Free 26 Week Savings Challenge Printable (save $1,000+ in 2024)

Saving money can feel like a daunting task, especially when you’re digging out of a hole or trying to build funds quickly.

This 26-week money saving challenge offers a structured approach to help you reach your money goals. You’ll gradually build your savings while creating a habit that benefits you for years to come.

Want to save this challenge? Enter your email and I’ll send the link straight to you.

What Is A 26 Week Savings Challenge?

In the 26-week money saving challenge, you put aside a pre-set amount of money each week.

And you will have a blast watching your money grow steadily!

This is where the real power of the challenge lies:

- 26 weeks is long enough to give yourself a sizable savings boost.

- you’re building precious momentum.

- the challenge gives you enough flexibility to both plan ahead and improvise.

By the end of the 26 weeks, you will have saved over $1,000 or $5,000 without feeling overwhelmed by large weekly deposits.

$1000 26 week savings challenge:

- Weekly Deposit: $39

$5000 26 week challenge:

- Weekly Deposit: $193

Key Takeaway: By breaking down your savings goals into manageable increments, you are better equipped to reach your financial dreams.

Now, this 26 Week Money Saving Challenge is also customizable to fit your financial situation and goals (see printables below). You can adjust the starting amount or increase the increments to suit your needs.

What You Can Use The Challenge Money For

Just think of all the great things you can use your challenge money for! Whether you are saving $1,000 or more, start dreaming now!

Here are a few ideas for your cash stash:

- Put it in your holiday fund for Xmas gifts & travel

- That dream vacation to Europe

- Building a 6-month emergency fund

- Bumping up your retirement or college savings

- Buying a new or used car

- Starting a business

*Find a great list of things to save up for for more ideas >>

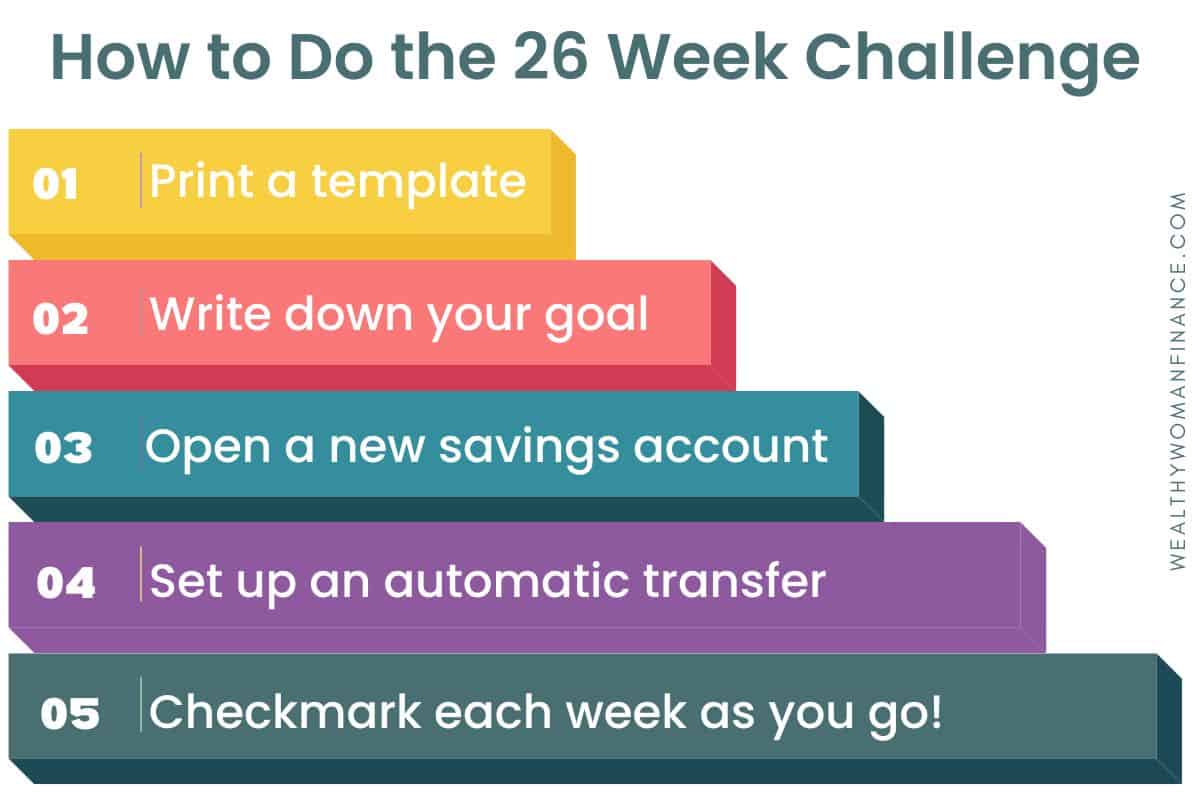

How To Do The 26 Week Savings Challenge

Now, you don’t have to do the steps below, but your chances of success will skyrocket if you do!

1. Decide on how much you want to save and print the free printable below (Choose from $1,000, $5,000 or sign up to grab the customizable template)

2. Write your goal on the printable. Remembering what you are saving for is a big motivator.

3. Open a new savings account that is labeled “Savings Challenge.” (Or whatever you’re saving for). Make this account separate from your usual money flow, and get in the mindset that you will not take money out of it.

4. Set up automatic transfers to this new account. This is accountability at its finest! You are committing, and making your dreams HAPPEN.

5. Track your progress. Checkmark your printable each week and celebrate the small victories! You are taking consistent action. And that’s how dreams are realized.

10 Quick Ways To Find Cash

Now, if you start the challenge and find yourself struggling, these ideas will help!

1. Bag Your Lunch. And Make Your Own Fancy Coffee.

This adds up! Even just a few times a week can be all you need to hit your goal.

2. Grocery Shop At A Different Store

A grocery bill at Whole Foods is going to look a lot different than one at Aldis. It’s just the truth about the overall cost. If you love your pricier store, that’s fine too! Instead, consider shopping based on their weekly sales or reward programs.

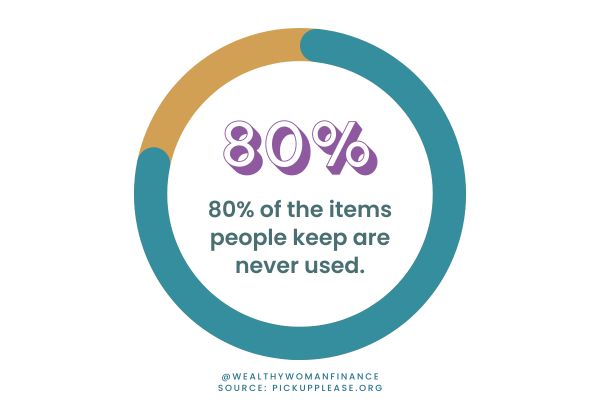

3. Sell Your Stuff

Most of us have plenty of items we’re not using. Declutter your house (ah, doesn’t that feel good!) and make your savings goal at the same time.

4. Audit Your Bills

One quick phone call can lower your bill EVERY month. Check on your:

- Internet bill

- phone bill

- energy bills

- insurance

- any memberships you pay for (see if you can pay all at once for a discount)

Taking the time to look through your bills can save you hundreds if you catch something.

5. Earn More For The 26 Week Savings Challenge

Write a list of the side hustles that interest you. Is there one or two you could try?

Here are a few quick ways to make cash:

- Babysit

- Pet sit or dog walk

- Flip furniture or lawn movers

- Pick up a side gig through work

- Become a serious investor

6. Use The 24 Hour Rule

To help with impulse shopping, set a rule that you can buy whatever you want after you’ve thought about it for 24 hours. This simple trick is all you need to find out if you really wanted it or if you got caught up in the moment.

7. Get Healthier

Does that alcohol bill add up? Or perhaps it’s cigarettes. Or chocolate. We all have a few things we turn to when we’re stressed. Work on creating healthier coping strategies and you’ll save money on the things you wish you weren’t buying so much of anyways.

Here are healthy ways to treat yourself on a budget instead.

8. Get Rid Of Subscriptions You Don’t Need

Do you really need Netflix, Hulu, HBO, AND Disney? Chances are there’s one or two you don’t watch much.

Or what if you got rid of one in the summer months? That’s what we do! We bring Netflix back when the temperatures drop in the fall.

9. Cook At Home More

You’ll save money AND be healthier. Win-win! Focus on meal planning and try a few frugal family freezer meals to help make this successful.

Related: Free Monthly Meal Planner

10. Entertain Strategically

Do you have parties that break the bank? Plan ahead for your next get-together by making it a potluck or serving cheaper food (i.e. try a baked potato or taco bar instead of serving salmon).

Related:

Grab The Free Printables!

Free 26 Week Savings Challenge Printable: $1,000

If you save $39 dollars a week for 26 weeks you’ll end up with $1014. This is a little above $1,000, and that way if you slip up or come short a few weeks you’re covered!

Get The Free Money Challenge Pdf: $5,000

Save $193 a week for 26 weeks and you’ll end up with $5,018. Again, this gives you wiggle room of $18 in case you come up short one week in the challenge. If you’d like to make this an even $200, grab the blank template below to modify.

Variations of the 26 Week Savings Challenge

While the basic challenge is a great start, you can also modify the challenge to fit your tastes. Here are a few popular options:

Do It Bi-Weekly

If you get paid every two weeks, this variation might work better for you. Instead of saving on a weekly basis, you can save every two weeks by adjusting your savings amount accordingly. (But don’t forget the automatic transfer!)

Double the Savings

If you want to aim for a higher savings goal, you can double the weekly amounts. For example, instead of saving $39 a month, you will save $78.

Related: How to Save $5000 in 3 Months

Customize Amounts

Create your own amounts. Set weekly saving goals based on your income, expenses, and desired savings amount.

For a customizable free 26-week printable, grab access to our resource library:

How to Stay Motivated Tips

However you choose to do it, the 26-week money saving challenge is all about adapting the plan so that you can remain consistent. Here are a few things you can do (along with the tracking printables) to keep motivation high.

- Fill out a free commitment card and have someone sign off on it.

- Create a vision board and put it on your fridge.

- Read financial books that make you want to save.

FAQs: 26 Week Savings Challenge

What If I Miss A Week? Or Three?

There’s no shame in this game. In the end, whatever you save is going to be MORE than what you would have.

So what if you have a bad week or month? Get back in there! We all lose our way sometimes. The difference is what you do about it after.

When you get back on the wagon: Save double the amount or spread out the savings among future weeks to make up for the lost time.

Can I Start Mid-Year?

Of course! The 26-week challenge can begin at any time during the year. What matters is how consistent you are along the way. Not when you start.

Related: More Free 6 Month Savings Challenge Printables

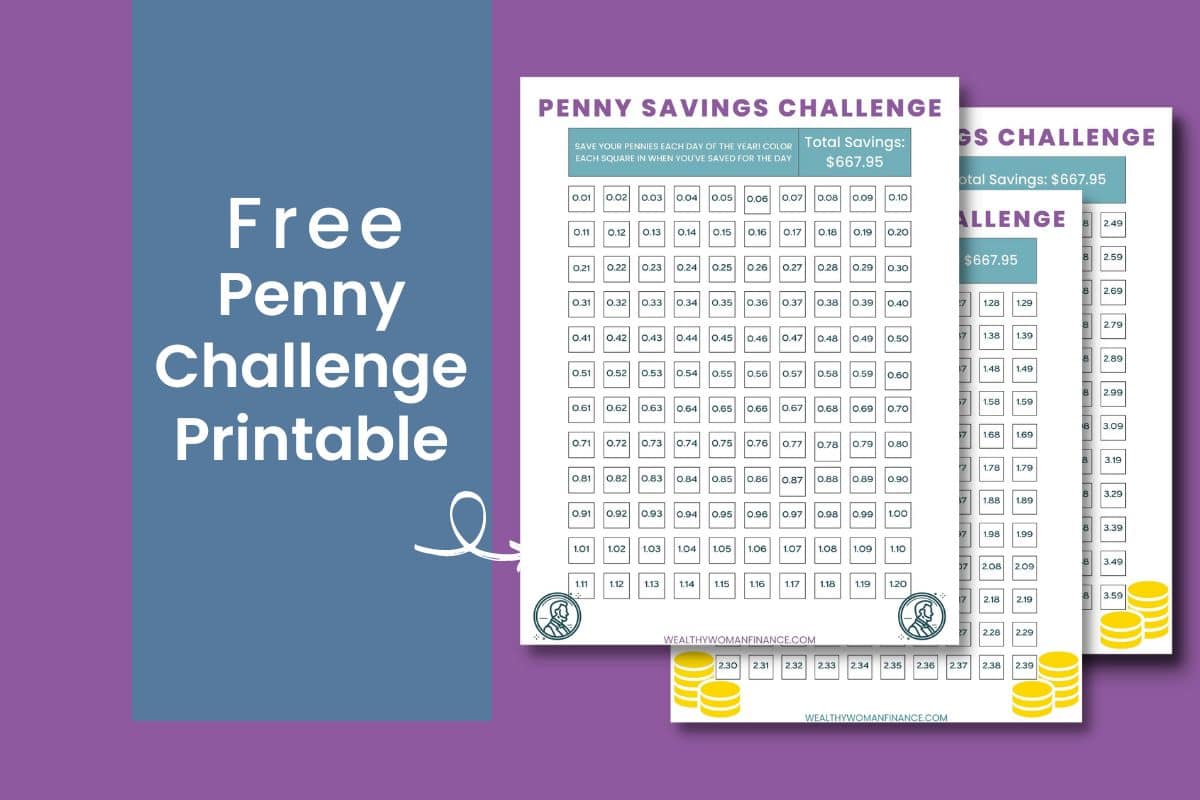

Are There Alternatives to the 26 Week Savings Challenge?

Yes, there are many several alternatives to the 26-week challenge. You can find free printables for all of them on our site:

- 52-Week Challenge: This popular version allows you to save money for an entire year. This is a great option if you need more time.

- Penny A Day Savings Challenge and Nickel Savings Challenge: These are great challenges if your budget is tight or you’d like the excitement of changing your savings amounts each day.

- 100 Envelope Challenge: Make your challenge physical by turning it into cold hard cash.

How much money can you save in 26 weeks?

The answer to this is up to you. With our challenge, save $1,000 or less, or go bigger with $5,000, $10,000, or even $20,000.

Is it possible to save $10,000 in 6 months?

You bet it is! It will take determination, and you may need to overcome your limiting money beliefs. But it’s doable if you are willing to put in the work.

“Predicting rain doesn’t count. Building arks does.”

– Warren Buffett

To Consider With the Savings Challenge For 26 Weeks

By creating a scheduled easy-to-follow plan, you’ll be more likely to commit and develop a sustainable savings routine.

So, now it’s time to get going. Start the 26 week money saving challenge today!

More Great Articles on Wealthy Woman…

- Harsh Truths About Money: Everyone Should Know These!

- Liquid Net Worth Meaning: Why You Need to Know It

- How to Find Your Money Values