70 20 10 Rule Budget (What is It & How Does it Work?)

Are you learning how to budget or save? The 70 20 10 rule budget is the perfect place to start!

Now, this budget plan is great for beginners because it’s flexible. But it’s also amazing for anyone who wants to prioritize their debts, include giving in the budget, or make saving a regular monthly event.

What’s the 70 20 10 Principle of Budgeting?

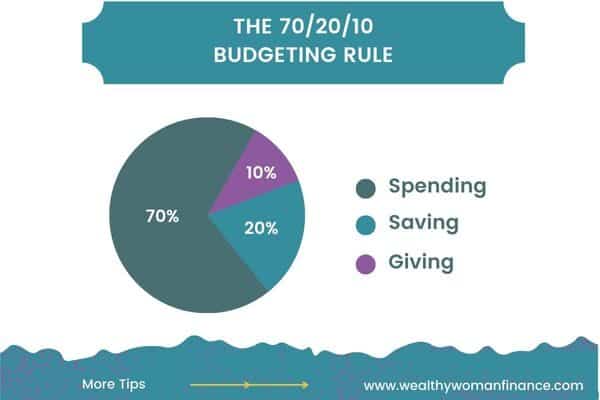

With the 70/20/10 budget, you’ll start with your monthly after-tax income. Then, divide the money into 70% for needs and wants, 20% for savings, and 10% for debt repayment or donations.

With this rule, you’ll see exactly where your money goes, and if you’re overextending in certain areas.

Key Categories to Know

Now, let’s explore which subcategories fit under our “needs,” “wants,” and savings.”

- 70% on necessary or discretionary expenses: Needs like home, car, basic groceries, insurance, utilities, and necessary childcare. But also wants like entertainment, cool stuff, eating out, and streaming services.

- 20% on savings: Things like emergency savings, retirement, college savings, and your bright beautiful future

- 10% on debt repayment or donation: Paying extra on things like high-interest credit cards, student loans, car loans, and mortgage loans. For donations, this could be to your church or a cause you care about deeply. Or supporting your parents, family, or friends in a time of need.

Here’s a bit more on each, so that you’re clear on what portions of your income go where…

70% Spending on Needs And Wants

First, when setting up this budget, review your budget categories. This should include things that are essential to your everyday life, and fun little expenses. Here’s a quick example of what your spending category could look like on this budget plan:

- Household Expenses (Mortgage, insurance, utilities, supplies, etc.) 40%

- Car Repairs, Maintenance, Insurance 15%

- Health Insurance/Healthcare 10%

- Food 10%

- Kids & Pets 10%

- Personal, Entertainment, Miscellaneous, Fun 10%

- Job-Related Expenses 5%

20 % Savings (70 20 10 Budget Rule)

Just like with your expenses above, you can divide out your savings however you want to. Put it entirely into one account or split it up like below:

- Retirement 10%

- College 5%

- Downpayment on a Home 5%

However you do it, consider all of the following excellent places to put your savings (But remember, when investing your money there will always be an element of risk):

Create an Emergency Account

First, build an emergency savings account. Not only will this keep you out of debt when times get tight, but you’ll also breathe easier during a job loss, health emergency, or unexpectedly finding water in your basement.

In your financial home, your emergency fund is your foundation. It’s what keeps your house from crumbling and is what your wealth upon.

Keep 3-12 months of monthly expenses in cash in a savings account.

Save Money Into Sinking Funds

Next, start saving for things you know you’ll need in the future. By having the cash ready, you’ll be able to enjoy milestones and look for great deals without money stress. Here are great examples:

- Are you going to have a baby? Create a baby fund.

- Will you need to replace your car? Create a sinking fund for a car.

- Kids activities get expensive. And vary by month. Have a kid activity fund to cover what you need all year long.

Find more helpful sinking fund category ideas and a free sinking fund printable.

Put Money Into An HSA

Next, if you have an HSA available, use it! It’s like a medical emergency fund and it is tax-free as long as you use it for qualified medical expenses.

Put Money Into Retirement 401k, Roth, IRA

If your company offers a retirement account match, TAKE ADVANTAGE. That’s free money you’ll get to use later.

And when you can, add even more money to your 401ks, and IRA accounts. These all have tax benefits that make them the smartest place to start (and continue) investing.

Put Money into College Funds, custodial and 529s

Do you have children you’d like to help with college someday?

Check out a low-fee 529. These are great because your money will not be taxed when you withdraw for educational expenses and some states offer other tax benefits (source). Or start a custodial account that your kids can take over when they turn 18.

Invest: stocks & real estate

Once you’ve covered the basic savings and investing options that have tax benefits, explore other ways to invest your 20% savings. You can get started in real estate, invest in passive income stream opportunities, or buy stocks.

10% Debt Repayment & Giving

And finally, if you’re digging out of debt, use this category to climb out quickly. This is 10% that you pay ABOVE the minimum amount that should already be considered in your 70% spending budget.

And if your debts are paid off, use the 10% to give to your favorite organizations. Or use a hybrid mix below:

- Car loan 5%

- Causes You Believe in 5%

Here are a few tips for paying off debt

Pay Down Discretionary Spending Debt

Always start with the high-interest debt that you used to buy things you wanted. This includes credit card debt, second mortgages, and car loans.

Pay Down Things you needed

This would include medical bills and student loans.

You can also pay off your mortgage here, but that decision is different for everyone. If your mortgage interest rate is very low, you may choose to keep it.

“Budgeting isn’t about limiting yourself–it’s about making the things that excite you possible.”

–Unknown

Debt Snowball Method & Debt Avalanche Method

You can pay off your debt using one of two popular methods.

- With the debt avalanche approach, you pay off your highest-interest debts first.

- With the debt snowball approach, you pay off your smallest debts first to gain momentum.

Both methods have their benefits. The debt avalanche will save you money while the debt snowball will give you a massive psychological boost to keep going. In the end, as long as you use one of them or a hybrid approach, you’ll have the same result ~BEING DEBT FREE.

It’s the consistency that matters.

Donations

If you’re debt free, or you’ve chosen to keep a few low-interest debts, now is the time to give back to the community. Here are great ways to make the world a better place:

Causes You Believe in

Do you hold a cause near and dear to your heart?

Church

If you have strong ties to your church, give back to the organization through regular tithing.

Friends and Family

Also, it’s a beautiful thing to be able to help family and friends without having to worry about your own financial situation.

Perhaps you’ll need to help aging parents. Or would love to be able to give to a friend who’s undergoing expensive fertility treatments. These things come up occasionally, and you can make a big impact.

Free 70 20 10 Budget Template

A worksheet makes things easy! So snag yours now!

70 20 10 Budget Examples

Now, let’s look directly at a few 70 20 10 rule budget examples:

Let’s say you’re Teresa and you bring home $3,000 a month (after taxes). You’re single and living in an urban high cost of living area.

Your budget could look something like this:

- $2100 into things you need. Probably an expensive apartment, but also food, healthcare, and public transportation. But also going out with friends on the weekend.

- $600 into savings for your emergency fund and retirement.

- $300 into paying off your credit card debt.

Now, let’s say your name is Tasha. You are married and living in a low-cost of living area. Between you and your spouse, you bring home $5,000, but this money stretches to take care of a family of five.

Your 70 20 10 budget example may look like this:

- $3500 into things you need. This pays your mortgage, supports your 2 car lifestyle, and covers other basic household food, supplies, and medical needs. Plus gets your streaming services, Friday night pizza, and kid activities.

- $1000 into your savings. You’re splitting this between retirement accounts, your HSA, and college savings for the kids.

- $500 into paying off your mini-van or giving to your church.

As these examples show, everyone is different! You will have different budget categories, income levels, and percentages. Play with the numbers to see what works for you.

How to Start: 70 20 10 Budget Plan

Now, here’s a step-by-step guide for building a 70 20 10 budget:

1. Find your monthly after-tax income. If your paycheck lists your yearly rate, divide this number by 12 to determine your monthly amount. If not, add up your paychecks from the last year. For example, if you get paid every other week, multiply your paycheck by 26 to find your yearly income. Then, divide by 12 to get your monthly average.

2. Divide out your monthly number by 70/20/10. Here’s what to use for your 70 20 10 budget calculator:

Monthly Total x .7 = Needs & Wants. Monthly Total x .2 = Savings. Monthly Total x .1 = Debts or Giving

3. Determine your essential needs first. What are the absolutes in your budget? Can you trim them up to make them easier on the budget? Next, write out your wants. This is the category you have the most leeway with. Write the most important ones first. Decide how you’ll fit this into 70% of your income.

4. Figure out what you’re saving for. Do you need to cover emergencies and sinking funds first?

5. Decide on what debts you’ll pay first or set up an automatic transfer to give money.

Why You Need The 70 20 10 Budget

Using the 70 20 10 money rule of budgeting comes with incredible advantages. Here are just a few:

It Gives You Flexibility

You have a lot of flexibility between your needs and wants in this budget. If your needs are higher, make your wants lower. If your needs are lower, you have more money to use for your wants.

You’ll Get Out of Debt FASTER

This is a great budget if you’re struggling under a pile of bills, or you’re ready to financially get ahead. It has a category for paying off debt, so you’ll prioritize it every month. And shave YEARS off of your debts.

It helps you see where your money is going

For many, the real trick of budgeting is keeping track of what your money is going toward. With the 70 20 10 budgeting method, you’ll have a guide.

It Allows You to Give

Most budgets don’t make room for giving. But being generous is important to happiness. We all want to feel as though we’re improving the world. Let’s make a big impact!

It gives you a nice balance

The numbers don’t lie! And you’re going to know immediately if your lifestyle is out of whack. If it is, no worries. Just make the necessary adjustments to get it back in balance.

The 70 20 10 Budget Rule helps you save every month

The BEST benefit is that you’ll now be saving 20% each and every month. This lets the power of compound interest work for you!

How Does This Compare to Other Budgeting Rules?

Not sure about this rule? Here are a few other options and the pros and cons for each.

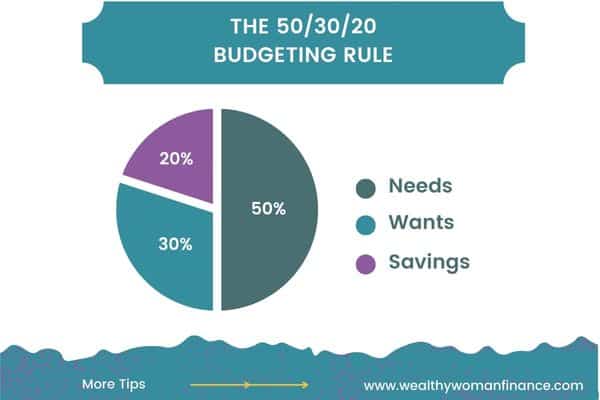

The 50 30 20 Rule (50% Needs, 30% Wants, 20% Savings)

Advantages of the 50 30 20: This method is the most popular budgeting rule. It gives you more room for spending and still offers flexibility.

Disadvantages of the 50 30 20: It will be harder to pay off your debts or give generously if you don’t have a specific budget plan for it. And you don’t with this method.

See a 50 30 20 budgeting template here >>

The 60 30 10 Rule (60% Savings, 30% Needs, 10% Wants)

Advantages of the 60 30 10: This method aggressively has you saving 60%. It’s for the ambitious and it’s no joke! If you split up your savings into debt repayment and giving, you’d be able to do a lot with your money.

Disadvantages of the 60 30 10: Saving that much money is a HUGE commitment. If you’re a beginner, or you just need to start with something steady and consistent, go with the 70 20 10 rule.

See more on the 60 30 10 rule for budgeting here >>

Common Q & As

How do you live on a tight budget?

Now, if your budget is already tight, you may need to get creative with bringing in more money. Consider adding to your income through a part-time job or flipping items on the side. Or try a free savings challenge to give you a jumpstart.

Does the 70 20 10 rule include 401K?

In this budgeting rule, your 401k would be included under the 20% savings category. Your HSA will be under this too.

What percent of income should go to expenses?

When using the 70 20 10 budget a total of 70% of your budget will go towards your expenses.

How Do I Stay Motivated on The 70 20 10 Rule Budget?

Motivation comes and goes, but there are a few things we can do to keep the fire burning!

1. Make good financial goals for yourself so that you know exactly what you’re fighting for.

2. Motivate yourself with affirmations for success & wealth, debt freedom quotes, or other inspirational tools to keep you moving forward.

3. Find great things to do that are free or cheap. It will make saving money a painless process!

4. Grab free debt trackers so that you can see your progress visually. This will make it easier to move forward when times get tough.