Best Money Saving Motivation Steps (Free 2024 Checklist)

Have you struggled with money saving motivation? Do you start excitedly pumping your fists but end in a defeated heap on the couch? It’s not your fault!

Staying motivated is an intriguing combination of determination, inspiration, and habit formation.

Before we get into the best money-saving motivation tips, let’s gain perspective.

Money Saving Motivation: Work + Patience

In my favorite fable, a spectator watches as a man breaks a large rock with a sledgehammer. The rock splits down the middle with one blow, and the spectator is impressed.

“What an amazing feat!”

But the man points out that the spectator only sees the end result. When, in fact, it is the thousands of times that the man pounded his sledgehammer into the rock that broke it. Not the final one.

Few people see this work being put in. We envy how easy it looks for others, without taking into account the work and patience behind the scenes.

Or as Michaelangelo once said…

“If people knew how hard I worked to gain my mastery, it wouldn’t be so wonderful at all.”

Wherever you are on your financial journey, use the money motivation tips below to help you put in the work and patience. Before long, you’ll see the results you dream of.

You’ll find a simple action task below each money motivation tip. These take 2 minutes or less. And they’ll put you on your way to a life of financial abundance.

How to Stay Motivated To Save Money

Light your fire and spring forward each day. These will help you do it!

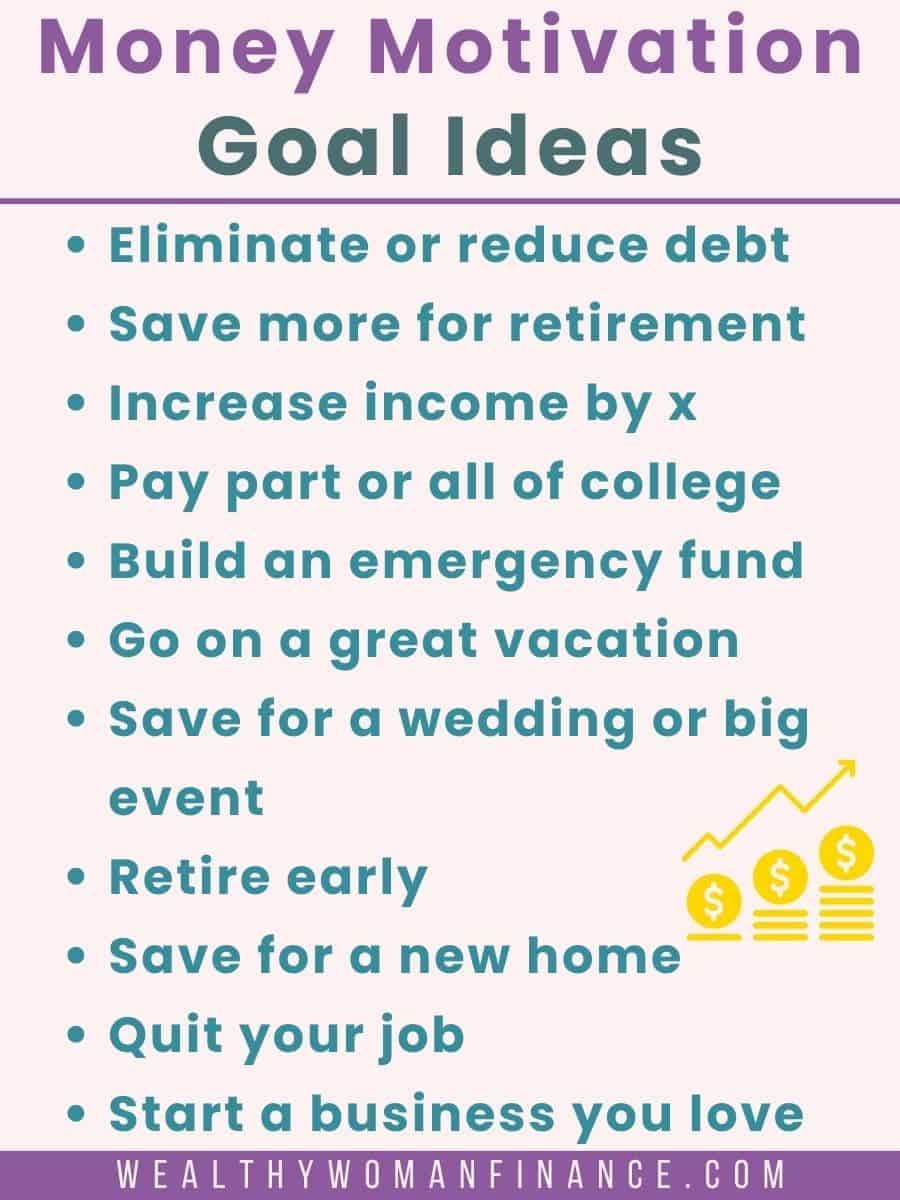

1. Set Clear and Specific Goals

First, clear objectives keep you focused and motivated.

So, if you want a new home, get very clear on what it looks like, feels like, and even what neighborhood it is in. Understand how much money you will need to save and set a deadline for yourself.

Also, break down large goals into smaller milestones. This helps you focus on the next right thing instead of becoming overwhelmed with the whole. And in this way, any audacious goal is possible.

Example: 2 YEAR GOAL = 24 MONTH SAVINGS TARGETS

Action Task: Write 1 SMART financial goal that motivates you to do the next right thing.

2. Learn Something Every Day

Read or listen to one thing every day that helps her learn about personal finance. This could be a podcast episode about investing, a blog article about saving, a money mindset book, or even a youtube video on starting a business.

The more you learn, the more you will grow personally and financially. Not only will the learning expand your limits, but you will add more value to everything you do.

Action Task: Make a list of tools and resources within reach that you can pick from each day.

3. Get Clear on Your Why

Envisioning the end result can be a powerful motivator.

So, imagine how your life will change once you reach your goals. Remind yourself of all of the benefits – peace of mind, security, and open doors of opportunity.

Action Task: Make a vision board or write a paragraph about why saving is important to you and your family.

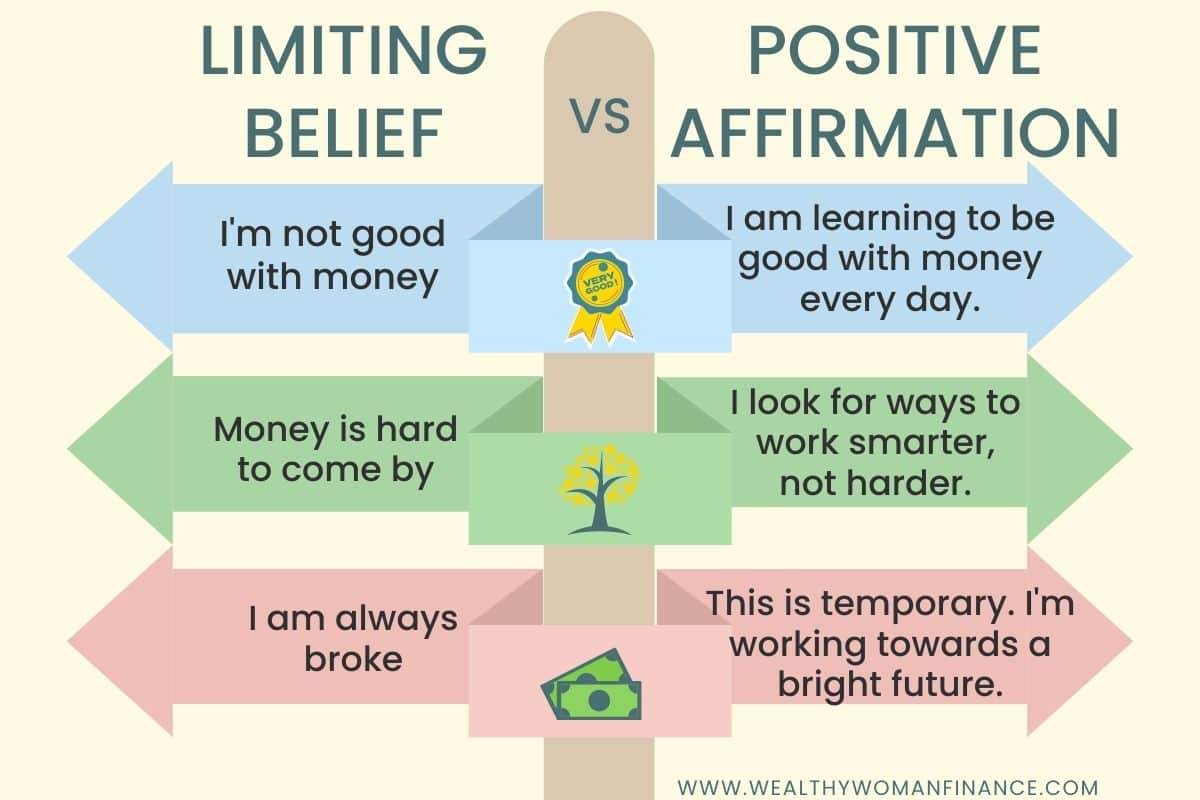

4. Uproot Bad Financial Beliefs

The story we tell ourselves about money impacts every single decision we make.

So, speak like a leader. Never a victim. Take full responsibility for your life.

Replace your limiting money beliefs with words of encouragement. Visualize where you want to be in 5 days, 5 months, or 5 years. And then tell yourself the story that aligns with this better version of yourself.

Action Task: Say a positive money affirmation every day.

Related: Rich Vs. Poor Mindset: What’s the Difference?

5. Track or Measure Your Progress

This gives you accountability and shows visual progress. It is highly motivating! If you are focusing on a simple habit, write an x on a calendar for each day that you do it, or use one of the visual ways to track below.

If it’s a money goal, write down your bank account number each week.

And for specific money trackers, see:

Action Task: Decide on one way to measure your progress toward your goal.

6. Add Accountability

This free commitment card combines money motivation elements with proven habit and influence strategies. It helps you follow through on your promises, even when the going gets tough.

Action Task: Sign a commitment card or make a bet with a friend.

7. Challenge & Stretch Yourself

Challenges are exciting. Plus, they supercharge your progress! Start one of the amazing free money challenges on this site.

- Emergency Fund Challenge

- Vacation Savings Challenge

- Penny A Day Savings Challenge

- No Spend Challenge: for a week or month

- Christmas Savings Challenge Tracker

- 100 Envelope Challenge

- 26 Week Savings Challenge Trackers

Action Task: Start a challenge!

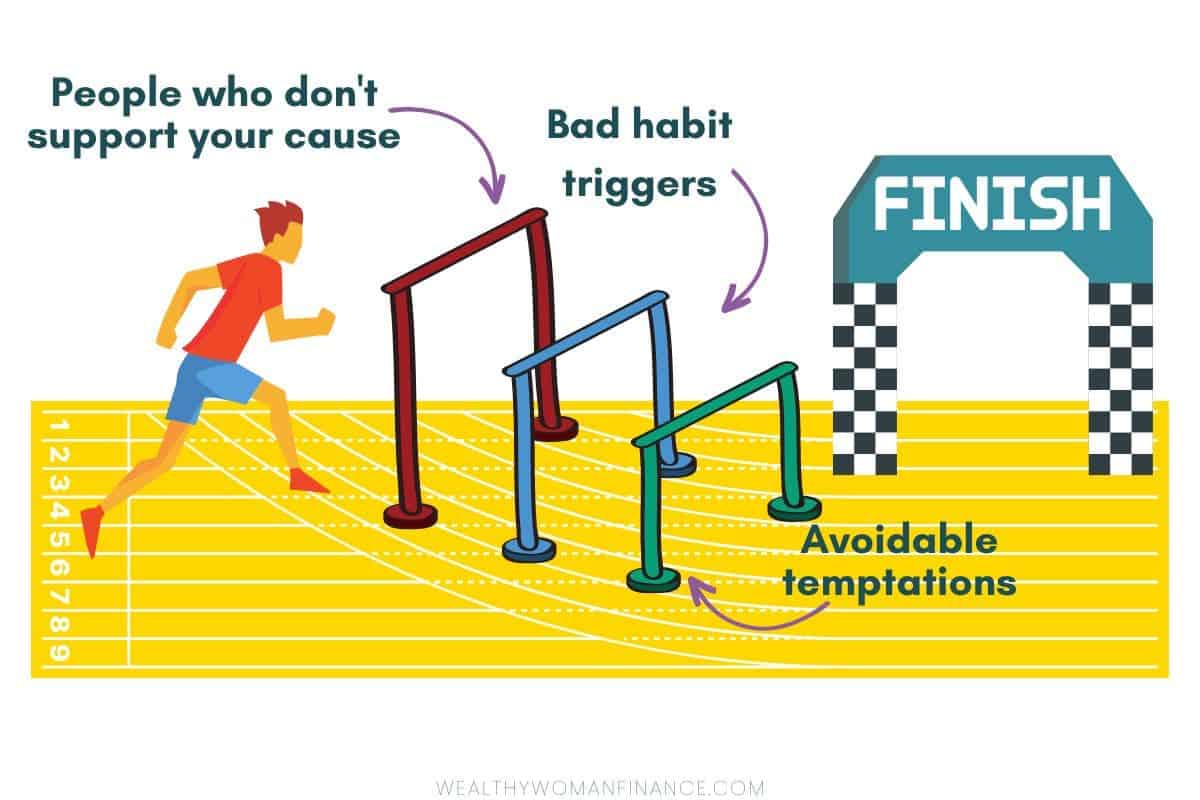

8. Remove a Bad Trigger

Often, we do well with a new goal or habit. Until a trigger makes us stumble. Luckily, there are ways around these hurdles.

You can make sure they occur less frequently. And when they do, get back on track quickly.

Make Bad Habits Harder

One key element to better money practices is to change your environment. Make it easier to do the right things and harder to do the wrong ones.

Here are examples:

- limit your time on online platforms that get you to buy things

- unsubscribe from emails that get you to buy

- hide your credit cards

- only bring enough cash to buy your essentials

- take a different driving route if you are tempted to stop and buy

Set a Rule

Rules help you control your bad habits so that they don’t control you.

- Do you buy impulsively? Create a 24-hour rule. You don’t buy anything until sitting on it for 1 day.

- Do you want to stop eating out? Make a rule that you only eat out on the weekends.

Give Yourself Space

We model the behavior of the people we are around most.

That’s a proven concept. So, be very careful about who you surround yourself with.

- Avoid people who don’t respect your budget or pressure you to overspend.

- Hang around someone you admire. Their magic and “know how” will rub off on you!

- Be around others who have similar financial goals. It is easier to create a supportive environment and encourage each other.

Action Task: Remove one temptation or bad influence.

9. Set Top Tasks For the Day

Most people in today’s fast-paced world are busy. But they aren’t productive.

Productivity is about making progress with what matters. Surprisingly, there are only a few key actions that do that.

“Being busy does not always mean real work. The object of all work is production or accomplishment…Seeming to do is not doing.”

Thomas edison

Action Task: Set your top 3 tasks that move you toward your main goal. Do one now. Schedule the other two for the next few days.

10. Be Your Biggest Cheerleader

Acknowledge and celebrate small victories along the way. When you reach a milestone, reward yourself with a budget-friendly treat, a day off, or indulging in your favorite hobby.

These small celebrations create positive reinforcement. They help tremendously if you haven’t felt the benefits of your good deeds yet.

Also, forgive yourself for mistakes made. We all fall off the wagon sometimes. It’s how quickly you get back on the ride that matters! Learn from your mistakes, refocus your efforts, and keep going.

Action Task: Decide on one small treat for yourself when you hit a goal milestone.

11. Make & Review Your Plan (A.K.A. Budget)

A good budget shows you where your money is going and empowers you to make informed decisions.

So, record your expenses for a week (or month). Then, use the 50 30 20 Budget Tracker & Wants Vs Needs Worksheet to create a budget that works for your income, expenses, and saving targets.

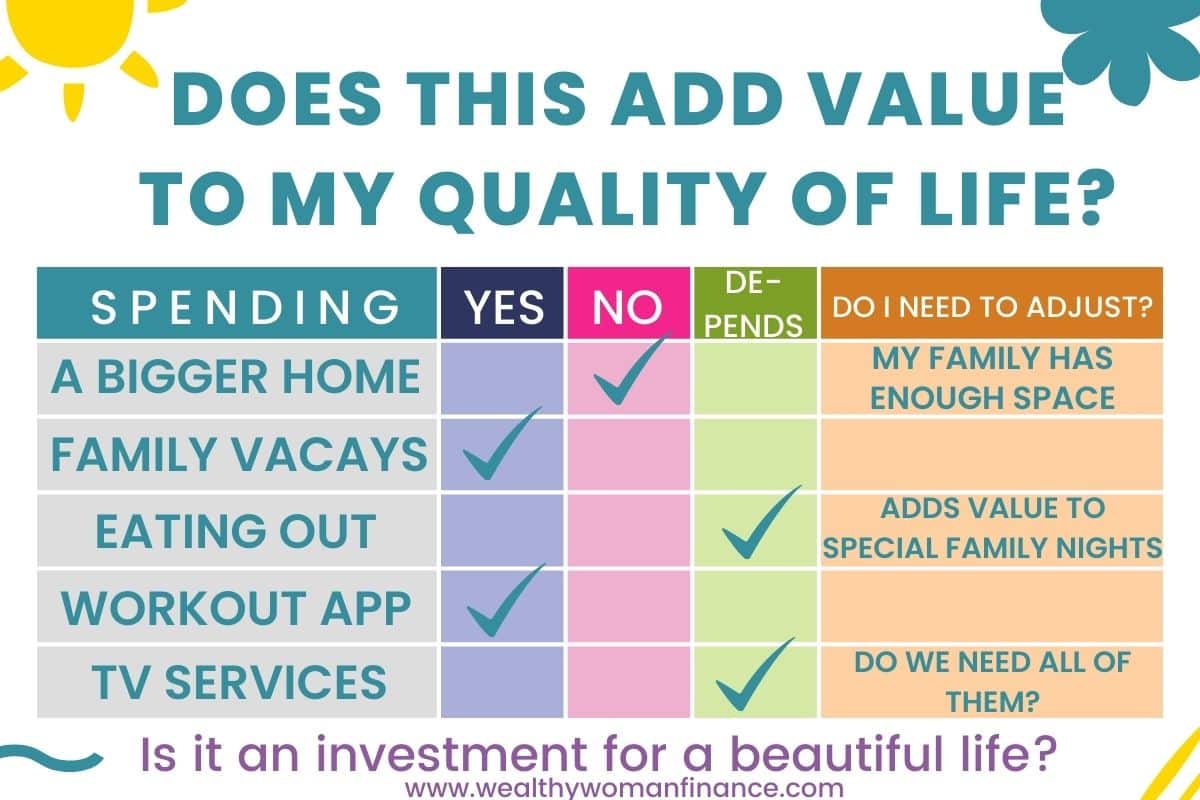

Don’t Forget! You need to stick to your budget! Regularly review your expenses and look for spending that doesn’t add to your quality of life.

Related: Zero Based Monthly Budget

Action Task: Write/Track your expenses from the last week

12. Make It Automatic

There’s nothing more motivating than doing the right thing without even thinking about it!

Set up automatic transfers from your checking to your savings account. When the money is transferred automatically, you’re less likely to spend it, and your savings will grow.

Action Task: Set up one automatic deposit.

13. Record Your Blessings and Small Wins

If all you chase is money, it will never be enough. So, don’t forget to love the life you have NOW, while striving to make it better too.

If you live for having it all, what you have is never enough.”

–Vicki Robin

Action Task: Write 3 things you are thankful for every morning as you drink your coffee (or tea).

14. Make It Fun (Financial Motivation)

Turn your saving into a game!

- Use a savings game that rewards you for meeting your goals. Or turn saving into a competition with yourself or another person.

- Try online apps and tools that make it interesting. (I love Mint.com)

- Use the free money motivation checklist below!

Related: Exercises for Money Mindset

15. Pick the Low Hanging Fruit

Gain quick momentum by reaching for the easiest money fixes.

- Impulse grocery buying: Create a grocery list and stick to it. Do grocery pickup to help with this!

- Eating out: Meal plan and put your basic meals on rotation.

- Paying high-interest debts: Negotiate with creditors, consolidate, or get laser focused until they’re gone.

- Forgotten subscriptions: Review monthly subscriptions and membership fees. Cancel those that don’t bring enough value to your life.

16. Avoid Comparisons

This can be a huge demotivator! Everyone’s financial journey is different. So, focus only on your progress and how far you’ve come.

17. Set Aside Fun Money

Finally, all work and no play can lead to a meltdown, breakdown, or buying binge.

To keep yourself money motivated, set aside a small amount of money to do as you wish. Perhaps this is a once-a-week coffee or a monthly outing with friends. Whatever it is, pick something that makes you feel abundant. With this strategy, can save mountains of money without feeling you’re selling your soul.

When Money Motivation Starts To Wane….

Revisit the steps above.

Stay patient and focused on your progress. Stick with it and you’ll see the benefits of your hard work!

Free Money Saving Motivation Checklist

Use the money motivation checklist to stay on track. Or make your own with a blank copy! Grab access below!

*You can use this checklist on your phone without printing it off! View the pdf on your phone and take a screenshot. In the photos app, use the “edit” feature to check off items as you do them each day.

25 Motivation To Save Money Quotes

Finally, here are words of money motivation that inspire and move you toward positive action.

1. “The more you learn, the more you earn.” – Warren Buffett

2.”It does not matter how slowly you go, as long as you do not stop.” – Confucius

3. “Your income is directly related to your philosophy, not the economy.” – Jim Rohn

4. “It’s not about having it all. It’s about having what you value most.” – Jean Chatzky

5. “The only thing that stands between you and your dream is the will to try and the belief that it is actually possible.” – Joel Brown

6. “Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” – Ayn Rand

7. “The goal isn’t more money. The goal is living life on your terms.” – Chris Brogan

8. “Every day is a bank account, and time is our currency. No one is rich, no one is poor; we’ve got 24 hours each.” – Christopher Rice

9. “If you don’t value your time, neither will others. Stop giving away your time and talents. Value what you know & start charging for it.” -Kim Garst

10. “The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.” -T.T. Munger

11. “Money is a terrible master but an excellent servant.” –P.T. Barnum

12. “Before you speak, listen. Before you write, think. Before you spend, earn. Before you invest, investigate. Before you criticize, wait. Before you pray, forgive. Before you quit, try. Before you retire, save. Before you die, give.” -William A. Ward

13. “Money is multiplied in practical value depending on the number of W’s you control in your life: what you do, when you do it, where you do it, and with whom you do it.” – Tim Ferriss

14. “Rich people have small TVs and big libraries, and poor people have small libraries and big TVs.” -Zig Ziglar

15. “The only limit to our realization of tomorrow will be our doubts of today.” – Franklin D. Roosevelt

16. “The best investment you can make is in yourself.” – Warren Buffett

17. “You can only become truly accomplished at something you love. Don’t make money your goal. Instead, pursue the things you love doing, and then do them so well that people can’t take their eyes off you.” -Maya Angelou

18. “An investment in knowledge pays the best interest.” -Benjamin Franklin

19. “Don’t work for money, let money work for you.” – Robert Kiyosaki

20. “Opportunity is missed by most people because it is dressed in overalls and looks like work.” -Thomas Edison

21. “Empty pockets never held anyone back. Only empty heads and empty hearts can do that.” -Norman Vincent Peale

22. “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

23. “Money is usually attracted, not pursued.” – Jim Rohn

24. “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” -Robert Kiyosaki

25. “Formal education will make you a living; self-education will make you a fortune.” – Jim Rohn

What’s Next?

I leave you with the thoughts of Steve Jobs. These words of motivation inspire me financially and personally if I wander off the path. Plus, they remind us that real change is often seen as “crazy.” And that’s perfectly ok.

“Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules. And they have no respect for the status quo. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do is ignore them. Because they change things…And while some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.”

Steve Jobs