10 Best Ways to Get Emergency Cash Immediately (2024)

Learn the best ways to find emergency cash immediately, the dangers of fast easy pay and cash instant loans, and how you can prevent needing immediate cash in the future.

Have you ever found yourself footing the bill for an unexpected expense? Maybe your cat needs emergency surgery or your A/C went out on the hottest day of the year. This can leave you short on cash, searching for solutions.

Key Takeaway: In those ‘I need money now’ emergencies, it can be hard to see clearly. Before you resort to predatory loans, evaluate your situation. Avoiding high interest rates protects your hard-earned financial stability.

How Can You Get Instant Cash?

If you’re stuck asking yourself, “How can I get instant money for an emergency?,” you have options. Some of them don’t come with many side effects. All you need to do is replenish the funds spent. In contrast, others aren’t in your best interest and can leave you paying stiff interest rates for months.

Here are the emergency cash immediately options you have.

1. Use Extra Cash On Hand – If you have a savings or checking account with extra funds, you should tap into these first. Excess cash, like an emergency fund, can be used easily when you need cash immediately.

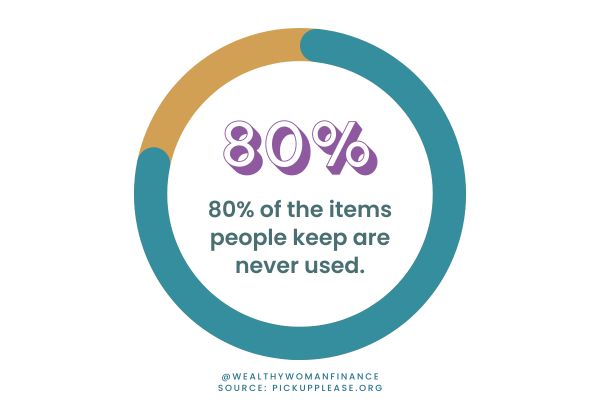

2. Sell Things You Own – Most of us have things that we don’t use. Sell items on Facebook Marketplace or hold a garage sale to put cash in your pocket quickly.

3. Cut Your Budget – Try a no spend weekend or low spend week if you have a little time to come up with the money.

4. Get Creative to Find Money – When you need emergency cash immediately, it pays to think outside the box. Could you use cash back rewards that you’ve built up? Or sell investments that you own? (Check if selling retirement assets comes with a penalty first). Where else might you have money to use?

5. Bill Deferral – If you have cash coming in, reach out and try to defer some bills. Although you might be subject to late fees, these can be less than the APR associated with credit card advances and payday loans.

6. Personal Loans – Personal loans are short-term loans taken out through a financial institution. There are set repayment terms, with interest. This process does involve a credit check, but generally retains lower interest rates compared to payday loans.

7. Home Equity Loans – If you’ve built up equity in your home, you can take out a home equity loan. Like personal loans, these do need to be repaid with interest.

8. Credit Card Cash Advance – Many credit cards offer cash advances. There is a limit on how much cash you can advance, and APRs can be as high as 30% (source).

9. Payday Loans – Payday loans are short-term loans that require you to repay the amount when payday rolls around, with interest. Payday loans have high-interest rates, upwards of 400% APR.

10. Friends and Family – Close friends and family members might be willing to lend you money.

How best to get immediate cash depends on your financial and personal situation. But keep reading to learn the best and worst options for most.

Dangers in Easy Cash Loans and Cash Instant Loans

Hundreds of emergency cash immediately apps lure you in with blanket promises, like same-day funding and easy repayment terms. But what fast cash and no credit check providers don’t tell you about is the astronomical interest rates.

Payday loans can have interest rates as high as 400% APR with additional finance charges tacked on to your loan.

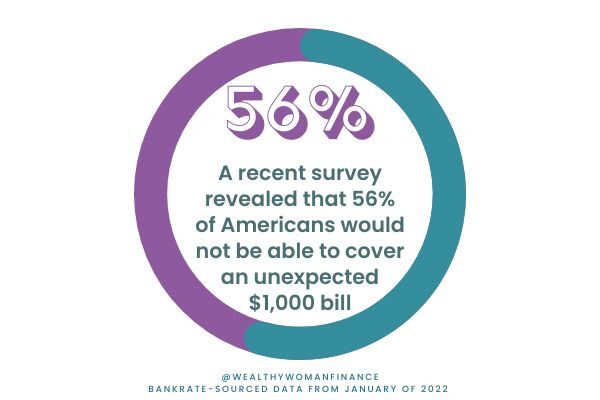

This means for a $1,000 payday loan that you repay in two weeks, you could end up paying nearly $1,700. If you don’t repay the loan ASAP, your interest will continue to climb, leading to potential wage garnishments and liens.

Companies promoting immediate emergency cash for those with bad credit and no job can have long-term detrimental effects on your finances.

Which Emergency Cash Immediately Option is Best?

Considering the dangers of payday loans and instant cash loans, how do you choose which option is best for you? Use these steps!

1. Use Your Own Money First

If you have the cash in savings, that should be the first place you look for immediate emergency cash. Even if your savings only cover a portion of what you need, it’s better than having to borrow the entire amount.

This includes an emergency fund, but it can also be savings for a house downpayment, car, or vacation. You will save yourself money by slowly replenishing your accounts rather than paying high interest rates.

2. Look at when you need the cash

Things to consider:

- Home equity loans and personal loans can take a week or two to process. If you need cash immediately, this might not be a viable solution.

- Do you just need cash to hold you over until next week?

In this case, could you ask your landlord if you can pay a week late? Or reach out to your utility company to defer your bill for a few days? If you have the money coming in, it doesn’t make sense to take out a payday loan and pay high interest.

3. Contemplate the big picture

Scrutinize how your action will affect your overall finances and life. For example, borrowing from friends and family may be a quick and easy option, but it can also damage relationships.

Zone out and picture the cause and effect of your decision 5 months from now. Imagine how you will feel. Will your future self be happy with the decision you made?

Related: Make a Money Vision Board

How to Prevent Needing Cash Immediately

No one can predict the future. But there are steps you can take to turn many potential mountains into mole hills. Next time an emergency occurs, instead of feeling desperate, you’ll feel calm and in control.

- Make a 50 30 20 budget to lower your spending.

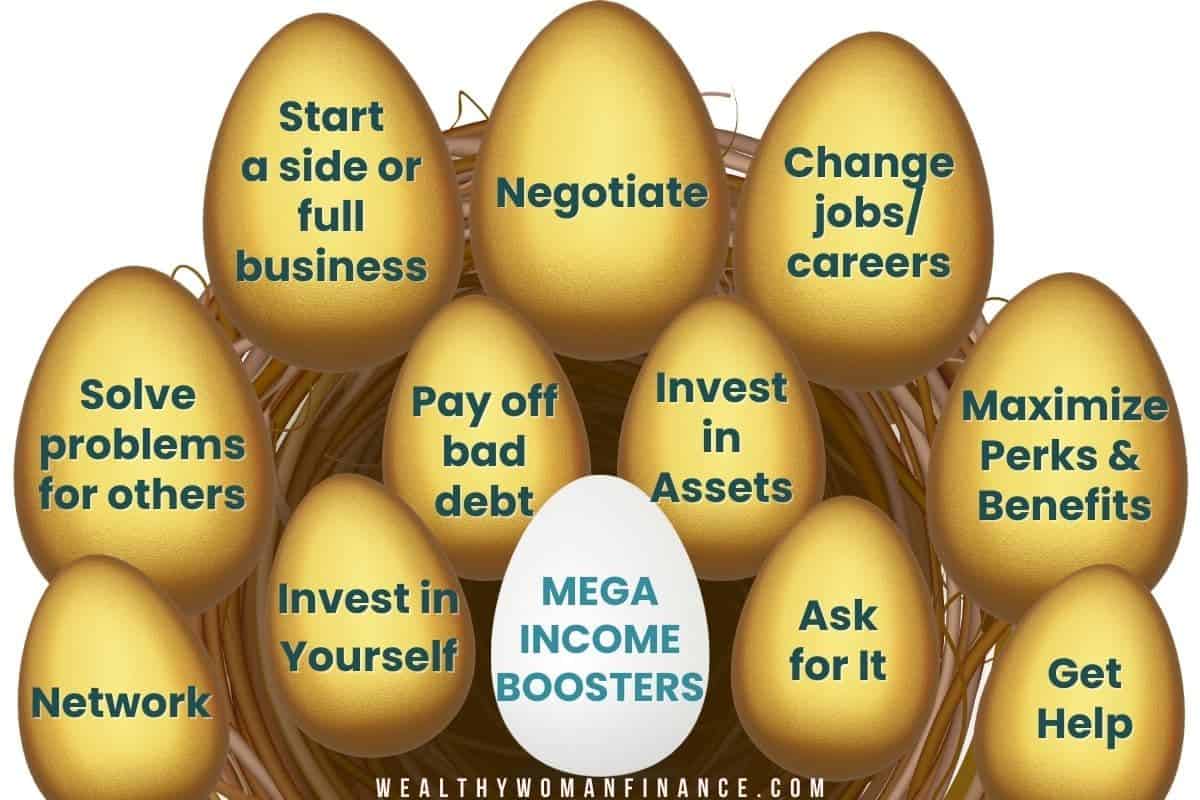

- Work to increase your income. By improving both spending and income, you will make it 10x easier to live below your means and have cash flow each week.

- Save your new cash flow in an emergency fund. (Try this fun emergency fund challenge.)

Typically, a solid emergency fund contains around six months of your operating expenses. If you spend $3,000 a month on average, you will have about $18,000 in an emergency fund.

Utilize emergency funds when you need cash immediately. Women often hesitate to tap into the funds they worked so hard to build. Think about the trade-offs. How much will it cost you to take out a payday loan? Is it worth racking up significant interest?

Related:

Evaluate Your Emergency Cash Immediately Options

Before you take to Google and search “emergency cash immediately near me” or “payday loan near me,” evaluate your situation.

Don’t automatically resort to predatory loans because they pop up first in your search results. You don’t want to negatively impact your financial future when you’ve worked so diligently to get where you are.

What’s Next?

Keep learning! You’ll build a financial future that feels inspired and free. Check out these articles next: