How to Build Your Holiday Fund (Save Big By Christmas)

Have you ever worried about how you’ll afford everything during the holiday season? You aren’t alone. Holidays are filled with family, friends, and fun. But they can also be expensive.

According to a Lending Tree survey, 35% of people took on debt from holiday spending in 2022. The average amount was $1,549 – the highest since the survey began.

With gifts, parties, and travel expenses, it’s enough to make anyone nervous. That’s why you need a holiday fund. Imagine how amazing it will feel when you’re using your stash instead of stressing about the bills.

In this article, learn how to build a holiday fund that works for you, even if you’ve struggled in the past.

Because the holidays will be here before you can say “ho, ho, ho.”

What is a holiday fund?

A holiday fund is a specific savings account for holiday-related expenses. It’s a way to save money throughout the year so that you don’t have to scramble to come up with enough money when the holiday season arrives.

How do I create a holiday fund?

Creating a holiday fund is easy.

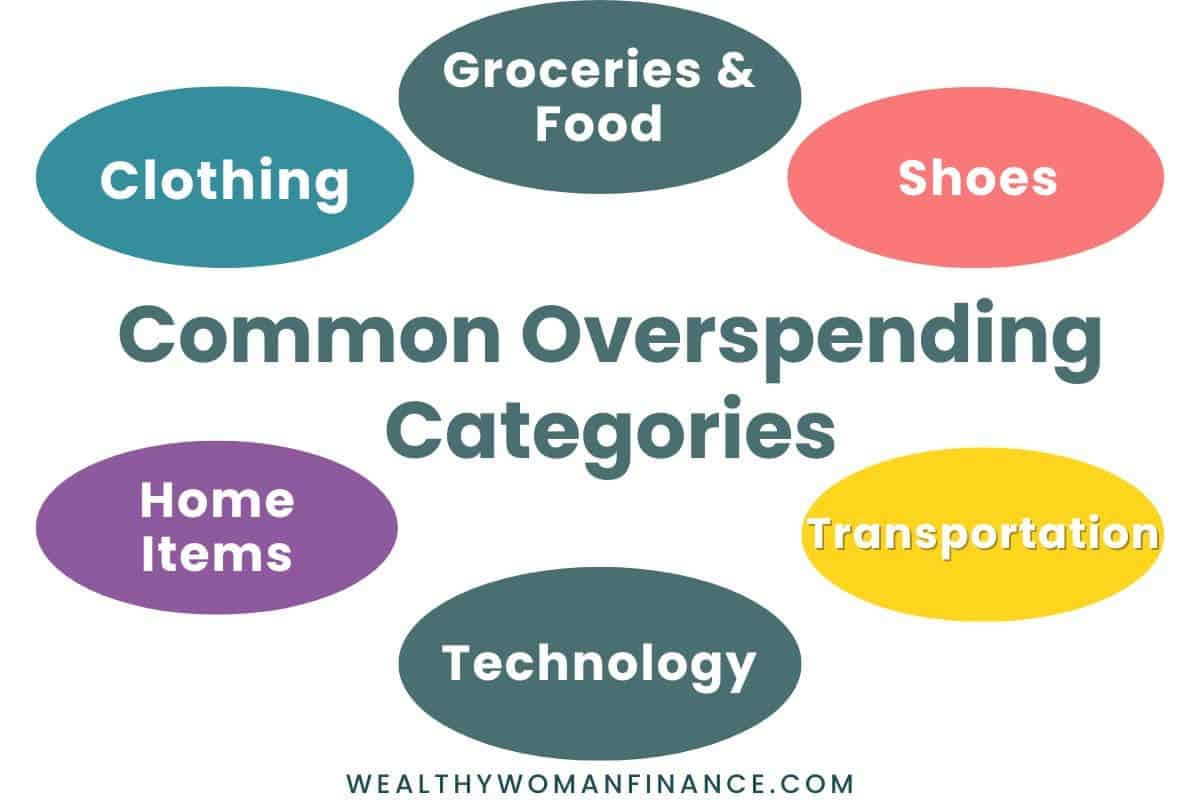

1. Create a holiday budget. Add up gifts, travel, decorations, food, and any miscellaneous expenses that might come up. Look at your last holiday season expenses to help you.

2. Divide the total of your holiday budget by how many months you have to save. If it’s a year, you will divide by 12. If it’s 3 months, you will divide by 3. Here’s an example:

$1200 (holiday budget) / 4 months (to save) = $300 a month

3. Set up a separate savings account specifically for your holiday fund. Give it a nickname that motivates you.

4. Finally, set up an automatic transfer to your holiday fund or sinking fund category. Then, watch your savings grow.

How does a holiday savings account work?

A holiday savings account works like any other savings account, except that it’s reserved specifically for holiday-related expenses.

You can deposit money into the account throughout the year, and then withdraw the funds when you need them to cover holiday costs.

Why You Should Build a Holiday Fund

A holiday fund has many benefits – some of which are hidden.

You Spread It Out

First, you cover the costs of the holiday season over the entire year, making it easier to manage. This can help you avoid dipping into your emergency fund or going into debt.

It also makes it easier to take advantage of sales and discounts throughout the year, saving you even more money!

You Save Ahead For Dream Items

A holiday fund for families is a great way to save money specifically for vacations or big ticket items. By setting aside a small amount of money each month, you slowly build up a fund that allows you buy something you’ve dreamed of.

Related: Money Vision Board Ideas

You Reduce Stress

Additionally, a family fund for the holidays reduces the stress and worry that comes with this time of year. You’ll have peace of mind knowing that you have the money ready. And that’s priceless!

You Build Stronger Habits

Saving a little bit at a time adds up to big money over time. But it also strengthens your habit-building muscle. Once you get into the groove of saving, you’ll be able to build wealth for life.

8 Tips for Building a Full Holiday Fund

Whether you’re planning for holiday travel or just want to have extra cash for gifts and decorations, it’s never too early to start saving. The following are the best tips to help you build up your holiday fund.

Holiday Fund Money Box

Find a box or money jar. Decorate it how you’d like, and start putting in your spare change at the end of each day. It might not seem like much at first, but over time, your holiday fund money box will add up.

It will feel painless. Plus, it is a great way to get your entire family involved with you.

Shop Around For a Holiday Savings Club Account

Many credit unions and banks offer special savings accounts just for holiday funds. These accounts (sometimes referred to as Christmas Club accounts) often come with higher interest rates. Some even offer special rewards or bonuses if you reach your savings goal.

Try the Christmas Savings Challenge

Use our free Christmas savings challenge printable to supercharge your efforts and get you excited about hitting your goal. Keep it on your fridge!

Make a Plan

Creating a holiday budget is the easy part. The difficult part is saving the money each month. So, make a plan for how this will happen.

What recurring expenses can you cut? Can you make extra money?

Learn creative ways to save and stick to the process.

Pro Tip: Don’t underestimate your budget. Small, unexpected expenses add up! Consider building a margin of error into your estimations.

Earmark Windfalls

Tax refunds, money from relatives, bonuses, insurance refunds, and credit card reward points are all ways that you can boost your holiday fund without sacrificing in your monthly budget.

Pro Tip: Consider a cashback credit card (pay it off monthly!) and then use the cashback for the holiday fund.

Earn Extra on the Side

A side hustle or passive income can be all you need to grow your holiday fund. Think about what you love or what you are good at. Can you turn a hobby into a money-making opportunity?

Related:

Try Another Type of Challenge

Money challenges are motivating because they give you a push toward what matters most. Jumpstart your holiday fund progress by trying a short no spend challenge or a longer low spend challenge.

See how long you can go without impulse buying something you don’t need.

Or make savings fun with our free money saving games. Grab access below!

Declutter and Sell Stuff

Not only do most of us NOT use what’s in our homes, but all that stuff makes us work harder to keep them clean! Make room for your holiday stuff later and put cash in your pocket that goes toward your holiday fund at the same time. It’s a win-win!

Also, check out Minimalist Christmas Gifts and Tips to keep the clutter out and save money.

F&Q About Holiday Savings Funds

What if you’re in debt? Is it Still possible to build a holiday fund?

Yes! If anything, it’s even more important! A holiday fund is a great way to avoid more debt during the holidays. While it’s important to pay down debt before saving for frivolous expenses, you can work towards both goals.

And if you’re saying to yourself “There’s no way I can save enough money!” you are letting your limiting money beliefs get in the way of your financial freedom.

‘He (or she) who has a why can endure any how.

German philosopher, Frederick Nietzsche

Is a Holiday Fund Only for Christmas?

No, a holiday fund doesn’t have to be just for Christmas. You can use it to save for any holiday-related expenses including Halloween, birthdays, Valentine’s Day, and more.

Is it too late for this year?

It’s never too late to start a holiday fund! While it’s ideal to start saving at the beginning of the year, you can start at any time. And even if you can’t get the full amount by the holidays, any amount that you DO save makes you better off.

Should I Spend All of the Holiday Fund? What if there’s some left over?

Don’t go out of your way to spend all of the holiday fund. Any money left over will go towards the next holiday.

What’s Next?

Every little bit counts. And everyone can do it.

Building your holiday fund is a great way to take control of your finances and avoid the stress of holiday-related expenses. By setting a realistic savings goal, automatic transfers, and looking for ways to save money throughout the year, you can build a holiday fund that will help you enjoy the holiday season without breaking the bank.