100 Genius Ways to Turbocharge Your Savings in 2024

We know we should try to resist the siren call of Starbucks. And put insulation in our homes. But what about the little-known ways to save?

Today, we are digging into creative ways to save money that fewer people talk about – but are just as (or more) effective!

These hidden treasures cover many different areas. Use the table of contents to skip around!

Most Creative Ways to Save Money

First, we’re taking a detour to the unique. These ways to save are often not discussed but can save you hundreds or thousands over time.

1. Take a Different Route

Habit formation statistics show that by changing your routine or taking away the temptation, you’re much more likely to succeed. So, if you have the habit of stopping at the same fast food or coffee joint, go a different way to get where you need to go.

2. Cut Things When You Don’t Need Them

For the last several years, we have cut Netflix from April-October. It forces us away from tv and gets us outside in the best weather months. Plus, we save money on something we don’t watch as much in the summer anyways.

3. Go Cold Turkey on Your Vices

We tried a dry January in my house, and let me tell you, we saved $200 in one month. The little purchases add up. So, perhaps it’s time to go for it with quitting (or drastically cutting) the bad habits you know you should quit.

4. Go Back to the Library

This savings tip has two benefits. One, the library has loads of free entertainment. And two, books are the cheapest investments you will ever make on your self-education. So, take advantage of your local library to learn and grow.

5. Try a Money Saving Challenge

Money challenges can be a motivating way to get your finances in order! Try our

- 52 week savings challenge printable

- or the 100 envelope challenge chart to get started saving more money.

6. Build a Morning Routine For Your Financial Future

While this isn’t a direct money saver, the results to your bottom line over time can be stunning. Carve out time in your morning routine to support your financial future.

It helps to do this before your family gets up. Sit with a cup of coffee, and make it a priority.

- Read money books about management, mindset, passive income, etc.

- Read financial articles or listen to a podcast

- Repeat money success affirmations

- Journal about your beliefs around money (you’ll find self-limiting thoughts that need to be rooted out)

- Review your financial goals (studies show that reviewing your goals daily makes you more likely to achieve them)

7. Buy Less – But Better Quality

“But it was on sale!”

Instead of buying 5 cheap shirts that are going to fray and fall apart in a year, invest in 2 more expensive, but quality pieces. These will last for years, saving you money and time in the long run.

8. Ask Yourself Better Questions

Often, we just don’t know what the right decision is to move forward. And this leads to decision paralysis.

Instead, ask yourself these good financial questions. You’ll customize your roadmap and be able to do what needs to be done.

“Successful people ask better questions, and as a result, they get better answers.” –

Tony Robbins

9. Do a Spending Audit – in a Unique Way

Print out or write out your regular spending for the last 3 months.

First, of all of these expenses, cut the things that you didn’t need first. If they were impulse buys, decide how you’ll steer clear of the temptation in the future. If they are subscriptions or services you no longer use, cancel them immediately.

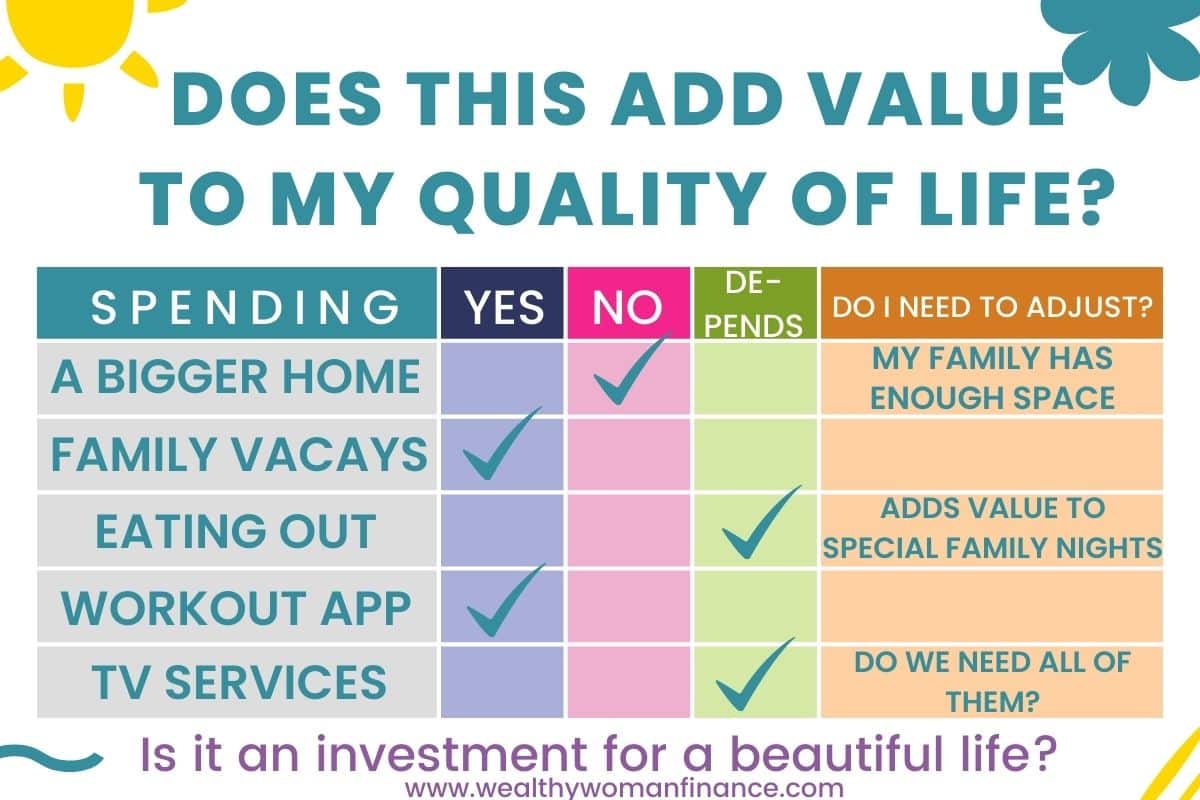

Next, audit your spending based on what I call the “quality of life metric.” I look at my expenses through the lens of what adds significant value to my life. (You have to stop caring about what others think to do this).

These tend to be things that invest in myself or my family.

10. Unsubscribe From Marketing Emails

The best way to spend less money is to expose yourself to fewer sales pitches. So, regularly unsubscribe to email lists that sell you things.

11. Do the Math

Calculate big purchases by how much time you will have to spend working to pay it off. That big shiny new car isn’t as exciting when you realize you will have to toil for months or years to pay it off.

12. Set Mini Goals

Studies show that people are more successful when their goals are shorter. With that in mind, set a savings goal for the next week, month, or quarter that feed into your larger goals. This will keep you focused and urgent when it comes to saving money.

*Best Tips For Financial Wellness

13. Treat Yourself in Smarter Ways

If it’s a big purchase, force yourself to wait 24-48 hours before clicking the “buy button.” And for smaller indulgences, read this great list of budget friendly ways to treat yourself to get ideas that won’t break the bank.

14. Prevention, Prevention, Prevention

We live in a world of instant gratification, so this is becoming a harder concept to bear. But the truth is, you will save yourself tens of thousands of dollars over time by using the concept of prevention.

Here are great examples:

- Taking care of your marriage prevents a costly divorce

- Going to regular checkups saves you big money on medical and dental care.

- Keeping your car maintained means you won’t have to spend on repairs later.

15. Add Money to Save Money

For some, saving money is hard because there isn’t enough money coming in on the other side. Visit this article on how to make $500 fast to help you brainstorm ways to boost your income.

Because often, making a little extra dough is a lot easier (and quicker) than clipping coupons.

16. Make It Harder to Spend

Next, set yourself up for success by making spending a difficult action. You can do this by leaving your credit cards and cash at home when you go out.

And to make this easier at home, do NOT save your credit card information in your computer. This forces you to get up and find your card whenever you want to make a purchase.

Creative Ways to Save For Families

When you are a parent, you have an all-new array of expenses to consider. Add in multiple kids and your expenses are a doozy. These ideas will help!

17. Cut Back on Gift Giving

Seriously, most of us are drowning in stuff. According to NAPO, 80% of what we own we don’t use.

Speaking up is not easy, but you will cut your future stress in half. Ask other parents to bring donation money to birthday parties, draw names at Christmas instead of gifting to each person, and use other strategies to lighten the load.

Related: Best Minimalist Gifts for Christmas (+Tips to Save)

18. Network With Others

If you are a parent of young kids, your community is so important. Swap toys, clothes, books, and more with others and stop buying things new.

The same can be done with anything in your neighbordhood. My husband shares lawn care equipment with neighbors.

19. Carpool

This saves you money in transportation costs, and also saves you valuable time shuffling your kids everywhere. If your kids go to the same school or share activities with a neighbor, see if they want to carpool a few days a week.

20. Barter And Trade

What goods and services can you provide others?

Offer to babysit an overwhelmed parent, fix a lawnmower, or make something great in exchange for what you need. (This works well for small things like a haircut or produce from someone’s garden.)

21. Get Your Family Working With You

Are your kids constantly whining for more at the store?

Or asking for money like it grows on trees?

Grab one of these money smart kids books at the library and start educating your family. With a little time, you will all be on the same page. (Plus, what great tools to give your kids for the future!)

22. Utilize Free Days

Museums and zoos often have one or two days of the year that you can get in for free. Go early or late to beat the crowd and enjoy the same experience.

23. Make Kids Wear What They Have

The other day, I blew up on my kids. You see, I had been washing tons of clothes that they weren’t even wearing. The shirts and pants ended up on the floor and were rotating through the laundry.

Not only was this a waste of money, but it was a waste of my time too. Since that day, my kids have gotten better because now they do their own laundry.

24. Make Your Own Experiences At Home

When you have a family, it pays to find fun things to do at home. Try one of these great ideas:

- At home movie theater: Build a living room fort, stock up on a few fun snacks, and watch a movie no one has seen yet.

- Indoor picnic: Instead of taking them out to eat, make a creative little picnic to enjoy in the living room, backyard, or at a nearby park.

- At home party: Instead of a big expensive party out, we did a board game party at home for my son’s birthday this year.

25. Get Things You Need at Baby Showers

Baby showers are so fun!

But often, you get clothes and accessories that don’t last. Instead, ask for diapers, books, and essential gear that you know will be creative ways to save money over time.

Smart Entertainment and Extras

26. Eat Out Less

Cook one thing at the beginning of the week that you can use for multiple nights throughout. And if you need to mix things up, try a picnic in the park instead of takeout.

27. Bring Your Own Snacks

Whether it’s to the movies or to an event, bring your own water and snacks to save big at the concessions. Then, enjoy one purchase there you really love, instead of 3-5 purchases that blow your budget.

28. Make It a Game to Bring From Home

Try a “no coffee shop challenge” or compete with a friend over how many times you bring your lunch. Turn your money-saving efforts into a game with others to see the best results.

29. Consider a Staycation

If your budget is tight this year, try exploring your own nearby city instead of spending all that money to go far away. Plan ahead so that you try new foods and adventures in the same ways that you would on a vacation. Then, you won’t even know the difference.

30. Choose to Do Free Things

Specifically, get outside into nature. Not only does it save you money, but it will boost your happiness as well. Nature lowers stress and helps clear your head.

The best things ARE free.

See this great list of things to do when you are broke or saving money >>

31. Get In on Happy Hour

Do you love spending time with friends and family? Awesome!

Now just go a little earlier to grab the specials on your favorite drinks. You’ll get the same experience for half the price!

32. Ditch Store Greeting Cards

The last time I bought a greeting card it was $5. That’s five dollars for something that the person will likely throw away in a day or two! If you love the sentiment of a well-written card, then write your own. If not, ditch the cards.

33. Turn Off The TV

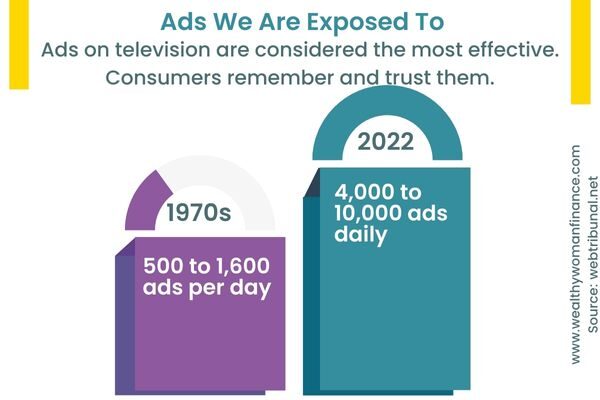

Fun facts:

- In the 1970s, we only saw 500 to 1,600 ads per day.

- Fast forward to 2022, and the average American sees 4,000 to 10,000 ads daily (source)

Not only does this equate to more money spent (marketers are good at what they do), but when it comes to tv and social media, it takes away from learning a new skill, reading, getting outside, and doing other things that are good for you.

34. Ditch Cable – But Beware Services Too

There’s no reason to have cable anymore when you can buy streaming services for a fraction of the price.

But BEWARE. Many households these days have 5-6 streaming services. And they pay far more than they would have with cable. So, make sure you are only keeping the services that you use regularly.

35. Share Streaming Services

On that note, sharing passwords with roommates or another family can help you save money as well.

Note: Sharing works in other things too! Get on a phone plan with another family and you will likely save money.

36. Host Potlucks

Cut down on the work and the cost by having guests bring a fun side dish. You will all be able to try new things and your guests will feel better contributing.

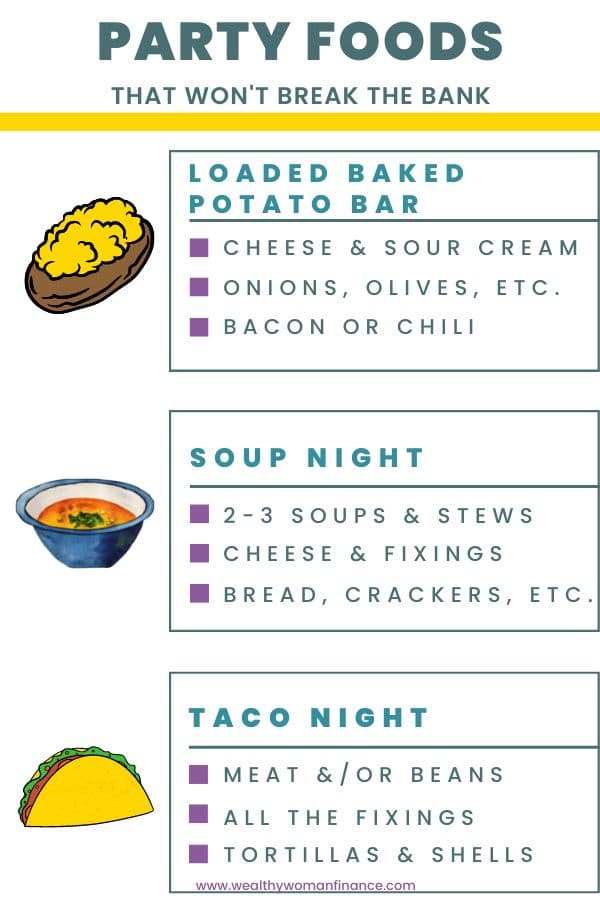

37. Host With Cheaper Foods

This does NOT mean you feed everyone cheap hot dogs every time. It’s still cool to be generous.

Try one of the above options instead, where the protein is on the side or mixed in. It will save you money and be healthier for everyone (without suffering on quality). It is also great for hosting people with allergies because they can pick and choose what to include.

For an even healthier option, try a salad bar: Include hard-boiled eggs, chicken, chickpeas, side salads, seeds, nuts, cheese, and all the other add-in ideas you love.

38. Hit Up the Matinee (Or other cheaper days/times)

Like the movie theater, hotels and airfare vary widely depending on what days and times you are looking. Get the same experience for cheaper with a little research.

Best Ways to Save Money At Home

Next, these ideas are creative ways to save money in the spaces you use most.

39. Go Natural

Vinegar, lemon, and baking soda make a wide assortment of cleaning mixtures and aren’t hard to put together. We like making our own granite cleaner too.

40. Declutter Your Home

*Use the free decluttering checklist to help go through your home.

You will save money (and live better) by not going out to buy duplicates of what you already own, selling your gently used items, and freeing up mental clutter so that you can spend time on more productive things.

41. Try Cloth

Nice cloth napkins can replace paper towels and napkins. And if you have a baby, cloth diapers can save you lots of money over time.

42. Make Meal Planning Easy

Rotate your meals! When we switched to a basic 2-week meal rotation, our meal planning became 10x easier. On breaks from work, when we have more time, then we will switch up the meals for fun.

*Or try making a monthly family meal plan.

43. DIY

My husband is the king of DIY. And I have to hand it to him, he has saved thousands of dollars putting in his own flooring, repairing pants, and fixing up equipment. You can also do your own hair coloring, paint your own nails, and more.

44. Do a Minimalism Challenge

Try this free minimalism challenge calendar to clean out, and then continue by only buying the essentials for another 30 days. By the end of the two months, you will have an entirely new mindset!

45. Dress For The Weather

I can’t tell you the number of times my kids have whined about being cold in our house. In the middle of winter. While they are wearing shorts and t-shirts. It’s winter! Put some clothes on!

46. Switch To Energy Efficient Everything

The average household saves about $225 in energy costs per year by using LED lighting (energy.gov). Not bad for something that doesn’t take much effort to do. Consider switching over your appliances to high efficiency for even more energy savings.

47. Use Surge Protectors to Help With Power

Phantom energy is the electricity that is being used while everything you owned is plugged in. Easily save money by adding surge protectors to all of your high-energy usage areas. That way, you can turn everything off with the flick of a switch.

48. Set a Timer For the Shower

If you are like me, you love a good long hot shower. But meanwhile, we’re using up 20 gallons of water or more. A simple timer can help you keep your shower lengths in check.

49. Use Cold Water

Save the hot water for your towels and heavily soiled laundry. Otherwise, wash your normal clothing on cold to save.

50. Utilize Your Fans

Fans can help circulate air-conditioned air (or help you go without it). And in the winter, if you rotate the blades, they will save on your heating costs too.

Innovative Work Tips to Save Money

Next, this section helps you keep more of your money at the office!

51. Utilitize Your Corporate Discounts & Points

Many businesses offer perks that are not widely used. If you have airfare points, hotel points, or discounts to local places, use them!

52. Do a Brown Bag Challenge

Try it out with a colleague to save extra dough. You can lunch together to offer moral support.

53. Create a Business Vision & Mission Statement

Whether you own your own business or work within one, dreaming big helps you challenge yourself and grow. The world has enough people who play small. What it needs are more brave souls who reach for the stars.

*Here are ideas for a business vision board

54. Automate & Get Help on Taxes

If you own your own business, you know that keeping track of documents can be a bear. Get help with automation software or hire an accountant to save you time (because time is money) in the long run.

This also applies if you don’t own a business, but your taxes are complicated in other ways.

55. Invest In The Right Things

Sometimes you have to pay money to make money. Every business comes with expenses, but are your expenses adding to the value you bring to the company?

56. Save on Work Clothes

Save big money and mental energy by investing in a capsule work wardrobe. These wardrobes include stables that you can mix and match to create different looks.

Be sure that any new piece you add to your wardrobe can be mixed with anything you already own.

57. Adjust Your Work Schedule

If you have kids, your work schedule makes a huge difference in how much childcare you need. These days, many employers are flexible if you ask.

58. Save Working From Home

Remote work even a few days a week can save you in commute, eating out, and other costs that add up!

59. Save on Work Trips

Many employers pay for the main expenses on work trips. But pack anything else you might need to pay for (headphones, snacks, etc.).

60. Get to Work Smarter

Going into the office regularly? If you live close by, walk or bike several times a week. If you live far, see if someone at work would be up for a carpool. You can also try public transportation.

Related: Cheapest Months to Buy Everything

Biggest Bang For Your Buck Ideas

These are one-time decisions that require the least amount of effort for the biggest amount of savings. Even if you do NOTHING else on this list, but get these right, you are in excellent shape!

61. Don’t Buy More House Than You Can Afford (Gasp!)

In a world that constantly screams “more, more, more.” Be different.

Do you really need a 5,000-square-foot home?

And have you considered that you will have to clean, repair, and maintain that home? And that you’ll probably see your family less because you will be so spread out?

62. Re-Think Your Transportation

We switched to all-electric cars a few years ago and have saved HUGE as gas prices have fluctuated.

*This idea works best if you don’t have a long commute. Run your numbers and evaluate your needs! You might find that electric is a better option than you thought.

63. Take Care of Yourself

Taking care of your body saves you on huge hospital and medication bills later.

If you only eat low-quality foods and never exercise, it will catch up with you. And it will not be cheap.

Brilliant Ways to Save on Groceries

Next, after spending on home and car, many of our dollars go to food. Here are creative ways to save money, without losing out on quality.

64. Cut Down on Impulse Grocery Shopping

Americans are spending more on impulse purchases than ever before – a whopping $314 a month, according to Slickdeals. Here are three great ways to cut this down!

Make a list

Always go to the store with a list in hand, so that you know exactly what you need. Then, stay focused and get what you need quickly.

Buy online

We save money when we order groceries online and go pick them up. There’s much less temptation to pick up other items.

Impulse Buy Smarter

My husband was constantly impulse buying at Costco. But an impulse purchase there is $$$$. We agreed that if he wanted something extra, we would buy it at our local grocery store in smaller packaging instead.

65. Start A Garden

Want the highest quality food without the price tag? Grow your own food! Even an herb garden can save you money while giving you better taste.

66. Use Coupons, Ads, & Apps To Save On Groceries

Apps like Ibotta give you cash back. Or peruse the grocery sale ads to find the best deals for the week. *Just be sure to only buy what you would anyways.

67. Buy Generic

While this doesn’t always apply, MANY items are cheaper if you buy them in generic. This also includes organic packaged goods.

68. Buy In Bulk

If you are covering a large family, buying in bulk is an effective way to save money.

69. BEWARE: Don’t Buy In Bulk

However, only buy foods that you use up. We got into the bad habit of buying fridge items at Costco that we were not using up by the expiration date. I’m embarrassed to admit that we threw out tons of food.

We now stick to paper goods and grocery items that we use at least once a week.

70. Throw Out Less Food

Here are other ways to cut down on food waste:

- Understand expiration dates. The “best by” dates are guidelines, not hard rules. Use your own judgment to find out if food is no longer good.

- Use recipes that utilize veggies that need to be used up – soups and stirfries are great for this.

- Organize your fridge and pantry to put the things that need to be used up in the front. Try a no-spend pantry challenge.

71. Shop Smart

Go on a full stomach. And without whining kids (or your partner). And stay out of the middle aisles.

Stores put candy bars at the checkout for a reason – they know that your self-discipline is depleted after walking through the store.

72. Bring Your Own Bag

Not only will some stores give you a small discount, but you’ll cut down on the hundreds of plastic bags stuffed in your closet.

73. Buy in Season

Purchasing food that’s in season is both healthier and cheaper too.

Here’s a quick list of what’s in season different times of year >>

74. Choose Frozen Over Fresh

You are still getting your produce intake, but saving money too.

75. Cut Back On Meat

Eating less meat is not only better for your wallet, but has huge health (you will most likely live longer) and environmental benefits too. If going vegetarian seems too hard, just try a meatless Monday routine to see how it feels.

76. Buy Organic On What Matters

Do you want to eat cleaner, but are not ready to go exclusively organic?

Use the Clean 15 and Dirty Dozen lists so that you can make informed decisions on what’s worth the cost.

77. Double Your Recipes (The Easier Way to Freezer Cook)

Instead of busting your bum cooking for an entire month, double one of your recipes over the week. You are already dirtying the dishes and using the ingredients, so the workload is significantly lower.

Note: If you have a family put the extra aside right away. Otherwise your kids will eat the extras...

78. Drink More Water

Soda, coffee, juice, alcohol, tea – all of it costs money. By replacing one beverage with water, you’ll be saving big over time.

79. Utilize the Slow Cooker & Instant Pot

Crock pots and Instant Pots use up less energy to cook, and they also make cooking a breeze. You can also use less expensive cuts of meat in these.

80. Replace Starbucks With Your Own

Buy yourself the little frother and make your own drinks at home. You will get the same feel-good coffee rush, without all the added sugar and cost.

81. Grocery Shop Less Often

How many times have you been in a store this week?

Realistically, if it’s more than once, you need to evaluate your grocery and meal planning strategy. Each time you are in the store, you are bombarded with tempting options and advertisements. Free up time and money by only shopping one day a week.

Simple & Realistic Ideas

And finally, here are even more practical and creative ways to keep more of your money.

82. Use a Budgeting Template

Do you know where your money is going? Use one of the free budgeting templates below to help you get a handle on your spending.

83. Shop Around

Whether it’s for insurance or a new fridge, it almost always pays to compare prices between 2-3 places.

84. Accelerate Your Debt Payoff

Paying on debt interest is one of the worst things you can pay for. You get no return value on your money (unless it is an investment strategy).

Get your overall debts down. You will love the psychological boost and motivation of doing this as well.

85. Emergency Fund

An emergency fund is all about prevention. When you have money in the bank, you don’t have to go into debt for a new washing machine or a new car.

Related: Why Can’t I Save More Money?

86. Know Your Worth

Instead of taking what is given to you, ASK for more. The worst that someone can say is “no.”

87. Try the Envelope System

Separate your budget into envelopes. Now, go through your week, and when the money is gone it’s gone.

It’s a surefire way to cut out impulse spending!

88. Take the Free Money

You should be saving at least enough in retirement to get the employer match if you have one. THIS IS FREE MONEY.

89. Put Your Money Into a High Yield Savings Account

Online banks often offer high-interest rates because they do not have the overhead costs of a physical location. Do your research and find one that gives you more money.

90. Save For Something Meaningful

Money is just a number until you use it for something that’s meaningful to you. That enchanting vacation with your kids makes it much easier to save than just thinking you need an extra $10,000.

91. Create a Vision Board

After you’ve found a few things to dream about from #89, make it visual by creating a money vision board. This helps make it real in your head.

92. Pay in Full (or Do a Year’s Worth)

Both personal and business expenses are often cheaper if you pay a year in advance instead of a month at a time. Having the money upfront saves.

93. Use a Budgeting App or Website

Mint.com helps you keep track of your spending without having to rely on pen, paper, and a calculator. And like any habit, the easier you make it the more likely you will stick to it over time.

94. Utilize Reward Cards & Apps

While you may be cutting back on eating out, there are probably a few places you visit more often than others. Sign up for a reward card to maximize your visits. Then, grab that free coffee or sandwich without the guilt.

95. Wait For a Sale If It’s a Big Purchase

Flex your self-control muscles and get the item you are wanting when it falls on the next big sale cycle. Usually, holidays are great for this.

96. Shop After the Season (Creative Ways to Save Money)

Want an easy way to get 30-90% off of items? Scan the shelves after a major holiday or after a season has passed.

97. Save Your Loose Change

Dump out the money in your pockets regularly and you’ll be surprised at how much the coins and dollars add up.

98. Be Prudent With Medications

Use the generic version when it makes sense and see if you can pay 3 months ahead. Sometimes it is cheaper than paying month to month.

99. Get Rid of PMI

Pay extra on your mortgage payments in order to eliminate this needless insurance. Once your loan-to-value ratio falls below 80% of the home’s appraised value, you can request that PMI be removed.

100. Create Passive Income

And finally, make saving money easier by investing and building your income sources. These things can all add to your income over time.

- Stocks And Bonds

- Real Estate

- Books

- Digital Automation

See more great ways to make passive income >>

What’s Next?

This is a big list. So, pick and choose the ideas that work best for you at the stage of life that you are in.

And even better, shift your focus from lack to abundance. Yes, you are saving money for a better life. But don’t forget that you have a beautiful life right now too.