Financial Freedom Vs Financial Independence: How to Achieve Both

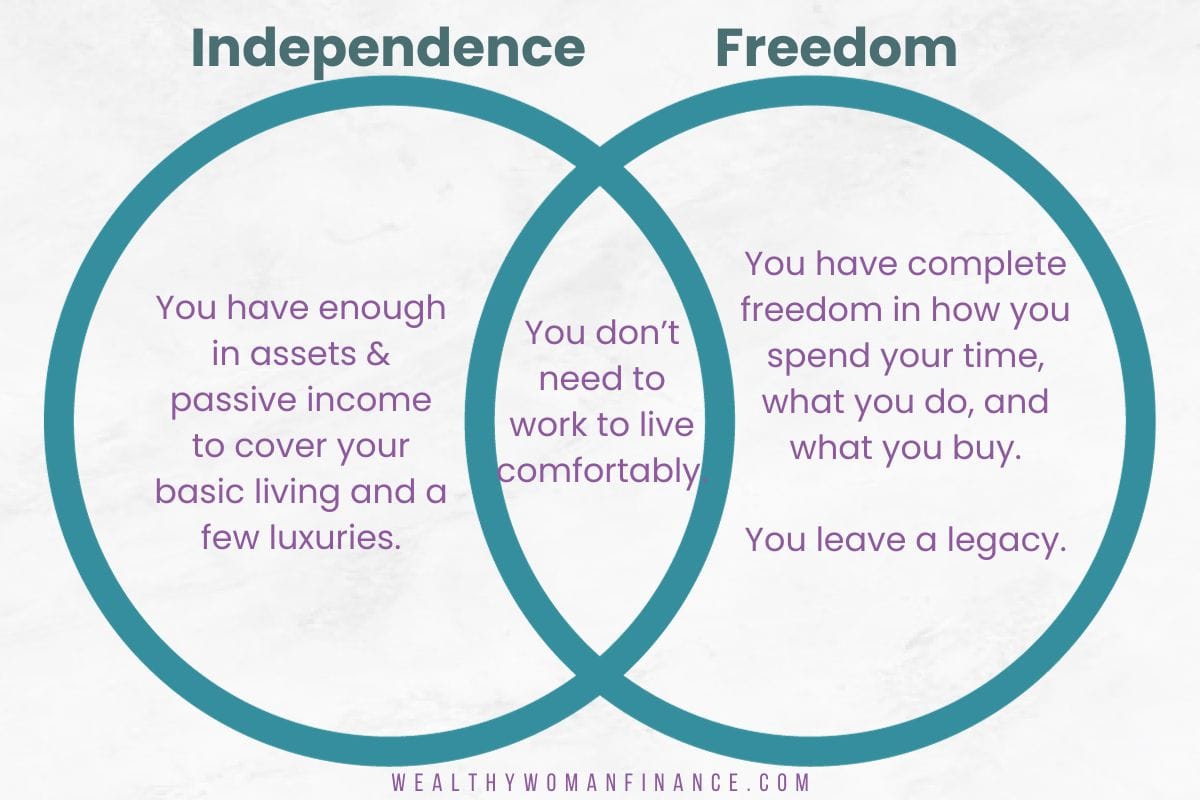

What does financial freedom mean? Is it the same as financial independence? We hear these terms often, but the way they are used can be confusing.

They are not the same!

Learn financial freedom vs financial independence. After, you’ll know how to reach both, starting now.

What is Financial Independence?

Financial Independence definition: Investments and savings cover your current lifestyle, including basic needs and wants.

You don’t question if you have enough money to take a reasonable family vacation or stop at Starbucks.

If you are financially independent, you can retire and live on your passive income. While this is a great place to be, it doesn’t offer complete freedom. Your expenses may rise, causing you to tighten your budget. And you might still choose to work a job for a side income.

But overall, you provide for yourself without active work.

What is Financial Freedom?

Financial freedom definition: Investments and savings allow you to live your desired lifestyle. This isn’t just getting by. It’s the ability to do anything you want, anytime you want, regardless of the cost. It’s freedom, baby!

First class flights? No problem. An ocean view suite? An easy decision. True financial freedom removes any financial burden from your view, allowing you to swipe your card without a care.

Note: Is financial freedom realistic or aspirational? It’s both! Why not dream big?!

Similarities: Financial Freedom Vs. Financial Independence

In both situations:

- you don’t need an active income (job). The primary source of income for individuals with financial freedom and financial independence is passive income.

- You live comfortably.

What are the Key Differences?

With financial independence, you are able to afford certain luxuries, like going out to dinner. But it does not give you the ability and funds to pursue whatever you like.

Because of this difference, you’ll need higher income and assets for a life of financial freedom.

Why is Financial Freedom Important?

Financial freedom is often the ultimate milestone. It allows for a life you live completely on your terms.

Cost is Not a Large Factor

How often do you go shopping and put something back because it’s too expensive? Wouldn’t it be nice to spend whatever you like whenever you like? This is the lifestyle that financial freedom can provide.

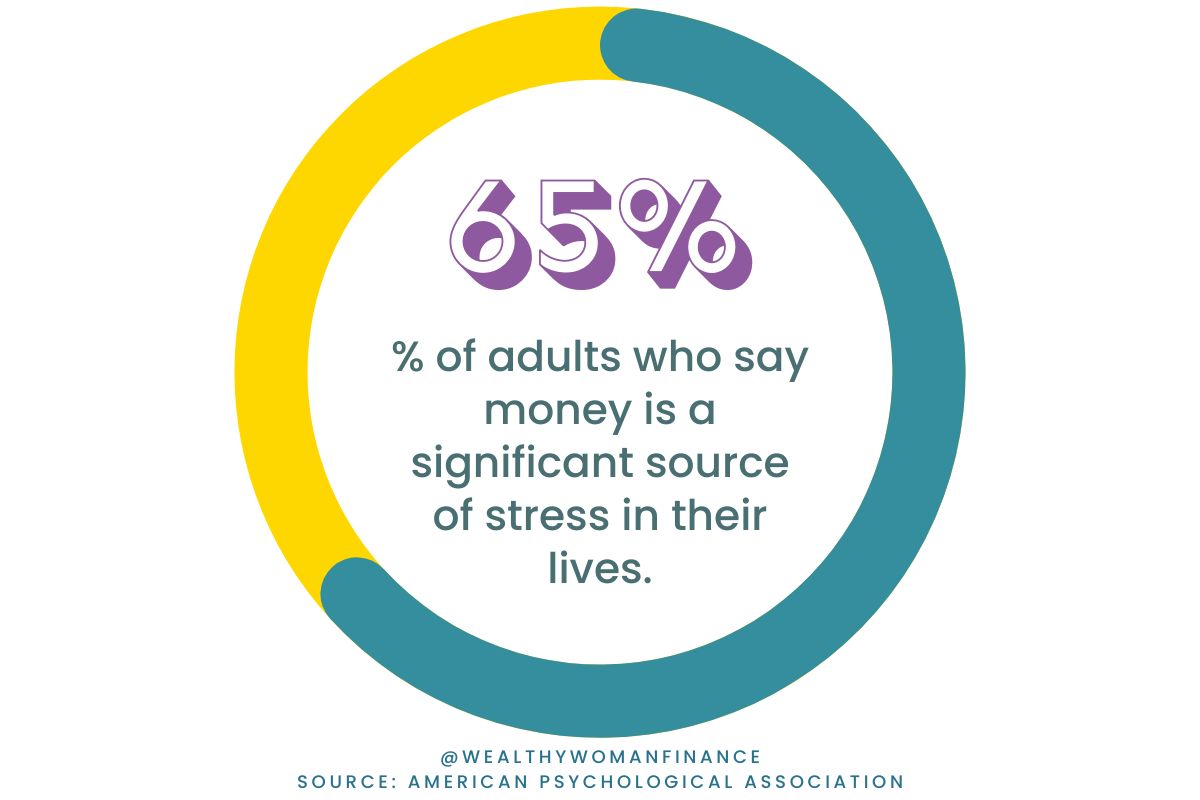

The Ultimate Sense of Security

Financial freedom provides an outstanding sense of comfort. You no longer need to worry about your air conditioner going out. Or how you will afford your children’s tuition. You have the means to be fully self-sufficient and live life to the fullest.

Money stress is a thing of the past.

“Financial freedom is freedom from fear.”

– Robert Kiyosaki

Leave a Legacy

Financial freedom gives you the option of leaving an inheritance for your children. Or to make a huge difference in the lives of others.

The first step to building generational wealth is through financial freedom. You don’t want to leave your loved ones with large debt payments. Working toward financial freedom ensures your bills are taken care of, with extra cash going where you want it.

So, What’s the First Step?

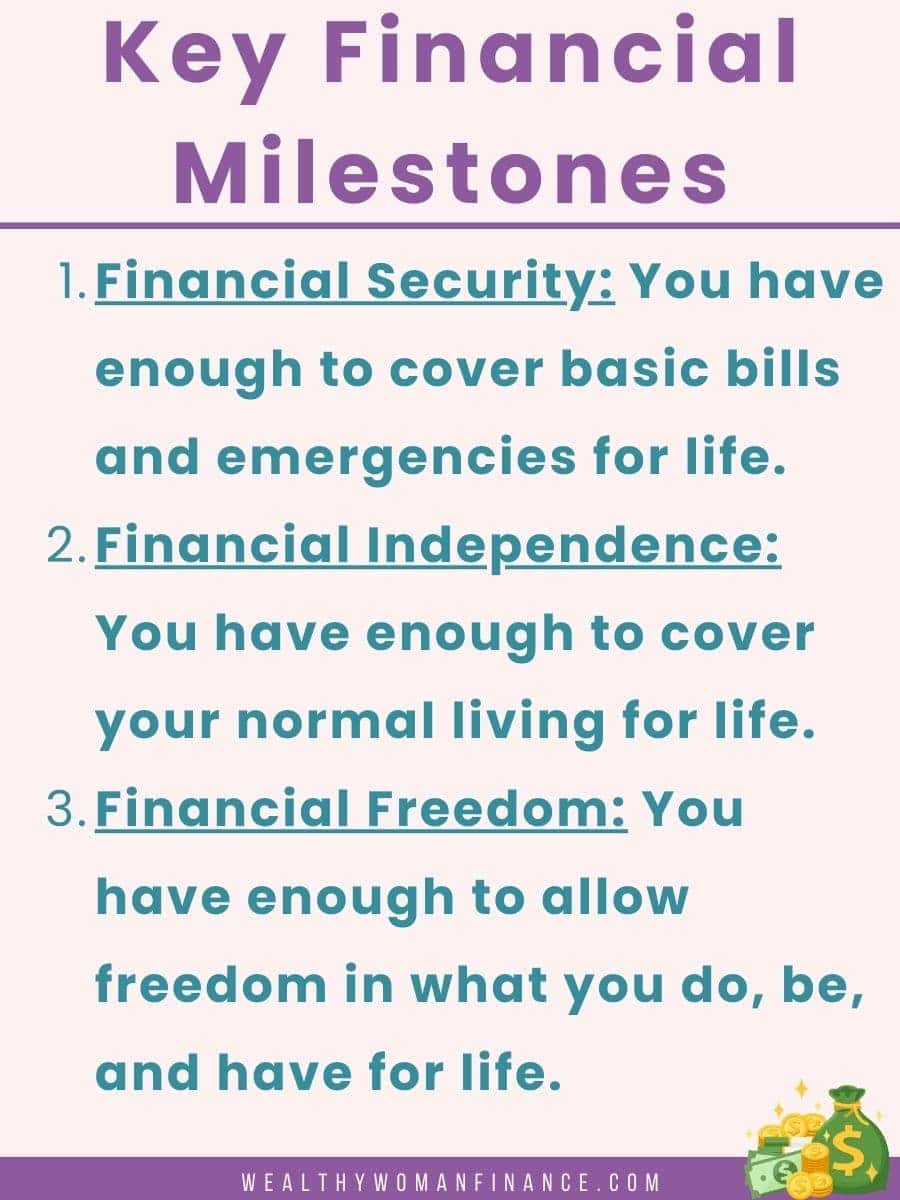

Actually, financial security is! Before you can reach financial freedom, or even financial independence, you need to have financial security.

Financial security is when you have enough in passive income and assets to cover your necessary expenses, like rent, mortgage payments, and car payments. Living in financial security means you might not have the funds to buy extras. But you won’t go into debt or worry about emergencies.

Here’s the order:

And How Do We Get to the Big Kahuna (Financial Freedom)?

Now, if you’ve read this article, you are already taking the initiative to better your financial situation. Use these steps to put yourself on the path to all three milestones.

#1 Milestone: Achieve Financial Security

Pay Off Debt

It’s very hard to hit any financial milestones when you’re paying someone else for things you bought a long time ago. Pay off high debts that are weighing you down. That money will be used for more passive income in the coming stages.

Grab free debt trackers to help!

Build an Emergency Fund

Next, cash emergencies are what often force people to take on debt. One of the biggest ways you can protect yourself from this is to stash 3-6 months of living expenses away.

Related: Emergency Fund Savings Challenge

Live Below Your Means

Invest in yourself and purchase quality when it aligns with your money values. But make sure that you are living well below your income level. This positive cash flow gap ensures that your nest egg grows even on your worst weeks.

If you don’t have a solid savings gap yet, set up a budget, jumpstart with a 26 week money challenge, and master paying yourself first.

“Earning a lot of money is not the key to prosperity. How you handle it is.”

– Dave Ramsey

Related: Follow the Dave Ramsey Steps

#2 Milestone: Achieve Financial Independence

Now that you’ve secured the foundation, it’s time to thrive! With both financial independence and financial freedom, you shift gears into planning, investing, and widening the cash flow gap.

Know Your Target Numbers

If you don’t know what you need, how can you get there?

First, you must understand:

- Where you are now

- How much you need for financial independence (basic living)

- How much you need for financial freedom (basic living + dreams)

- Whether you are on track, and how much you need to come up with

Calculate Your Financial Freedom Number

How will you know when you reach these milestones? That’s where the financial freedom formula comes in.

It’s also called the 4% rule. This rule states that you can cover your lifestyle when withdrawing 4% of your investments covers your annual expenses. There are two ways to find the number:

Annual expenditures x 25 = Amount You Need

Annual expenditures / .04 = Amount You Need

For example, let’s say that your annual cost of living is $50,000, including housing, transportation, groceries, and any other bill or expense. Dividing $50,000 by 4% results in a $1,250,000 investment balance to be financially independent.

Now, this isn’t to say that you should quit your job once you reach $1,250,000 in investments or savings. (Think of this number as more of a financial independence indicator.)

Pro Tip: Factor in health insurance and other expenses that would change if you quit your job.

For financial freedom, you need to consider your dream lifestyle. Will $50,000 each year be enough if you plan on traveling in retirement? How about if you want to retire in a state with higher-than-average living costs?

If you want to continue living comfortably and have no desire for a lavish lifestyle, your financial freedom and financial independence numbers might be very similar. But it’s important to consider your goals when evaluating your numbers.

Pro Tip: Another simple rule of thumb is to analyze your passive income. If you are still working, what is your annual salary? Do you make this amount of money from passive investments, like interest, dividends, and capital gains?

Make a Plan

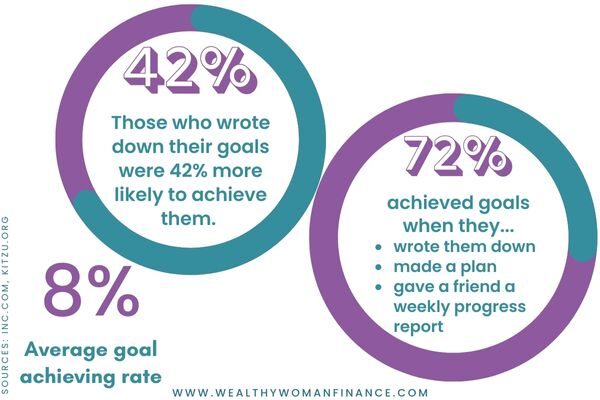

Now that you know your numbers, turn them into your specific, clear goals. Give yourself a deadline too. Then, write out your financial plan. Studies show that the simple act of writing goals and having a plan boosts your odds considerably!

If you are struggling with the “how,” don’t fret. Remember that there are many paths to financial freedom. You may just need to keep an open mind and get creative.

Related: Best Financial Goals Examples

Prop Tip: For Financial Independence, retirement vehicles will be your friend! Utilize 401k, IRA, and other retirement plans as early and as much as possible.

Build Your Passive Income

In order to reach the next milestone for your finances, you’ll need passive income to provide for you.

Passive income streams often require an initial setup, but then minimal time and effort after. This means you can earn money while traveling, sleeping, or spending time with family.

Passive income includes money from investments, rental income, stock dividends, residual business income, and more.

Diversify

Putting all of your eggs in one basket can kick you out of financial independence faster than you can say “a recession’s coming!” (Which people LOVE saying!)

Pay attention to your investments and try to have your money in different areas (stocks, bonds, real estate, direct business) and industries (tech, retail, etc.)

Related: Investment Checklist Pdf

Learn Like a Ninja

Learning is important at all stages of financial success, but it’s even more so on your way to financial independence and freedom.

At this stage, learning about investing, taxes, career advancement, and passive income leads to significant financial gains.

“Risk comes from not knowing what you’re doing.”

– Warren Buffet

#3 Milestone: Achieve Financial Freedom

Once you’re well on your way to financial independence, these steps help you make the jump to a life of financial freedom.

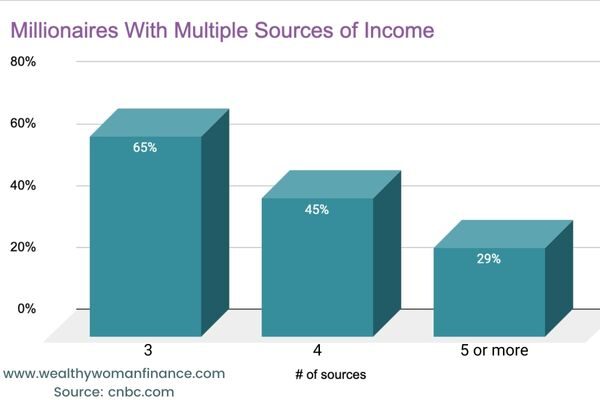

Build Multiple Sources of Revenue

In order to give yourself complete freedom, you need different sources of income. If any of them fail, you have others still working for you.

Invest For Financial Freedom

Here’s the truth: you won’t reach financial freedom by investing $5 a month.

Financial freedom requires you to become an active investor in the future.

- Invest in your retirement accounts and other tax advantage accounts

- Invest outside of your retirement accounts

- Invest in yourself (job skills, side businesses, etc.)

Watch And Build Your Net Worth

Finally, set check-in meetings to regularly track your net worth. Is it going up at the pace you need to achieve your goals?

If so, awesome! If not, it’s time to make a few tweaks.

Find out your liquid net worth number >>

Common Questions On the Path

How long does it take to Be financially independent or financially free?

The time it takes depends on many things. Here are the big ones:

- your income

- how well you live below your means

- how much you invest

- how risky those investments are

- and the amount of money you need or want to live

Luckily, many of these factors are under your control. Calculate your number to know for sure how long it will take for you.

What’s Next?

Trying to achieve these financial milestones should make you feel excited! Anyone can do it with enough determination and time. It’s up to you to make that change happen.

You can do it, friend!

Check out these other articles: