100 Epic Sinking Fund Categories & Examples for Beginners

Often in life, we’re faced with expenses that no one talks about. The car needs new tires. The Christmas bills are hefty. Or you’d like to take a few skill-building classes for work.

Sinking fund categories will help you cover these expenses!

What are sinking funds in budgeting?

Sinking funds are savings accounts you put money into monthly. This money is used for irregular big or little expenses you see often.

By doing this, you can save smaller amounts for longer periods (instead of trying to come up with the cash all at once.) It gives you flexibility and peace of mind when it’s time to pay.

This article gives you excellent sinking funds categories, but you can create a fund for anything you want to save for.

This post contains affiliate links. See our disclaimer for more.

Key Takeaway: Sinking funds work especially well for large-budget items you don’t want to blow your monthly budget on. Things like vacation, winter heating bills, and back-to-school shopping.

Sinking Funds Vs Emergency Funds

Sinking funds are not your emergency savings. An emergency fund is for unknown emergencies. You don’t know what emergency savings are for, so it’s meant to be a safety net when the unexpected happens.

Sinking Funds Vs Long Term Goals

Also, sinking funds are not your long-term goals. We’re not talking retirement, kids college, or big real estate goals. And they’re not your normal budget categories either.

These are large or irregular expenses you know are coming.

Want to save this list? Enter your email below and I’ll send the link straight to you.

How to set up sinking funds

There are many ways you can keep track of your sinking funds categories.

- I do an automatic transfer for the total of all our sinking funds into one main savings account. Then, I keep track of the separate funds on a Google spreadsheet.

- You can also create separate accounts for each of your funds.

- Or create one account with subcategories.

Name your savings account “holding tank,” or “sinking funds,” or the specific category so you remember what it’s for!

Best accounts for sinking funds

We like Discover and Capital One for their decent interest rates and convenient access (these are not affiliates). But any savings account will work!

While you can create sinking fund envelopes, I wouldn’t recommend it for most. It can be too easy to take the cash out when it’s sitting around in envelopes.

Whatever you do, keep it as simple as possible. Understand yourself and what will be easiest for you to follow through on.

What are good sinking fund categories?

Sinking funds can put you in the driver’s seat of your finances. They help virtually everyone plan ahead for big expenses. They also relieve the guilt of purchasing something large (because you already saved up for it).

Best Sinking fund categories & Ideas

These sinking fund examples cover everything!

Home Sinking Fund Categories

Housing costs are sneaky and they add up quick. A home sinking fund covers these important (but often irregular) expenses. It’s a lifesaver!

- Home Maintenance

- Home Improvement Projects (A kitchen upgrade, drywalling, etc.)

- New Furniture

- New Appliances

- A New Mattress (tv, large cost item, etc.)

- Property Taxes

- Homeowners/Renters Insurance

- HOA Fees

- Home Servicing (HVAC visits, pest control, etc.)

- Gardening & Lawn Care Supplies (These expenses ramp up in the spring.)

- Pool Maintenance

- Amazon Prime Membership (usually paid yearly)

Transportation Sinking Funds

Next to your home, how you get around eats up a lot of money. And many of these expenses are through irregular costs.

- Auto Insurance

- Car Tires

- Plane Tickets

- Car Registration

- Car Repairs

- Parking Passes

- Bus or Train Passes

- Car Washing Costs

- A sinking fund to save up for your next car

Medical Sinking Fund Examples

Use an HSA or FSA as your sinking fund account so that it’s tax deductible. The next time you have a large medical expense, you’ll already have the money ready.

- Co-pays and Deductibles

- Prescriptions

- Over-the-Counter Medicines

- Vision Visits

- Dentist & Orthodontic Visits

- In-Home Nursing

- Physical Therapy

- Lasik Surgery

- Chiropractic Care

Family Sinking Fund Categories

As a mom of 3, I’ll attest that kids get expensive. But saving monthly into a sinking fund can relieve this burden considerably, especially when back-to-school costs and camps come around.

- Kids Education (Fees, school costs, etc.)

- Kids Sports

- Kids Extracurriculars & Lessons

- Back to School Shopping & Expenses

- Birthday Parties & Gifts

- Babysitting

- Kids Clothes (this is helpful for when your kid has a sudden growth spurt)

- Braces

- Glasses or Contacts

- Summer Camps

- Childcare Expenses during the summer or school breaks

- School Uniforms

- Kids Musical Instruments

- Private School Fees

- Hair Cuts

- School Field Trip Fees

- Kids Entertainment Memberships (zoo, aquarium, children’s museum, etc.)

- New Baby Expenses (saving ahead for diapers and formula can be a lifesaver)

- Prom & Graduation

- Wedding Expenses

- Outdoor Equipment (swing sets, tire swings, sandboxes)

- Lunch Money (we pay the school in batches, so it’s hard to budget this monthly)

- Getting Teens a Car to Drive (+ insurance and gas)

- Family Photos

Seasonal Sinking Funds List

Whether you have high cooling bills in the summer, or you know you’ll spend for Christmas gifts, a seasonal sinking fund saves the day.

- Birthday Parties & Gifts

- Christmas Expenses & Gifts: (Create a holiday fund)

- Wedding Season (if you know you’ll be attending a lot of weddings, a sinking fund could help with this!

- A Big Anniversary Gift

- Utility Bills (if you know your electricity or heat will spike at a certain time of year, you can plan ahead with a sinking fund)

Pet Sinking Fund Types

Do you have a pet? Or many of them? Save in a sinking fund to make those necessary pet expenses feel a lot less painful.

- Routine Vet Visits

- Pet Medications

- Treats

- New Pet Supplies (if you know you’ll be getting a new pet, you can save ahead for bedding, toys, puppy pads, etc.)

- Pet-Sitting

- Boarding Services

- Grooming Services

- Emergency Vet Visits

- Flea and Tick Treatment

- Spaying and Neutering

- Pet Training

Fun & Travel Sinking Funds Ideas

Don’t forget the fun! As an adult, it’s easy to take life too seriously. So, plan for adventure and connection too.

- Vacation

- Celebrations like retirement parties, graduations parties, etc.

- Charity

- Nights Out With Friends or Family (good if you know that you spend more money when people come into town, or at certain times of the year)

- Gifts

- Passport Fees

- Ride-Sharing Services like Uber and Lyft

- New Technology Costs (if you know you’ll be upgrading phones when the next one comes out)

- Sporting Events (these can get pricey, especially if you’re season ticket holders)

Work Related Sinking Funds Examples

If you own your business or have a job that requires you to look a certain way, a sinking fund can be extremely beneficial.

- Work Clothes (scrubs, suits, dresses, etc.)

- Annual Renewals

- Estimated Quarterly Taxes (important for anyone who’s self-employed)

- Office Supplies

- Office Furniture

- Health Insurance Premiums

- Continuing Education (will you be going back to school or paying for classes?)

- Extra Travel Expenses

- Re-Certification Expenses

- Yearly Work Subscriptions

Self-Care Sinking Funds Categories

Anything that supports your health & wellness is important too! But these items can be irregular and add up fast. So, a sinking fund will help you take care of yourself when you need it.

- Manicures or Pedicures

- Massages

- Hair Cuts & Hair Coloring

- Weight Loss Programs

- Workout Equipment

- Gym Fees (often this cost is annual, making it hard on the budget)

- Counseling or Therapy

- Date Nights

- Laser Hair Removal

- Big Life Goals (marathon training, a meditation retreat, hiring someone to help you, a learning conference, etc)

Miscellaneous Sinking Fund Categories

Finally, these are two things that I didn’t account for and they smoked our budget in the months they were in last year. This makes them good candidates to put under a sinking fund.

- Buying meat in bulk (we bought a large amount of beef from a local farmer. While it was totally worth it, the up front price was not cheap).

- Mailing fees (if you have times of the year where you need to mail a lot, factor that in.

Now, should you have a sinking fund for all 100 of these? Heck no. Instead, create the “umbrella” fund like “Self Care Sinking Fund” and know that anything under it corresponds with that fund.

Real-Life Examples Of Sinking Funds

To give you a real-life example, here are the sinking fund categories I use in my home:

Car Fund

This includes saving for the next car. This sinking fund also covers tire, registration, and car maintenance expenses when they come up.

Vacation Fund

Traveling is a needed escape with family or on our own with adults.

Home Maintenence & Improvement

Houses have tons of hidden costs. By setting up a sinking fund, you’re covering all your basics.

Kids Activities

Some months these are expensive, other months it’s light. By having a sinking fund we can cover all months equally.

Charity

I wanted to push myself to be more generous. So, I set up a sinking fund to give a specific percentage every month. When an opportunity pops up to give, we already have the money in place.

Future Education or Business Education

We also want to have money available to invest in ourselves. My husband and I have used this for college classes, re-certifications, language learning, business courses, etc.

*Christmas and Auto insurance are covered by 2 extra paychecks that we don't account for in our budget. Otherwise, we'd have them as sinking funds as well.

Now, let’s say you have $500 to put in your sinking funds each month. Here’s how it could look with my sinking fund examples:

- Car Fund $100

- Vacation Fund $100

- Home Fund $100

- Kids Activities $100

- Charity $50

- Educational Investments $50

How Much to Put in Your Sinking Funds

In order to calculate what you need in your sinking funds, use this formula:

Yearly Amount Needed / # of Months to Save = $ Monthly

If you think you’ll need $600 for kids activities this year, then you’d do 600/12 = $50 each month.

Sinking Funds Calculator

Also, the fewer sinking funds you have, the more you’ll be able to put in each. For example, if you have $500 a month and 2 sinking funds, you could put $250 in each. You’ll have $3,000 available for each fund at the end of a year.

But if you have 6 sinking funds, and you split it equally, you’ll have only $1,000 in each fund after 12 months.

There’s no right or wrong way, but you’ll want to consider this when you create your funds.

How to Organize Sinking funds

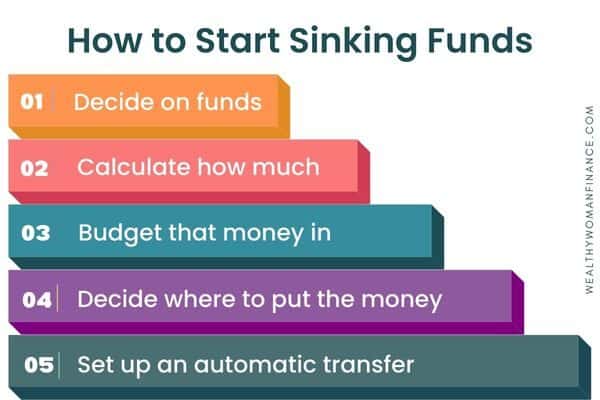

Here’s exactly how to get started with your sinking funds:

1. Decide on your sinking fund categories. Keep it between 1-5 so that you can see ample progress for each of your funds.

2. Calculate how much you’ll need to save each month. ($ Needed Total / Time to Save = $ Monthly) *If the number is a stretch, check out these clever ways to save more money >

3. Look at your budget and decide where you’ll get that money.

3. Decide where you’ll put your sinking fund money.

4. Set up an automatic transfer.

Sinking Fund Tracker Spreadsheet

Grab the free sinking fund worksheet too!

Check out this free 52 week savings tracker to help you meet your financial goals too >>

To Consider With Your Sinking Funds Categories

Sinking funds will save you many headaches, give you flexibility with your money, and help you sleep at night.

What are your sinking fund categories? Leave a comment below and let me know!