No Spend Challenge: How To Thrive For a Week or Month in 2024

Do you want to take control of your finances and save money? Do the No Spend Challenge for a day, week, or month!

While it may seem drastic, you’ll find many ways to make it easier in today’s article.

Plus, it is extremely effective at shaking up your routine so you can see your spending clearly. You finally stop bad habits in their tracks. And there aren’t many other challenges that give you such a turnaround.

So, if you need a breather or to re-think your spending habits, the no spend challenge is for you! *And don’t miss the free printables!

What Is a No Spend Challenge?

With this unique challenge, you live a pre-set time period only purchasing essentials.

Bye bye, non-essentials.

You will cut things like:

- dining out

- shopping for clothes

- indulging in hobbies that cost money

Instead, you’ll learn to prioritize essential expenses like rent, utilities, and groceries. And identify easy areas to cut back now and in the future.

Plus, you will be able to focus on forming good habits like:

- Finding fun ways to entertain yourself for free

- Cooking your meals at home

- Using up what you have

- Tracking your spending progress and savings

The no spend challenge is not about depriving yourself. It’s about building a healthier relationship with money and learning how to better live within your means.

Embrace this challenge with the right mindset and it will be a beautiful opportunity for personal growth.

Want to save this challenge? Enter your email below and I’ll send the link straight to you.

Benefits of a No Spend Challenge

There are many advantages to doing a challenge like this. Here are a few:

Money in the Bank

When you embark on a no spend challenge, the most obvious benefit is that you’ll save money. Wahoo! With this cash comes confidence, security, optimism, and swagger.

Extra money is always a sweet perk!

You Hit Your Financial Goals Faster

This challenge allows you to redirect your money towards more important financial goals, like paying off debt or increasing your emergency fund.

Suddenly, you are making progress that you only dreamed about before.

It Forces You To Re-Think & Be Mindful

It is easy to get stuck in a rut. To live life on an automatic routine.

But if you do the no spend challenge for a week or a month, you have the opportunity to become aware and develop mindfulness around your life.

You better understand your needs which allows you to prioritize. And as you continue, you make more informed decisions about your purchases, leading to amazing long-term habits.

Environmental Impact

Finally, a no spend challenge has a positive impact on the environment.

By purchasing fewer items, you are reducing waste and product demand. Both of these help with pollution and landfill space. The challenge not only helps your wallet, but also helps the planet.

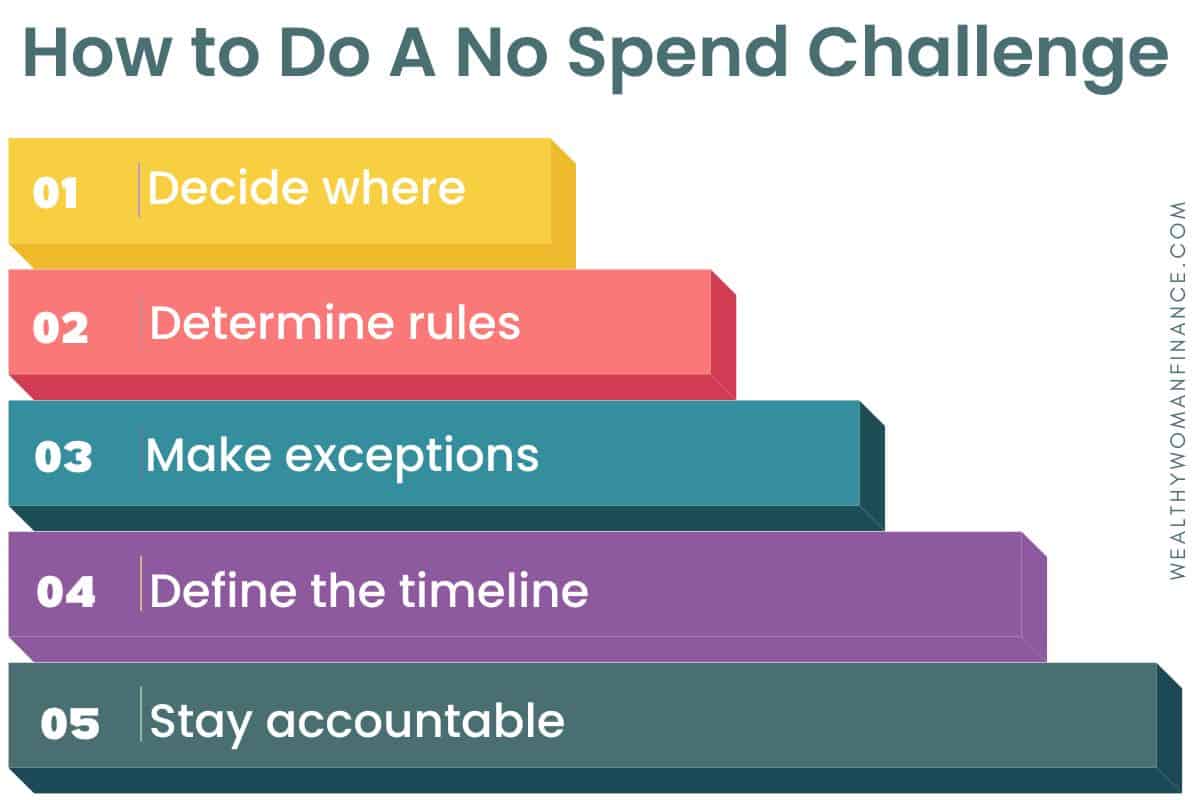

How To Do the No Spend Challenge

Next, here’s exactly how to dive in:

1. Decide Where You Want Your Post-Challenge Money to Go!

This is your biggest motivator! Be specific about why this money is going to help your future.

Will you….

- Put it towards your next trip?

- Build out your emergency fund?

- Use it as a downpayment for a house?

Related: Hidden Benefits of Saving Money

2. Determine No Spend Month Challenge Rules

Next, establish no spend challenge rules that are unique to you. Be clear at the START of the challenge about what is off-limits. Also, think about the areas where you tend to overspend and create rules to address those habits.

For example, you might:

- cut out non-essential purchases (clothing, entertainment, eating out)

- set a strict budget for groceries (so you are only buying essentials)

- cut out online shopping

- stop hair and nail visits

- drop subscription services, like streaming platforms

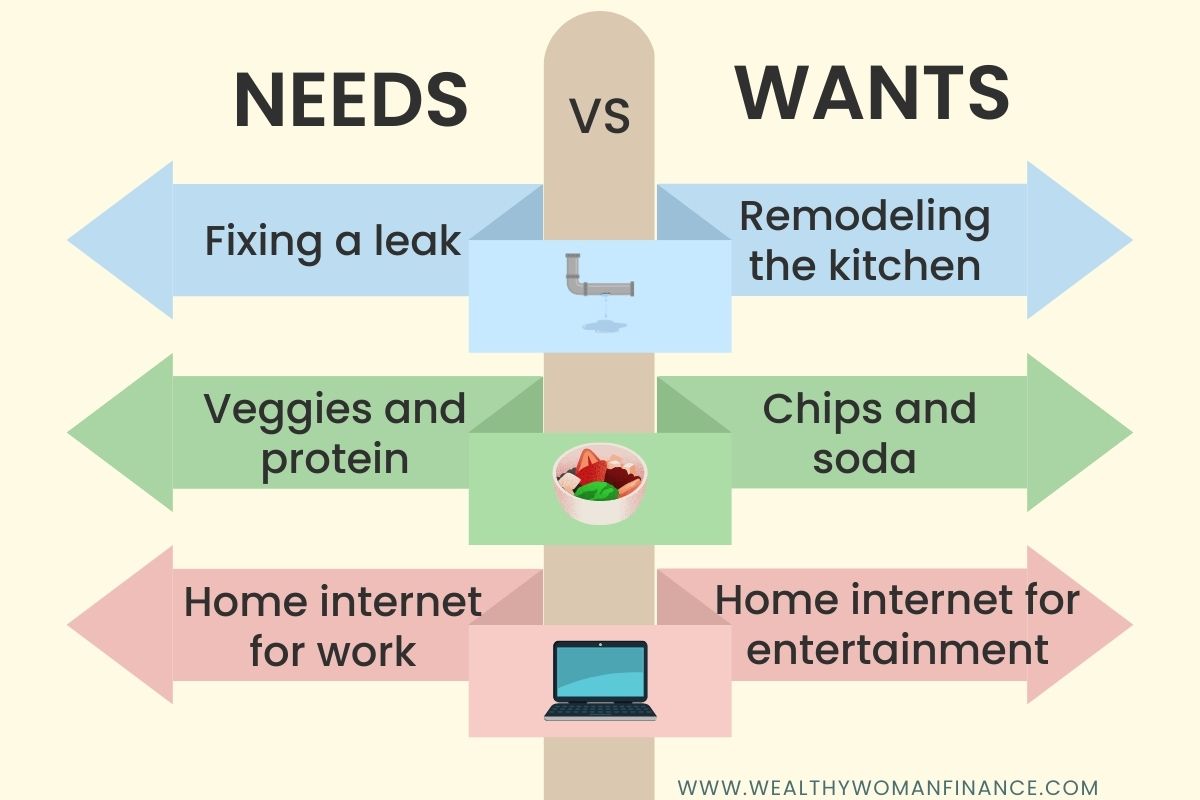

*Make a list of needs vs wants using this worksheet to help you separate essentials from non-essentials.

3. Be Clear About Exceptions

Identify any exceptions to your no spend challenge rules. These should be limited to necessities, such as:

- basic groceries

- important kids’ school activities

- healthcare expenses

- gas & any essential car

- bills

- phone/internet

By recognizing your exceptions, you avoid feeling stuck when an unexpected or ambiguous situation pops up.

4. Define Your Timeframe

Next, decide how long your no spend challenge will last. The timeframe can be any duration you want. These are the most popular:

- No Spend Weekend: A great first challenge to test the waters.

- No Spend Week Challenge: 7 days is enough time to build awareness and save serious cash.

- No Spend Month Challenge: 30 days is a commitment. But you can do hard things, my friend. And longer commitments reap the biggest rewards.

Remember, the longer you go, the better chance that you will make lasting changes to your spending habits.

5. Stay Accountable for A Week or Month Challenge

Building in accountability with this challenge will be the difference between sticking with it and flaking out. Read below for ways to make sure even the no spend month challenge is a slam dunk.

Prep Work For No Spend Week OR Month

Once you have decided on your challenge, you can set yourself up for success with a few minutes of preparation.

Make a list of Free Activities

Just because you aren’t spending money doesn’t mean you have to sit at home and stare at a wall. (Unless you want to of course!)

Maintain your social life by finding free activities in your area. And take advantage of the natural beauty around you! Parks, lakes, mountains, forest, beach – wherever you live there will be something to enjoy!

Talk to your family

Unless you live alone, you will be influenced by the people in your home. So, before the challenge, have a family meeting. In it, discuss:

- Why this no spend challenge is important to you

- How it will benefit everyone

- Get your kids involved and decide together where you’ll put your savings

- Brainstorm ways to make the no spend challenge work

Come up with a response

What will you say when your friend asks you to go out for drinks? Or your dad wants you to buy a giant bag of snickerdoodles? Try:

“I’m not spending money right now because I’m building towards ____________. But what if we __________ (give an alternative solution) instead?

By knowing what you are going to say beforehand, you take the anxiety and guesswork out of social situations.

More No Spend Challenge Tips For Success

Have a Support System

- Share your goals with friends or family and let them know the importance of this challenge to you.

- Join online communities, like no spend challenge Facebook groups, to connect with others who share your goals.

Get To The Bottom Of Your Why

Spend 5 minutes journaling about why changing your habits and saving money are so important to your future. Visualize yourself 10 years down the road with or without making changes.

Put your why on a post-it and stick it to your fridge, your desk, and your computer!

Rig Your Environment

Avoid temptation while you do the no spend challenge.

- If you notice yourself wanting to click social media ads, limit your time on the platform

- avoid browsing shopping websites

- unsubscribe from emails that get you to buy

- hide your credit cards

- only bring enough cash with you to buy your essentials

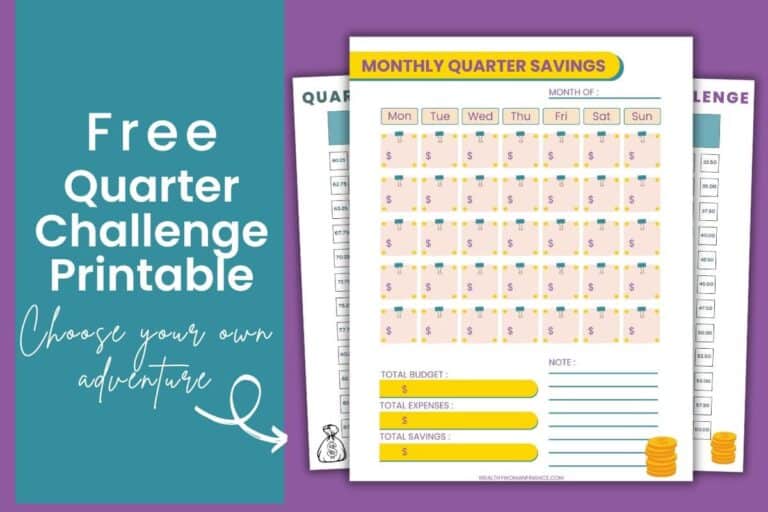

Track Your Expenses

One of the key factors in a successful no spend challenge is tracking. Start by creating a budget. This will help you identify areas to cut or eliminate spending.

During the challenge, maintain a daily or weekly log of your expenses to help you stay on track. Try budgeting tools, like spreadsheets or Mint.com, to make it easy and organized.

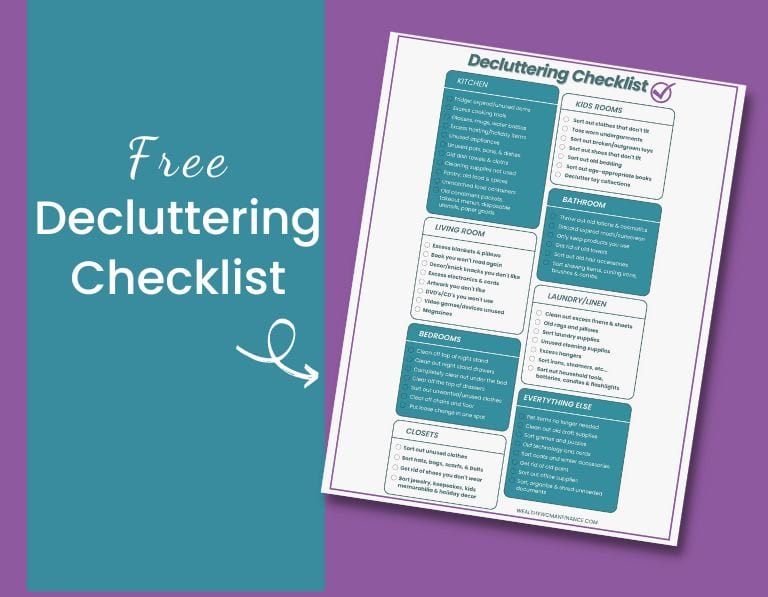

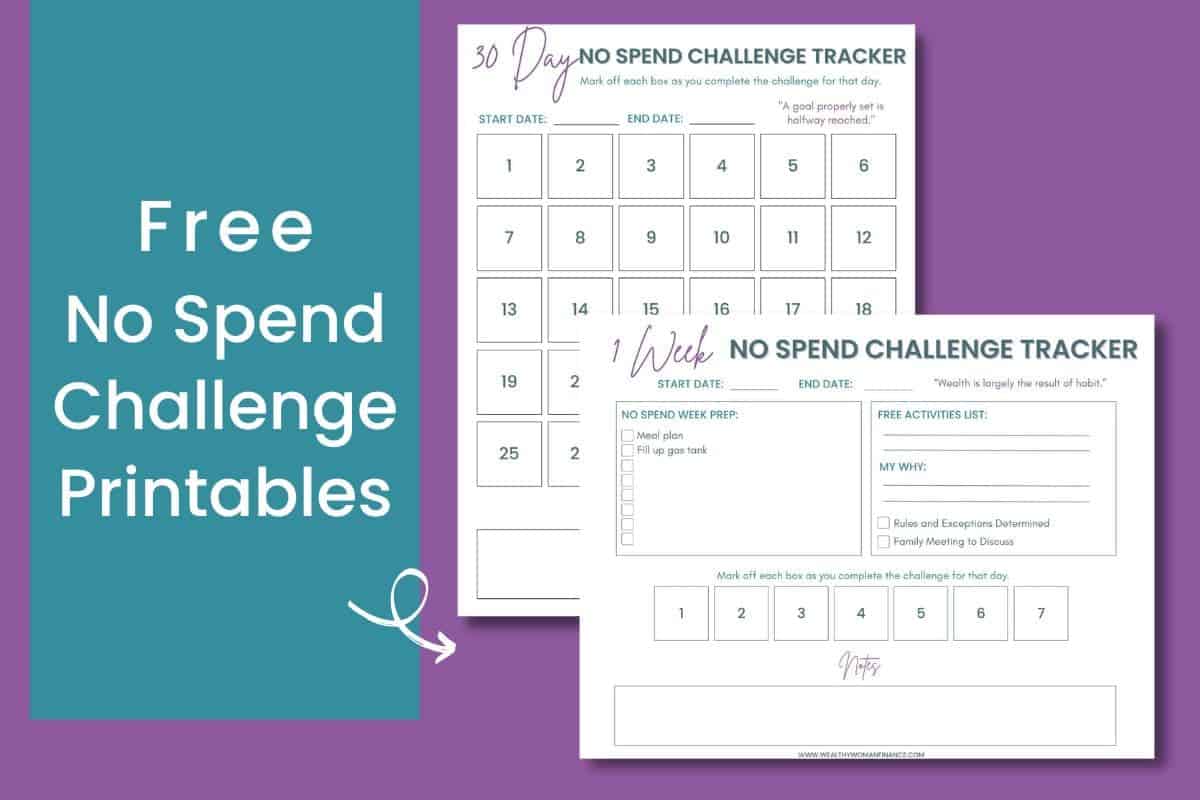

No Spend Challenge Printable

Other Great Ways to Stay Motivated

Along with your free tracker, you can measure your progress in other ways as well.

Years ago, I built the habit of waking up at 5am by putting a marble in a jar every morning for 66 days.

Or build in accountability with our custom contract that you make with yourself and a friend.

Grab the free commitment card and get started now!

How to Overcome Common Challenges

During a no-spend month challenge, you might face things that try to throw you off track.

Unexpected Expenses

To overcome these obstacles:

- Make sure you have an emergency fund or a healthy liquid net worth before starting the challenge.

- Do that prep work we talked about above.

- Be proactive by making sure your car and home are properly maintained.

Feeling Deprived

If the no spend week or month challenge feels daunting:

- Remind yourself of your why, the amazing benefits, and where you’ll be putting the money.

- Allow yourself small, budget-friendly rewards to indulge in as you proceed. This can help satisfy cravings without breaking the bank.

- Keep yourself busy with free activities or even making money (Declutter and sell stuff!)

- Change to a Low Buy Challenge instead.

You can also make a month no spend challenge easier by only doing a “no-spend” on one category.

For example, one month, we saved $200 on a no-spend alcohol challenge. Another month, we saved $500 on not eating out. (And we still eat out less!)

To Consider With The No Spend Challenge

Remember that improving your financial habits takes time and commitment. Be patient with yourself and celebrate small victories along the way.

Once you finish the no spend week or month challenge, harness that energy and your newfound self-discipline for even greater growth. What an amazing catalyst!

What’s Next?

Read: Save Money And Live Better Too

More Great Free Challenges on Wealthy Woman…

- 26 Week Savings Challenge

- Christmas Savings Challenge Printable

- Nickel Saving Challenge Template

- 6 Month Money Saving Challenge