Free 200 Envelope Challenge: How to Save 10,000 in 6 months

What is the 200 Envelope Challenge?

The 200 envelope challenge is the long version of the popular 100 day envelope challenge. It’s great if you want to save double the amount or give yourself more time.

I mean, what would you do with an extra 10k? A lot of things right?!

Want to save this challenge? Enter your email below and I’ll send the link straight to you.

What You Will Need:

To begin the 200 envelope challenge, you will need:

- 100 or 200 Envelopes – make them colorful for fun! (You can always do 100 envelopes and re-use them)

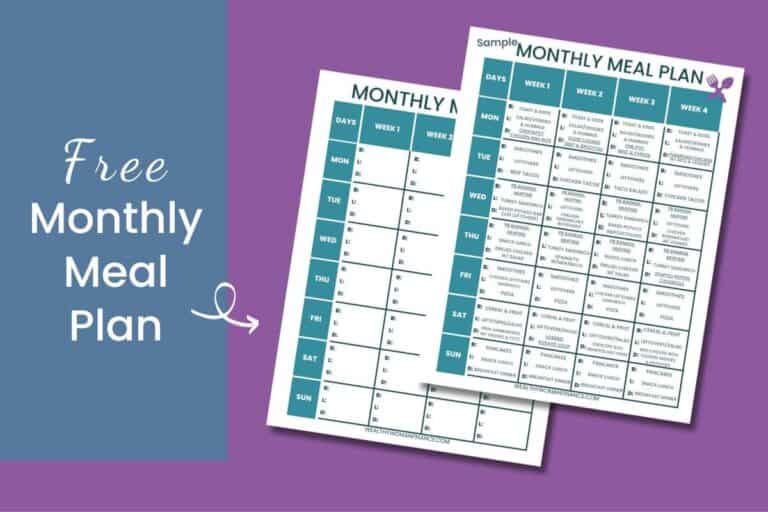

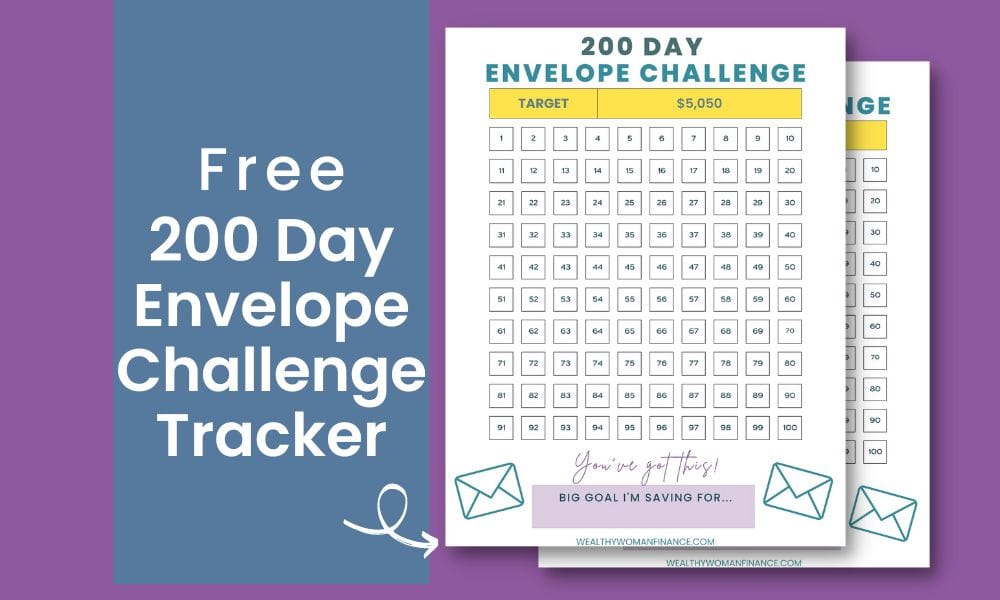

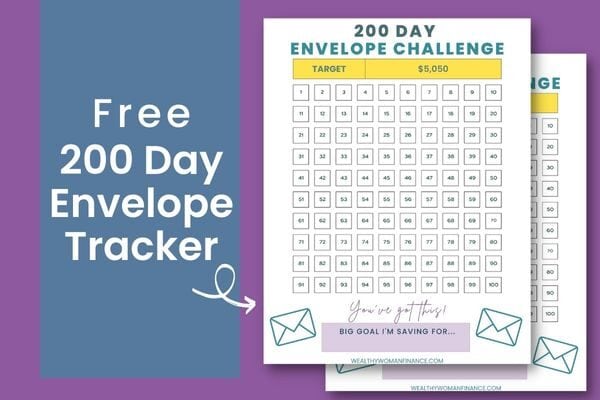

- Free printable 200 envelope challenge chart below. The printable makes a nice visual to mark your progress as you go. And if you don’t want to use all of the envelopes, you can still do the challenge with just the tracker!

- Black sharpie or pen

- Box or container

Rules For How To Do The 200 Envelope Challenge

This 10k money saving challenge is straightforward. Here’s how to start:

1. Take 100 envelopes and label them 1-100, just like with the 100 envelope challenge. These are the dollar amounts you will put into each envelope. (65 = $65) (The difference is that you will use each envelope 2x to make it to your 200 days)

2. Put your envelopes in a box or drawer.

3. Each day, pull out an envelope at random. That is the amount you need to save for that day. (If you draw a 39, put $39 in that envelope.)

4. After you put money in an envelope the first time, checkmark the envelope so that you know you’ve done it once. Then, put it back in the box. After you pull it out a second time, you will transfer the envelope from the group into a “completed” pile.

VARIATIONS: You could also do the envelopes in order or deliberately choose the envelope for each day. For example, if you negotiate down your insurance bill and save $53, you can find your envelope labeled “53” and use it (instead of picking at random).

How Can I Save $10,000 In 6 Months?

After the 200 days envelope challenge (about 6.6 months), you will have an extra $10,100 in your pocket. That is a lot of money!

With that you could…

- pay off a nagging car debt (use a free car debt tracker here)

- take your family on a nice beach vacation

- have a fully funded emergency fund

- Use it to invest and build a beautiful, bright future

There are lots of options!

What Are The Benefits Of The Challenge & Chart?

The obvious benefit is the extra money in your pocket. But there are other hidden advantages too!

It Makes Saving Fun

Saving money isn’t as exciting as spending it. It’s true.

But a challenge can quickstart your good intentions and transform “I should” statements into “I can’t believe I did that!” statements.

You Are Creating A Savings Habit

In my opinion, the BEST benefit of any money challenge is that it helps you build a habit. And because this challenge is long, you will be giving yourself a savings habit that may last for years to come! And this, my friend, is how financial empires are made.

“Define success in your own terms, achieve it by your own rules, and build a life you’re proud to live.”

— Anne Sweeney, President of the Disney–ABC Television Group.

You Are Trimming Up Your Budget

Perhaps you haven’t kept track of your budget as much as you’d like. The 200 day envelope challenge is a great opportunity to start again from scratch. It will help you question your wants vs your needs. And you will see where it is worth it for you to spend your money.

Common 200 Envelope Challenge Issues

Next, this challenge is excellent for saving money! But there are a few things that might be tough. Here are easy solutions to get around them:

It Requires Cash

If you are like me, you might do most of your financials by card or online. Try one of these approaches:

Solution: Determine how much you will need in total and take the cash out BEFORE the challenge starts. You can also experiment with an all-cash budget during the 200 days to see what you think.

Solution: Ditch the cash/envelopes entirely and do it digitally. At the end of each week, count up your total and move the funds from your checking account into a specific named savings account. (Just keep marking on your free 200 envelope challenge chart!)

It Requires Dedication

6 months is a good chunk of time. And depending on how tight your budget was before the challenge, you might find that the days get difficult (or at least challenge you to be resourceful).

Solution: Do the challenge with a friend, post it on social media, or make a bet with a family member. Make yourself accountable in some way!

It Requires Cash Flow

This 200 day savings challenge should stretch you, but also be realistic. If you are already running on an ultra-tight budget, you will need to get creative.

Solution: If you aren’t sure if this challenge is doable, try the 52 week savings challenge instead. It has a longer time frame and you can lower the total amount to $5,000 or $1,000.

Solution: If you know you won’t be able to “tighten your belt” much more, then make more money. Sell things or add a side income to help you have a greater cash flow during the challenge.

200 Day Envelope Challenge Chart pdfs

Grab the free printables here!

Related: Cash envelope categories for beginners

Grab more free ways to have fun with money:

Tips For Doing The Envelope Challenge in 200 Days

$10,100 in 6 months is a lot of money! Here’s how to make this longer challenge a success:

Utilize A Money Saving Budget

The budget that’s right for you is different for everyone. But regardless of which one you use, it is important to know where your money is going.

Try the popular 50 30 20 method or this 60 30 10 budget rule that supercharges savings.

Be Ready For Obstacles

There will likely come a day when you don’t feel like doing the challenge. Plan for this beforehand.

Your numbers may not always match up. Let’s say you saved $35, but your envelope was 30. Mark down or put the extra $5 in another envelope for when you are short another day!

Make It Easy To Follow Through

Try one of these to keep this challenge going even when it’s tough:

- Put the tracker &/or box of envelopes in an obvious spot that you walk by often.

- Before the challenge, write a list of all the possible ways you can save. Brainstorm how you will get the higher numbers. Will you need to stack a few things together to hit them?

- Do the challenge with a friend. Send each other “high fives” when you accomplish a big number!

Be Creative

This article on the most creative ways to save money will help you think outside the box when you have exhausted all of the well-known savings tips.

Stay Inspired

Aside from using your free 200 day envelope challenge chart, motivate yourself for the entire 6 months using these ideas!

- Write down why you are doing the challenge and review it each morning. (Grab more millionaire morning ideas)

- Repeat wealth affirmations to build your success mindset.

- Put up debt free livinig quotes around your house if you are trying to pay off a debt.

- Make an inspirational money vision board. What will you gain from more money in your life?

- Read financial and money mindset books that inspire and help you think of new ways to save.

- Decide on a reward or intentional treat for when you complete the challenge.

Get Good At Finding Free Or Cheap Things To Do

This article on good things to do when you are on a budget is great for anyone, at any stage of life. Use it in the months ahead to remind yourself of all the epic ways you can have fun with those you love.

Couple This Challenge With Other Smaller Ones

You can try other small money saving challenges within this one to keep your savings piling up.

Try a:

- Weekend or week no spend challenge or spending freeze

- No eating out challenge

- No new clothes challenge

- A challenge to make all of your gifts homemade

Other Fun Variations

First, we have the envelope challenge available in:

- 3 months (this is the original 100 day envelope challenge)

- 6 months (the current 200 day envelope challenge)

What About a 365 day envelope Challenge?

If you’d like to do this challenge over the course of a year, you can. Saving $10,000 in a year is still amazing progress! Just do an envelope every 2 days instead of 1. (Or half the amount on the envelope every day).

What About a 20K Envelope Challenge?

To save $20,000 ($20,100 to be exact) you would number your envelopes 1-200, and then follow the same steps as above.

How Do You Do The 200 Envelope Challenge Chart Weekly or Biweekly?

The 200 Envelope Challenge Weekly or Bi Weekly is the same challenge but split into weekly deposits to make things easy. You save up your money until the end of the week or every two weeks and then add them to your bank account.

To Consider With Your 200 Envelope Chart Challenge

I hope you are inspired to grow your money like never before! Have fun with this money-saving challenge, and then leave a comment to let us know how it went!

More Free Challenges on Wealthy Woman…

- Free Vacations Savings Challenge & Plan

- Penny Saving Challenge

- Free 30 Day Money Challenge Printable – Specific actions to help you reach your savings goals!

- 6 Month Savings Challenge Trackers