Easy Budgeting for kids: How To Teach +Free Printable (2024)

“I wish we were rich and could buy anything we wanted.”

Ahh, the familiar cry of my kids after telling them we won’t buy a requested toy.

Does something similar happen to you?

Or maybe your kids blow through any money they get as fast as they can.

Budgeting for kids will help you teach smart money management to your kids now in a manageable and easy way. Send your kids down the path to understanding how to earn money and take care of it wisely.

How do you explain a budget to a child?

As a kid, you often saw your parents paying for items with cash or writing checks. Today, technology has changed what our kids see and don’t see with money transactions.

But our kids are still watching how we spend money.

In fact, kids as young as seven years old have a basic understanding of finance concepts based on what they’ve experienced. (source)

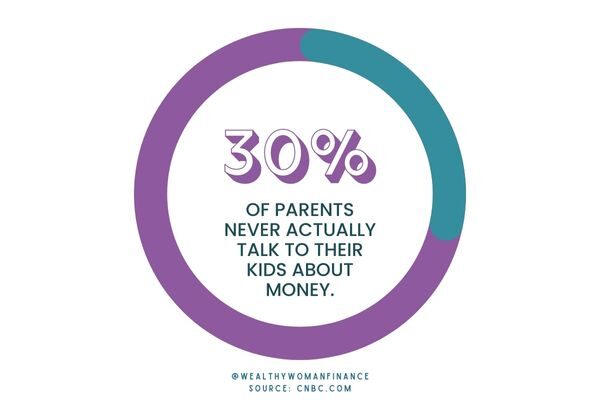

And, money management can be a stressful topic for many families.

In 2022, 59% of Americans said they worry about their general finances daily. (source) With this information, it’s no wonder that over 30% of parents never talk to their kids about money. (source)

We want better for our kids and their financial futures. Let’s teach our kids how to budget. Let’s raise money smart kids.

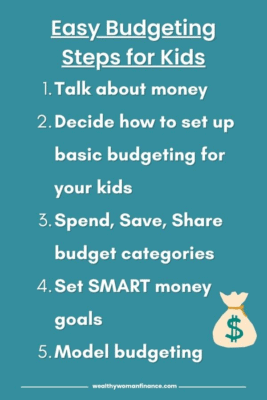

Teaching Kids How To Budget: Step-By-Step

Simply put, a budget is a plan for what you do with your money when you get it.

There are a variety of ideas on how to teach kids budgeting and wise money management.

The most effective approaches include money practice and real-life application.

Let’s break down basic budgeting ideas for kids into 5 steps and then discuss each step.

- Talk about money

- Decide basic budgeting for your kids

- Spend, Save, Share budget categories

- Set SMART money goals

- Model budgeting

Talk About Money

First, talk about money often! To understand money basics, we have to discuss it. It is so easy for kids to miss out on all of the money transactions that happen from day to day, especially when we don’t use cash.

Turn your daily activities into learning experiences.

- When buying groceries discuss the cost of each item and show how you comparison shop.

- Discuss what happens when you visit the ATM.

- When eating out at a restaurant, show your kids the bill and discuss tipping.

- When you visit a doctor’s office, discuss the payment process.

- Discuss the expenses you use daily in your house such as water, electricity, heating, etc…

After filling up my car with fuel last week, I turned to my boys and told them it cost me $53 to fill up my car. They were shocked by how much it was compared to how much spending money they had at home.

Make the work-money connection too. Your kids benefit from learning how your family makes money as well as discussing your basic monthly expenses.

Decide Basic Budgeting For Your Kids

Second, use one of the approaches mentioned below or a combination to teach your kids how they will be receiving and earning money.

Approach #1: The Weekly Allowance

To start, The Mom Psychologist, Dr. Jazmine suggests that we teach our kids to be money smart by using a weekly allowance. Her approach uses an allowance as a teaching tool that is not tied to weekly chores.

For instance, kids earn a set amount of money each week. She suggests giving a dollar per age (or an easy amount like $5 for younger kids). And by not tying the money to chores, you avoid a power struggle over chores and payment.

Approach #2: On Commission

Financial expert, Dave Ramsey’s approach to teaching kids money management starts with a weekly commission. In other words, kids get paid for the extra work they do.

This not only creates a strong work ethic, but kids learn from a young age that work = money.

What Both Approaches Share

There are three very important similarities between these approaches:

- They both suggest dividing up the money between three categories: spending, saving, and giving as a budgeting tool.

- They advocate that kids use their own money to buy purchases beyond the necessities. This is where real-life learning comes in.

- Both experts agree that kids should not be paid for regular, daily chores made to the family. Daily contributions around the house foster responsibility and curb entitlement. They help kids understand they are part of a family team.

Finding an Approach that works for you

While experts have differing thoughts about how kids receive money, they wholeheartedly agree that it’s important for kids to gain experience.

In our house, we’ve implemented a combination of both approaches that work for us. We pay our kids an allowance, and then let them earn additional money with extra chores.

This ensures that we are discussing money management every week, as well as making the work-money connection.

<<Check out this list for appropriate chores for your child’s age.>>

In order for any approach to be effective and sustainable, It’s important to consider what’s best for your family. Money practice and real life application should be the priority.

Spend, Save, Share: Kids Budget Categories

Next, let’s discuss dividing kids earnings into three basic budgeting categories: Spend, Save, Share

To teach kids how we want them to manage and spend their money, introduce and label a set of three jars or three envelopes: Spend, Save, Share

Next, discuss how you will be dividing the money and use the free budgeting printable at the bottom of the article to track spending.

Decide what percentage or how much of your kid’s money will go into each envelope. Make this manageable and easy for you!

We give our kids (ages 5 & 7) a $5 allowance each week that they split into spend ($3), save ($1), and share ($1). This is a basic 60-20-20 Rule Budget that can work well for beginners.

For kids in preschool and Kindergarten:

- Assign jobs and pay immediately so young kids make the work-money connection.

- Use clear jars or this moonjar toy bank so they can visibly see the money they are earning and watch it grow.

- Let them spend their money! This is the best reward and tool for younger kids.

Elementary-age students:

- Encourage ideas for your kids to make money, start saving, give to others, and set goals for larger purchases.

- Pay weekly or when it works for you.

- Use the envelope system to organize and divide up money.

Let’s discuss each budgeting category more in-depth.

Spend Budgeting Category For Kids

This is your kid’s money to enjoy! Let them use it how they wish. But, when it’s gone, it’s gone.

This category can be a challenge for parents. We don’t want them to blow their money on junk. But, this is an important part of the learning process.

Have them take their spending money when you go to the store so they have a physical transaction with the cashier and get experience.

Real-World Spending Practice

We recently had tickets to a fun event. I told my kids they could take their spending money along in case they wanted anything extra. The first thing we saw was the cotton candy (which of course my kids had to have). However, in order to get the cotton candy, you had to purchase a toy that went along with it for a grand total of $20.

Did they buy it? You bet they did. In fact, they each bought their own. We brought home two bags of mostly uneaten cotton candy that sat on our counter for a week and a toy that hasn’t been touched since that day.

And later, we had a valuable discussion about that purchase. It was a great, teachable moment. And the more of those we have, the better prepared they will be to make smart purchases when they are older.

What’s a need? What’s a want?

When teaching about using their spending money, it is also a good time to discuss needs vs. wants. Use this video for a quick explanation your kids will understand.

‘Spend’ money should be used on your child’s wants! While you should absolutely still be purchasing items your child needs for them, refer back to this video when your child “needs” something that really falls under the want category.

Save Budget Category For Kids

Saving doesn’t come naturally for all kids, which is why they need practice from the start.

But saving teaches patience and goal setting.

- Younger kids can set a savings goal for a larger purchase they wish to make.

- Older kids may want to start saving for a car or something they will need or want in their teenage years.

- If your child has worked hard to save for a big item, consider matching their savings to help them buy the item. Or help them with the last few dollars and tax. Continue to help your child feel motivated when you see them working hard.

Keep reading to learn more about setting saving goals for larger purchases.

*Make it fun with:

Share (or Give) Budget Category

The share budget category, stresses the importance of giving. This isn’t easy for most adults and it may not be easy for your child.

Whether it is to a place of worship or to make a community impact, practice setting aside money to share with others.

At some point, your child will see how giving affects others and they will also realize it has a positive impact on them!

Whatever the spend, save, share budget category system looks like in your family, don’t overthink it. Come up with a plan that works for your kids ages and fits into your family life.

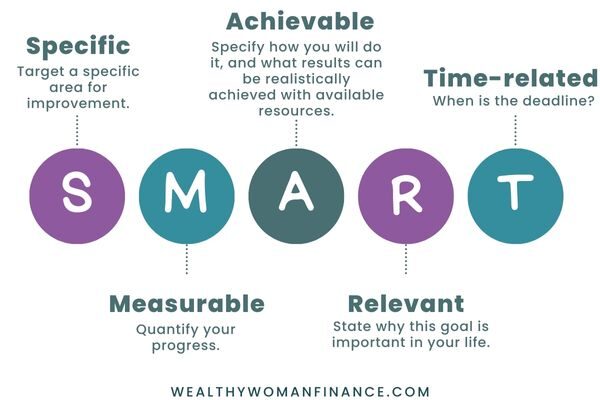

Set SMART Money Goals

Now that you have your budgeting categories and system in place, you can help your kids set a goal for a bigger purchase. Help them to come up with a plan to buy that item with their saved money.

Display the goal plan and a picture of the item where your kids can see it so that they are motivated to continue working for it.

Setting a SMART goal will help your kids practice setting specific, measurable, achievable, relevant, and timely goals.

Example: I will earn an extra $20 by the end of the month so I will have enough money to buy a new video game. I will do this by asking for a list of extra chores and responsibilities that can be completed each week from my parents.

Model Budgeting For Kids

Remember how closely your children are watching you?

For your kids to be successful, parents must set up a monthly budget and use it. Your kids need to see you living by a household budget and implementing the tools you are teaching them.

You may be familiar with different approaches to budgeting for personal finances like the 50-30-20 method. 50% is for needs, 30% is for wants, and 20% is for savings. This type of budgeting is common because it gives you flexibility and lets you easily see where your money is going.

Other basic budget rules can include:

Choose what works well for your personal budget.

The 24 Hour Rule

You also need to model avoiding impulse buys. This can save your young spenders from big mistakes in the future.

When you are considering a bigger purchase, talk out loud about how you are going to wait a day before buying to see if you still really need the item. Encourage your kids to do the same.

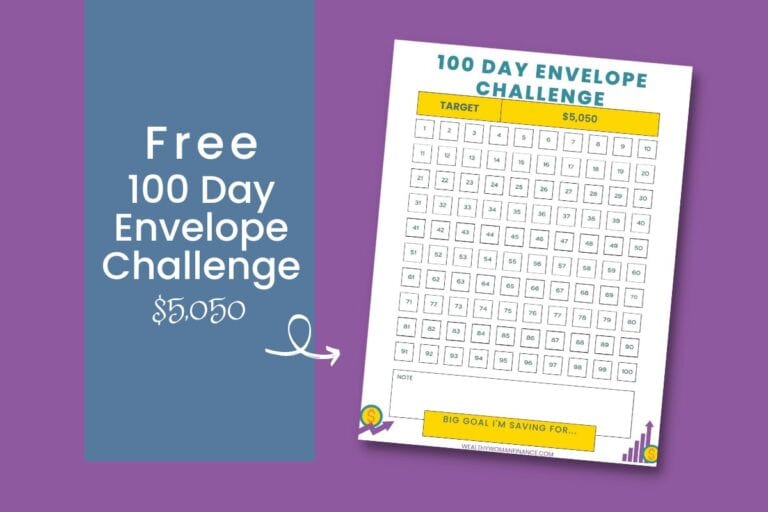

Free Printable Budget Tracker for Kids

A budget helps kids plan for how they want to spend their money AND prepares them for successful financial futures.

Use the free budget worksheet printable to help your child get started. ⬇️

Great Kids Budgeting books

Books are a great way to introduce a new topic to your kids. Use budgeting books for easy teaching tools through stories.

A Boy, A Budget, and a Dream by jasmine Paul (Ages 4-8)

Follow two siblings in this book as they use their money in very different ways. One of them will have to learn how to budget or give up on his dream.

Money Ninja: A Children’s Book About Saving, Investing, and Donating by Mary Nhin (Ages 3-11)

Join Money Ninja on a journey of saving, investing, and donating.

Investing for Kids: How to save, invest, and grow money by Dylin Redling (Ages 8-12)

Your kids will get money savvy with the practical advice in this book.

Related: 15 Kid-Friendly Stocks For Teens

Smart Money Smart Kids: Raising the Next Generation to Win With Money by Dave Ramsey and Rachel Cruze

Told from this dynamic father-daughter duo, this book gives practical advice on how to start your kids on the right path to becoming money-smart adults.

<<Look here for more great books about money for kids!>>