100 Things to Save Up For (Future Success & Fun!)

What are good things to save Up for?

In the span of life, we all have things we dream of doing.

But what if you’re not sure what direction to take? You don’t know how to get started? Or you’ve lost your passion because you don’t have a clear goal?

Today, fix these common struggles! Learn 100 smart things to save up for, plus read the section with tips on how to get started saving.

This post contains affiliate links. See our disclaimer for more.

The items below will help you determine what to prioritize, what to note for the future, and what to drop completely.

Important Things To Save Up For In Life

First, these are the BIG things. You want to have these covered before moving on to others.

1. Emergency Fund

Put 6-12 months of cash in an emergency fund. This one thing eliminates your biggest financial fears. Saving up for this may not be fun, but your peace of mind is priceless.

2. car

Save up to pay for your next car in cash!

According to Kelly Blue Book, you would save at least $5,200 in interest by paying the average car price $47,077 in cash (instead of a $3,000 downpayment and a 6% loan).

Even if you can’t come up with the entire amount for the car, a hefty downpayment will still benefit you big time.

3. House

Next, for most, a house payment is your biggest expense. But if you can save up for a good downpayment on your next house, you’ll have smaller monthly payments.

So, aim for saving 25% of the cost of the house. You’ll have a solid start as well as be able to cover closing costs and moving fees.

4. Things to Save Up For: Retirement

Due to compound interest, you’ll be MUCH better off if you can start saving for retirement when you’re young. And the more you put in NOW, the better off you’ll be.

The chart above shows you the difference time makes when investing $400 a month at a conservative 5% annual return.

5. Debts

If you have high-interest credit card debt or other loans, pay them off as fast as possible!

Not only will this give you massive freedom in the future, but every dollar of interest you don’t have to pay now can go straight to saving for another goal.

6. Kids College

College is expensive. Put money away now to be able to help them later. You can use a college cost calculator here to help get an idea of costs.

7. Health Expenses

Save up in your Health Savings Account so that when you have a medical emergency or even just a routine procedure, the money is waiting for you.

8. Weddings

If you plan to marry, you have kids, or you would love to help another family member, it’s smart to put money aside for a wedding early.

9. House Maintenance

Most people underestimate the cost of home ownership.

But if you save up in advance, these expenses won’t seem so extreme. Put money into a fund to pay for future painting, roof repairs, new windows, furnace replacement, getting carpets cleaned, etc.

10. House remodeling

After you take care of the maintenance, reserve money for voluntary upgrades you’d love in your home.

This could be as big as a swimming pool. Or as small as adding storage space to the attic.

Fun Short Term Things to Save Up For

And we’re on to the fun stuff! While it’s important to be responsible first, life is short. And there should be room for pleasure and adventure in your budget too.

11. Family Vacation

Save up for your family vacations ahead of time so that you know exactly how much to spend for your trips.

12. Couples Vacation

When was the last time you went on an adventure with your partner? Set aside money for that cross-country road trip you’ve always talked about. Or an all-inclusive resort for a special occasion.

13. fun things in your home

Pay cash for new furniture and that robot vacuum you’ve been eyeing.

14. New technology

Devices are expensive! Make sure you have cash in advance for a new phone, computer, iPad, or television. Remember that these are luxuries and shouldn’t come at the expense of your long-term goals.

15. hobby supplies

What do you love spending your time doing? Reserve money for a beautiful camera to take photographs, excellent art supplies, or even those mint-condition comic books you’ve dreamed about.

16. A Good Coffee Maker

For some of us, coffee is like breathing air. It’s essential.

If you feel this way, save up for a high-quality coffee maker. This will bring you joy, plus you may have more money later by making fewer Starbucks stops.

Coffee not your thing? Set aside money for tea supplies or cocktail equipment instead!

17. Girls/Guys Trip

As a mom, I believe that laying aside money for anything that supports your mental health is… mission-critical.

Going on a trip with your favorite people is part of this! So, save up to explore, relax, and adventure with your tribe.

18. Milestone Celebration or trip

Life milestones are worth celebrating! Plan in advance for a retirement party or trip, a babymoon, and anything else that marks a beautiful moment in your life.

Don’t let your life pass you by without savoring the good stuff.

19. fly first class: Cool things to Save up for

Save up for it at least once, and see what all the fuss is about.

20. Meet someone you admire

Meet your idol or mentor. See if you can buy them a meal and chat about life.

*Need help figuring out how to save more: Check out these ultra creative ways to save money*

Different Things To Save Up For

Now, these things to save up for are unique. But they get you thinking outside the box.

21. Cool Experiences

You’ll be happier if you focus on saving for experiences instead of things.

So, buy passes to the museum. Purchase that train ride ticket. Or enter a physical challenge.

22. A Vacation Home

Is there a vacation site that you visit often? Does it make you happy?

Save up for your dream cabin in the woods or that spectacular beach house.

23. Pay For Help

Think about saving up for things that support a lifestyle you’d like to have. If you hate cleaning and are sick of living in a mess, maybe it’s worth it to get help with your home.

24. Give A Big Donation

Leave a legacy to charity, or spend the money to build a bench in honor of someone. These things require money and a little foresight.

25. Start a scholarship fund

Save up to start a scholarship fund in someone’s name.

26. Taxes

While no one wants to think about this, setting aside money for your yearly taxes will eliminate TONS of pain later!

27. Home security system

If you’d benefit from the feeling of security, put aside money for a system that monitors your home.

28. A large adventure toy

Open a savings account for that camper or boat you want. Big things like these to save up for take time and patience. But your dreams are worth the wait.

29. A world series game

Experience that once-in-a-lifetime event you’ve always dreamed about. Tickets to the World Series, Olympics, and Super Bowl are great sports examples.

30. buy your dream house or car

If you have a specific home and car you dream of, set money aside consistently and buy it someday.

While these are big and take longer to save for, you’ll feel a sense of pride, accomplishment, and freedom when you meet your goal.

Related: Use these money saving games to help you!

Smart Expensive Things to Save Up For

These things can be cheap or pricey, but they’re often less expensive when you pay in full. And all of them are smart things to plan for.

31. Car Registration

Plan ahead to pay for this in full to save money.

32. amazon prime

Paying monthly will be pricier than saving up for a year’s worth of membership.

33. Real Estate Investments

Save up to buy investments through REITS or purchase properties to rent out. Both will give you passive income over time and build your net worth.

34. Appliances

We don’t always think about the dishwasher that needs to be replaced. Or the dryer that’s not working right. But saving for big appliances will eliminate a lot of headaches down the road.

35. Pay Car Insurance In Advance

Pay for your car insurance in a lump sum (just like Amazon Prime and car registration) to save money. And then see what else you can save money on by paying in larger amounts. Some subscription fees and life insurance will be cheaper if you pay in advance.

36. Start a Business

Starting a business requires both training and equipment. If you put aside money in advance, you’ll eliminate the pressure of having to make money quickly with your new business.

37. Being Unemployed

In the course of your life, there will probably be a time that you’re unemployed. Save up for this specifically, or make sure you have a good emergency fund to fall back on.

38. Helping Elderly Parents

Know your parents’ financial situation. Will they need financial or physical help from you as they age? If it’s possible, reserve money so that it’s less stressful for everyone later.

39. Retire early: Cool things to Save up for

I recently met a young man who dreams of retiring by the age of 30. I was mesmerized by the fire in his eyes as he talked about saving up for this goal.

40. Buy Investments

Build wealth over time.

Investments come in all shapes and sizes. You can invest in start-up businesses, real estate, your own business and personal life, stocks, etc. There’s no shortage of ways to pour money into building a life you adore.

Related: How to Start Investing $500

Self investments To Plan for

Next, investing in YOURSELF improves every aspect of your life and helps you become an expert in your field. When thinking of “things to save up for” this is often overlooked. And yet it has the greatest returns.

41. Lasik Eye Procedure

Doing the “Smile” procedure was the best thing I’ve saved up to do for my quality of life.

Bye bye contacts and glasses.

Hello being able to see my kids at night.

42. Gym membership or personal trainer

Get into shape for more energy, joy, and focus in your everyday life. You’ll be calmer and better able to take on the challenges of the day too.

43. Home Gym Equipment

It’s ALWAYS worth setting aside money to take care of your health. Invest in a new bike. Or equipment you can use every day in your basement.

Think of it this way...you can save up and invest on your health now, or spend the second half of your life spending all your money on medical bills. (And be miserable)

44. Apps That Improve Your Life

I use the Peloton digital app and the Headspace App almost every day. And I’d put aside money to buy them again because of the astounding benefits to my mental health.

45. Mental Health Days: Important Things to save up for

Save up to take a day off of work when you feel fatigued or burnt out. Then, spend the day relaxing at home. Or put money away for a massage or meditation retreat.

46. Healthy Meal Services

If your health is a priority and you’re crazy busy, these can be worthwhile investments for the long term. Try a healthy meal delivery service or a planning service.

47. Cooking Classes

Next, take a class to improve your cooking skills. While many overlook this, if you gain knowledge in cooking you’ll learn how to make healthier food taste good. This improves your health and saves you loads of money on eating out.

48. High-Quality Clothing

Instead of buying tons of cheap clothing pieces (that get donated every few months), what if you saved up for high-quality pieces once or twice a year?

Not only will you spend less by staying out of the stores, but your clothing will last longer.

49. Learn a New Skill

Study a second language or learn a skill related to your job. You’ll feel the rush of growth and be able to add value to what you’re doing.

50. braces or Invisalign

If you feel self-conscious about your smile, save up to correct your teeth. A little self-confidence goes a long way in the game of life.

51. Work Supplies & Equipment

I recently saved up and spent money on a new workstation. It includes a sit-stand desk that I’m in love with. It was well worth the money to work in an environment that supports my health.

52. Work Software

Software programs like Quickbooks can make your work life less stressful.

53. Workout Supplies

Invest in a great pair of running shoes. Or anything else that supports a healthy lifestyle. The extra energy and mood-boosting will transfer into all aspects of your life.

55. A Good Mattress

According to research, not getting enough sleep may cause problems with learning, reacting, and focusing, making it difficult to make decisions, control your emotions, solve problems, or cope with change.

So, be proactive by making sure you have a good quality mattress that makes falling asleep easy.

54. Other Things That Support Sleep

Then, save up for high-quality sheets and even a great pillow. Plus, research anything else that can help you fall asleep and stay asleep (like making your room cool at night).

56. Books: Good Things to save up for

*BEST VALUE

Save to buy books! It’s one of the best investments in your future. And books are ridiculously cheap when you consider what you get out of them.

Fiction books open your mind to creativity and imagination. Nonfiction can help you navigate everything from healthy eating to finances. And both leave you open to new ideas.

57. Courses & Conferences

Take courses and listen to podcasts. In ALL OF LIFE, the more you learn, the better off you’ll be.

58. Laser Hair Removal

If you’re sick of shaving, take back your time by saving up to do a hair removal treatment.

59. Anniversary

Experiences that build relationships are well worth saving up for. So, when your Anniversary rolls around, make sure you’ve set money aside for a dinner or trip.

60. Going Back to College

Perhaps it’s time for a career change, and you need to go back to school. Save in advance so that you don’t have to deal with hefty loans later.

Related:

- Great examples of sinking funds you can create to help you save

- Free Printable Sinking Fund Tracker

things To Save Up For with kids List

When you have children, you have a host of new things to save up for. Here are ways to get ahead financially.

61. Having a Baby

Doctor appointments are one thing. But sometimes you need to save for fertility treatments or adoption expenses. If you’re older or have a medical or family history, this is important. These treatments are expensive, so plan ahead.

62. Hospital Expenses

A study by the Kaiser Family Foundation found that the total costs associated with being pregnant, experiencing childbirth, and postpartum care averaged $18,865. (Kaiser Family Foundation)

Hopefully, your insurance takes care of a good portion of this. But either way, know that there will be bills!

63. Kids Activities & Sports

I had NO idea how expensive sports activities were before I had kids. And it’s difficult to avoid as they get older.

Not only can these come with hefty fees, but you’ll also need equipment like cleats and balls. And if you choose to be competitive, you’ll battle extra traveling and eating out expenses as well.

64. Kids Stuff

There’s no doubt about it. Kids come with lots. of. stuff.

It’s strollers, formula, and diapers galore. And when they get bigger, you’ll be paying for high-tech games, cars, and phones. This is all fine if you’ve saved up.

65. Kids Clothes

Kids grow quickly, so clothes can also be a costly expense. It helps to find clothes cheap and reuse what older kids wear. However, if you know this will be a big expense for you, save up for it.

66. Big Equipment for kids

You’ll want to plan ahead for things like swing set equipment and large furniture items (like bunk beds).

67. Kids Health expenses

Next, kids come with their own set of health expenses. MANY American kids have braces, glasses, and/or contacts by the time they graduate high school.

68. Daycare

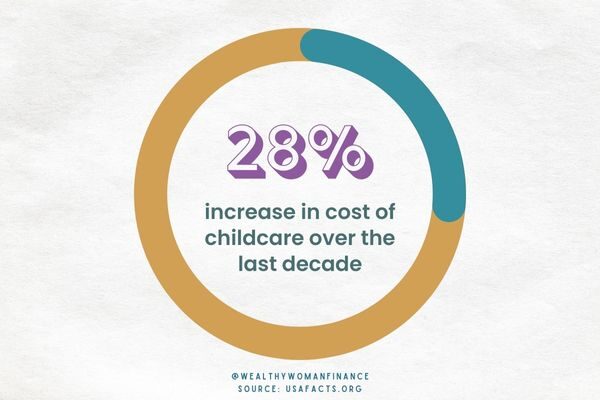

Research shows that childcare costs have risen substantially (source). If you know this is coming in your future, why not create a little nest egg to fall back on for it?

69. Cutting your income

Being able to stay home when your kids are young is a gift. But it’s helpful to plan ahead for this event and set aside money so that it’s not a stressful, tight-budget situation.

70. Lunch Money

Kids eat. A lot. (At least mine do anyways!)

And I’ve been shocked by how much we could spend on lunch money alone for them. To ease the burden, have them take lunches, save ahead, or even have them put money aside for extra lunches.

71. Allowance

It’s crucial to teach kids money management skills.

This education begins through allowance. The amount can be as low or high as you want to give, but it’s good to plan ahead for what you want to use towards this.

72. Summer camps

Last summer, I spent $1,000 on summer camps for two kids. This included 2 basketball camps, 1 nature camp, 1 day-long gymnastics camp, 1 church camp, and 1 soccer camp.

I wanted them to be busy, but I didn’t realize how much this would add up. So, next year we’ll be saving up for them and cutting the list down to only those things my kids love.

73. A Car

You might not consider this when you first have kids, but you’ll need a bigger car at some point. Most families settle on an SUV or minivan. And don’t forget that larger vehicles also cost more in gas, registration, and insurance.

74. Babysitters

Daycare covers your time at work, but what about date nights and mental health time? This is desperately needed for parents. So, save up for occasional or regular babysitters that can help relieve your responsibilities at home.

75. Pets

My kids are clamoring for a pet. Because of that, I know we’ll eventually crack.

And since I can see it in their future, I know that we can save together for the supplies and vet bills.

76. birthdays & Other kids birthdays

Kids come with birthdays of all kinds. Not only do you want to make your kids’ birthdays special, but you’ll be invited to countless birthday parties of other kids. And you’ll be buying a lot of gifts.

77. Christmas

A recent study reported that American parents spend an average of $276 on their children (under 18) and $251 on themselves at Christmas (source). This may be just the start of what you plan to spend, so set aside money for these purchases first.

Related:

78. Back-to-school shopping

Getting the kids ready for school is no joke!

And these days, it’s costly. Sure, you’re picking up the essentials. But kids also need clothes and shoes for heading back. Save up for this annual expense and you’ll relieve any major spending headaches that come with it.

79. Various school expenses

Put money aside (or budget) for beginning of the year fees, yearbooks, PTO parties, musical instruments, and all the extras your kids need through school.

If you choose a private school for the kids, save up and budget out carefully so that the school expenses don't take over your life.

80. Life Insurance

Adults with kids often need more life insurance. You want to ensure that your kids are protected if something happens to you. Also, make a will so that they are taken care of no matter what.

*Now that you have an idea of what to save up for, use these smart financial goals examples to turn your dream into an actionable goal.

Things to Save Up For As a kid

Kids everywhere wonder about good things to save up for. So, these ideas are a mix of helping them find future success, but having a little fun too.

*Also, look for good ways for kids to make money when they are ready to get started.

81. Investing

Remember that compound interest chart from #4? If you set aside money now, that number will grow so that you have MUCH less work to do later.

82. Games & Gaming Stuff

Save up for that new gaming system you’ve been eyeing.

83. A Car

At some point, you’ll need a car. So save up now to buy a decent quality car that will get you places without breaking down.

84. car expenses

Cars come with expenses of all kinds. You’ll need money for car insurance, gas, and car repairs.

85. Clothes, Footwear, accessories (handbags)

Set aside money for your own name brand clothes and shoes.

86. School/Friend Trips

Trips you take with others cost money. And your parents may not pay for it all. If this is the case, make sure you’re saving up so that you can participate when the time comes.

87. New Tech

Stereo systems, Ipads, and all the latest high-tech things that kids love.

88. Deposit for an apartment

Apartments will most likely ask for a deposit. And utilities may require one as well.

89. gifts

Save up for gifts you want to give to friends and family. If you know the money’s there, you’ll be less stressed when the occasion rolls around.

90. fun experiences

As you grow older, you’ll remember the fun experiences you had versus the stuff you bought. So, don’t forget to save for prom night expenses and anything else that adds to your life in a meaningful way.

91. Extra Hobby Stuff

Do you love painting? Or building computers?

Always be curious and try new things. And when you find a passion that suits you, set aside money to indulge in your creativity.

92. College application fees

The average application fee costs $50 (source). Plan ahead for these fees if you know you’ll be applying to multiple colleges.

93. Higher Education Costs

And of course, college is expensive. It’s smart to save anything you can ahead of time when it comes to college, classes, or any kind of training. And you’ll need money for textbooks too.

94. Beauty Products

Teens spend good money on beauty products. If that’s you, make sure you have the cash for these purchases.

95. Food

Outings with friends add up! So, have enough money in the bank to indulge in a coffee or breakfast sandwich occasionally.

96. Furniture For A Dorm Room

Moving away will require everything from furniture to utensils. You can often find great deals on these things, but you’ll still need money reserved.

97. Phone expenses

Will you need a new phone? Or a data plan?

Put aside money to cover these expenses when you’ll need it.

98. Streaming services

If you have a subscription or streaming service that you’d love, save up and buy it. Just make sure you have the cash for at least 6-12 months’ worth. These subscriptions are tricky because they lock you into long-term spending.

99. Summer camps

Camps that run through the summer are expensive for teens. If you’re eyeing one of these for the future, start saving now.

100. Graduation memorabilia

You may purchase a class ring, yearbook, or other memorabilia. Have money ready if you know these might add up.

Tips For How to Save Up

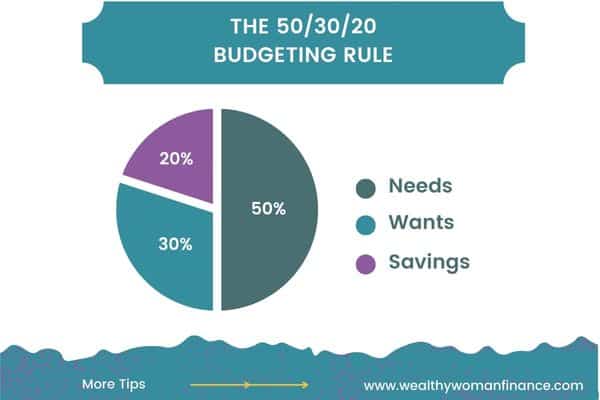

To save up for these things, you can add more income or live more frugally (or both). The image above shows a great rule of savings to use in your budget. Once you have your overall percentage set, decide how much to allot for each savings goal.

Here are a few recent posts that will help you too!

To Consider With Good Things to Save For

If you could be, do, or have anything, what would it be?

Answer the question and you’ll be well on your way to prioritizing what to save for in the coming months and years.

Best of luck friend! What are you saving for right now? Leave a comment and let me know!

Wouldn’t video game systems and gaming PCs be considered fun things and new technology as well as hobby supplies?

Of course Taylor!