15 Fun Ideas For Saving Money in a Jar (2024)

Do you find it difficult to save money? Saving is how we achieve goals and improve quality of life. But even though we know this, it can be hard to put it into practice.

Saving your money in a jar is easy to do, satisfying, and fun. Even on your worst weeks, you can put a few coins in the jar. And in three months, you’ll love carrying that heavy jar to the bank. Then counting your bills.

In this article, learn 15 creative ways to save spare change using a money jar.

Small amounts saved daily add up to huge investments in the end.

― Margo Vader

Why a Money Savings Jar?

Yes, you can save money in a bank account (and you should!). But often that’s abstract and easy to forget about. Saving in a money jar has many hidden benefits.

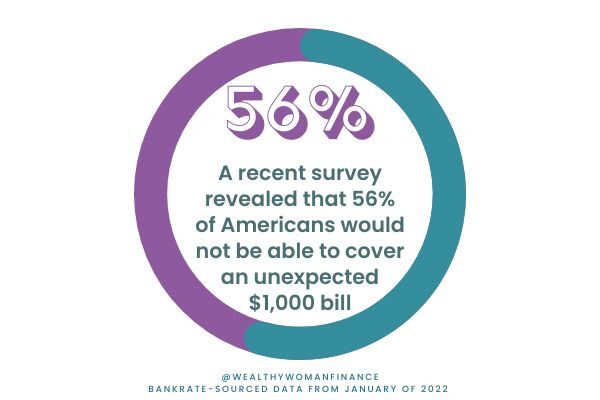

Protect Yourself

Do you have enough to cover a dishwasher repair or replace a tire? By having money set aside, you can keep yourself from going into debt when life throws you a curve ball.

Curb Your Impulse Spending

While credit cards make it easy, they also make it easy to spend. “Buy now, pay later” is a tempting siren.

In fact, studies show that we spend more with credit. Probably because without physical money in your hands, it’s hard to feel like you’re even spending.

So, if you convert more of your money to cash, you’ll most likely spend less overall.

Create a Lifelong Habit

Not only does a money jar provide a place to store your spare change, it also offers a visual of your savings progress. This is motivating!

As each day passes, you build the habit of saving. Sure, it’s not a million dollars, but every little bit adds up over time.

Reach Your Money Goals Faster

As time passes, you’ll be surprised at how quickly your savings can add up. This gets you moving toward your beautiful money dreams.

Imagine you’re growing a tree. It starts as a tiny seedling, and each day it gets slightly bigger. It takes time, sun, and rain. And you don’t notice much for long periods. But one day, suddenly, it shades your whole backyard.

Teach Your Kids About Saving

If you have children, saving money in a jar is a great way to teach them about how money adds up when you save consistently. It also opens up conversations about what to do with your money once you have filled up the jar.

Quick Tips for Saving In a Money Jar

For a savings jar to be effective, you have to be consistent. If you only ever drop coins into the jar once in a while, it could take years before you’ve saved up enough to meet your goal. Here’s how to avoid that!

Set a Clear Goal

One easy way to make the most of your money jar is to set a specific savings goal and break it down into monthly or weekly targets. Then set a specific date when you will count your savings. This will help you stay motivated and on track.

Make It a Group Effort

Encourage your family members, friends, or roommates to participate by adding their spare change to the jar. This will not only help you reach your savings goals faster but will also keep you accountable.

Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.

– James W. Frick

15 Money Jar Ideas to Save Spare Change

These ideas are both practical and fun. They’ll help you decide how to use your money savings jar.

Pro Tip: If you’re saving up for a specific thing, add fun pictures and notes to the outside of the jar for motivation!

1. Adventure Fund Jar

If you want to try something new, like bungee jumping or skydiving, create an adventure fund jar and start saving up.

2. Travel Fund Jar

A great way to save up for your next trip is a travel fund jar. Every time you have spare change, add it to the jar. Every bit helps when it comes to travel expenses.

3. Holiday Fund Jar

Save your cash for an upcoming holiday celebration or birthday. When you want to splurge, you won’t have to fret over the money.

Get great tips for your holiday fund. >>

4. Disney Savings Jar

Plan your trip to Disneyland or Disney World with a Disney savings jar. Every time you add money to the jar, you’ll be one step closer to a magical experience.

5. Date Night Jar

Keep the romance alive by creating a date night jar. Every time you have spare change, add it to the jar, then use the funds for a special date night with your partner.

6. Entertainment Fund Jar

With the money you save in an entertainment fund jar you can buy concert tickets, go to the movies, or attend sporting events without dipping into your regular savings.

Or check out these cheap and free things to do >>

7. Emergency Fund Jar

It’s always a good idea to have money set aside for an immediate cash emergency. Use an emergency fund jar to help build up 3 to 6 months’ worth.

8. Swear Jar

If you’re someone who needs a little motivation to break the habit of cursing, use a swear jar. Every time you swear, add $5, $10, or even $20 to the jar. You’ll stop cursing and save money at the same time!

9. Savings Challenge Jar

If you love a challenge, a savings challenge jar is a great way to save extra cash fast. Set a goal and a timeframe beforehand.

Try one of these awesome free printable challenges:

10. Round-Up Savings Jar

Many banks offer round-up savings programs. Every time you make a purchase, the total is rounded up to the nearest dollar, and the difference is transferred to a savings account.

If your bank doesn’t offer this, create your own round-up savings jar and transfer the difference yourself.

11. Saving Found Money In a Jar

Whenever you…

- find money on the ground

- find money in your car

- find money in a cushion or pocket

- receive unexpected cash

Save it in a jar instead of spending it. You’ll be surprised at how quickly your coin savings jar adds up.

12. Time Capsule Savings Jar

A time capsule savings jar is a great way to save up for a specific event in the future, like an anniversary, wedding, or graduation.

13. Wish List Jar

Make a list of items you want to purchase in the future. Every time you have spare change, add it to the wish list jar until you can afford the items on your list.

14. DIY Savings Jar

If you’re someone who loves to be creative and take on DIY projects, use a DIY savings jar to save up for all the supplies you need for your next project.

15. Saving Money in a Charity Jar

A charity jar is a great way to donate to a cause close to your heart. Every time you have spare change, add it to the jar. Then donate the money to your favorite charity or organization.

Saving Money in a Jar: Next Level

Ready to take it up a notch? Get creative with your cash and coins!

The 3-Jar Method

The 3 jar system is a popular way to teach budgeting to kids.

- Give your child (or yourself) three jars.

- Label them saving, spending, and giving.

- Divide the money out based on how much you want to put in each.

Related: Best Money Books For Kids & Best Ideas For Teens to Make Money

The 5 Money Jar Method

This method is for adults and is a fun way to save for multiple things at once. It’s like having visual sinking fund categories. Choose the categories that fit your lifestyle and goals.

Do You Have to Use a Money Jar?

No! Mason jars are cheap, and you may already own one. But you can also use a piggy bank, bottle, or money box.

What’s Next?

Coin jars provide a visual of your progress, and make saving money exciting.

To use savings jars effectively, remember to set clear financial goals, be consistent, and make it a team effort. Try a percentage budget, like the 30 30 30 10 budget to help you.

With these tips, you will be on your way to achieving your savings goals in no time. So, which of these money jar ideas will you try out first?

Grab access to the free resource library below for lots of free goodies and tips.

You must gain control over your money or the lack of it will forever control you.

– Dave Ramsey