Life-changing Low Buy Challenge: Rules & How To Succeed in 2024

Are you tired of junk littering the floor? Or ready to supercharge saving for a goal? A low buy year challenge will help with both!

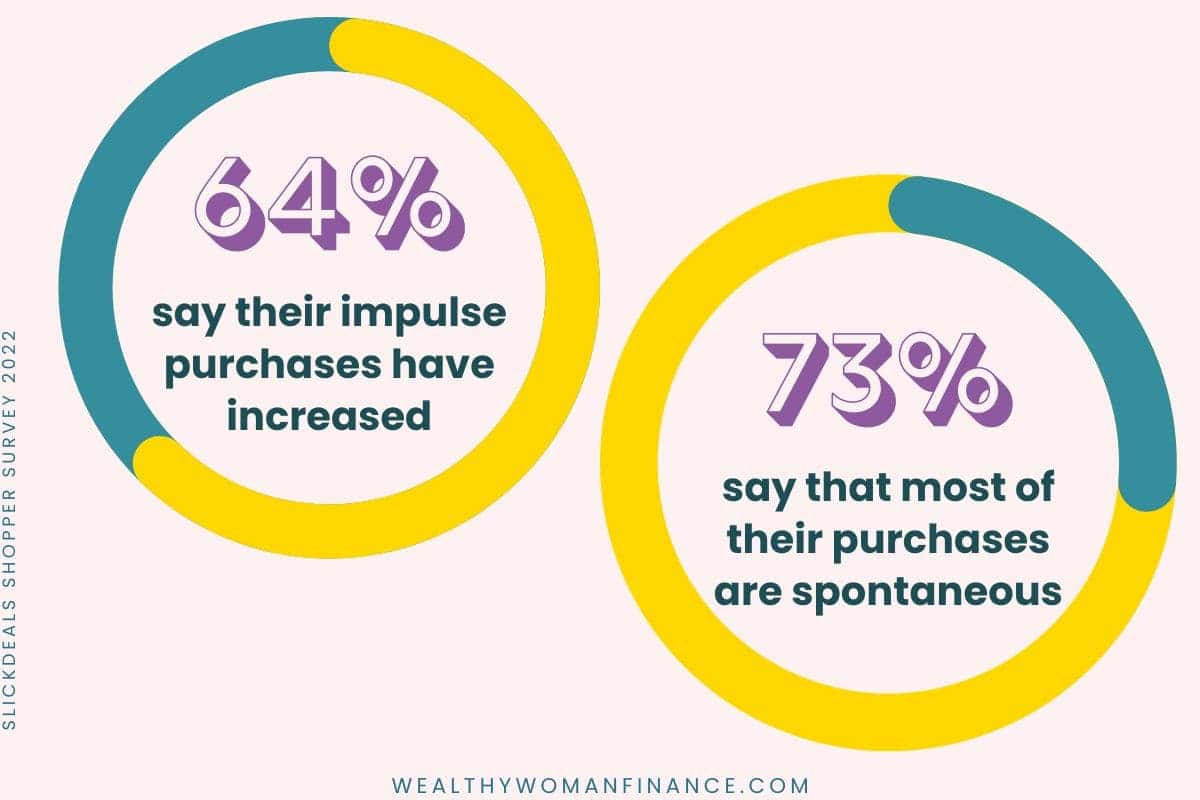

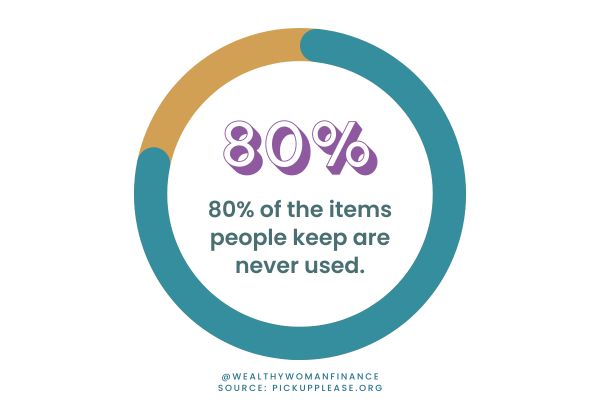

As Americans, we’re drowning in stuff and debt more than ever before. Plus, according to an annual survey, in 2021 impulse spending rose 16%. And another 14% in 2022.

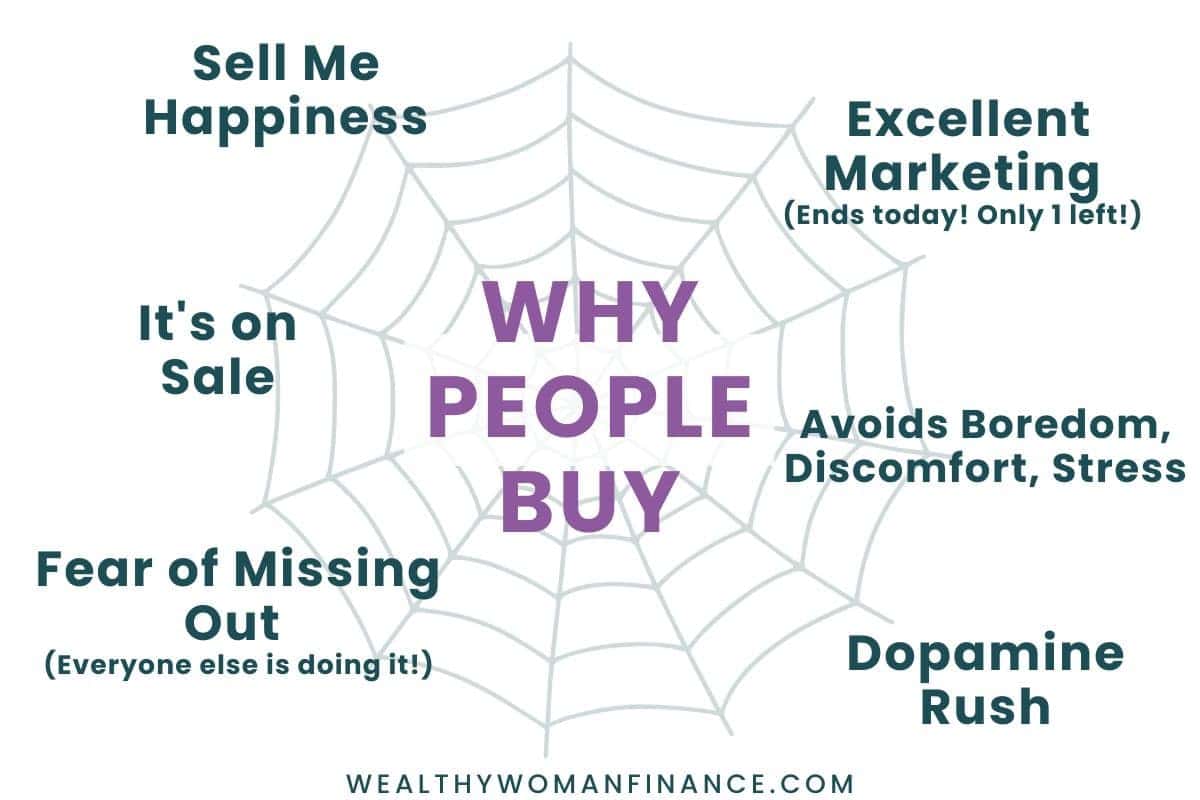

What causes impulse buying? Companies have become experts at getting us to click and swipe. The image below shows just some of the ways we get caught in their web.

But buying too much leads to debt, stress, and mental fatigue. You’re now just drowning in stuff instead of feeling happier.

Want to save this challenge? Enter your email below and I’ll send the link straight to you.

What Does a “Low Buy Year” mean?

A low buy challenge is designed to cut your excess spending for a year. However, it’s not about sacrificing! Instead, you are making fewer impulse buys and investing in things that bring you long-term value and joy.

It’s about living a simpler, more intentional lifestyle.

Low Buy Challenge Benefits

A low spend week, month, or year has many benefits in today’s frantic 24/7 lifestyle.

- It frees up time and energy for things that matter. In turn, you’ll gain a deeper understanding of your priorities. And be more fulfilled.

- You 10x your savings toward financial goals. You’re able to invest in future wealth (and even big future purchases that matter to you).

- You re-set your spending habits long-term.

- You reassess your needs and wants, discovering what’s important to your happiness.

- Your more minimalistic lifestyle means you’ll be doing less housework. (40% less!)

- You’ll feel more focused and less stressed because clutter isn’t pulling on your mind.

- You tread more lightly on the earth. You’re no longer destroying precious resources to prevent boredom.

- You model excellent habits for your kids. You guide them to make smart decisions through your actions.

- You grow. A low spend challenge requires self-discipline, persistence, creativity, and reflection. These qualities make you wiser and more resilient.

These benefits will also last far beyond the time that you do the low spend challenge!

Low Buy Rules: How To Do the Challenge

Next, here’s exactly how to get started with a low spend year, month, or week.

1. Find Where You Are

First, look at your spending over the last month and determine the areas you spend excessively or impulsively. Make notes of these.

Now, on a blank piece of paper or our needs vs wants worksheet, determine your non-negotiable and “I can live without this” expenses.

2. Set Clear Goals

Next, write out at least one goal for doing the low-buy challenge and put it on your fridge. Will you pay off student loan debt? Buy a car?

When motivation is low, knowing why this is important will help get you through.

3. Set Clear Low Buy Rules For Yourself

Use your notes from step #1 to guide your low buy rules.

For example, if you notice you are eating out a lot, establish a rule. Perhaps instead of 5 times a week, you commit to 2.

4. Create a Budget & Track Expenses

Understand how much you want to spend in total and where you want it to go.

Check out our popular 50 30 20 budgeting method or try the zero based budget template. Whatever you choose, use the rules you created above to guide you.

Next, track your expenses diligently. Keep a record of all your purchases and make it a habit to review them daily, weekly, or biweekly. This will keep you accountable and identify any areas you might be slipping up.

5. Celebrate Low Spend Progress

Tell friends and family. You will inspire others. And keep track of your weekly or monthly progress by your bank account number, an X on the calendar, or another method.

Then celebrate the small milestones along the way. Acknowledge your progress instead of only focusing on how much left you have to go. You’ll motivate yourself to continue.

Low Buy Challenge Ideas

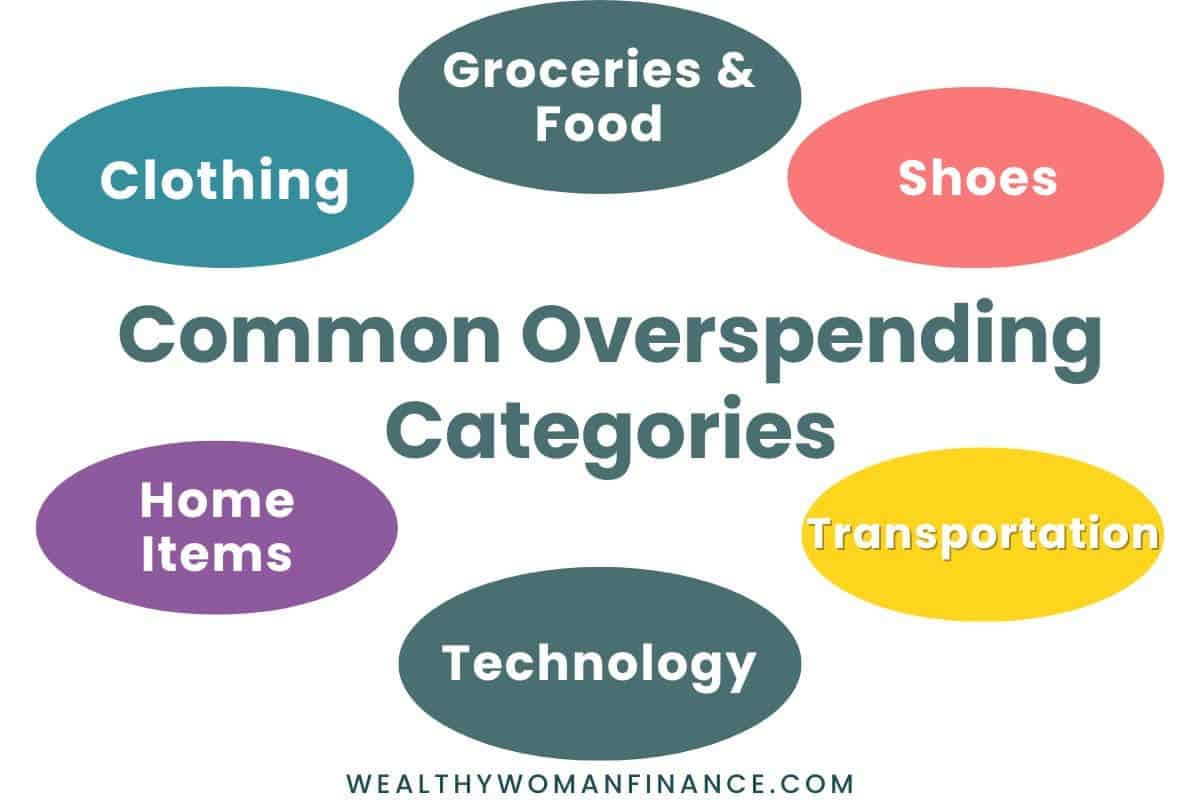

Below are the types of items people overspend or buy impulsively most often.

Clothing

A few years ago, a survey by ClosetMaid found that the average American woman owned about 103 pieces of clothing. And only liked 10% of it.

Are you wearing all of your clothes?

Food & Groceries

Grocery store impulse buys have grown steadily. So have eating out and paying for conveniences like Grubhub and grocery delivery.

Cooking meals at home is not only cheaper, it’s way healthier too. But it’s even better if you stick to your grocery list and pick it up yourself.

Transportation

With the rise of Uber, it’s easier than ever to get around. But gas prices, drivers, and insurance costs don’t always make it cheap.

Explore alternatives like biking, carpooling, or public transit to save on fuel and maintenance. Or block your errands together.

Shoes

I wear the same 3 pairs of shoes even though 10 more sit in my closet. I doubt I’m alone in this.

Home Decor & Items

Keeping up with the Joneses has a lot higher standard than it used to thanks to Pinterest and social media.

But a well-maintained minimalist space is more peaceful, and also beautiful.

Technology Services

Technology services are often small and insidious. And they add up to significant money in the span of a year. Almost everyone has one or two of these that they don’t actively use. Here are a few examples:

- Tv streaming services (do you need 5?)

- Audible subscriptions

- App memberships

- Apple costs for movies, etc.

Related: Best Times to Buy Each Month

Top Tips For Success In A Low Buy Challenge

Next, you want this low buy challenge to be a massive success. These will make it happen!

plan for each Low Spend rule

Saying that you will dine out less and having a plan for it are two different things. In order to follow through on your rules, write down a few changes that need to be made.

For dining out less, you could:

- Start a rotating weekly or monthly meal plan

- Make freezer meals ahead (or double cheap family dinners)

- Create a “leftover” or “snack” night at your house.

- Brownbag your lunch the night before

- Split duties with family members

- Buy the ingredients to make your own Starbucks drink at home

This requires a bit of forward-thinking. But if you can plan ahead, you’ll be much less tempted!

Get Off Your Phone At Night

Shopping in bed was found to make up for 37% of overall impromptu shopping in 2022 (source).

By turning off your phone or putting it in airplane mode at 8 or 9 pm, you could save yourself thousands over the long term.

Find Cheaper Things To Do

Not sure what you’ll do? GET OUTSIDE. Into nature. You’ll be happier, healthier, and wealthier for it.

- Hike

- Bike

- Take walks with your family in your neighborhood

- Camp

- Visit parks and botanical gardens

- Take your vacations to the mountains, beach, or desert (many of the activities are cheap or free) My kids spend entire days building sandcastles!

Focus on natural beauty and you won’t miss the artificial amusements.

Use this list of cheap ideas to do for more ideas.

Prioritize Quality Of Life

A low spend challenge is NOT advocating giving up the things that make your life better. On the contrary! It’s about stepping into what lights you up. And releasing the excess weight that pushes you down.

If your gym membership is a vital piece to your physical and mental health, you keep it. The same might go for a meditation app that you use regularly. Or a regular coffee date with your mom.

When evaluating your spending, always prioritize your health, happiness, and growth.

Related: How to Choose Quality Over Quantity

Develop a process before you buy

Your process could look something like this…

Make a Solid Commitment

Our commitment card is free and adds all of the elements to follow through on amazing new habits. Best of all, your goals and accountability will be clear.

Embrace Minimalism

A low spend challenge pairs exceptionally well with a new minimalist lifestyle.

“Imagine yourself living in a space that only contains things that spark joy.”

–Marie Kondo (Decluttering quotes)

To clean out as well, check out our:

- 30 Day Minimalism Challenge Pdf

- Great Motivation To Declutter

- How to Declutter Fast

- Decluttering Books You’ll Love

Become Resourceful

Make things yourself or repurpose items instead of buying new ones.

And when that isn’t an option, comparison shop, use coupons, and save in other ways. Think outside the box for your low spend challenge.

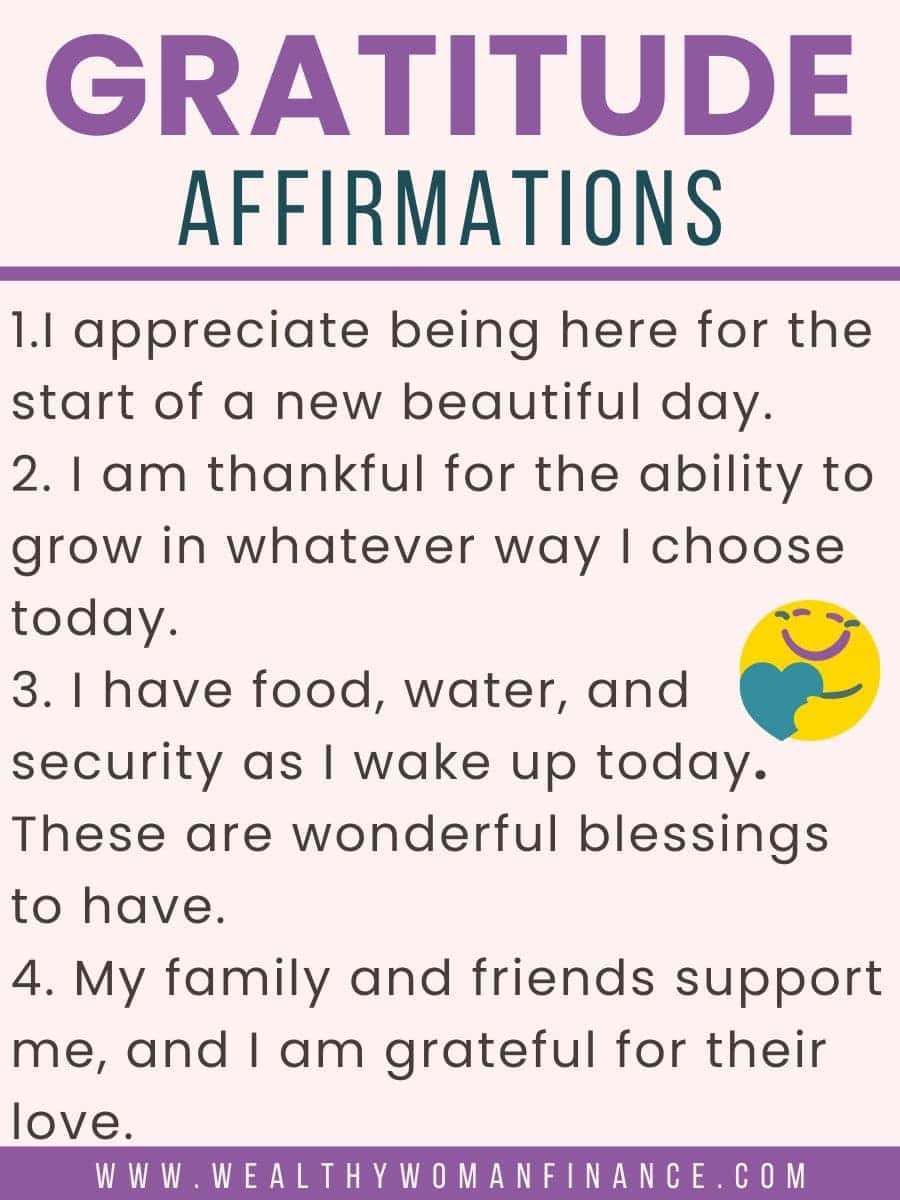

Practice Daily Gratitude

To thrive in a low buy environment you need to feel content for the things you already have. Even if you are working at making something better, you and what you have can be enough now.

When you wake up, write a gratitude affirmation or journal 3 things you are grateful for.

Give yourself grace

Finally, setbacks happen. They are a part of life. Instead of beating yourself up over them, choose to come back quickly. Over time, it’s the consistency that matters. Not the slip-ups.

But Does it have to be a year?

Heck no! You can do any time period that you want! Do a low buy:

- day or weekend

- week

- month

- quarter

- 1/2 year

- full year

All forward motion is progress!

No Buy Vs Low Buy Year

The no spend challenge is a variation of this and is also popular. But it can be difficult to do for long lengths of time (especially with a family). That’s where a low buy challenge is a better option.

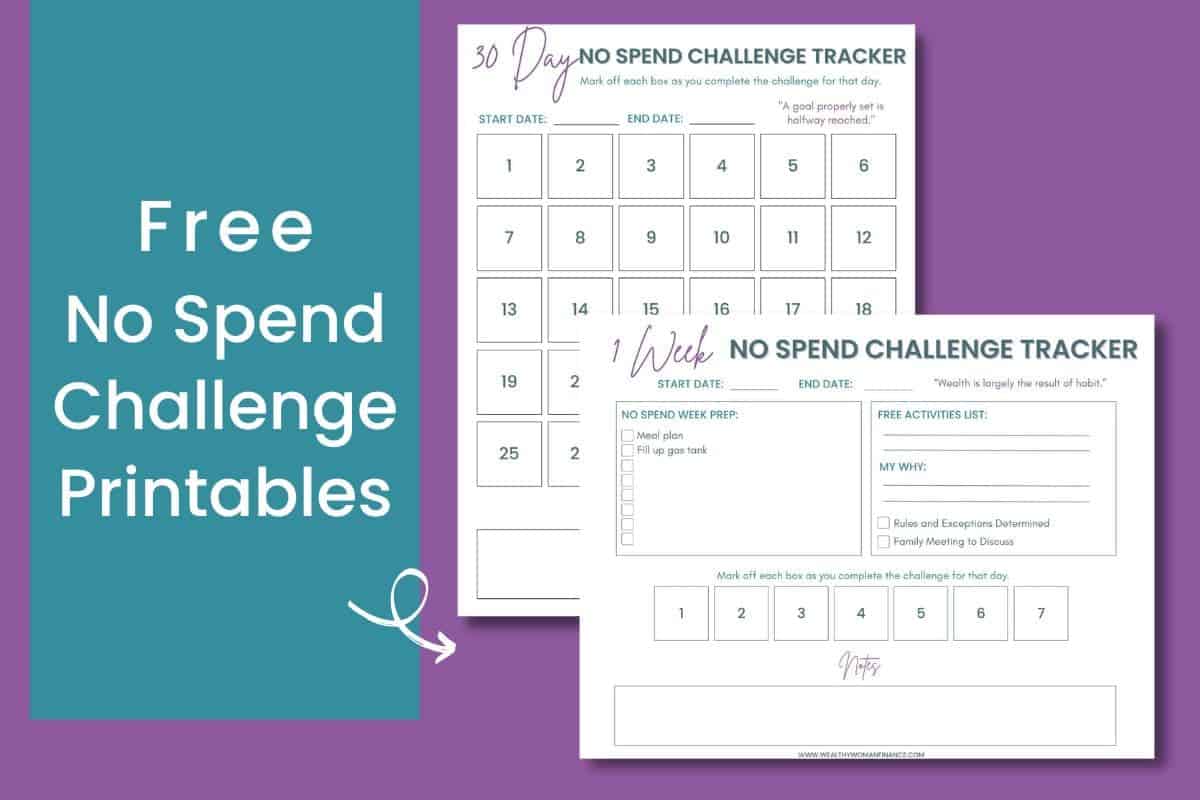

What’s Next? Grab the No Spend Pdf

We have an entire article on the no spend challenge, along with cool free printables. Combine a short no spend challenge with this longer low spend one. Or use the printables with either of them.

And if you love savings challenges, don’t miss these great ones: