30 30 30 10 Budget Rule: How It Works For You (2024)

The 30 30 30 10 rule budget is a great plan for beginners and advanced budgeters alike. It’s a structure that will help you even if you’re currently living paycheck to paycheck. And anyone can use it to accelerate savings and achieve their dream life sooner.

What is The 30 30 30 10 Budget Rule?

With the 30-30-30-10 budget, you’ll start with your monthly after-tax income.

Then, divide the money into 30% for housing, 30% for needs, 30% for savings or debt, and 10% for wants. With the 30-30-30-10 rule, you’ll see exactly where your money goes, and if you’re overspending in certain areas.

Categories For 30 30 30 10 Rule

Now, let’s explore which subcategories fit under each category.

- 30% on housing: this could be a mortgage or rental. Insurance and taxes.

- 30% on necessary expenses: Things like car, basic groceries, insurance, utilities, and childcare.

- 30% on savings: Things like an emergency fund, retirement, car savings, college savings, and your bright beautiful future. (This also includes paying off debts)

- 10% on wants: Entertainment, cool stuff, eating out, and streaming services.

30 30 30 10 Budget Example

Let’s say your name is Emily. You are married and living in a mid-cost of living area. After taxes, you and your spouse bring home $5,000. But this stretches to cover a family of four.

Your 30 30 30 10 budget example may look like this:

- $1500 in housing. This pays your mortgage, insurance, and property taxes.

- $1500 into things you need. This supports your 2 car lifestyle and covers other basic household food, supplies, and medical needs.

- $1500 into your savings. You’re splitting this between retirement accounts, your HSA, and college savings for the kids.

- $500 into Disney+, Friday night pizza, and kids activities.

Of course, every situation is different! You will have different budget categories and income levels. Play with the numbers to see what works for you.

How It Works: 30 30 30 10 Budget Rule Plan

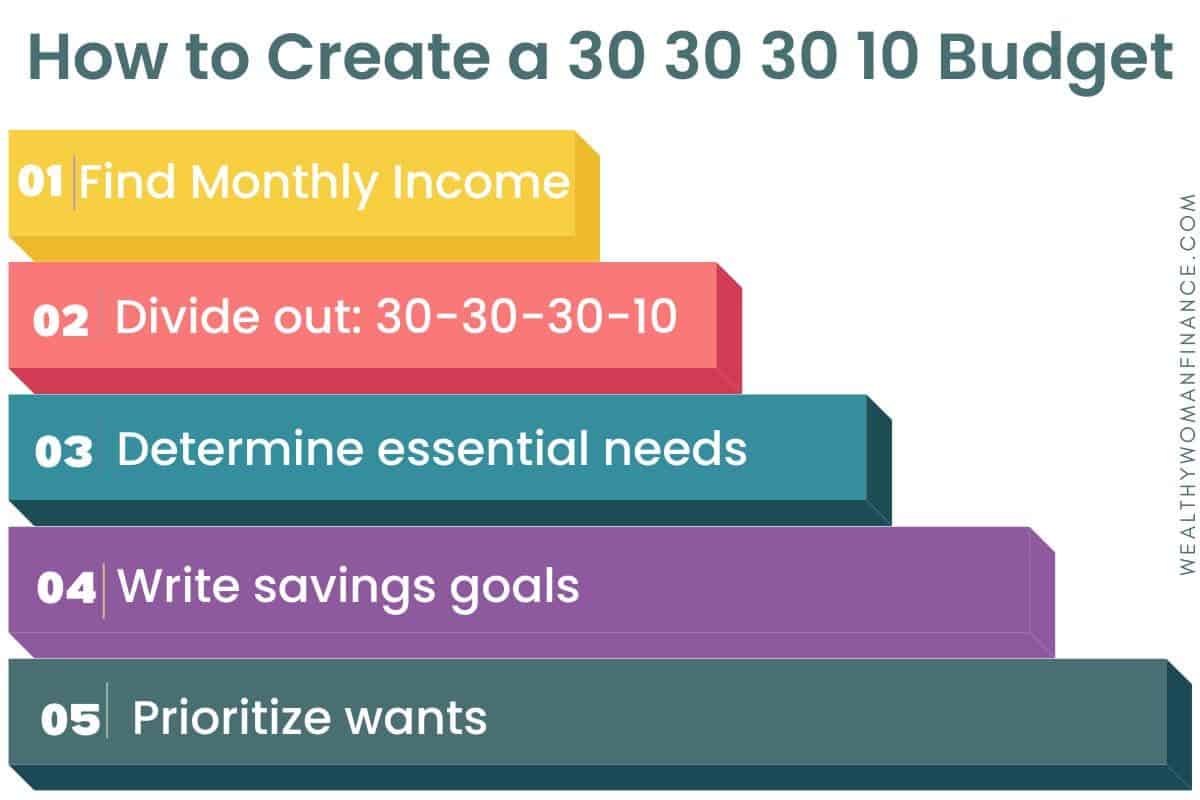

Now, here’s a step-by-step guide for building a 30 30 30 10 budget:

1. Find your monthly after-tax income. If your paycheck lists your yearly rate, divide this number by 12 to determine your monthly amount. If not, add up your paychecks from the last year.

For example, if you get paid every other week, multiply your paycheck by 26 to find your yearly income. Then, divide by 12 to get your monthly average.

2. Divide out your monthly number by 30/30/30/10. Try the 30 30 30 10 budget calculator below to help you:

- Monthly Total x .3 = Housing

- Monthly Total x .3 = Needs

- Monthly Total x .3 = Savings

- Monthly Total x .2 = Wants

3. List out your housing costs and essential needs first. What are the absolutes in your budget? Can you trim them?

4. Figure out what you’re saving for. Do you need to cover emergencies and sinking funds first?

Set up an automatic transfer to put your money into savings every month.

5. Next, write out your wants. This is the category you have the most leeway with. Write the most important ones first.

Not sure of the difference between a need and a want? Check out: Needs Vs Wants Examples & Template

6. Tweak and adjust as you go.

30% Savings (30 30 30 10 Budget Rule)

In this budget, you save plenty. But where should you put it? You can divide out your savings however you want. Put it entirely into one account or split it up like below:

- Retirement 10%

- Saving for a Future Vacation 10%

- Paying off Your Car 10%

Consider the following excellent places to put your savings. (But remember, when investing there is always an element of risk):

1. Work Towards Debt Freedom

First, if you have nagging debts, take care of them first. With a 30% savings rate, you should be able to knock these out much faster.

2. Create An Emergency Account

Next, build a 3-6 month emergency savings account. This keeps you out of future debt and helps you breathe easier during a job loss, when your washer breaks down, or if your dog needs surgery.

3. Put Money Into An HSA

Next, if you have an HSA available, use it! It’s like a medical emergency fund and it is often tax-free (for qualified medical expenses).

4. Save Money Into Sinking Funds

Start saving for things you know you’ll need.

- Wedding

- Baby

- Car

- Kids Activities

By having the cash, you’ll be able to enjoy milestones and look for great deals without money stress.

Related: Free Sinking Fund Tracker & Calculator

5. Put Money Into Retirement 401k, Roth, IRA

Next, if your company offers a retirement account match TAKE ADVANTAGE. That’s free money you’ll get to use later.

And when you can, add even more to your 401ks, and IRA accounts. These have tax benefits that make them the smartest to start (and continue) investing.

6. Put Money Into College Funds

Check out a low-fee 529 if you’d like to help kids with college.

Your money will not be taxed when you withdraw for educational expenses. Some states offer other tax benefits too (source). Or start a custodial account that your kids can take over at 18.

7. Invest: Stocks & Real Estate

Once you’ve covered the basic options with tax benefits, explore other ways to invest. You can get started in real estate, invest in passive income streams, or buy stocks.

What Are The Benefits Of A 30 30 30 10 Budget?

Using the 30 30 30 10 budgeting money rule comes with incredible benefits. Here are just a few:

It’s Great For Reaching Financial Goals

The BEST benefit is that you’ll now be saving 30% each month. What an incredible savings habit! Over time, compound interest will work wonders for you.

Limiting wants in your budget accelerates progress and does a great job of curbing overspending. In no time, you’ll be getting ahead financially.

Try a low spend year challenge >>

You See Where Your Money Is Going

For many, the real challenge of budgeting is keeping track of the in and out flow of your money. With the 30-30-30-10 budgeting method, you’ll have a guide.

Related: Best Budgeting Practices

It Helps You See Missteps

The numbers don’t lie! And you’re going to know immediately if your lifestyle is out of whack. If it is, no worries. Just make the necessary adjustments to get it back in balance.

Who Does This Budget Not Work For?

Anyone in a high cost of living area! If you live in a place like Los Angeles, fitting your housing into 30% will be difficult. In this case, it’s smart to put housing and needs together at 60% for more flexibility.

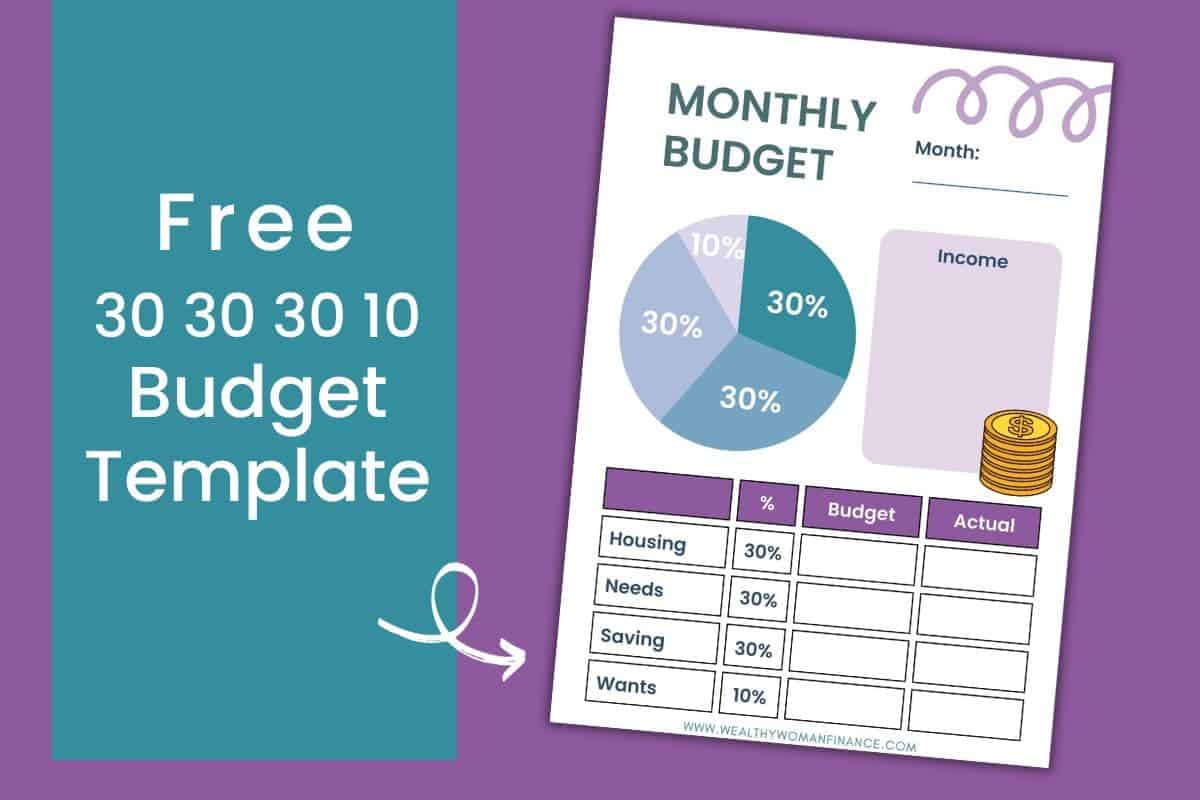

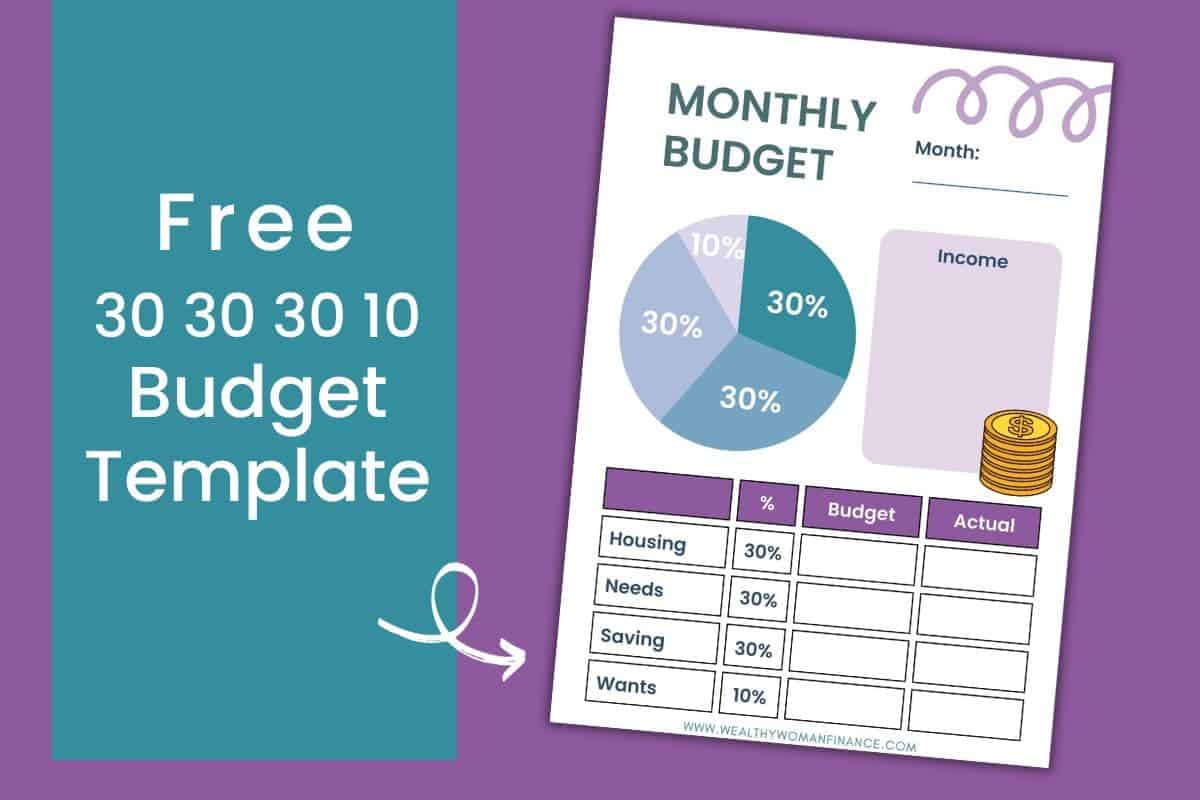

Free 30 30 30 10 Budget Template

A worksheet makes things easy! So snag yours now!

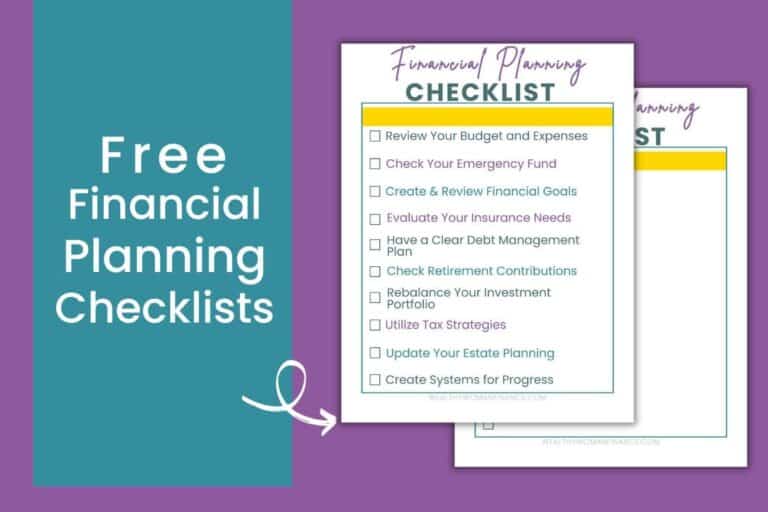

Grab more great free printables:

Which Budget Rule Is Best?

While this article covers the 30 30 30 10, there are many different budget percentage plans. The “best” one is the one that works for you! Consider your other options:

The 50 30 20 Rule (50% Needs, 30% Wants, 20% Savings)

Advantages of the 50 30 20: This method is the most popular budgeting rule. It allows for more spending on your wants, which may give families more flexibility if they have children in activities.

Disadvantages of the 50 30 20: If you have more “needs” you might struggle to fit that into only 50% of your budget.

See a 50 30 20 budgeting template >>

The 60 30 10 Rule (60% Savings, 30% Needs, 10% Wants)

Advantages of the 60 30 10: This method flips everything and has you saving 60%. It’s for the ambitious. And it’s no joke! But it also means you’ll reach your financial dreams in breakneck speed.

Disadvantages of the 60 30 10: Saving that much money is a big commitment. If you’re a beginner or need to start with something consistent, go with the 30 30 30 10 rule instead.

See more on the 60 30 10 rule for budgeting >>

See the tamer version of the 60 20 20 here too >>

The 70 20 10 Rule (70% Needs & Wants, 20% Savings, 10% Donation/Debt)

Advantages of the 70 20 10 Rule: This rule puts needs and wants together, which makes it very flexible. It also has a specific allocation for donations or debts. This is unique from other plans.

Disadvantages of the 70 20 10 Rule: Because needs and wants are bunched together, the lines can get blurry. If you’re looking for more structure, try the 30 30 30 10 rule.

See more on the 70 20 10 Budgeting Rule >>

Q & As: 30 30 30 10 Budget Rule

How Do You Do This Budget When Money Is Tight?

Now, if your budget is already tight, you may need to get creative with bringing in more money.

- Start a side hustle as a couple

- ask for a raise

- or resell items on the side.

Does The 30 30 30 10 Rule Include 401K?

In this budgeting rule, your 401k would be included under the 30% savings category. Your HSA will be under this too.

How Do I Stay Motivated On The 30 30 30 10 Rule Budget?

Keep the fire burning with these motivation strategies:

1. Create a money dream board to make your goals more visual.

2. Write financial goals that are specific, doable, and have a timeline. These will remind you what you’re fighting for.

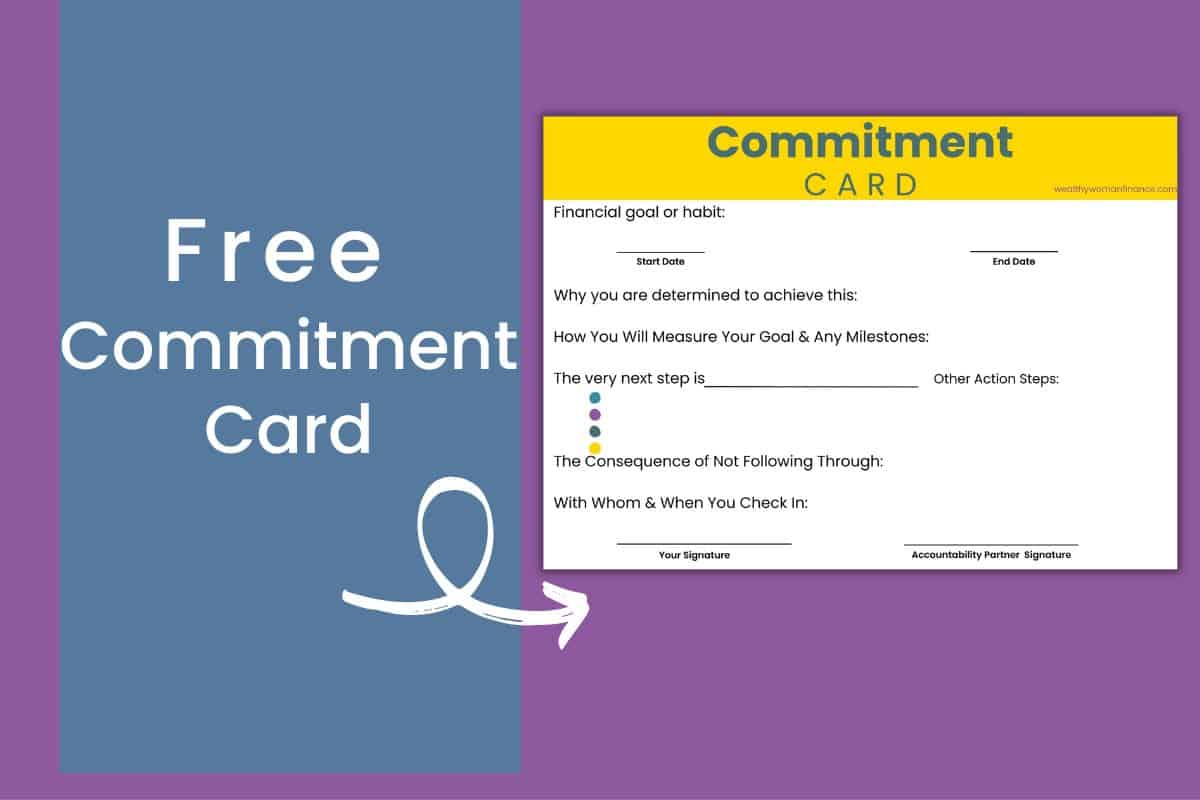

3. Fill out a commitment card pledge. A little accountability will help when your motivation wanes.

4. Motivate yourself with wealth affirmations, debt free quotes, or other inspirational tools to keep moving forward.

What’s Next?

Try a free savings challenge like the Penny Savings Challenge Printable or the 26 Week Savings Challenge. And don’t miss these unique ways to save money.