60 30 10 Rule Budget (What is It & How Does it Work?)

Free 60 30 10 Rule Worksheet To Use!

Are you deep in debt or looking to super charge your savings?

Then the 60 30 10 rule budget is for you! Now, this budget plan isn’t your standard breezy budget plan. It’s not for everyone. This rule takes focus and commitment, but the rewards are insanely higher than with any other budget you’ll find.

What’s the 60 30 10 Budgeting Rule?

With this rule, you’ll start with your monthly after-tax income (your take-home pay). Then, divide the money into 60% for savings, 30% for needs, and 10% for wants. With the 60-30-10 rule, you’ll be seeing exactly where your money goes, and if you’re overextending in certain areas.

What are the categories for the 60 30 10 rule?

Now, let’s explore which subcategories fit under our “needs,” “wants,” and savings.”

- 60% on savings (or debt): Things like retirement, emergency savings, college savings, paying off high-interest debt, your bright beautiful future

- 30% on necessary expenses: Things like home, car, basic groceries, insurance, utilities, and necessary childcare.

- 10% on things you want: Things like entertainment, cool stuff, eating out, and streaming services.

Is the 60/30/10 rule realistic?

Now, you might be thinking…is this possible? Can I really save 60%? After all, the average American saves a whopping 6% to 8% (source).

Well, first, you’re here because you’re not the average American. You’re learning and growing and YES you can save 60% of your income. If you really want to.

But here are a few common issues to troubleshoot if you’re not sure:

What If My Needs Are Too Expensive?

The number one reason you’d freak out about a 60% savings rate is that your house or cars are too expensive. You have two options in this case.

1. Move to a more affordable house and/or trade out for a more affordable car. These are obviously big steps, and they can be easy or hard depending on where you live. However, if you lower your big needs, you’ll save yourself years of penny-pinching while freeing up major cash (almost immediately).

And if #1 is out of the question,

2. Take some of your money from the wants section to use for your needs. (But do not touch the 60% savings!)

Either one works, and it depends on your priorities and life situation.

Related: Use a Needs And Wants Worksheet to help categorize.

How do you live on a tight budget?

This budget will force you to get creative. You’re putting your financial future over your current needs. And that’s not always easy.

So, if your budget is already tight, you may need to get creative with bringing in more money.

- Make hundreds (or thousands) more through a part-time job or flipping items on the side.

- Or try an aggressive savings challenge to give you a boost.

How Do I Stay Motivated on a Budget Like This?

Motivation comes and goes, but there are a few things we can do to stoke the fire!

1. Make smart financial goals for yourself so that you know exactly what you’re fighting for!

2. Motivate yourself with success affirmations, quotes about debt freedom, or other inspirational tools to keep you moving forward.

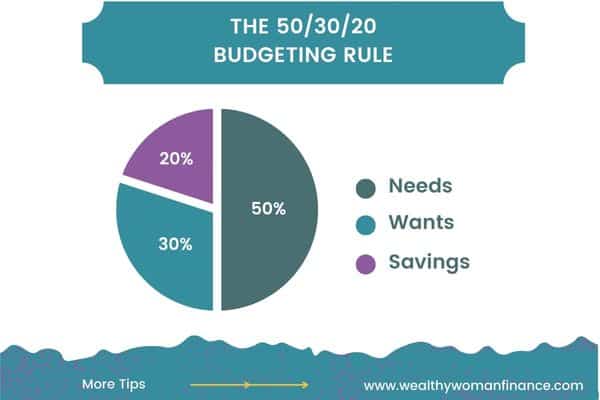

How Does This Rule Compare to the 50 30 20 Rule?

The most popular budget rule remains to be the 50 30 20 method. (50% for needs, 30% for wants, and 20% for savings.

Advantages of the 50 30 20: This method gives you more flexibility and wiggle room. If you’re a beginner or you think you might lose motivation, this may be a better method for you.

Disadvantages of the 50 30 20: While you’ll be saving steadily, you won’t be crushing it in terms of paying off your debt or building a sizeable nest egg quickly. The 60 30 10 rule is the best budget method for ambitious savers who want to supercharge progress.

60 30 10 Budget Examples

Now, let’s look directly at a few 60 30 10 budget examples:

Let’s say you’re Ester and you bring home $3,000 a month (after taxes). You’re single and living in an urban high cost of living area.

Your budget could look something like this:

- $1800 into paying off your credit card debt and savings for an emergency fund.

- $900 into things you need. Probably an expensive apartment, but also food, healthcare, and public transportation.

- $300 in things you want like going out with friends on the weekend.

Now, let’s say your name is Laura. You are married and living in a low-cost of living area. Between you and your spouse, you bring home $5,000, but this money stretches to take care of a family of five.

Your 60 30 10 budget example may look like this:

- $3000 into your savings. You’re splitting this between retirement accounts, your HSA, and college savings for the kids.

- $1500 into things you need. This pays your mortgage, supports your 2 car mini-van lifestyle, and covers other basic household food, supplies, and medical needs.

- $500 into things you want like the Disney streaming service, Friday night pizza, kids activities, and family vacations.

As these examples show, everyone is different! You will have different budget categories, income levels, and percentages. Play with the numbers to see what works for you.

60 30 10 Budget Plan

Now, here’s a step-by-step guide for building a 60 30 10 budget:

1. Find your monthly after-tax income. If your paycheck lists your yearly rate, divide this number by 12 to determine your monthly amount. If not, add up your paychecks from the last year. For example, if you get paid every other week, multiply your paycheck by 26 to find your yearly income. Then, divide by 12 to get your monthly average.

2. Divide out your monthly number by 60/30/10. Try the nifty 60 30 10 budget calculator below:

Monthly Total x .6 = Savings. Monthly Total x .3 = Needs. Monthly Total x .1 = Wants

3. Figure out what you’re saving up for. Or if you need to pay off debts or cover emergencies first. (Create savings accounts or sinking fund categories for them)

4. Account for your essential needs. What are the absolutes in your budget? Can you trim them up to make them easier on the budget?

5. Finally, write out your wants. Write the most important ones first.

6. Make adjustments and tweak until your numbers are right.

What are the benefits of a 60 30 10 budget?

Using the 60 30 10 rule budget template comes with incredible advantages. Here are just a few:

You’ll Get Out of Debt Or Build Wealth MUCH FASTER

This is the perfect budget if you’re struggling under a pile of bills, or you’re ready to get ahead financially. Putting 60% of your take-home pay towards your financial future will mean you shave YEARS off of your debts and the wait for financial freedom.

It helps you see where your money is going

For many, the real trick of budgeting is keeping track of what your money is going toward. With the 60 30 10 budgeting method, you’ll know what you can afford, and have a guide to help you use your money for your greater good.

The 60 30 10 Budget Template Keeps You Consistent

The BEST benefit is that you’ll now be saving 60% each and every month. You’re not dreaming about it. You’re doing it. And this lets the power of compound interest work for you. Once it starts adding up, you’ll be astonished at how quickly it grows.

Grab the Free 60 30 10 Rule Budget Template >>

A worksheet makes things easy! So snag yours now!

Common Questions And Answers

Does the 60 30 10 rule include 401K?

In this budgeting rule, your 401k would be included under the 60% savings category.

What percent of income should go to expenses?

When using the 60 30 10 budget a total of 40% of your budget will go toward your expenses.