How to Save $5000 in 3 Months (Go Big in 2024)

Learn how to save $5000 in 3 months with this simple, actionable guide!

What would you do with $5,000? Would you…

- unlock the debt handcuffs?

- embark on a traveling journey?

- invest in brighter days?

In 3 months, you can do this! Whether you need to turn around your financial situation or you’re up for a challenge, saving $5,000 in 3 months is doable! All it takes is a clear plan and a little support along the way.

Understand Where You Are Now

First, evaluate your financial situation.

- Start by making a list of your income sources and expenses. Then, group your expenses into needs vs wants.

Once your list is complete, compare your total income to your total expenses. To save aggressively, you’ll want a solid gap. Keep reading for tips on how to make that gap grow!

Break Down Your $5,000 Goal

Now you’re ready to save $5,000 in 3 months. But to make it more practical, break the goal down into smaller, more manageable targets:

Here’s a great calculator result:

| Amount per month ($5,000 ÷ 3 months) | $1,667 per month |

| Amount biweekly ($1,667 ÷ 2 times a month) | $834 every two weeks |

| Amount per week ($1,667 ÷ 4 weeks) | $417 per week |

*The biweekly number is helpful if you get a paycheck every two weeks.

Create a Realistic Budget

Now you know where you are and where you want to be. It’s time to set a plan for how to get there.

To save $5,000 in 3 months, set a realistic budget. You can use a percentage-based system to help guide you:

Or try a zero based budget plan to help get where you need to go.

It can also be helpful to use expense-tracking tools like Mint and YNAB. They categorize and monitor your spending. So it’s much easier to know where your money is going.

10 Tips to Creatively Cut costs

3 months is a short deadline. These key actions will get you from 0 to $5,000 before you can say “Let’s make the monopoly man jealous.”

1. Cancel unused subscriptions. One of the most profitable business models in history is the subscription-based model. Why? Because people forget what they are paying for and keep it going for months. Evaluate which services you actually use and cut out the rest.

What if you did a digital detox? Could you go just 3 months without this extra stuff? After three months, you’ve likely saved a boatload and you can add back anything you missed.

2. Automate savings. Paying yourself first is the smartest decision you can make when saving more money.

Set up recurring deposits that transfer money from your checking account to your savings account for the weekly or biweekly amount above. By automating your savings, you’re keeping yourself accountable and making saving a habit. This helps you reach your goal of saving $5,000 in 3 months without herculean willpower.

3. Shop smarter for groceries. Look for sales, use coupons, and buy in bulk if it’s something you know you’ll use. Switching grocery stores can also save hundreds.

Warning: Buying in bulk is not always cheaper! My family got into the bad habit of buying junk food (we ate more empty calories) and stuff we didn’t use in time. It wasn’t until we made a specific list of the stuff we should buy in bulk that warehouse shopping became a money saver.

4. Have fun for cheap or free. Find affordable things to do in your area that don’t break the budget.

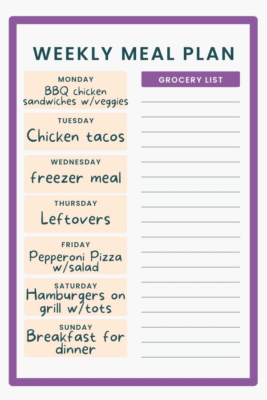

5. Limit Dining Out. Cook more meals at home and reserve dining out for special occasions. Create a rotating meal plan for every week or two to make this much easier. Or try this monthly meal plan.

6. Consider carpooling or public transportation. It saves money and gives you time to do other things while someone else drives. Walking or biking to work can also save money while improving your health.

7. Compare prices. For larger items, compare prices from different retailers before making a purchase. You can also utilize seasonal promotions and cashback websites.

Related: Car Buying Checklist (+ best times to buy)

8. Track your expenses to find patterns in your spending. Maybe you find that you tend to impulse buy on Saturdays because that’s when you get a great sales email from your favorite store. That’s good to know! You can make tweaks depending on what you find.

9. Create useful daily rules. Last year, I decided that I wouldn’t impulse buy sweet treats at the store anymore. This rule made me healthier and saved money. But even better, it stopped the internal battle I was having every time I saw those tasty goods.

Rules can help you by relying on structure instead of willpower. They can improve your life in countless ways.

Here are a few other examples:

- My family’s Netflix rule. We enjoy Netflix from October through March. During the warmer months, we’re busy or outside and cancel it.

- Wednesday Starbucks rule: You treat yourself to a coffee on hump day. It’s a fun treat! The rest of the week you make coffee at home.

Related: Stop Buying Stuff You Don’t Need

10. Don’t forget fixed expenses too. These can be extremely rewarding! Sometimes all it takes is one change to lower a monthly bill for months and years.

- Use energy-efficient appliances and LED bulbs

- Call to see if you can get a discount on utilities or insurance. Or switch to a different plan

5 Ways to Raise Income

Next, these will help increase your cash flow without having to make drastic changes, like changing jobs or careers.

1. Negotiate a Raise. Before approaching your employer, research average salaries for your position.

- Prepare a list of your contributions and ways you’ve made a positive impact.

- Practice your negotiation skills by role-playing with a friend or family member.

2. Earn extra money on the side. Try a side hustle, freelancing, or resell items for profit. Today’s gig economy makes it easier than ever to find a flexible side hustle.

Related: Make an Extra $300 Fast

3. Put money in a high-interest savings account. Look for banks with high rates, no fees, and low deposit requirements.

4. Build an emergency fund. It’s a safety net for when unexpected expenses arise. Since you won’t have to go into debt when something happens, you’ll be increasing your income.

Build your emergency fund to cover at least 3 to 6 months of living expenses.

*Paying off debt can also considerably raise your cash flow!

5. Maximize job perks and benefits. Use an FSA if you have it, instead of paying out of pocket. And take advantage of employee discounts and 401K retirement matches. Make sure that you’re utilizing the money that’s already available to you.

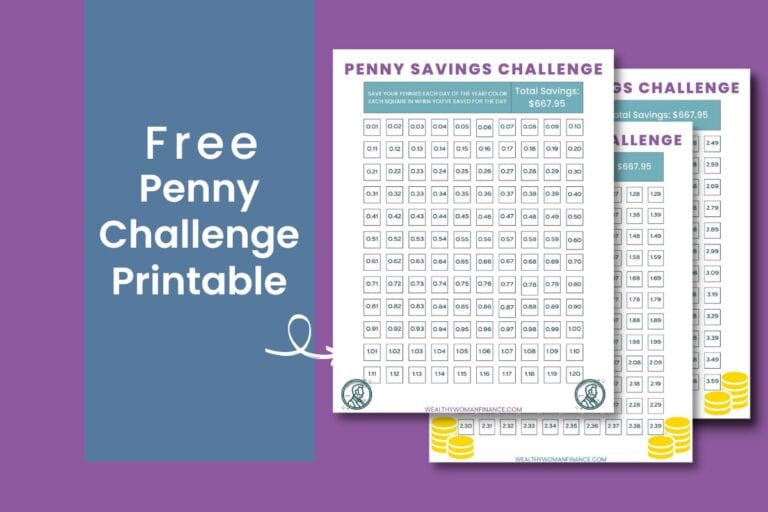

How to save $5000 in 3 months with 100 envelopes

Using money in cash can be an excellent savings strategy to save $5000 in 3 months. It helps to SEE your money. Use the 100 envelope challenge pdf with this!

Stay Focused to Save $5,000 in 3 Months

The key to achieving any savings goal is to adjust as necessary and stay determined. Use these tips to stay in the game until your big goal is realized!

Find a Partner

Grab a friend or family member and build a support system around your goal. Fill out this free commitment card and you’ll be well on your way.

Add An Element of Play

In Adam Grant’s new book, Hidden Potential, he discusses the importance of deliberate play in keeping you from burnout. Beginners turn into experts when skill-building stays interesting.

Incorporate this idea by coming up with smaller money challenges, fun money games, and adding variety into your routine.

Track Your Progress

To stay motivated while saving $5,000 in 3 months, create a simple chart and update it weekly with your milestones. The visual will help you see how much closer you are getting to your goal. It’s simple but effective!

Use the Motivation Checklist

Related: Great Self Discipline Examples

Reward Milestones

The process of saving can be challenging. Reward yourself with affordable treats for every $1,000 you save.

Here are fun ideas:

- going for a scenic hike or bike ride

- taking yourself out for a coffee

- taking the night off from responsibilities

- relaxing in the bath with your favorite scented candles

- splurging on a few ingredients for a fun meal at home

Common Q&As to Save $5000 in 3 Months

What’s Next?

Challenge Yourself! Start now! It’s three months of figuring it out (which you are highly capable of doing) and then you’ll have a bank account so buff, it’ll be flexing on its own!

“The best time to plant a tree is 20 years ago. The second-best time is now.”

Proverb