How to Teach Kids to Save Money (+Free Savings Tracker)

How do you teach kids to save when all they want to do is blow their money on a Barbie Dream House?

Teaching children about saving money is sometimes harder than it sounds. But this article will show you how to teach important concepts, reinforce them through real-life practice, and track progress through the free savings tracker. All so that early education sticks. And sets your child up for years of success.

Key Takeaway: Teach key concepts, but back them up with hands-on activities. Practice makes progress.

3 Key Concepts For Kiddos to Understand

Explain the Value of Money

By understanding the value behind saving, your child can make better money decisions from an early age. But how do you get them to understand?

Explain it this way:

- Money is more than just paper and coins. Or a number on a computer screen. It represents time and work.

Let’s say you want a toy that costs $30. If you earn money at $10 an hour, you have to work three hours to buy the toy. Is the toy still worth it? That’s for your child to decide, but now there’s a frame of reference.

Pro Tip: You can do this with teens and adults too. Want a new car? How many hours of work will it take to pay off your car (including interest on a car loan)? Is the car still worth it? Perhaps. But at least you know what you’re getting into.

Help Them Understand Needs Vs Wants

Understanding the difference between needs and wants is a crucial aspect of financial literacy. Start by explaining what each is:

| Needs | Wants |

| Food for basic meals | Going to Chuckie Cheese |

| A safe place to live | Living in a big house with a pool |

| A way to get to school | Getting to school in a fancy car |

| Internet for school & work | The Disney Channel |

Wants are not bad, they just aren’t necessary for healthy, happy living. Kids need to understand that if you spend too much on what you want, then you won’t have enough for what you need.

Pro Tip: Use everyday situations to highlight the difference. Ask them if what they want is a need or a want. It’s ok if it’s a want, but if they understand the difference they’ll make more mindful decisions later in life.

Teach Children The Power of Compound Interest

It’s like a snowball rolling down a hill. As it gathers momentum, it accumulates more and more snow (the interest), therefore making it faster and larger the farther it goes.

Even small regular contributions can grow over time due to the power of compound interest.

Set Your Kids Up For Saving Success

Teaching financial literacy starts at home. You are the primary influencer of your child’s money habits. And the environment you create will have a lasting impact.

Lead by Example

Your actions speak louder than words when it comes to savings. Show your child:

- how you budget

- how you save for emergencies

- how you’ve set up your savings accounts

- how you prioritize needs over wants

- how you invest

- how you save for family vacations

- how you comparison shop

Talk through your financial decisions with them and encourage questions.

Openly discussing money is the #1 thing you can do to teach your kids to save!

Leave Books Lying Around

I do this in my home, and it has brought on the best conversations! I pick up nonfiction books at the library and leave them in a stack in my living room. I make sure at least one of them is about money.

My kids will pick up a book when they’re bored. A discussion (sometimes randomly, days later) almost always follows.

Turn Learning into a Game

Try money trivia, money would you rather, or another money saving game to help your kids understand finance without the boredom.

Utilize Technology

There are apps designed to help children learn how to save money. Utilizing these apps introduces your child to digital finance management, an essential skill in today’s electronic world.

Explore Real-Life Scenarios

In teaching kids to save, tangible examples resonate (just like hands-on experience). Talk through these fun case studies with your kids!

Practical Hands-on Ways to Save

Teaching kids to save money is essential for instilling financial responsibility. By using visual aids, practical goals, and motivational incentives, you can help them grasp the value.

Use Clear Jars for Savings

Instead of piggy banks, use clear jars. This allows children to see their money grow. It gives a strong visual reinforcement. Place the jar in a common area where they frequently see it.

Set Achievable Savings Goals

Help your child set specific savings goals that are easy to accomplish – like saving for a toy or book. This will show them the satisfaction of reaching a goal.

Older kids may want something bigger. My 12-year-old son is saving to build a computer. In this case, break the goal down into smaller, more manageable chunks.

Name the savings account or jar to help them stay motivated and remember their why.

Save for a trip together (Or Something Else)

By having a shared goal, you can work together for a specific outcome. Once they experience the trip, they’ll understand why it’s important to save for special things.

Save for your vacation with a challenge. You can use the calculator on this challenge to develop a vacation budget together too! >>

Develop a simple budget with them

To begin teaching your child about budgeting, start small.

Teach them to set aside portions for savings, spending, and sharing. A simple table like the one below can help them visualize and plan their budget. This is assuming they get a paid allowance, but kids can also earn money in other ways.

| Allowance ($ per week) | Savings | Spending | Sharing |

|---|---|---|---|

| $8 | $3 | $5 | $1 |

Pro Tip: The key is to give them a sense of control over their money.

Talk to them about looking ahead with their savings. Short-term pleasures are fun. But what can they do today to make their tomorrow better?

Give Them Freedom to Save

My kids have a certain number of hot lunches I’ll pay for each week. If they go above that, they have to pay for them with their own money. But if they want to take extra cold lunches, I’ll pay them.

Give Extra Chores For Money or Allowance

In order to teach kids about saving, they need to be able to make it. There are three ways you can do this:

- Through an allowance. This can be tied to chores or simply to teach money management.

- Through extra money chores they do for you. I have a list of things my kids can do for cash.

- Through helping others. Shoveling driveways, raking leaves, etc.

Put Them in Charge of Their Money

If your kids want to buy something at the store, make sure they do the transaction. It’s an excellent learning opportunity. The same goes for banking. Younger kids can practice at home by playing store.

Offer Rewards for Saving

You can offer small rewards when they reach certain saving milestones. For example, an extra hour of playtime or a choice of what’s for dinner. Try fun free coupons for kids >>

Free Savings Tracker Printable for Kids

Grab this free savings tracker to help kids learn how to save money in a fun way!

Next Level Saving: Banking for Kids

Introducing your child to the basics can help them develop habits early. Here’s how to get started:

Open a Child’s Savings Account

When you decide to open a savings account for your child, look for banks that offer youth or custodial accounts.

Youth savings accounts are specifically designed for individuals under 18. These are ideal because they often don’t have minimum balance requirements and monthly maintenance fees.

Pro Tip: Go with convenience. When opening a bank account for my kids, what I needed most was a bank that was close and convenient. – One that wouldn’t take a huge effort to go to!

To open an account, you’ll need your child’s Social Security number, birth certificate, and a small initial deposit.

Explain Interest and Banking Terms

Once the account is open, explain the concept of interest. It’s the money the bank pays into the account, and you can make more money over time. Explain any financial literacy terms you need to, like deposit, withdrawal, and balance.

Then, play with interest calculators to help show them how interest compounds.

Challenges To Teaching Kids to Save

Helping children save money involves overcoming obstacles. Remember that Barbie Dreamhouse? (That was my daughter!). Use these strategies to help reinforce better habits.

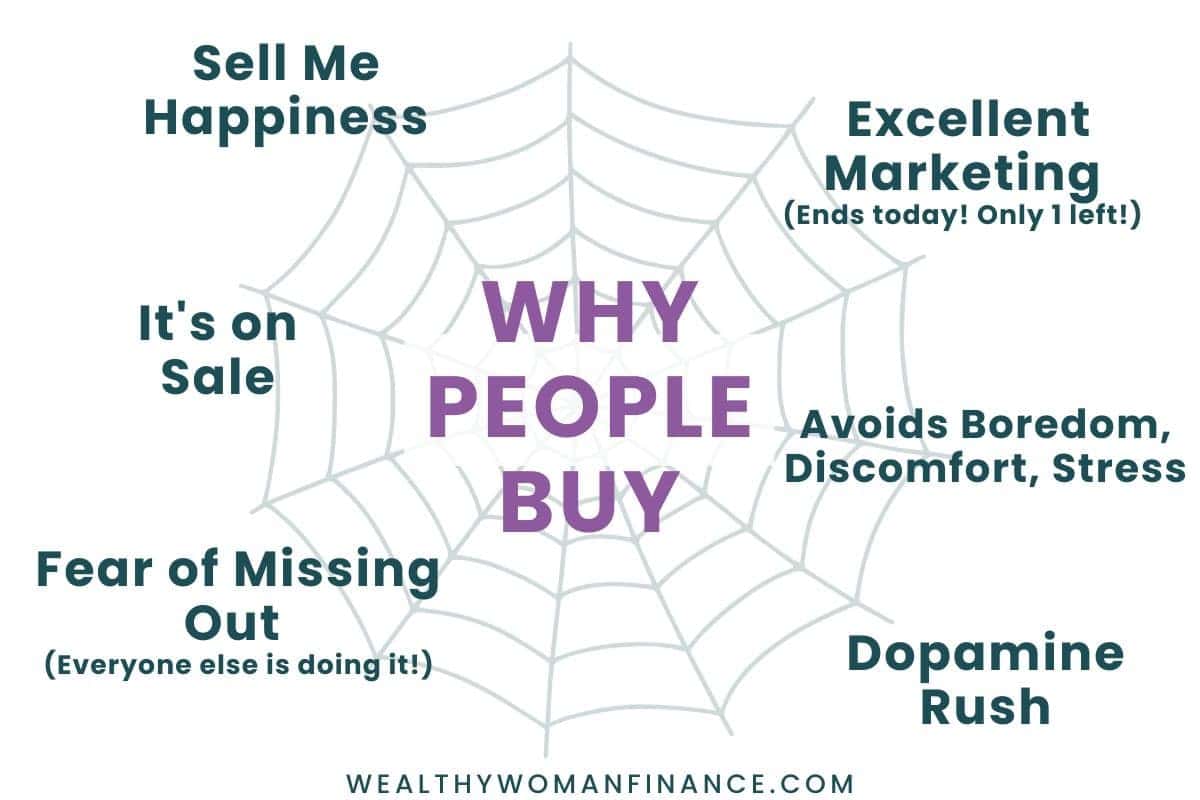

Identify Impulsive Triggers

Kids are like adults, but they can be even more susceptible to marketing. Understanding what prompts your child to make impulsive purchases can help you steer clear or at least find better alternatives.

The major ones kids face are:

- Peer influence

- Ads and marketing on tv, online, and with digital games

Teach Kids to Save & Wait

Instead of saying no, set a rule that your child must wait 24 hours before purchasing. This time allows them to think about it.

Encourage Consistency Over Perfection

At some point, your child is going to buy something that you disagree with.

Mistakes will be made. Even adults make them all the time. But mistakes help us grow too!

Help your child learn, forgive, and move on. Financial success is not a sprint, but a marathon.

Adapt to Changing Interests

Children are constantly growing. One minute they want Legos and the next they’re saving for an XBOX. Embrace the change and try not to keep them to any one thing. What’s important is that they develop the saving habit. This is what will serve them for life.

Check in: Are you still excited about saving for the scooter? Or is there something else you’d rather save for?

Teach Kids to Save So They Can Give

Saving isn’t just about keeping money to yourself. It’s also a way to help others. Illustrate to your kids how their monetary contributions can support people and the community.

Make this visual too! Use a simple chart or illustration to help show them what their money can do.

What’s Next?

Monitor and adjust. I’ve learned three things as a parent and financial educator:

- Kids require oversight. Try to be involved with what they’re learning and their savings progress.

- The more choice your child has the better.

- You will make mistakes. It’s a part of parenting that none of us can escape. Forgive yourself and move on.

Personal finance is a journey. And it can be a beautiful awakening. Try one of these articles to strengthen what you know too:

And don’t miss 3 point Thursday – it’s a quick newsletter I send out with practical wealthy woman tips each week.