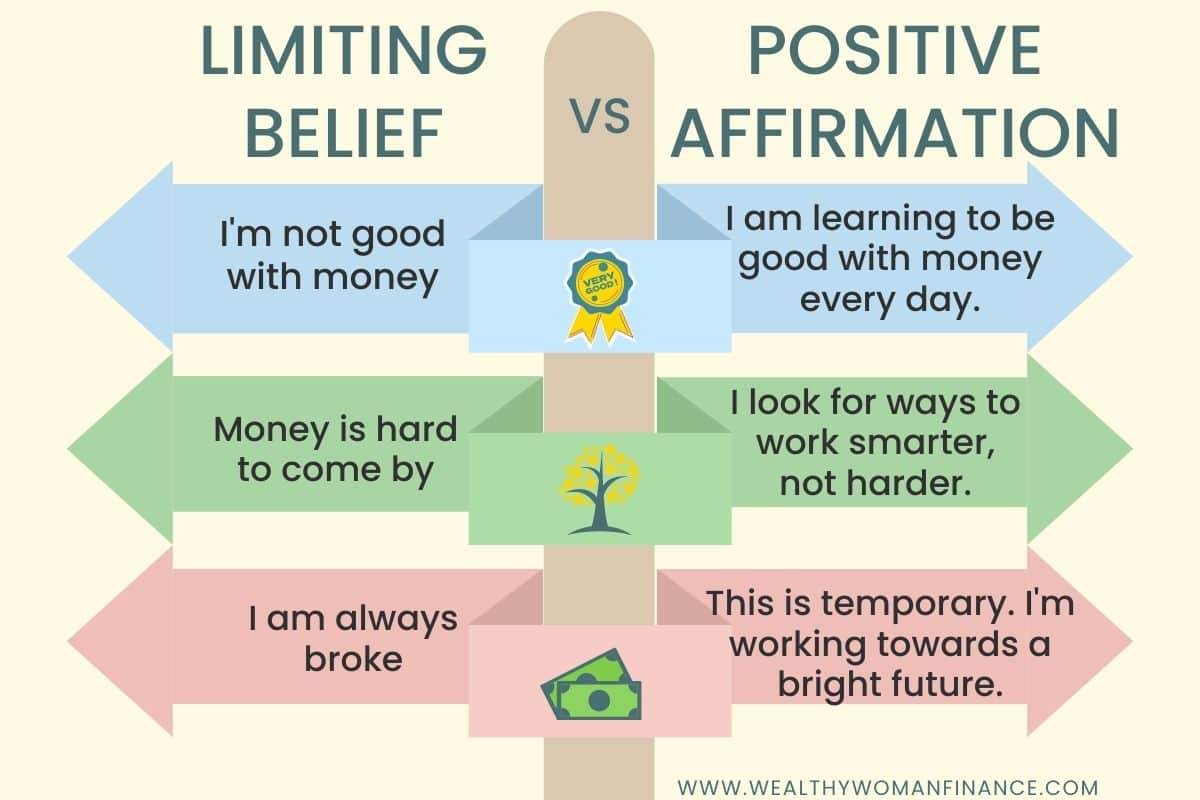

18. Work on Your Limiting Money Beliefs

The person you think you are is the person you will be. There are no exceptions. So, get your mind right by banishing your limiting money beliefs.

19. Track Your Progress

Use a free online budgeter like Mint to see all of your expenses and budget categories. And if you are saving for something in particular, write down how much farther you are to your goal each month.

“What gets measured gets managed.”

– Peter Drucker

20. Negotiate at Work for Flexibility

Working from home a few days a week can lower commute costs and childcare costs. It can also give you more time to work on a side hustle or improve your craft.

21. Reward Yourself For Positive Changes

One way to ensure you keep saving is to make it rewarding! So, pick small goals along the way and reward yourself when you hit your milestones!

22. Buy Off Brands

Most of us know to go off-brand when it makes sense for groceries and small items. But what about for the big things? Furniture, TVs, cookware, ear pods, etc. can all be bought for cheaper.

Do your research. But if it functions the same, save hundreds with the off-brand!

23. Waste Less

Nearly 40% of all food in America is wasted (FeedingAmerica.org).

That also means that 40% of your grocery bill is going down the drain. That’s a ton of money you could be saving!

- Use up foods you already have before buying new

- Plan meals that allow you to use up what you have in the fridge: soup, eggs, and stir-fry are great for this!

- Understand expiration dates. The “best by” dates are guidelines, not hard rules. Use your own judgment.

24. Buy More Intentionally

A simple switch in grocery stores can help you save money. Waiting for the sale on things you already want and buying in bulk (on things you know you’ll use) are other strategies.

25. Fix Your Leaky Bucket Items ASAP

We all have small ongoing expenses that slowly drain our accounts. If these expenses add to your quality of life, they fill your bucket. But if they don’t and they are “leaking” your accounts, it’s time to get rid of them!

Common Questions For “Why Can’t I Save Money?”

What percentage of people don’t save money?

In a recent Bankrate survey, 68% of people worry they wouldn’t be able to cover their living expenses for one month if they lost their primary source of income (including 85% of Gen Zers).

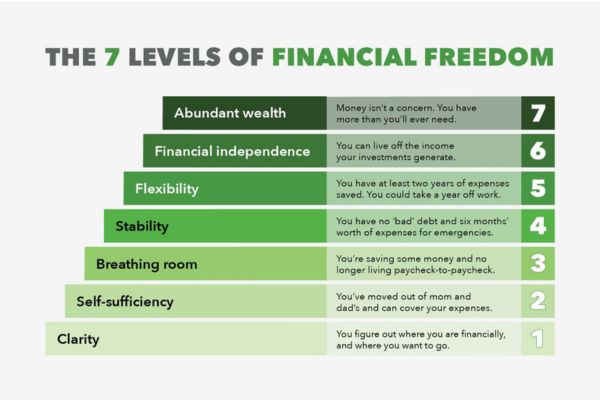

How many Americans are financially free?

This depends on your definition of financial freedom. If it’s breathing room, then according to the statistic above, 36% have it. If it’s independence and wealth you are after, here’s a great chart from CNBC about the levels of financial freedom:

Where are you in these levels?

To Consider With Why You Can’t Save Money

While there are common denominators, the answer to the question “why can’t I save money” will be different for everyone. So, dig into your financials and lifestyle to find out why!

Then, leave a comment and keep us updated on your progress.

Next, read the best ways to live better while saving money >>