119 Budget Categories List + The Best Ones for You

Complete List of Budget Categories

Setting up and improving your budget can be confusing. Even worse, you start and then realize you’re missing something important. That frustration leads to backsliding on everything.

So today, we’re looking at the big list of budget categories examples. Plus, we’ll discuss which ones are right for you, how often you’ll need these in your budget, and more.

Why You Need Budget Expense Categories

First, if you don’t know exactly where your money is going, you won’t see when you’re blindly throwing it away. Awareness is key.

“If you can’t measure it, you can’t improve it.”

Peter Drucker

And when it comes to old subscriptions and purses you don’t really need, just looking at your budget may be all it takes to change course.

How to Build Your Categories List & Budget

Before we get to the categories, here’s an easy how-to for using this big list:

- Build your own list of household budget categories. Go detailed or keep it simple.

- Record your monthly income

- Set up your budget (see the end of the article)

- Keep track

- Make adjustments

Main budget categories and Subcategories list

Now, we’ll start with the main budget categories. These are essential to living.

Housing

Housing is the largest expense for most people, and a must-have in terms of your monthly budget. Plus, many of us don’t realize the side expenses that come with where we live.

- Mortgage or Rent

- Property Taxes (may be part of your mortgage payments)

- Household Repairs

- Home Improvement Projects

- House or Renters Insurance

- Home Owners Association Fees (HOA)

- Household Maintenance (yard services, HVAC yearly maintenance visits, pest control, etc.)

Car & Transportation

While the uptick of working from home has helped some, many still have large expenses that come from transportation. Don’t forget to add the totals for all of your vehicles. Even the ones you don’t drive often.

- Car Payment

- Car Warranty

- Car Repairs & Maintenance (new tires, oil changes, inspections, etc.)

- Gas & Fuel

- Car Insurance

- Public Transportation Costs

- Extra Car Supplies (trashcan, cup holders, etc.)

- Parking Fees

- Tolls

10. Car Registration (DMV) Fees

Basic Utilities

Utilities are any expense you use regularly that maintains your home.

These would be one of the last things to take away if you were cutting the budget. However, utility bills are a GREAT place to cut back on if you’re looking to save money. Often, all it takes is a call to the internet company to lower a bill, and you have control over how much in resources you use.

1. Electricity

2. Water

3. Trash / Recycling

4. Gas

5. Sewer

6. Phone Bill

7. Internet Bill

8. Alarm System

Insurance Expenses

We covered house and car insurance, but you may also be paying for these insurances as well.

- Health Insurance

- Dental Insurance

- Vision Insurance

- Life Insurance

- Long-Term Care Insurance

- Disability Insurance

- Malpractice Insurance

- Liability Insurance

Medical/Healthcare

These expenses are necessary and part of taking care of your health. Co-pays and deductibles apply to some or all visits.

- Prescriptions

- Doctor Visits

- Dentist Visits

- Eye Doctor Visits

- Other Essential Doctor Visits (Dermatologist, Gynecologist, etc.)

Savings/Investing/Debt

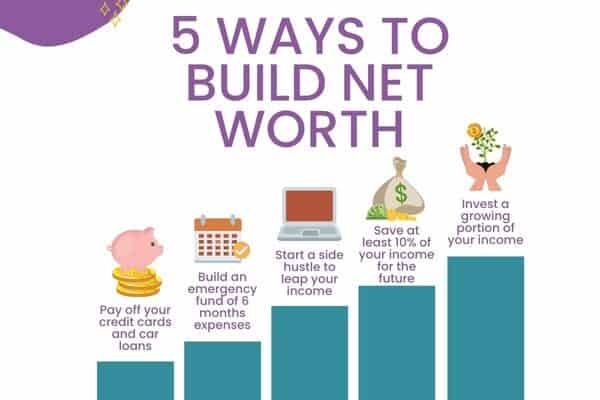

Next, we’re looking at savings and debt before personal expenses. These are often big and they’re critical to making your financial goals come true. Let’s build that net worth!

Debt Payments

1. Credit Cards

2. Student Loans

3. Car Loans

4. Personal Loans

5. Medical Bills

6. Extra House loans

Savings/Investing

- An Emergency Fund

- Saving for Retirement

- Saving for College

- Other Saving Accounts (for a house, car, vacation, real estate purchase, etc.)

- Additional Investing

Food

How much you spend on food can vary widely. When making a budget for food, consider how important organic and healthy convenience foods are to you. And how much you want to spend on extras like eating out.

1. Groceries

2. Restaurants

3. Holiday and Celebration Food

4. Convenience Meals (Pre-cooked grocery store meals, meal delivery services, etc.)

5. Grub Hub, Insta Cart, and other grocery service fees

Necessity Budget Items For Home

These items can be sneaky and tough on your budget. Especially during the baby years, it’s easy to spend a pretty penny here.

1. Paper Towels

2. Baby Diapers and Wipes

3. Baby Formula, Feeding Supplies

4. Cleaning Supplies

5. Dishwasher Detergent & Soaps

6. Laundry Detergent

7. Kleenex

8. Paper Plates, Napkins, and Plastic Utensils

9. Basic Tools For Your Home

Job-Related Expenses

Your job comes with expenses of its own. Here are common budget subcategories to watch out for.

1. Childcare

2. Office or Work Supplies

3. Journals, Magazines, Subscriptions For Work

4. Extra Travel Expenses

5. Continuing Education

6. Work Uniform or Clothing

Personal expense categories list

The great thing about these items on the budget categories list is that you can cut back on them when the budget is tight.

1. Gym Memberships

2. Hair Cuts, Styling, Coloring, Salon Visits

3. Alcohol

4. Makeup

5. Clothing and Shoes

6. Vitamins & Supplements

Entertainment

Just like with personal expenses above, decide how much value these optional purchases bring to your life. Some may be more important to you than others.

1. Movies (in the theater or at home)

2. Concerts and Sporting Events

3. Books

3. Bars/Clubs/Restaurants

3. Outings With Friends

4. Cable

5. Supplies for Hobbies (camping gear, etc.)

6. Streaming Services (Disney, Netflix, Hulu, etc.)

7. Other Subscriptions and Memberships

8. Vacations

9. Casinos

10. Amusement Parks, Toys, Outings For Kids & Families

Giving Budget Category Examples

We all want to be generous to our loved ones and contribute to causes we believe in. So, don’t forget about this budget category!

- Gifts

- Christmas, Other Holidays

- Donations

Kids Activities and Education

As a mom of three kids, I can tell you that kids costs add up! Consider the family budget expenses that come with activities and school.

1. Babysitters

2. Extracurricular Activities

3. Supplies for Activities (soccer socks, cleats, swim goggles, etc.)

4. Books and Supplies for School (+ beginning of the year fees)

5. Healthcare-Related Expenses (glasses, braces, etc.)

6. Haircuts

8. School Pictures and Other Miscellaneous School Costs

9. Birthday Gifts for Friends

10. Allowance

11. Kids Clothes and Shoes

12. Lunch Money

13. Summer Camps

*Teach kids to manage money too. See this budgeting for kids article with tips!

Pet Related Personal Expenses

If you have a pet (or 5), add up the hidden expenses that can be associated with caring for your furry friend.

1. Pet Food

2. Pet Medications

3. Kenneling and Boarding

4. Veterinary Bills

5. Grooming Fees

6. Pet Sitter / Walker

7. Pet Training

Miscellaneous Expenses List

Finally, there will always be a few expenses that you didn’t account for. The following list includes examples of random things that you may need a “miscellaneous” category to catch.

1. Household Replacements (printer ink, a new toaster, etc.)

2. Parking Tickets

3. Postage Stamps

4. Special Occasion Purchases

5. Party Expenses

6. ATM Fees

Try Sinking funds

Next, consider setting up sinking fund categories for irregular expenses. This is a fund that you put money into every month to take care of those things you know you’ll need, but you’re not sure when.

If you save monthly, the money will be there and you won’t have to worry about it. So, estimate the costs for things like car tires and vacations and put them in this fund.

See a free template and sinking fund calculator >>

How to Set Up Your Budget

Now that you’ve seen the expense budget list, here’s how to make it work for you.

First, Know Your Income

Write down what you make every month. You can’t know how much you’ll spend on each category until you have this number.

Income sources could be:

- Salary

- Bonuses

- Side Hustles (only add it if it’s regular income you can count on)

- Investments

- Child Support / Alimony

- Other Income Sources

How to Divide Your Household Budget

Next, write your main budget categories. Then, decide how much you want to spend on each one. Or use one of the helpful models below.

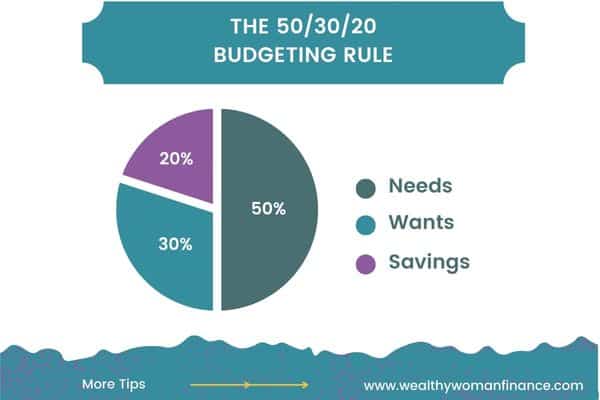

The 50-30-20 Model

The most well-known budgeting method is the 50-30-20 model. With this rule, you spend no more than 50% on necessary expenses, 30% on things you want, and 20% on savings.

One example could be:

50% Necessary Expenses:

- Home Expenses 20%

- Car Expenses 5%

- Utilities 5%

- Insurance/Healthcare 10%

- Food, Kid, Household Necessities, Sinking Fund 10%

30% Things You Want:

- Entertainment 10%

- Personal Expenses 10%

- Giving 5%

- Miscellaneous 5%

20% Savings:

- 5% Paying Off Debt

- 5% Emergency Fund

- 10% Saving For Retirement

Of course, you may have different budget categories and percentages. Do what’s right for you!

*Find a free 50-30-20 budget template here >>

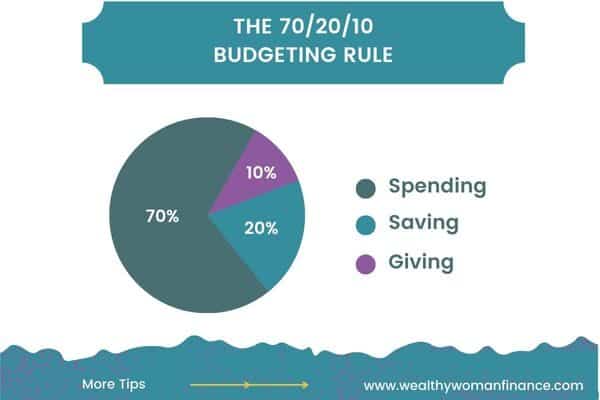

70-20-10 Budget Categories Percentages

And to try a different set of numbers, test out the 70-20-10 budget. For this model, you spend 70% of your monthly income (on needs & wants), save 20%, and give 10%.

A sample may look like:

Spending 70%:

- Household Expenses (Mortgage, insurance, utilities, supplies, etc.) 40%

- Car Expenses 15%

- Insurance/Healthcare 10%

- Food 10%

- Kids & Pets 10%

- Personal, Entertainment, Miscellaneous, Fun 10%

- Job-Related Expenses 5%

Saving 20%

- Retirement 10%

- College 5%

- Downpayment on a Home 5%

Giving 10%

- Church 5%

- Causes You Believe in 5%

For another budget option, see the 60 30 10 budgeting plan >>

Cash Envelope Categories List

Now, if you’re wanting to try the cash envelope system, you’ll take the percentages you picked and put the dollar amounts of each category into each envelope. Once the cash is gone, you’re done for the month.

If you started with $3,000, your envelopes might look like this:

- Household Expenses (Mortgage, insurance, utilities, supplies, etc.) 40% = $1200

- Car Expenses 10% = $300

- Insurance/Healthcare 10% = $300

- Food 10% = $300

- Kids & Pets 10% = $300

- Personal, Entertainment, Miscellaneous, Fun 5% = $150

- Job Related Expenses 5% = $150

- Savings/Debt 10% 300

You could also only do the envelope system for your personal budget categories list (i.e. NOT house, car, savings, debt)

*Try out the free 100 envelope challenge to help you save more!

Zero-Based Budget Plan

Finally, a zero-based budget is an extension of the ideas above. It’s saying that each one of your dollars coming in has a specific plan. And at the end of the month, it’s all accounted for.

If you make $3,000, then all $3,000 has a place to go. This type of plan helps to make sure you’re not spending on things at the Target Dollar Spot that you didn’t plan for.

Income – Expenses = Zero

Note: This doesn’t mean you’re spending everything you make! It just means that it’s all accounted for.

What’s Next? to Consider With Your Personal Categories List

Now, Keep Track of Your Budget Categories

I like to make it easy with Mint. But you can use Excel, Google Sheets, or old-fashioned paper as well.

What If You’re Short Money

Often, as soon as you focus on your budget you’ll see one or two money moves that would help you. Perhaps there’s a subscription you didn’t realize you had. Or you’ve been spending a lot more than you thought on coffee.

Here are other great ways to trim your budget:

- Focus on meal planning to cut back on eating out

- Choose to host more potluck dinners (or snacky girl nights in) instead of meeting out with friends

- Shop at cheaper grocery stores

- Brainstorm easy ways to cut back on your utilities (turning the lights off, conserving water, etc)

- Cut out a streaming subscription for a few months (We cut Netflix in the summer because we don’t have time to watch it. When we get it again in the fall, the shows are fresh)

- Add money through a side hustle

Try this free savings challenge printable to help too! >>

What If You Have Money Left

Hoorah! That’s amazing! If you got ahead this month, focus on building your net worth through an emergency fund, paying down debt, or beefing up your retirement. Then, give yourself a big pat on the back!

*Here are great tips for how to get ahead financially with that extra money too!

To Consider With Your Budget Items List

If you’re stuck in a rut with your money, you NEED a budget. Becoming aware of your expenses is the only way you’ll make progress on those big beautiful money goals.

And determining what your budget categories will be is the first step. So, take that baby step friend. It will lead to amazing things!

*Need help getting into the right money mindset? Try these positive affirmations for success!