50+ Fun Financial Literacy Month Ideas, Challenges, & Games

April is financial literacy month! Teaching through ideas, challenges, and games can be a lot of fun. And it’s one of the most important things to learn.

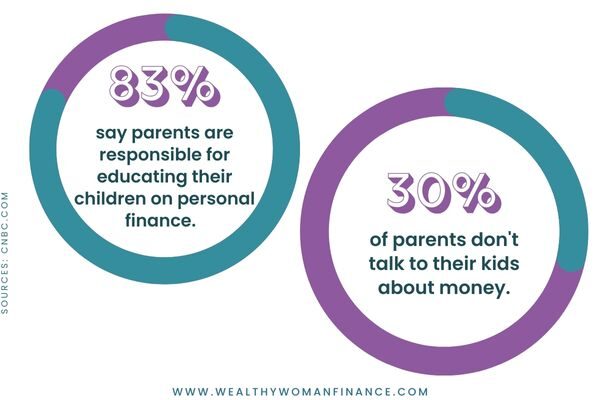

- According to the Milken Institute, only 57% of adults in the US are financially literate.

- Women are 40% more likely to have low levels of financial literacy (source).

- And while most people know they should talk to their kids about money, only 30% do it.

Studies show that financial education MATTERS. Those with financial knowledge have better savings, lower debt, and greater wealth.

On the other hand, lack of financial literacy costs many Americans thousands yearly. Almost 60% of Americans can’t even cover a $1000 emergency.

All in all, education helps you make better decisions with your hard-earned money. And it’s why we need more financial education in our country, pronto.

“Do the best you can until you know better. Then when you know better, do better.”

― Maya Angelou

Let’s start here! Use the fun financial literacy activities to learn and teach the biggest financial lessons – giving everyone you know a leg up on building wealth.

Financial Literacy Ideas For Young Kids

- Play store using play money and have kids buy and sell goods.

- Start an allowance or chores for money chart

- Teach kids budgeting using a three-part system (Spend, Save, Give)

- Read a money book for kids

- Buy a stock with your kids. Explain to them that you can buy more than their products. You can own a small piece of the company.

- Brainstorm together ways your kids can earn extra money

- Start a savings jar where your family saves spare change for something fun.

- Take kids to the store for something they want to buy and have them do the transaction.

- Open a bank account with your kids.

Financial Literacy Month For Teens & Adults

- Play a game: This or That Money Questions

- Build a financial vision board – then discuss ways to get there.

- Discuss the different types of income.

- Read a money mindset book

- Answer this question in a money journal: What’s one thing you can do today to improve your financial situation?

- Evaluate your budget or create a new 70 20 10 budget.

- Overturn one toxic belief about money.

- Check your credit score

- Audit expenses – get rid of the low-hanging fruit like subscriptions you know longer use.

- Calculate compound interest together.

- Role play talking to your partner about money if you’re nervous. If you’re not, go on a money date to map out your beautiful future.

- Brainstorm ways to make an extra $500 a month. Too much? Come up with a list for making $300 a month instead. Circle your top 3.

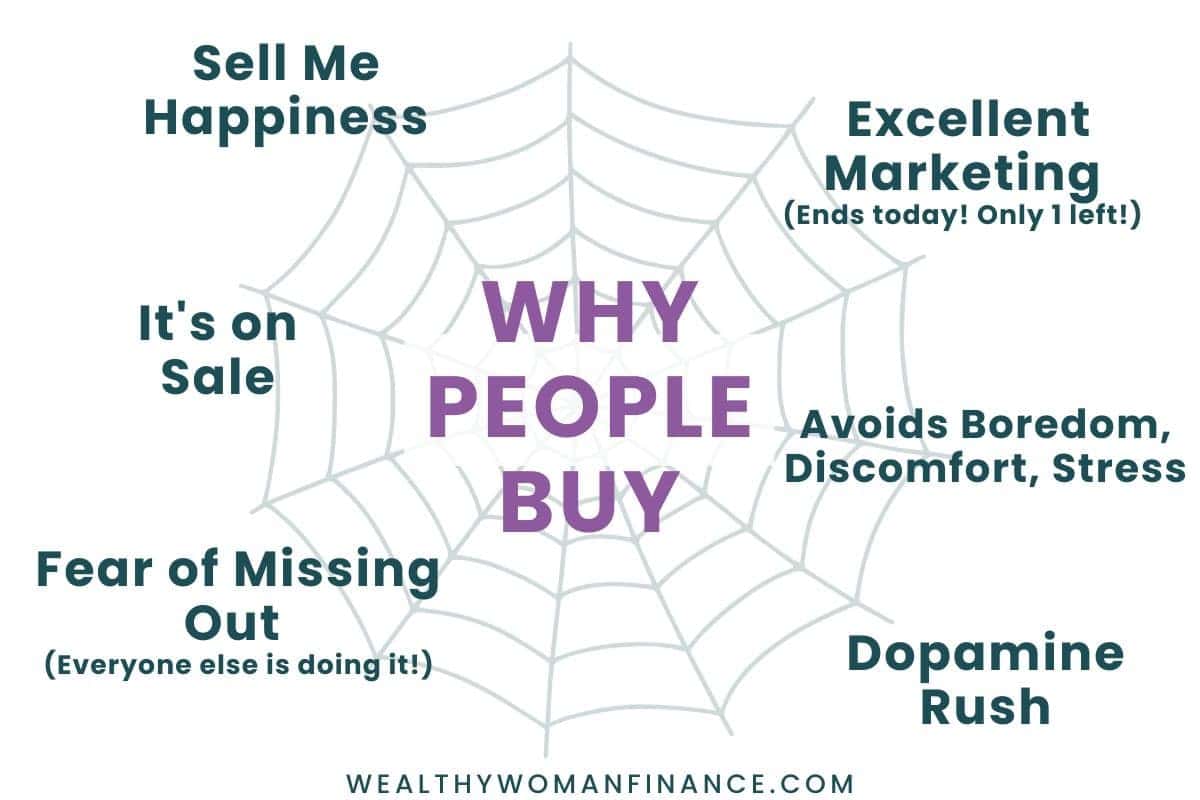

- Talk about the role of marketing so that you can be aware when a company is selling you something.

- Make a list of fun things to do that don’t cost money.

- Clean out your house and host a garage sale. Or sell things online.

- Instead of a regular potluck, challenge your friends to create a dish based only on their home ingredients. Vote on the winning dish!

- Plan out a side hustle idea. Or make a business vision board.

- Make at least one increase to your debt payments or savings.

- Practice at least one money mindset exercise – like gratitude, affirmations, or visualization.

- Invest in one asset using a simple investing checklist.

- Think about one spending habit that’s holding you back. Make a list of ways you can make this spending harder to do. (I.e. take a different route to work, leave cash at home, etc.)

- Start a morning routine that serves your financial wellness.

- Make a meal plan for the month. Decide you aren’t going to eat out.

- Invest in yourself in at least one way.

- Define your money and life values.

- Make a bucket list for retirement, this year, or this season to give you motivation.

- Spend 5 minutes reading up on key financial literacy terms. The next time someone talks about it, you’ll know!

Financial Literacy Month Games

- Play Money Trivia. Test your knowledge!

- Do Money Bingo (enter your email below and I’ll send it straight to you)

- Do a Financial Learning Scavenger Hunt

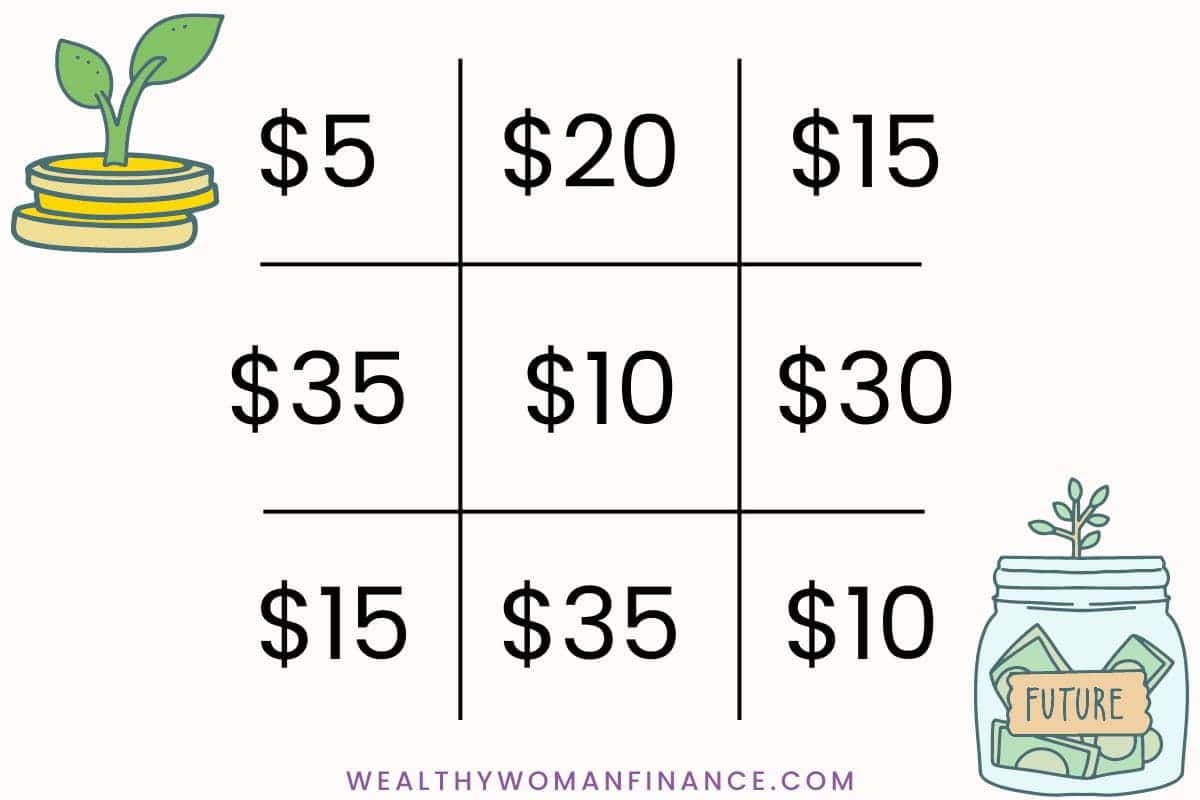

- Play Tic Tac Save

Financial Literacy Month Challenges

Try a Short Term Challenge:

- No Spend Challenge Printables (Decide you will collect moments and not things for a set period)

- 100 Envelope Challenge Printable

- Save for 30 Days Challenge

- Declutter Your Life for 30 Days

Try a 6 month Challenge:

Try a Longer Challenge:

- 52 Week Savings Plan

- 200 Envelope Challenge Plan

- Penny a Day Challenge

- Nickel a Day Savings Challenge

Save for Something Specific:

Other Ways to Motivate Financial Success

- Give your bank accounts motivational names

- Try a commitment card for accountability

- Make your progress visual by putting marbles in a jar for each step forward you make.

- Try the free money motivation checklist

What’s Next?

Don’t stop at April! Improve your financial literacy all year long with the wealthy woman newsletter. Join us now!