What Is Liquid Net Worth? & Why It’s Important

What does your liquid net worth mean?

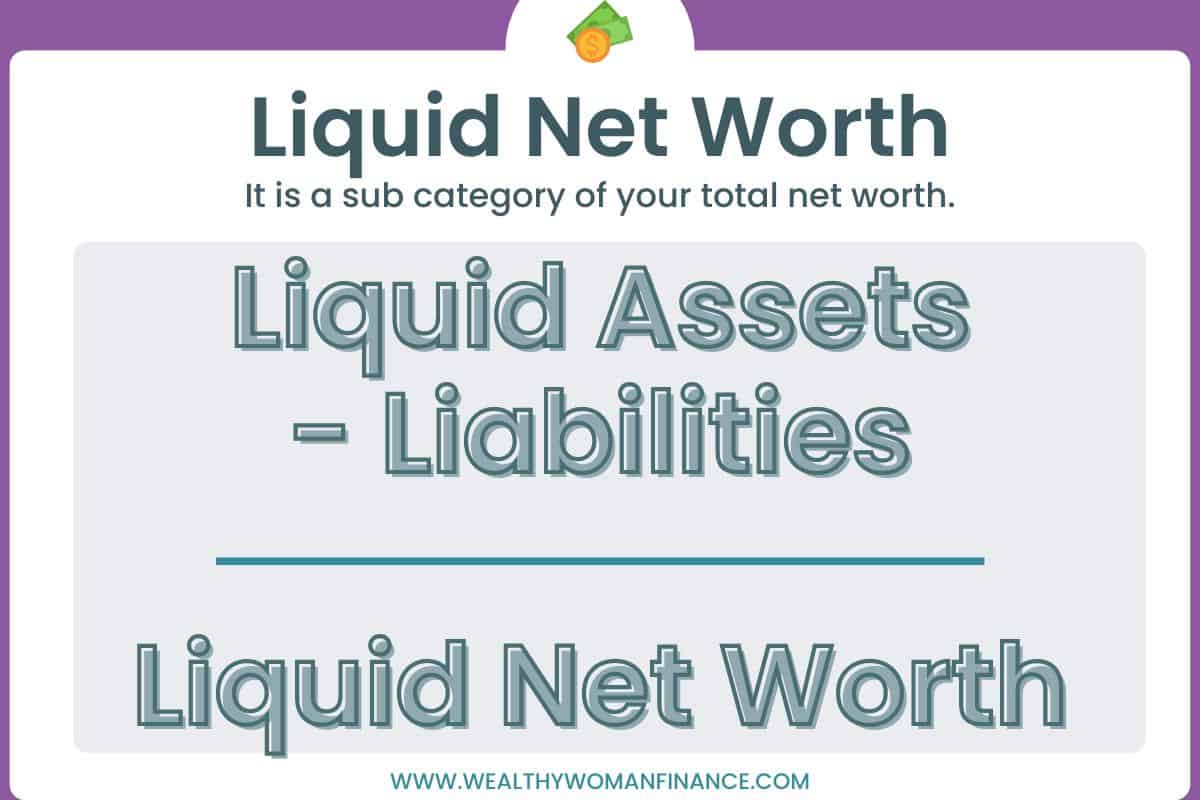

Liquid net worth is the amount of assets you can turn to cash in a hurry, after subtracting debts and liabilities. It is a crucial measure of financial health. It affects your ability to handle unexpected expenses, take advantage of investment opportunities, and weather economic storms.

Knowing this number will help you determine if you are where you want to be financially. Plus, you can make better decisions about investing and spending habits.

Liquid Net Worth Assets Examples

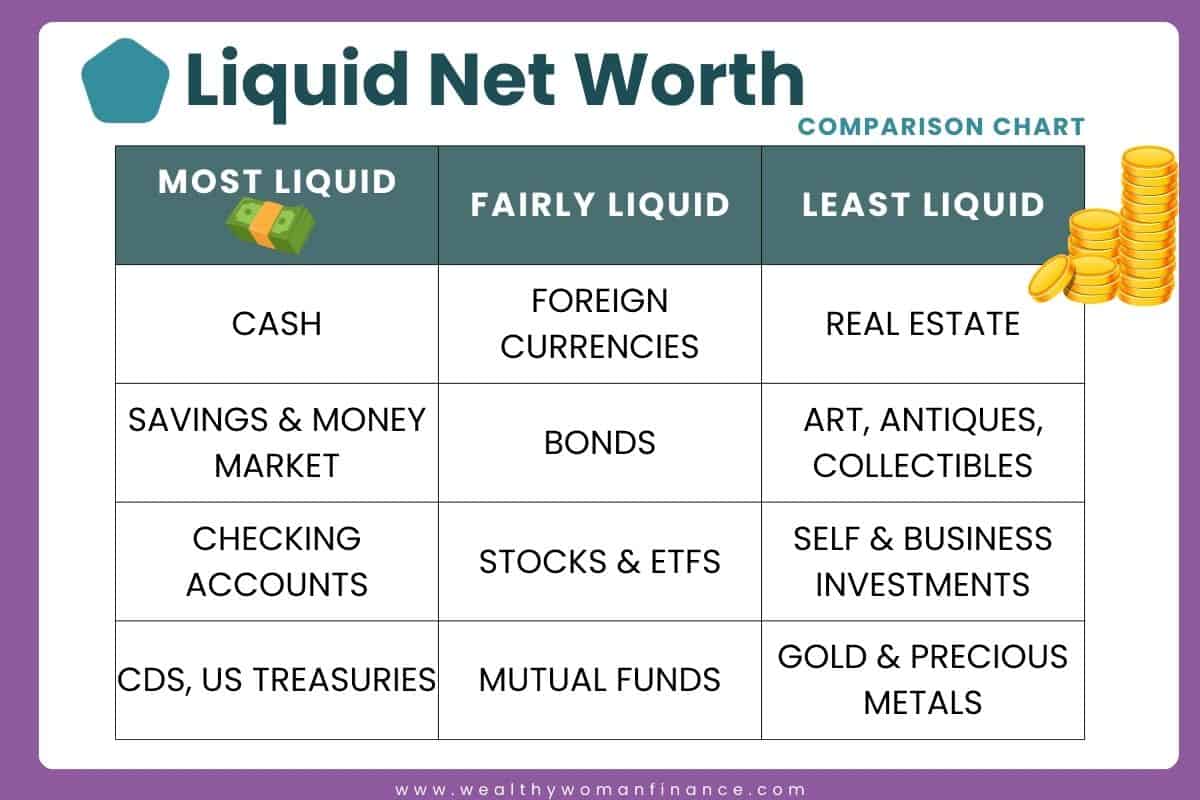

Your liquid net worth includes accounts that you could take cash out of within a few days, without having to sell tangible things.

- Checking accounts

- Savings

- CDs (Certificates of Deposit)

- Money Market Accounts

- Bonds

- US Treasuries

Are stocks part of liquid net worth?

Yes. You can usually sell your taxable stocks, ETFs, bonds, and mutual funds within a day or two. However, beware that you run a higher risk of selling for lower than you paid if you need the money out quickly.

Non Liquid Assets

For these investments, you have to find a physical buyer, which can take time. This isn’t to say that the investment is “bad.” It just means that you can’t count on cashing out fast.

- The home you live in & your cars (if you count them as assets)

- Collectibles (art, classic cars, cards, etc.)

- Precious metals

- Jewelry

- Gold & silver coins

- Items you plan on flipping for resell

- Investment properties

If it’s a tangible item, it might take time to sell = non-liquid.

Why Liquid Net Worth Is Important

By calculating liquid net worth, you can assess your ability to pay off debts, save for retirement, and achieve your financial goals. Here are your two biggest reasons for having healthy cash accounts.

Financial Security: Emergency Fund

It helps you build and maintain your emergency fund. An emergency fund is a pool of cash (liquid assets) that can be used to cover unexpected expenses, such as medical bills, car repairs, or job loss.

Having a robust emergency fund provides peace of mind and financial security. It ensures that you won’t go into debt or have to sell assets if you need cash immediately.

Check out our emergency fund challenge to get yours up to speed!

Financial Growth: Investing

It gives you or your business the flexibility to take advantage of investment opportunities. Let’s say someone is starting a business and wants to know if you’d like a piece of the action. In order to even think about it, you’ll have to have enough liquid net worth to become a part of it.

Liquid assets, such as cash and stocks, can be used to invest in:

- new ventures

- buying property

- growing your business

- investing in yourself or your learning

All of which can lead to significant growth for your money.

Another example: let’s say you want to pay down your mortgage or pay it off entirely. Before you can do anything, you need to know how much liquidity you have.

how do you figure out your liquid net worth

The calculation is straightforward:

- Determine the total value of your liquid assets.

- Subtract all outstanding debts. This includes mortgages, loans, and credit card balances. The remaining amount is your liquid net worth.

Liquid Net Worth Calculator

Use our calculator to find your numbers:

Bottom Line: Could you get this money out in a few days?

Liquid Net Worth Vs Total Net Worth

These two are not the same.

Total Net Worth = Full Picture (All assets – liabilities

Liquid Net Worth = Amount You Could USE tomorrow (Liquid assets – liabilities)

Let’s say…

- You have $350,000 in assets (of all kinds)

- You have $110,000 in liquid assets

- you owe $100,000 between a home mortgage and student loans.

If you subtract $100,000 from $350,000, your total net worth is $250,000.

But $250,000 isn’t what you could use tomorrow if you had to. To find what would be smart for you to access, you look at liquid net worth. That would be $10,000 in this case.

Related: Free Total Net Worth Tracker

Factors That Affect Liquid Net Worth

- How much you earn

- How much you save

- If your assets fluctuate (i.e. stocks will go up and down)

- How much you owe

How To Increase Your Liquid Net Worth: Tips

Using the factors above, you can improve your liquid net worth through a series of simple actions. These can help you achieve financial freedom and greater security.

Reduce Debt

Debt reduces the amount of cash you have to invest or save.

- Create a budget: A budget helps you identify your blind spots and gives your money direction.

- Try The Debt Snowball: Studies show that paying off your smallest debts first gives people the psychological boost to keep going. See more Ramsey steps >>

- Use a free debt tracker to keep you motivated.

- Consider consolidating debt: This can lower your interest rate and make it easier to manage.

Increase Savings

Boosting your savings can also improve your numbers.

- Set up specific savings goals to help you stay motivated.

- Try a 52 week money saving challenge or the vacation savings challenge.

- Set up automatic transfers from your checking account to a savings account to be more consistent. See more: reverse budgeting tips

- Look for better interest rates: High-yield savings accounts, CDs, and treasuries can offer higher interest rates than traditional savings accounts.

- Boost your income or get creative with buying less. Play with both sides of the saving equation to give yourself more wiggle room.

- Invest in things that boost your cash flow without increasing debt. This could be a side hustle or dividend stocks.

Related: Best Benefits of Saving Money & How to Make $500 Fast

Common FAQs: What Is Liquid Net Worth?

What about self and business investments?

Personally, I consider investing in yourself (or your business) your best investments. But they often don’t end up in your net worth calculations. Where do these fall between liquid and non-liquid assets?

In most cases, they are non-liquid because you are investing in services or tangible items. And it will take time to see the benefits. You can’t just cash out of these.

- Investing in a nutritionist to get healthier = feel better + pay fewer doctor bills later

- Paying a service to help your business grow = more revenue next year

- Joining a mentoring program = a potential career boost

- Investing in new office equipment = more productive hours

Don’t forget the power of these types of “assets” too, even if you can’t use them for your liquid net worth.

Is 401k liquid net worth?

No. You can’t get your money out without facing taxes and a penalty until age 59 1/2. Therefore retirement accounts are not very liquid accounts.

This may go for company shares as well. My husband’s company is employee-owned and gives shares to employees as a benefit. However, the only way to sell is to leave the company or retire. Therefore, this money is non-liquid.

Does It Include a mortgage or House?

Yes and no. You’ll subtract your mortgage as liabilities but your home isn’t a liquid asset.

What does it mean if you have a negative liquid net worth?

This may indicate that you need more cash in case of emergencies, unexpected expenses, or future opportunities.

It may or may not mean that you have a negative total net worth. It could be that too much of your portfolio is comprised of non liquid assets.

How much of my net worth should be liquid?

For starters, you will want 3-6 months of expenses in case of emergencies.

According to US Bank, a general rule of thumb is that cash and cash equivalents should be between 2% and 10% of your full asset portfolio. But this number will vary depending on your lifestyle.

What Is A High Liquid Net Worth?

Anything above 10% of your portfolio.

Does It include bank accounts?

Yes. Savings accounts, money market accounts, and checking accounts are included.

Is Social Security a liquid asset?

No. Like annuities, you can’t sell them. There’s no liquidity.

“If you have wealth without liquidity, you’re still in bondage. If you have capital without currency, you’re still in bondage. Liquidity equals freedom.”

― Hendrith Vanlon Smith Jr

To Consider With Your Cash

Understanding your numbers is important when it comes to taking advantage of life’s opportunities and making sure your family is covered.

So, what about you, do you have enough liquid net worth?