Free Zero Based Budget Template That Will Have You Saving Double

Are you ready to take your budget to the next level? This free zero based budget template and calculator will give you everything you need!

What is Zero Based Budgeting?

Zero based budgeting is just like it sounds! Instead of trimming your expenses (like with most traditional budgets), you rebuild your budget from the ground up. Then, when you finish creating your budget, your expenses (including saving) equal your income.

Why Is Zero Based Budgeting Important

Budgeting this way is often more effective because it forces you to:

- analyze and justify each expense.

- give every dollar you have a specific job.

How It’s Different From Traditional Budgeting

The purpose of all budgeting is to track your spending. But traditional budgets often increase gradually without you noticing. It is easy to let lifestyle creep set in with other methods.

Think of zero based budgeting as that of building a new invention. Sometimes, you need to stop trying to improve on what someone else has built. Instead, start from scratch to reset and innovate.

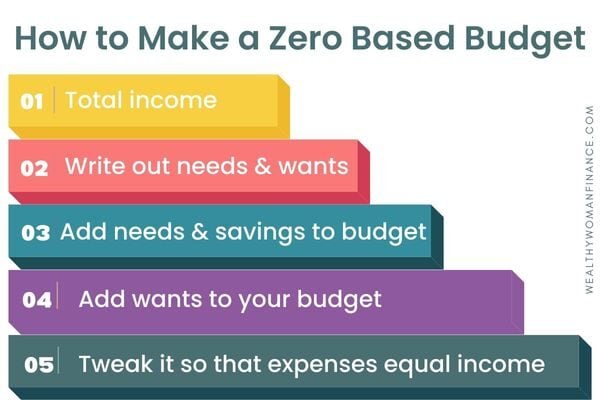

How To create a zero based budget

Making a zero based budget is a step-by-step process you can do any time you want.

1. Total up your monthly income (after tax)

2. List out all of your expenses on this needs and wants worksheet. It will help you categorize your expenses.

3. Use the zero based budget template to make a new budget. Start with your needs from the list (in #2) as well as the giving and saving you want to do. These are all easy to justify.

4. Evaluate the rest of your expenses and decide if they provide enough value to your life to be in your budget.

*Give yourself a small amount of wiggle room for miscellaneous and seasonal expenses.

5. Add the total of your new list. Now subtract your expenses (including savings) from your income. Use the zero based budget calculator below to make this easy.

Chances are, you will not be at zero. And this is where you get creative.

If you have money left over…

Wahoo! Celebrate! And then add that money to your vacation savings, emergency fund, or new great investment.

If you are short (this means your number is negative)…

You are not living below your means, and you need to make adjustments. Here are questions to ask yourself if your budget is over:

- What in my budget is a “want” and not a “need”?

- How much am I eating out on a weekly basis? Can I swap for cheaper meals?

- Can I cut back on vices like alcohol, cigarettes, or unnecessary junk food?

- Can I make more money? (side hustle, work hours, etc.)

“If you don’t decide what your priorities are in life, everyone else will decide for you.”

— Christy Wright

Why Should The Zero Based Budget Equal Zero?

Making your budget equal zero means that you have chosen for every dollar you have. It’s highly intentional!

So if you make $4500, all your savings, spending, and giving should equal $4500 when done with your budget.

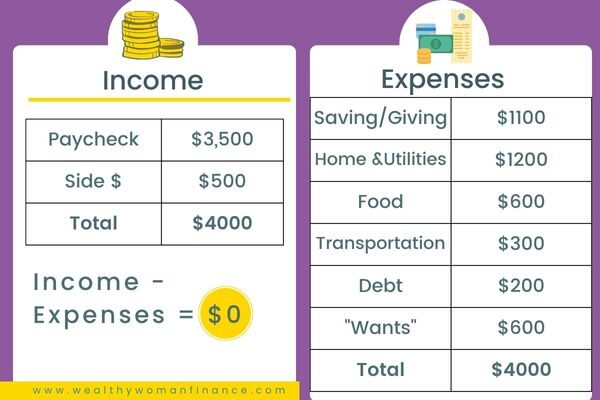

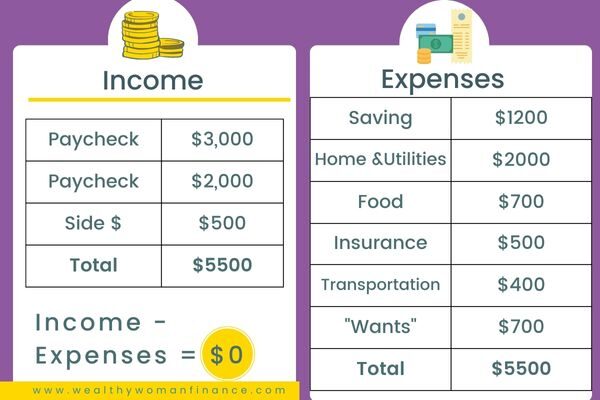

Key examples of a zero based budget

Here’s how it looks below:

Remember that everyone is different. You may categorize your budget differently, live in a lower or higher cost of living than others, or make different life choices. These are meant as examples only.

Zero Based Budget Calculator

Use this to help find the numbers that are right for you:

Pros & Cons of Zero Based Budgeting

Are there advantages and disadvantages to the zero based budget? Of course!

Pros of Zero Based Budget & template:

- The zero based budget is not based on percentage (like with the 60 20 20 rule or the 50 30 20 rule) which makes it incredibly flexible.

- You can create a new budget every single month to fit the exact seasonal expenses you need. (Again, how flexible!)

- Traditional budgets are primarily concerned with new expenses. Zero based budgets target old expenses as well. This means that you are looking at the big picture and taking a deeper approach to budgeting. You will likely reach your financial goals faster because of this.

- This budgeting method gives you maximum control over every detail of your money.

Cons:

- It is more time-consuming than other budgets because you are analyzing everything. For this reason, zero based budgeting might be a great once-a-quarter or once-a-year practice if you don’t have time monthly.

- If you have a great handle on your finances and you are meeting all of your money goals, then this budgeting method may be more than you need. It is ok to go with a more laid-back approach if this level of detail stresses you out.

- In the business world, the budget is also very useful. But it can reward short-term thinking because it favors the highest revenue parts of a business. These sectors easily justify their costs, as opposed to sectors like research and development, which are equally important but might not be able to quantify this as well.

Follow Through Is Important!

Throughout the month, keep track of where your money is going and if it lines up with your new zero-based budget template. Subtract from each category as you spend so you know how much you have left.

Free Zero Based Budget Template Pdf

Grab your free zero dollar budget template there:

How do you make a zero based budget in Excel or Google Sheets?

Want to do it with a digital spreadsheet? No problem!

Build your budget in exactly the same way:

- Write in your (after-tax) income.

- List out your needs (mandatory expenses) and savings

- Write out your wants and irregular expenses

- Subtract your expenses from your income (this number should equal zero)

After, track your expenses and make a new budget (again from scratch each month, quarter, or however often you want to.)

Zero Based Budgeting Apps

Here are a few apps that are also useful tools:

The You Need A Budget App is the most recommended for a zero based budgeting strategy. And they have a free trial for 34 days.

EveryDollar is another option that would work well. This app has a free version available.

How do you do the zero based budget template for an irregular income?

This is a great budget for an irregular income because you can start from scratch every month.

Keep your needs vs wants list handy. Then, tweak your budget monthly based on the money you know you will have that month (or the lowest of the previous 3 months).

Then, you can add more “wants” during the month if you find your income increases.

How Zero Based Budgeting Works in Business

In business, the zero based budget template works great for helping you find misallocated money. Just like with individual budgets, sometimes we need to take a second look at funds that have been set up and forgotten.

Grab more of the best budgeting tips, plus free resources below!

To Consider With The Zero Based Budget Worksheet

This page should have everything you need to find your perfect budget! Utilize the calculator and free zero based budget template and you will soon find that you are reaching your money goals far faster.