30 Important Financial Literacy Terms to Know in 2024

Financial literacy terms can be confusing. And this makes them intimidating. In fact, fancy money terminology paralyzes many good souls. You might think, “I have no idea, so I’m not even going to try.”

But not here friend. You’ve got this. These explanations are straightforward. And you are more capable than you think.

Understanding these terms unlocks the door to financial freedom.

They help you:

- manage your day-to-day money decisions

- plan for the future

- take action on your biggest dreams

- hold an in-depth conversation with someone else

Whether you’re investing, managing debt, or setting up a budget, knowing these terms empowers you. So, take the helm of your financial ship!

Pro Tip: Take out a pen and paper and jot down notes on any that you didn’t know. This helps you remember for the future!

Key Making Money Financial Literacy Terms

1. Active Income

Active income is the money you work for actively. You are trading your time for money, most often in a job.

2. Passive Income

Passive income is the money that you can make while you sleep. These forms of income are not entirely passive. Many of them require upfront work and/or occasional maintenance.

- Renting out properties

- Setting up an email list and automated sequences

- Renting out your car when you’re not using it

3. Cash Flow

Cash flow is the in and out movement of your money (or flow within a business).

What you make = inflow, what you spend = outflow

You want a gap between the two to live below your means.

4. Gross Income

The income you make before taxes or deductions are taken out of it. This income can be from wages and salary plus other forms, including pensions, interest, dividends, and rental income.

Gross income for a business is total revenues minus the cost of goods sold.

Be aware: Many people will talk about gross income. It’s sexy. But it’s important to understand what your net income looks like. That’s the money and profit you actually see.

5. Net Income (Also Called Net Earnings)

Net income for an individual is the amount of money you see from your paycheck each month.

For a business, it is calculated as revenues minus expenses, interest, and taxes. It’s the profit the company makes after paying all expenses.

Crucial Saving Terms to Know

6. Budget

A plan for how you’ll use your money and where it will go. Good budgets leave ample room for saving and/or debt payments. Check out:

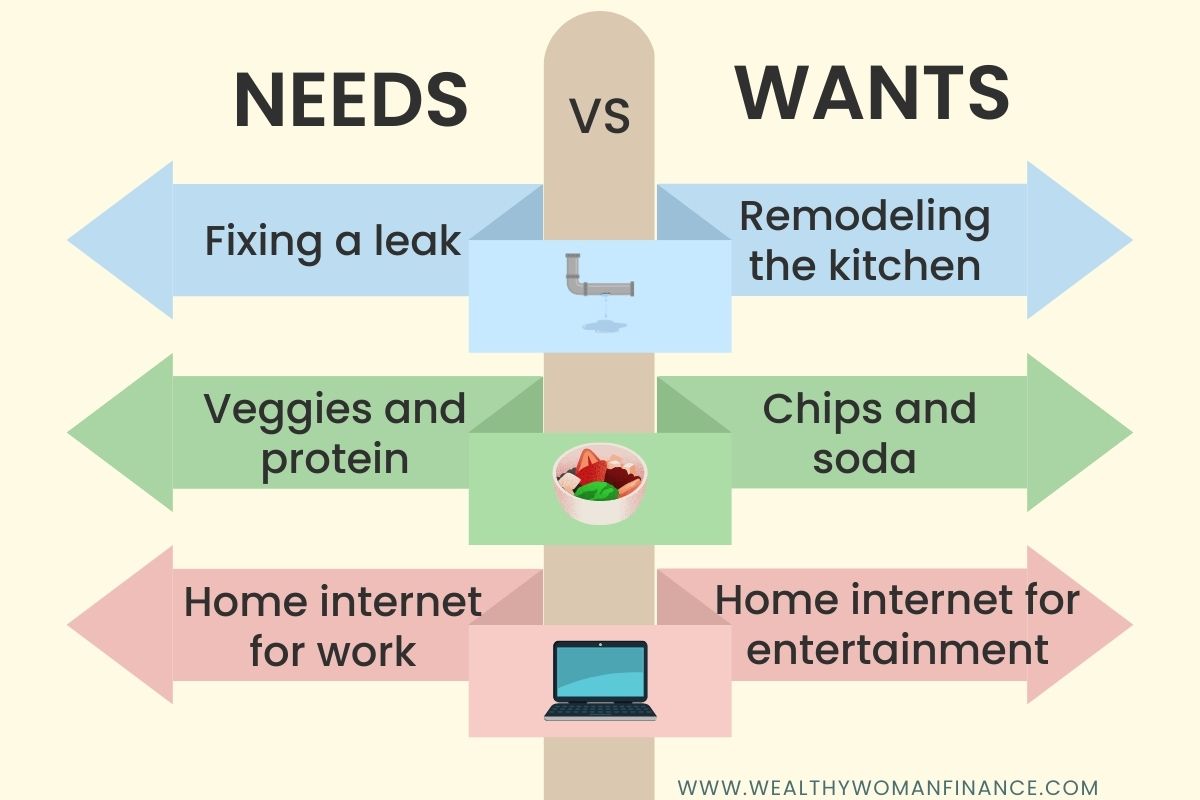

7. Needs Vs Wants

It can be easy to confuse a need vs a want in today’s fast-paced society. But needs are essential to maintaining security and basic living. Wants are desirables that you can live without if your money is earmarked for different things.

8. Health Savings Account

It’s a tax-advantaged savings account that you can use for qualified medical expenses. Things like:

- deductibles

- copayments

- coinsurance

- prescriptions and approved over-the-counter medicines

By using untaxed money, you can save significantly on out-of-pocket health care costs.

9. Fixed Vs Variable Expenses

Fixed expenses are stable costs that remain the same each month, such as rent or mortgage payments.

Variable expenses fluctuate from month to month. They include items like groceries, entertainment, or dining out. These expenses can change more easily based on your choices.

10. Emergency Fund

An emergency fund is money you set aside for life’s unexpected emergencies. This could be a health crisis, home repairs, a job loss, or any curve ball that comes your way. You’ll want at least 3-6 months of expenses in cash.

Try the emergency fund challenge >>

11. Direct Deposit

Possibly the most important term on this list! Why?

A direct deposit is an automatic transaction from your paycheck to a savings, debt payment, or investing account. And it’s the PRACTICAL way to wealth. You are making your savings a habit instead of just a wish.

You can also set up an automatic deposit from one account to the other. We transfer money from checking to savings each month. It’s easy to set up on your bank’s webpage.

12. Principal

Refering to the original sum of money.

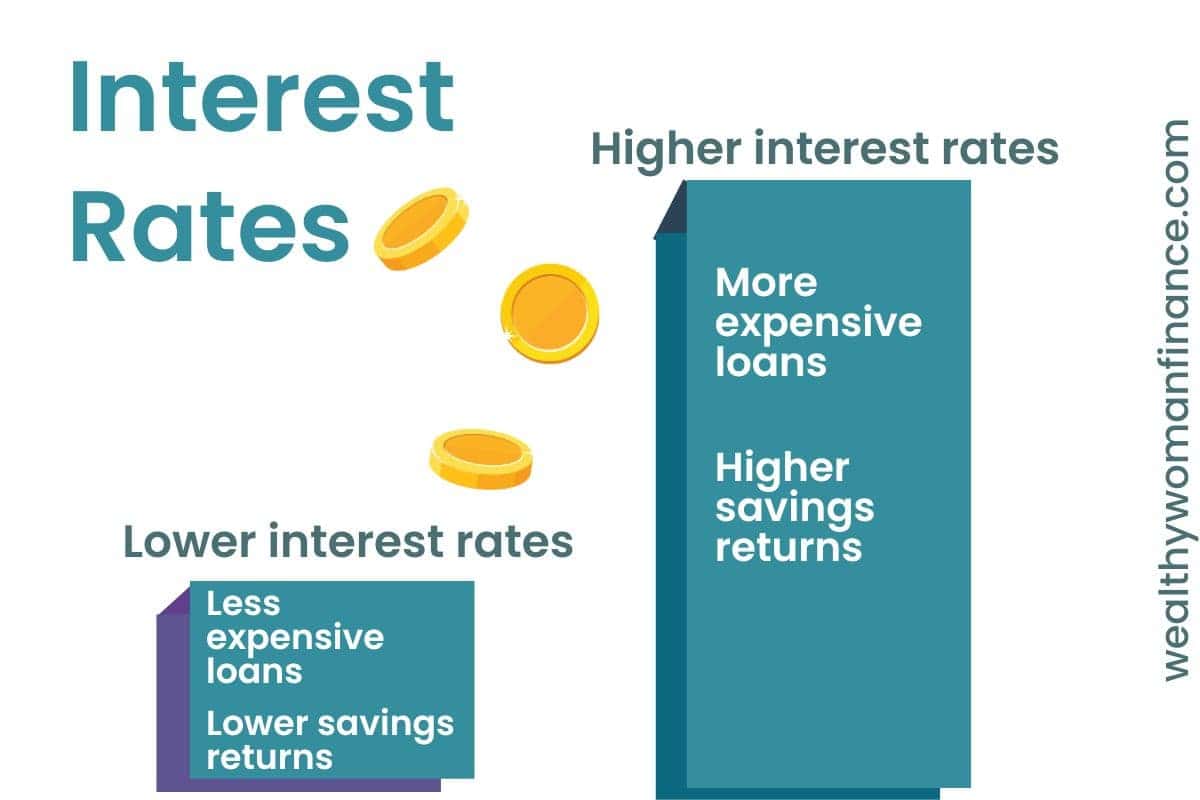

13. Interest Rates

Interest rates determine the cost of borrowing money as well as how much you make on your savings. When a bank quotes an interest rate, it’s the percentage that will be charged or earned annually on the principal.

14. Compound Interest

Compound interest refers to the interest earned (or charged) not only on the principal but also on any accumulated interest from previous periods.

It’s like a snowball rolling down a hill. As it gathers momentum, it accumulates more and more snow (the interest), therefore making it faster and larger the farther it goes.

15. Yield

The income generated by a savings account or investment.

16. APY Interest Rate

APY stands for Annual Percentage Yield.

It represents the total amount of interest earned on an account, including compound interest, over a one-year period. APY takes into account the frequency with which interest is compounded.

If you have a savings account with an annual interest rate of 2%, compounded quarterly, the APY would be slightly higher than 2% due to the compounding effect.

17. Certificate Of Deposit (CD)

A Certificate of Deposit (CD) is a financial product offered by banks and credit unions. With these, you keep a specific amount of money in your CD for a set period. It’s known as the term of maturity. In exchange, the bank pays a higher interest rate.

CDs typically have fixed interest rates and penalties for withdrawing funds early. They are low-risk for those looking to earn interest over a shorter fixed period.

18. Savings goal

The amount of money you plan to put aside for a specific purpose. See great financial goals examples or great things to save for.

Key Money Management Terms

19. Loans

Loans are financial agreements between two people or organizations. A lender provides money to a borrower. The expectation is that the borrower will pay the loan back fully, plus interest. Terms of loans vary widely.

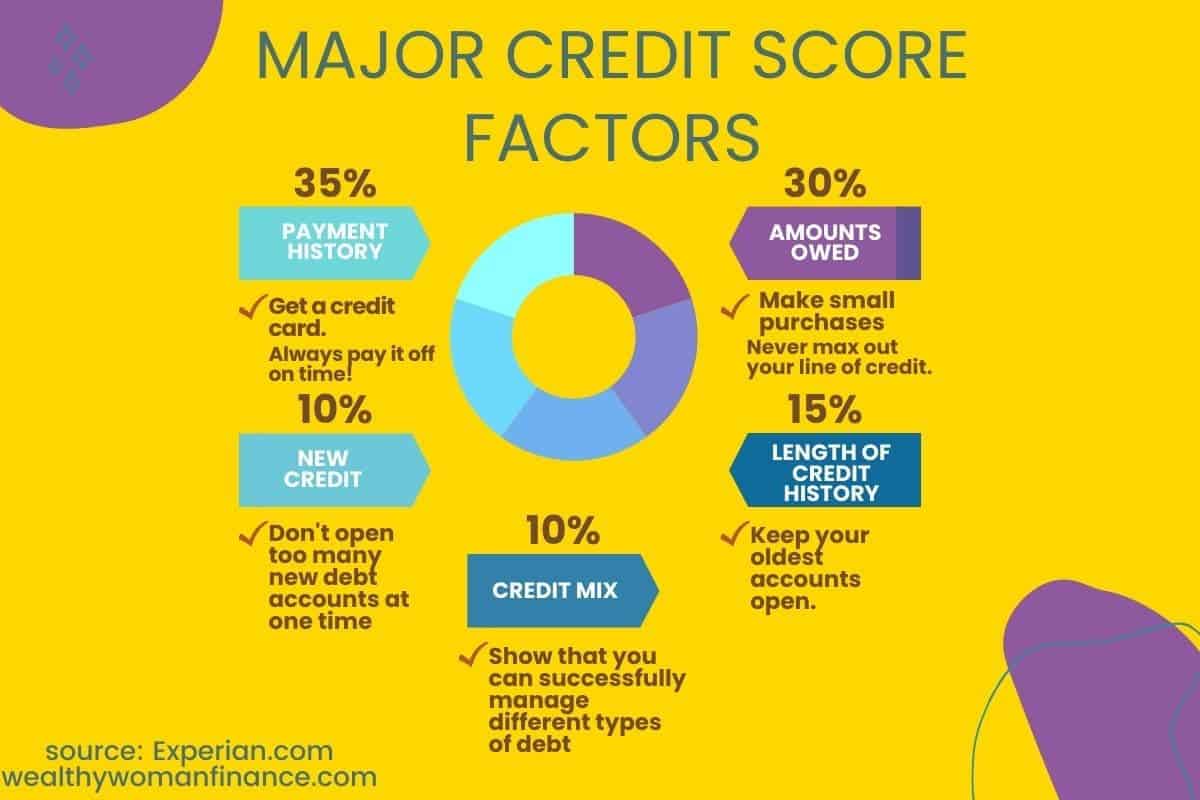

20. Credit Score

Your credit score is a representation of your creditworthiness – how smart it is to give you a loan. It is calculated using information from your credit report. This score affects your ability to get a loan and how high or low your interest rate will be.

21. Credit Report

Your credit report contains a detailed record of your credit history, including accounts opened in your name, payment history, and debts.

Check your credit report regularly for accuracy and to identify any potential fraudulent activity.

22. Assets

Assets represent anything you own that has value.

These can be physical items like real estate or vehicles, or intangible ones like stocks and bonds.

23. Liabilities

Liabilities are what you owe to others—debts or obligations. (Mortgages, car loans, student loans, credit card balances, etc.)

24. Net Worth (Financial Literacy Terms)

Net worth is the difference between a person’s assets (what they own) minus their liabilities (what they owe).

Related:

- How to Calculate Liquid Net Worth

- Financial Literacy Month Ideas (Keep learning!)

Important Tax Definitions

25. Tax Brackets

Tax brackets determine the rate at which your income is taxed. In the United States, the rate increases as your income does. These rates and brackets can change, so consult the latest tax bracket information.

26. Tax credit (Financial Literacy Terms)

A dollar-for-dollar reduction in a tax. It can be deducted directly from taxes owed. Examples of tax credits include the Child Tax Credit and Education Credits.

27. Tax deduction

An amount (often a personal or business expense) that reduces your taxable income. Things like student loan interest, business use of home, and money you put into a 401k or IRA.

Insurance Financial Literacy Terms

Whether it’s car, health, or another type of insurance, these financial literacy terms are important to know!

28. Policy

A policy is a legal contract between you and the insurance provider. When you purchase an insurance policy, you gain financial protection in the case of something happening.

29. Premium

The premium is the amount you pay to the insurer, often on a monthly, semi-annual, or annual schedule. It keeps your insurance policy active.

30. Deductible

The deductible is what you pay (at the time of needing to use the insurance) before your insurance policy pays its share. Your deductible will be outlined in your policy.

For example, if you need to replace your roof because of a storm, your deductible may be $500. You pay that out of pocket. Then your insurance will pay the rest.

What’s Next?

Good on you for taking the steps to learn these financial literacy terms. You’re a rockstar!

Now, the next time something financial comes up, you’ll know what’s up.

*Check out the must-know investing terms coming soon!

And don’t miss the wealthy woman newsletter and free resources!