5 Money Moves I Made In June

Hi friend! Once a month I’m highlighting ways I saved, earned, and invested in the hopes we all learn and share. You will be able to see these, and much more in our Weekly Wealthy Woman (the fun newsletter!)

Here are 5 money moves I made this month.

1. We Bought A Used Van

We almost bought a brand-new van. The prices between new and used are so similar these days! But when it came time to sign, I dragged my feet. I just wasn’t comfortable spending that much money on our second car.

Three days later, a van with 40,000 miles showed up on the market for $6,200 less. So, we took advantage to lower the upfront cost.

2. We Paid Cash For This Van

In our pre-marriage counseling, 15 years ago, my husband and I discussed money. For him, this meant dreaming about the cool boat, car, and grown-up toys he would one day have.

But I already had strong financial beliefs. So, I said to him, “What if we make a deal? Buy anything you want as long as we can easily afford it with cash.” (*Excluding a home)

He agreed. (Whether it’s because he was in love or he thought I was bluffing, we’ll never know!)

Especially in the beginning, paying in cash forced us to wait or be pickier. But it has also allowed us to live below our means, enjoy amazing experiences, and live according to our money values. (And he has still bought the things he talked about that day.)

Running the numbers on our used Honda Odyssey…

- paying cash instead of the typical loan is saving us another $5,738.72 (assuming a 5% interest rate on a 72 month loan and $1,000 down payment)

Related: Key Benefits to Saving

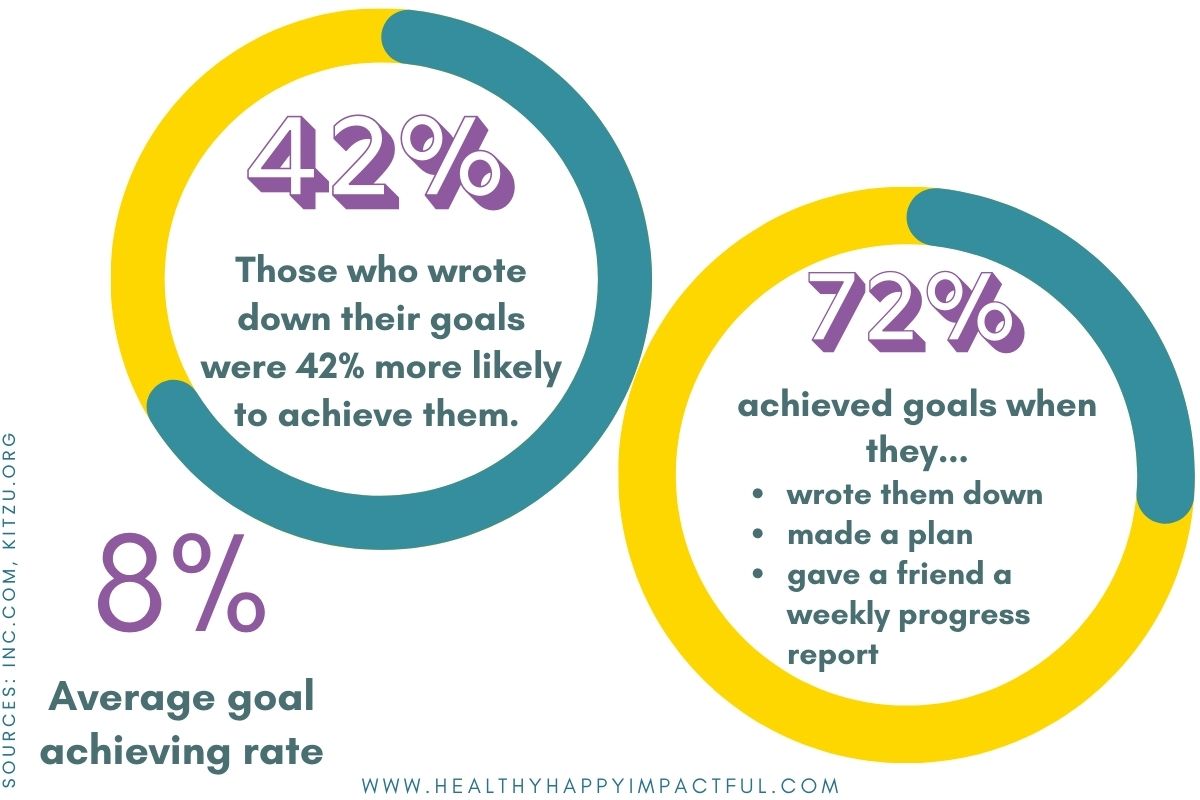

3. I Wrote Out Specific Goals

A money vision board is amazing for motivation, but you also need clarity to get important things done. So, this month I took the time to write specific SMART financial goals for the things we’re saving for. For example, I wrote

- how many trips we want to take a year and what they will cost.

- the exact amount we’re shooting for in college savings for the kids.

- How much the business will earn in the next 6 months.

Being vague means that you’re off the hook. I fall into this trap too. But specific money goals help you stay accountable to what truly matters.

Related: Free Commitment Card

4. Household Time Savers

Time (not money) is our most precious resource. You can never get your lost time back!

That’s why I spent June mulling over ways to manage my household and business better.

Here are a few new examples for the household:

- I made a rotating grocery list. Now that we have the same meals every week or two, it’s easy to know what needs to be picked up.

- I asked our teen babysitter to stay an extra hour. She helped with a grocery list, picking out gifts, and veggie chopping.

Related: How to Stop Eating Out So Much

5. Business Time Savers

For the business:

- I started batching similar work together. Instead of producing one email at a time, I could be writing three while I’m in email-writing mode. The same goes for photos, video, and smaller work projects.

- I shrunk my email inbox. I unsubscribed from email lists I don’t need, and cut back on emails within the work team.

- I considered outsourcing for work. Trying to “do it all” damages mental health and quality of work. Plus, it makes you less focused on the things that move the needle.

Especially as a mom, it’s easy to drown in work and family to-dos. Managing these pitfalls is often on my mind!

What Money Moves Did You Make This Month?

Did you…

- Read a money article, listen to a podcast, or watch a learning video?

- Make a budget?

- Open a new money account?

- Declutter your home and sell items?

- Invest?

- Choose a free activity over an expensive one?

- Start a money saving challenge?

- Make a meal plan?

- Work on overcoming your limiting money beliefs?

- Stop buying so much stuff?

There are many ways to make a great money move! Share in the comments and let us know!