5 Money Moves I Made In March

Hi friend! Once a month, I’d like to highlight ways I’m saving, earning, and investing money in the hopes that we all learn and share here. You will also be able to see these, and much more in our Weekly Wealthy Woman (the fun newsletter!).

Here are 5 money moves I made this month:

I Invested In My Business

More specifically, I invested in multiple people who can take the business much further than I would be able to on my own.

Thus far, almost every business investment I’ve made has produced amazing results, whether it is outsourcing, learning, family help, or equipment. So, I won’t be stopping any time soon.

Related: Is it ok to spend money on yourself?

I Cooked More

Cooking for my family of five has been a struggle. But not only is eating out expensive for us, it also affects my husband’s health. He has Crohn’s disease and a lot of food intolerances because of it.

So, in March we brainstormed ways to make homemade meals a priority. We came up with:

- Splitting up meal-making duties better

- Repeating meals more often. Hello, Taco Tuesday!

- Being more strategic with planning and grocery shopping

- Asking or paying for help with meals

- Buying more grocery store pre-prepped food if it saves us from eating out.

And we will be taking it one step further in April with a no-eating-out challenge!

We Resurrected Our Library Visits

I got so frustrated with library fines that I began buying all of my books on Amazon. The problem? This habit gets expensive! Especially when they are easily available for free.

So, we dusted off the library card and have begun a once-a-week library visit with the kids. Everyone is learning and our regular visits help me remember to return books (less fines). It’s a big win!

We Made Unpopular Kid Choices

This time of year, it seems like we are dishing out money left and right for school things. Yearbooks, t-shirts, school carnival events, and field trip cash – this stuff adds up!

My oldest is in 5th grade, so we wanted him to have great experiences for his last year in elementary school. This brought up the question of if we need to spend more money on the younger kids too.

In most cases, we have decided not to. While this brought tears and shouts of “it’s not fair!”, we also felt that:

- Spending more money on school activity fun is an expectation we don’t want our kids to have every year.

- This gives the younger kids something to look forward to when they get into 5th grade.

Sometimes I worry that my kids are going to grow up as adults who feel entitled to have everything that everyone else has – because it’s the society we live in. So, this was both a money decision and a parenting one.

Note: We all have different money perspectives. I’m simply sharing our angle, and how we chose to save with this. It’s ok to disagree!

Related: Making Money Ideas For Kids

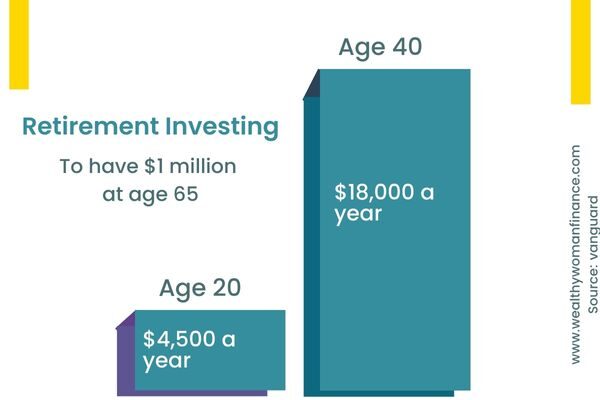

I Invested In Retirement

And finally, this month I put more money into my retirement fund and invested in an easy Vanguard index fund. This means that the money will be working for me from now on, and I don’t need to worry about it because I don’t plan on using it soon.

I’ll just let compound interest do it’s magic!

What about you?

What money moves did you make this month?

Did you….

- Read a money book, listen to a podcast, or watch a learning video?

- Open a savings account?

- Do a money challenge?

- Earn a little more money?

- Make a financial decision you are proud of?

- Save money on something you were going to buy anyway?

There are many ways to make a great money move! Share in the comments and let us know!